MGMT 30B Ch 1

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Managerial accounting

provides info to employees in the organization to make plans, control operations, and make decisions

Cost object

anything for which cost data is desired (products, customers, plants, office locations, departments)

Direct cost

easily traced to a specified cost object

Cost MUST be caused by a specific cost object

Common cost

incurred to suppose a member of cost objects be can’t be traced to them individually

Ex: factory manager’s salary

type of indirect cost

Direct materials

raw materials whose costs can be easily traced to finished products

Direct labor

labor costs easily traced to finished products

Aka touch labor since direct labor workers TOUCH the products being made

Prime cost

sum of direct materials cost and direct labor costs

Manufacturing overhead

all manufacturing costs outside of direct labor and material costs

includes indirect labor and indirect materials

Includes other production costs like depreciation of manufacturing equipment, utility costs, property taxes, insurance premiums, etc needed to run the factory

Conversion cost

sum of direct labor and manufacturing overhead, costs incurred to CONVERT direct materials into finished product

Selling costs

costs incurred to secure customer orders and get the finished product to the customer

Ex: advertising, shipping, sales travel, sales commissions, sales salaries, cost of finished goods warehouses

Administrative costs

costs associated with general management of an organization

Ex: executive compensation, general accounting, legal counsel, secretarial, public relations, etc

Product Costs

all costs involved in acquiring or making a product

Attach to products as they’re purchased or manufactured and stay attached in inventory while waiting to be sold

When they’re sold, the costs go to the income statement as COGS and are matched against a sale

Period Costs

include all the things product costs exclude

All SG&A expenses

Expensed on income statement in the period incurred

Cost behavior

how a cost reacts to changes in the level of activity

3 types: variable, fixed, and mixed

Cost structure

relative proportion of each type of cost behavior in a company

Variable Cost

varies in direct proportion to changes in the level of activity

Ex: COGS for a merchandising company, direct labor, variable elements of manufacturing overhead (indirect materials, supplies, power), variable elements of SG&A (commissions, shipping costs)

Activity base

measure of whatever causes the incurrence of a variable cost

Ex: direct labor hours, machine hours, units produced, units sold, number of miles driven by a salesperson, number of pounds of laundry cleaned by a hotel, etc

Fixed Cost

remains constant in total no matter the changes in the level of activity

Ex: insurance, property taxes, rent, supervisory salaries

Committed fixed costs

long-term, multiyear organizational investments that can’t be significantly reduced for short periods of time

Ex: investments in facilities and equipment, real estate taxes, insurance premiums, salaries of top management

Discretionary fixed costs

come from annual decisions by management to spend on certain fixed cost items

Ex: advertising, research, PR, management development programs, internships for students

Can be cut for short periods of time with minimal damage to long term goals of the company

Relevant range

range of activity within which the assumption that cost behavior is strictly linear is reasonably valid

Mixed Cost

contains both variable and fixed cost elements

Ex: “fees paid to the state” has a license fee of $25,000 per year (fixed) plus $3 per rafting party (variable) costs

Mixed cost formula: Y = a + bX

Relevant costs/benefits

considered when making decisions for the company

Differential cost

future cost that differs between any 2 alternatives

Always relevant

Differential revenue

future revenue that differs between any 2 alternatives

Always relevant

Opportunity cost

potential benefit given up when one alternative is selected over another

Sunk cost

has already been incurred and can’t be changed by any decision made now or in the future

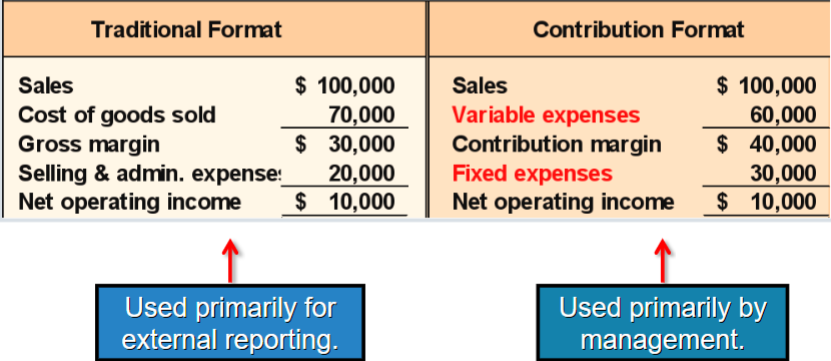

Contribution approach

separates costs into fixed and variable categories, deducting the variable expenses from sales to get the contribution margin

For a merch company, COGS is variable and gets included under Variable Expenses

Contribution margin

amount remaining from sales revenues after all variable expenses have been deducted

Amount CONTRIBUTES toward covering fixed expenses and then toward profits

Contribution Format Income Statement