Income & Taxes, Income Taxes

1/31

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

32 Terms

Earned Income

Any income (wages/salary) that is generated by working.

Social Security

A federal insurance program funded by taxpayer dollars that provide benefits to people who are retired, unemployed, or disabled: 6.2% of income.

Income Tax

Taxes paid out by anyone who earns an income.

Federal Income Tax

Used to support government programs such as military defense and public services.

State Income Tax

Used to support protection, roads and social services.

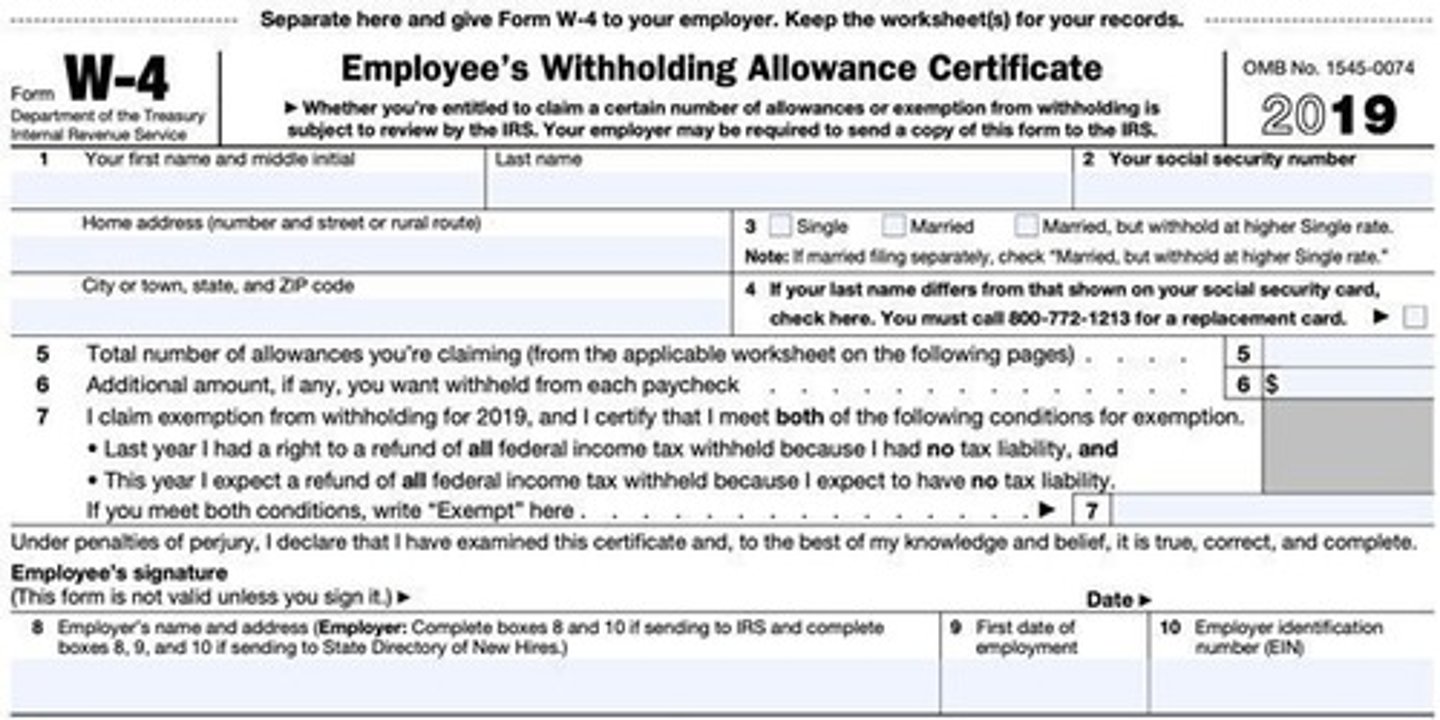

Form W-4 (Employee's Withholding Allowance Certificate)

A federal tax form filled out by an employee to indicate the amount that should be withheld from his/her paycheck for taxes.

Tax Liability

Total amount of taxes that you owe

Tax Evasion

Willful failure to pay taxes.

Tax Audit

An examination of an individual's tax returns by the IRS to verify income and deductions are accurate.

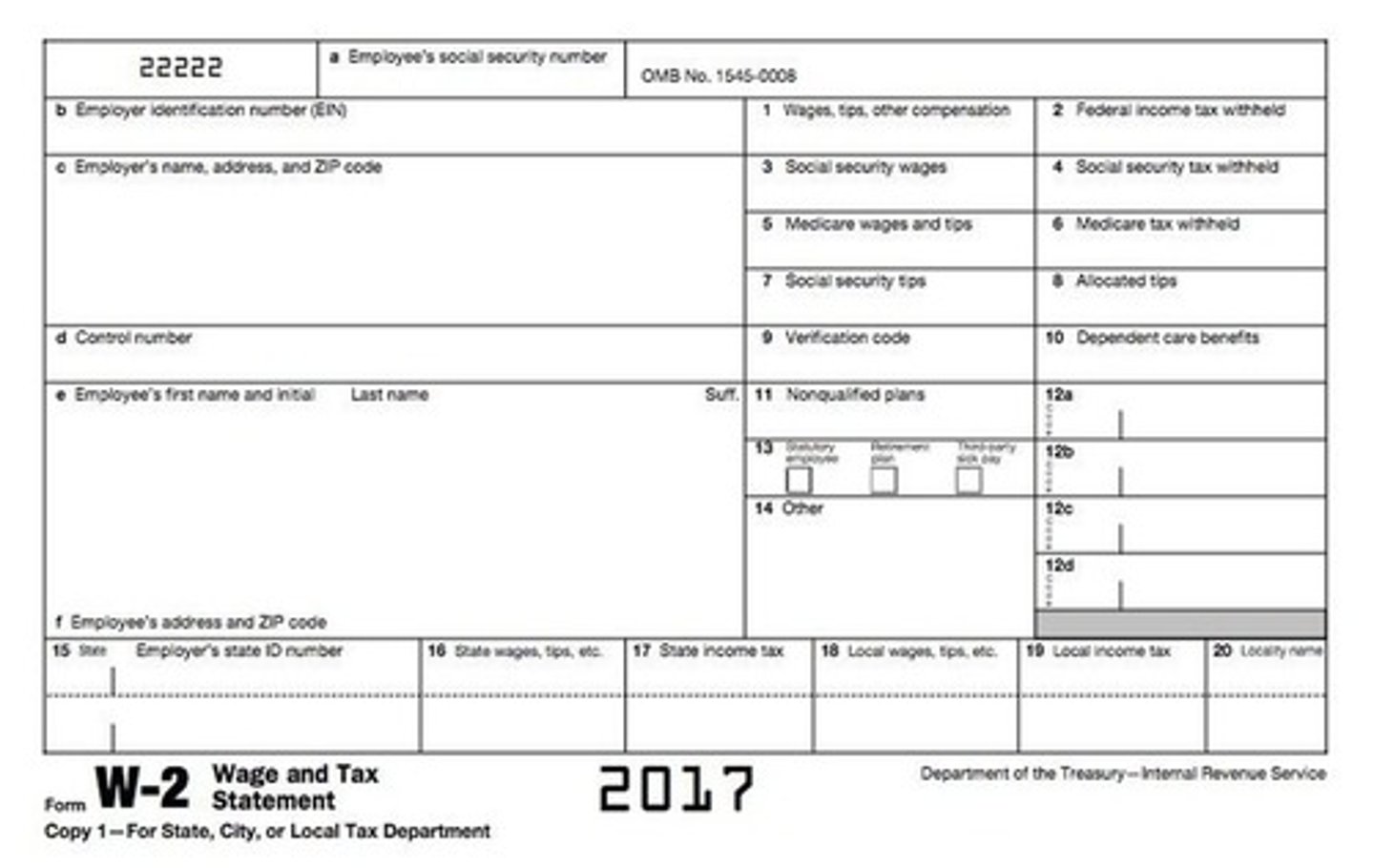

Form W-2 (Wage & Tax Statement)

Summary of the income you earned during the year and all amounts the employer withheld for taxes.

Medicare

Federal health insurance program for people who are 65 or older and certain younger people with disabilities.

Excise Tax

Tax on specific goods such as gas, air fare and cell service

Estate Tax

levied on the total value of a deceased person's money and property and is paid out of the decedent's assets before any distribution to beneficiaries.

Inheritance Tax

A tax collected on the property left by a person's will- beneficiary pays the tax

Gift Tax

a tax on money or property that one living person gives to another

Wages

Payments received for each hour of work

Salary

Payments received regardless of the number of hours worked

Interest Income

Interest from banks, credit unions and other financial institutions

Adjusted Gross Income

Income after certain reductions have been made

Taxable Income

income on which tax must be paid; total income minus exemptions and deductions

Tax Deduction

An expense you can subtract from your adjusted gross income to arrive at your taxable income; ex. child care, sales tax, health insurance, charity contributions, etc.

Exemption

Amount set by the IRS on which no taxes are paid

Dependents

Someone you support financially and is under the age of 24.

Tax Credits

An amount subtracted directly from the taxes that you owe; ex. higher ed.

Earned Income Tax Credit

Credit for people who work but their income is under a certain amount

Medicaid

Federal program that provides medical benefits for low-income persons.

free enterprise

Economic system in which individuals and businesses are allowed to compete for profit with a minimum of government interference

consumption tax

a plan in which people are taxed not on what they earn but on what they spend

property tax

a tax based on real estate and other property

pay-as-you-go

Withholding taxes on on income payments to employees

401(k) plan

a tax-deferred retirement plan offered to employees by their employer

IRS (Internal Revenue Service)

US government agency that is responsible for the collection and enforcement of taxes