Monetary Policy

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

26 Terms

What is monetary policy?

Changes to the base rate of interest, money supply and exchange rates

What is expansionary monetary policy?

Used to increase AD

Low interest rates

Fewer restrictions on the money supply

What is Contractionary Monetary Policy?

Used to decrease AD

High Interest Rates

Greater restrictions on the money supply

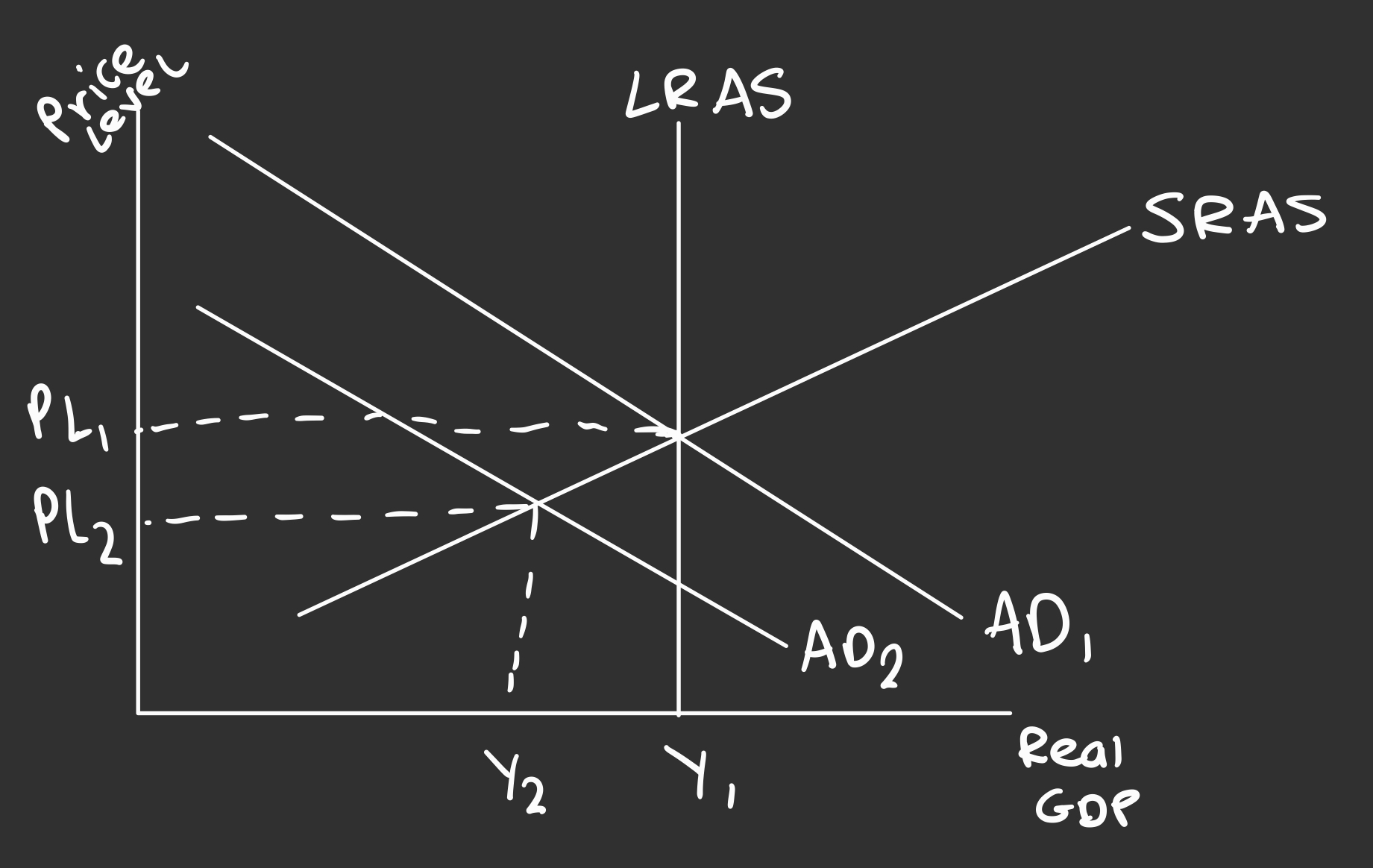

What is a diagram for contractionary fiscal policy?

Increasing interest rates, should decrease AD, reducing inflation

Negative multiplier effect could lead to a further fall in AD

What is the multiplier effect?

An initial increase in AD, e.g. through extra government spending, will lead to a further increase in AD.

e.g.

If the gov spends £1B on building new hospitals

Construction workers earn more

So spend more on restaurants, shops etc

Shop owners earn more and the cycle continues

Why do higher interest rates reduce AD?

Cost to borrow money increases, so consumption falls

Reward of holding money increases, so there are more savers and less spenders

Investment by firms falls, as it is more expensive to borrow and fund the investment

Gov spending falls, as cost for government to borrow money increases

What does contractionary monetary policy depend on?

Size of the reduction in AD depends on all components of AD

Time lag, new IR don’t come into effect for around 18 months

The wage rises from reduction in economic growth may eventually cancel out the fall in AD

Wage rises from fall in economic growth could cause cost-push inflation

What are other ways to reduce inflation instead of increasing interest rates?

Increasing taxes - reducing AD

Reduced government spending - reducing AD

Increasing immigration- increases productivity and LRAS

What happens to inflation if the money supply increases?

Inflation falls, as banks raise interest rates

becomes harder to borrow and spending falls

firms lower their prices

What happens to inflation if the money supply increases?

Inflation rises as banks decrease interest rates

Borrowing increases, so consumption and AD increases

Firms raise prices to maximise profits

What happens to interest rates if the reserve requirement is increased?

Commercial banks hold more money with the bank, reducing the money supply

Commercial banks have to raise interest rates to maintain profits

What happens to interest rates if the reserve requirement is increased?

Commercial banks hold less money with the central bank, increasing money supply

Commercial banks reduce interest rates to attract borrowers

What happens to interest rates if the BoE increases the base rate?

More expensive for commercial banks to borrow

Pass on this cost to consumers through increasing interest rates

What happens to interest rates if the BoE reduces the base rate?

Cheaper for commercial banks to borrow, so they can borrow more

Money supply increases, so commercial banks reduce interest rates to attract borrowers

How does Quantitative Easing reduce interest rates?

Central bank buys government bonds from commercial banks

Commercial banks have more money available to loan, so money supply increases

Commercial banks reduce interest rates in order to attract borrowers

Spending increases, boosting AD

Why may monetary policy become ineffective in order to get out of a recession?

Due to liquidity traps

What are liquidity traps?

When interest rates or close to or at zero, and the central bank is unable to stimulate AD

Why do Liquidity traps occur?

Preference for saving

Consumers may not be confident about the future, so look to save rather than borrow money to spend, no matter how low the interest rates are

Deflation

If prices are continually falling, people hold money as it is increasing in value and will buy more in the future

Balance Sheet Recession

Firms and consumers may have high levels of existing debt

Low interest rates encourages them to pay off debt now

Therefore they don’t take on new debt by borrowing

Illustrate a liquidity trap diagram

Illustrate the loanable funds theory

Why is supply of loanable funds upwards sloping?

Why is demand for loanable funds downwards sloping?

What is the loanable funds theory?

Interest rates are set by savers and borrowers

EVALUATE the impact of Expansionary monetary policy on macroeconomic objectives

Economic Growth

Reducing interest rates increases spending

AD increases, and AS then increases (so total output or GDP rises)

Low and Stable Inflation

Increasing money supply will reduce interest rates, which will increase borrowing and AD so firms raise prices

BUT IF THERE’S A LIQUIDITY TRAP ANY CHANGE TO MONEY SUPPLY IS INEFFECTIVE

Unemployment

Unemployment will fall as spending and borrowing increases when interest rates are low

Firms require more workers to meet this demand increase

Stable Current account on balance of payments

Inflation increases price levels

If exports get more expensive, foreign demand falls

Demand for imports rises as they’re cheaper

Current account on balance of payments becomes unstable

EVALUATE the impact of contractionary monetary policy on macroeconomic objectives

Economic Growth

Increases IR reduces borrowing and spending

AD falls, so firms reduce their supply, reducing total output and GDP

Low and Stable Inflation

Higher IR reduce spending, so inflation may fall

But if consumer and business confidence is high, they may continue to borrow and spend

Unemployment

Higher IR reduces spending and AD

Workers aren’t needed as no pressure to increase supply

Unemployment rises

Stable Current Account on Balance of Payments

Current account position worsens

Currency becomes stronger, so exports are more expensive

IR are high so households don’t spend on imports

Why does the currency appreciate due to contractionary monetary policy?

As interest rates increase, foreign investment rises, so demand for currency increases, making it stronger