step 3: 7. Intangible Assets and Inventories

1/55

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

56 Terms

an intangible asset is an _____, _______ asset with no physical substance

identifiable

non-monetary

what does identifiable mean

can be sold separately without selling the business

arises from a contract

examples of intangible assets

goodwill

development costs

patents

computer software

trademarks

goodwill is the ______ payment made and can be defined as the amount paid over and above the ___ value of the ______net assets and liabilities acquired

(like a premium you are willing to pay for the business)

excess

fair

identifiable

_____ generated goodwill is not recognised

internally

purchased goodwill, acquired by buying another entity is capitalised

t/f

t

research is the original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding

research is the original and planned investigation undertaken with the prospect of gaining new scientific or technical knowledge and understanding

development is the application of research findings or other knowledge to a plan or design for the production of new or substantially improved materials etc, before the start of production

development is the application of research findings or other knowledge to a plan or design for the production of new or substantially improved materials etc, before the start of production

examples of research activities

activities aimed at gaining new knowledge

searching for information

examples of development activities

design

with research and development you are applying the ____ concept

accruals

research is ____recognised as an intangible asset, but shown as an ____in SPL

no certainty of future economic benefits

not

expense

development ___ be recognised as an intangible asset when all PIRATE criteria are met

must

PIRATE

Probable future economic benefits

Intention to complete, and use/sell

Resources adequate to complete

Ability to use/sell

Technical feasibility of completing asset

Expenditure can be measured reliably

PIRATE

Probable future _____benefits

______ to complete, and use/sell

Resources adequate to complete

Ability to use/sell

______feasibility of completing asset

Expenditure can be measured _____

economic

Intention

Technical

reliably

amortisation

depreciation for intangible assets

indefinite life on intangible assets :

no foreseeable limit for when asset can be used

intangible asset is not amortised

useful life re-assessed every year

impairment review conducted annually

intangible asset with an indefinite life is not ________

amortised

finite life on intangible assets

amortise over the usefull life

residual value of intangible assets is normally ___

0

impairment - an asset is impaired if it’s carrying amount is greater than its recoverable amount

impairment loss is the amount by which the carrying amount of an asset _____its recoverable amount

exceeds

impairment indicators: external sources

significant fall in the assets market value

increases in interest rates (bad economy)

impairment indicators: internal sources

damage in asset

fall in cash flows

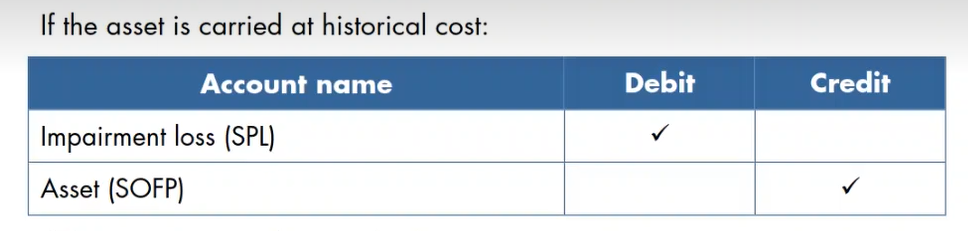

accounting for impairment cost, when the asset is carried at historical cost

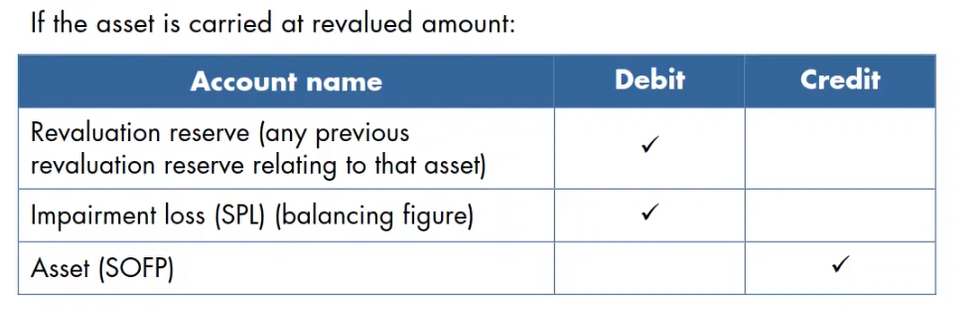

accounting for impairment cost, when the asset is carried at revalued amount

NRV =

selling price - selling costs - costs to complete

cost =

purchase prince + directly attrituble costs

LIFO (Last In, First Out) is ______ by IAS

prohibited

LIFO (Last In, First Out)

assumed most recent purchases are used first

therefore, the items in inventory are the earliest purchases

FIFO (First In, First Out)

items used in the order they are recieved

therefore items in inventory are the most recent purchases

AVCO (Weighted Average)

total cost of items in inventory / total number of items

according to IAS 16 PPE, if a tangible non-current asset is valued using the revaluation model it is carried in the SOFP at:

historical cost less accumulated depreciation

fair value

fair value less any subsequent accumulated depreciation

market value

fair value less any subsequent accumulated depreciation

which of these intangible assets cane be capitalised in the financial statements

goodwill arising on the purchase of another business

its workforce

a licence purchased during the teas

a brand the company has developed over a period of several years

1 and 3

an impairment review has been carried out in respect of an item with:

carrying amount = 100,000

value is use = 80,000

fair value less costs of disposal = 90,000

replacement cost = 95,000

what is the amount of impairment loss that should be recognised

10,000

difference between the carrying amount and recoverable amount

in this case fair value less costs of disposal (recoverable amount is the higher of the fair value less costs of disposal)

Sycamore plc carried out an impairment review on a freehold property. The property had previously been revalued to £850,000 when its carrying amount was £800,000. At the date of the review the carrying amount of the property was £840,000. Its value in use was £775,000 and its fair value less costs of disposal was £760,000.

how much of the impairment loss should be recognised in the statement of profit or loss?

The impairment loss is £65,000 (840,000 – 775,000, based on value in use).

Recoverable amount is the higher of fair value less costs of disposal and value in use.

Since there is a revaluation surplus of £50,000 (850,000 – 800,000) in respect of the property, £50,000 of the impairment loss can be set against the revaluation surplus (recognised in other comprehensive income).

The balance of £15,000 is recognised in profit or loss.

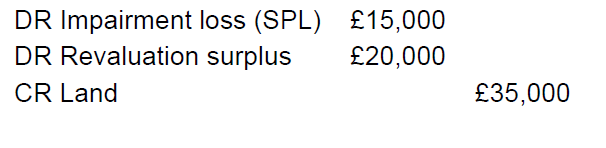

A piece of land acquired for £100,000 and subsequently revalued to £120,000 has been impaired and its value has fallen to £85,000.

show the journal entry

internally generated brands should never be capitalised

t/f

t

intangible assets can be revalued

t/f

t

although rare, there is the choice between cost model and revaluation model

impairment loss should be disclosed

t/f

t

impairment losses are recognised in the profit or loss if the asset had not previously been ____

otherwise, they are treated as downward revaluations

revalued

FRC

independent regulator of accounting and auditing in the UK

corporate governance

the systems by which companies are directed and controlled

audit committee

a collection of non-executive directors charged with overseeing various controls in place over the audited financial statements

non-executive director

a board member whose responsibility it is to evaluate the effectiveness of the financial reporting process

audit committee is responsible for:

monitor integrity of the audited financial statements

whether the financial statements communicate the company’s position, performance

review risk management and internal controls

address the agency problem

3 things to prove negligence

duty of care existed

duty of care breached

caused loss to the claimant