Lesson 6.2: Understanding Federal, State, and Local Taxes

1/16

Earn XP

Description and Tags

Flashcards made from a presentation segment created as a lesson on federal, state, and local taxes.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

17 Terms

Taxes

How federal, state, and local governments primarily raise money to pay for schools, roads, and national programs

Raises or lowers aggregate demand as part of the government’s fiscal policy for cooling or growth

Government revenue

Money the government receives from taxes and other sources

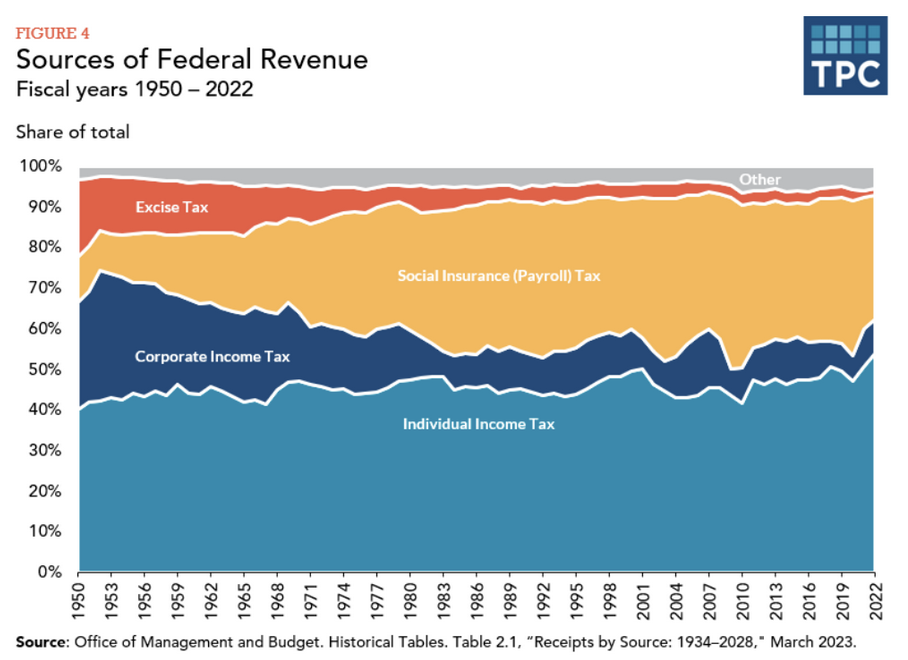

About 84% of this comes from individual income taxes and payroll taxes for Social Security and Medicare

About 11% of this comes from corporate income taxes

The remaining 5% comes from excise taxes, tariffs, fees, and other sources

Congress

The body of government given the power to “lay and collect taxes” according to Article I, Section 8 of the Constitution for:

The payment of debt

The common defense

General welfare

Cannot levy taxes on religious services, exports, or polls, as they were used to restrict voting in the past

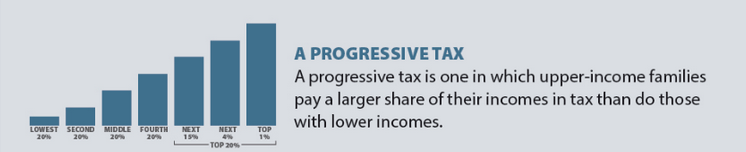

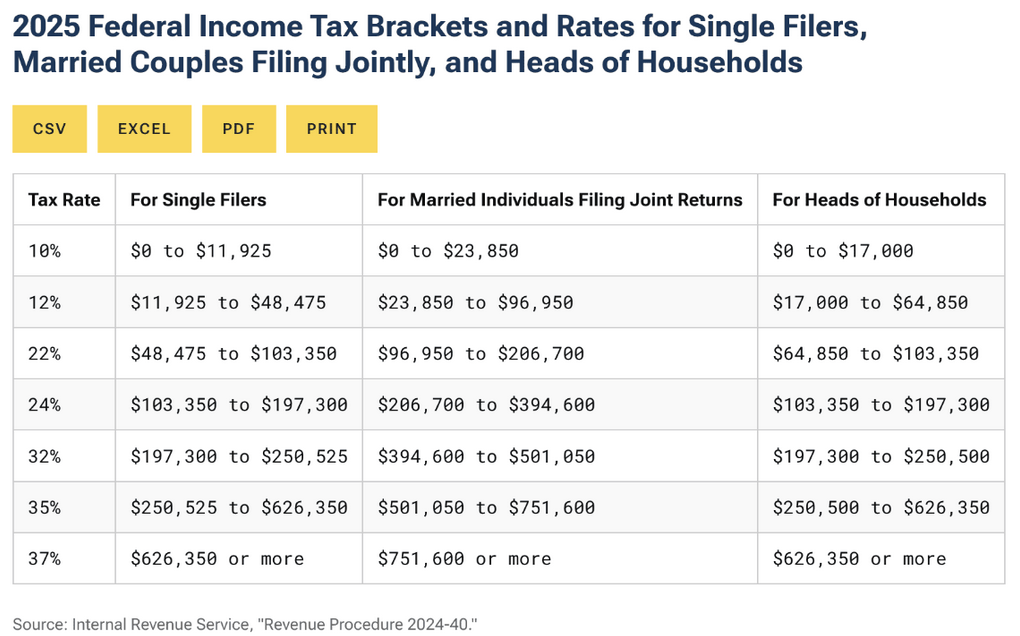

Progressive tax

A tax structure that makes a person’s effective tax rate rise with their income level, as seen in the federal income tax

Serves as an automatic stabilizer to reduce tax burdens on the low income while increasing taxes on the higher income

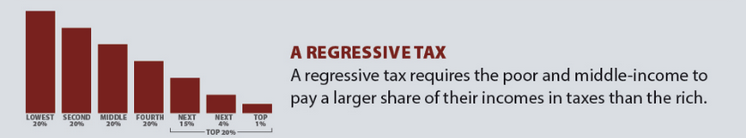

Regressive tax

A tax structure that makes a person’s effective tax rate fall with their income level, as seen in sales taxes

Higher income households spend a lower portion of their incomes on taxable goods and services

Proportional tax

A tax structure that makes a person’s tax rate the same across all income levels with minimal deductions or exemptions

Tax base

The income, property, good, or service that is subject to a tax; seen in the forms of personal earnings, company profits, real estate, and goods and services sold

Pay as you earn

A tax collection system where money is withheld from a paycheck throughout the year by employers to avoid a large tax bill during filing season

Taxable income

The income one earns (minus exemptions and deductions) that can be taxed

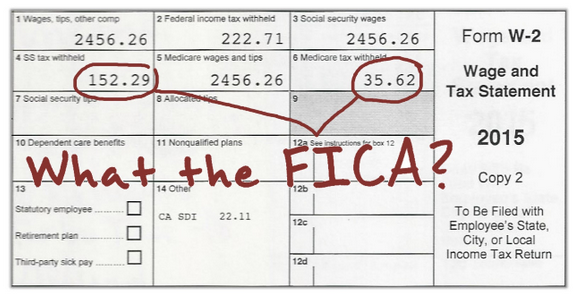

Federal Insurance Contributions Act (FICA)

Act that funds Social Security and Medicare through payroll withholdings and employer contributions

Corporate income tax

A progressive tax paid on corporate profits

Excise tax

A regressive tax on specific items, such as gasoline, cigarettes, and alcohol

Estate tax

A tax on the total value of an estate that changes year-by-year

In 2025, this applied to any estate worth over $13.99 million

Tariffs

Taxes on imported goods

Once one of the most important sources of federal revenue; today, they represent just a tiny share

Intended to protect American industries with better trade deals, lowered trade deficits, and increased government revenue

State revenue

Mostly in the form of:

Personal income taxes

Sales taxes

Excise taxes

Corporate income taxes

Charges (university tuition, tolls, park fees)

Federal funds (for healthcare and low-income programs; one-third of total revenue in many)

Funds are often passed on to lower levels

Local revenue

Revenue that goes to counties, cities, towns, and school and special districts for schools, emergency services, libraries, parks, and utilities in the form of:

Property taxes (largest contributor)

Sales taxes

Income taxes

Fees for utilities, land, and public resources

Intergovernmental transfers

Grant

A portion of money set aside to another entity for a designated program

The federal government offers these to states and localities for healthcare, income support, transportation, and education