BUSS1040 Lecture 6 - Monopoly

1/16

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

17 Terms

Characteristics of Monopoly

single seller (high concen)

no close substitutes

unique product

barriers to entry

legal barriers

exclusive rights over a goods prod (patent, copyright)

public franchise (aus post), govt licenses (taxis, practice of med)

Why do monopolies exist?

natural barriers to entry

control over essential input not available to other firms

e.g Esso and gas fields in Victoria

monopolist might have lower COP that effectively allows them to prevent other firms entering

favourable access to raw materials, geographic location, learning curve advantages

Tech/level of d make one producer more efficient than a no. of producers — natural monopoly

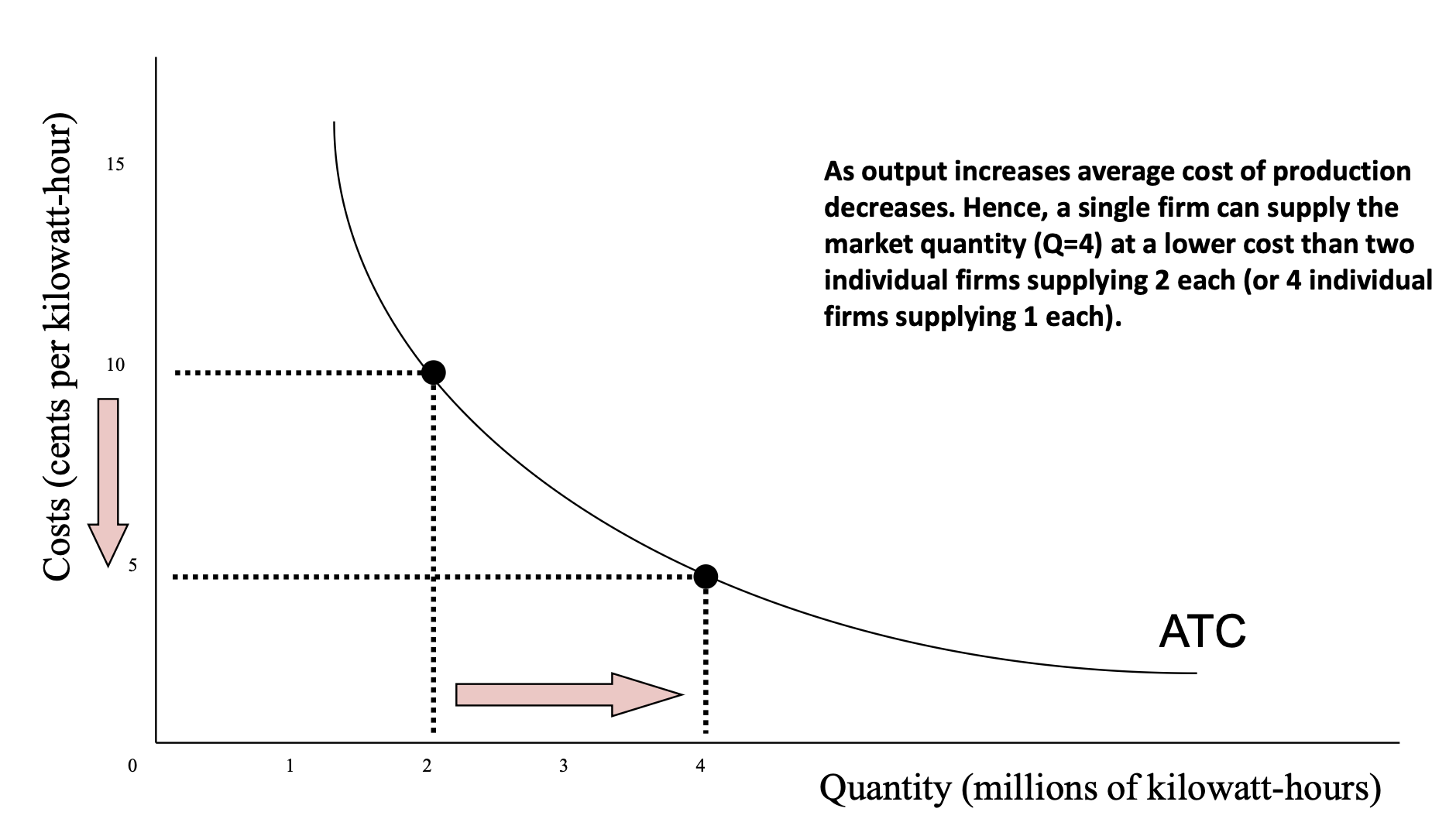

Natural monopoly

single firm can supply an entire market at lower cost than 2/more firms could supply

e.g. telecomms, electricity, tap water

declining LR ATC implies natural monopoly

substantial EOS (natural barrier to entry)

often larger capital costs (infra) but low marginal cost of supply

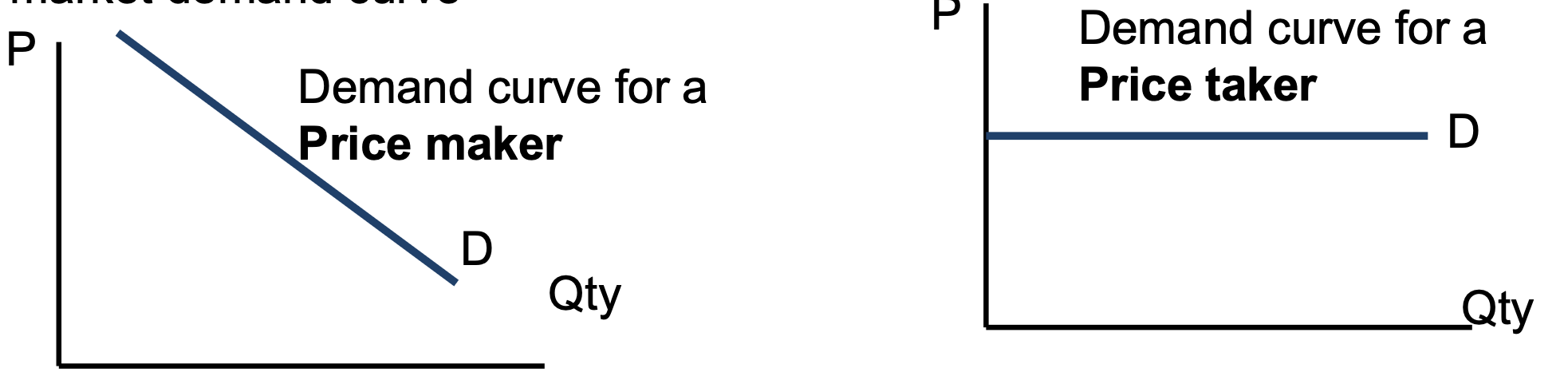

Price taker/maker

since only one single seller — monopolist can decide p of their product to max profit

d curve for monopoly same as market curve as only 1 seller

monopolist is the price maker hence d curve for monopolist is downward sloping

Monopoly market power

firm that has low PED for output can raise p and not lose customers

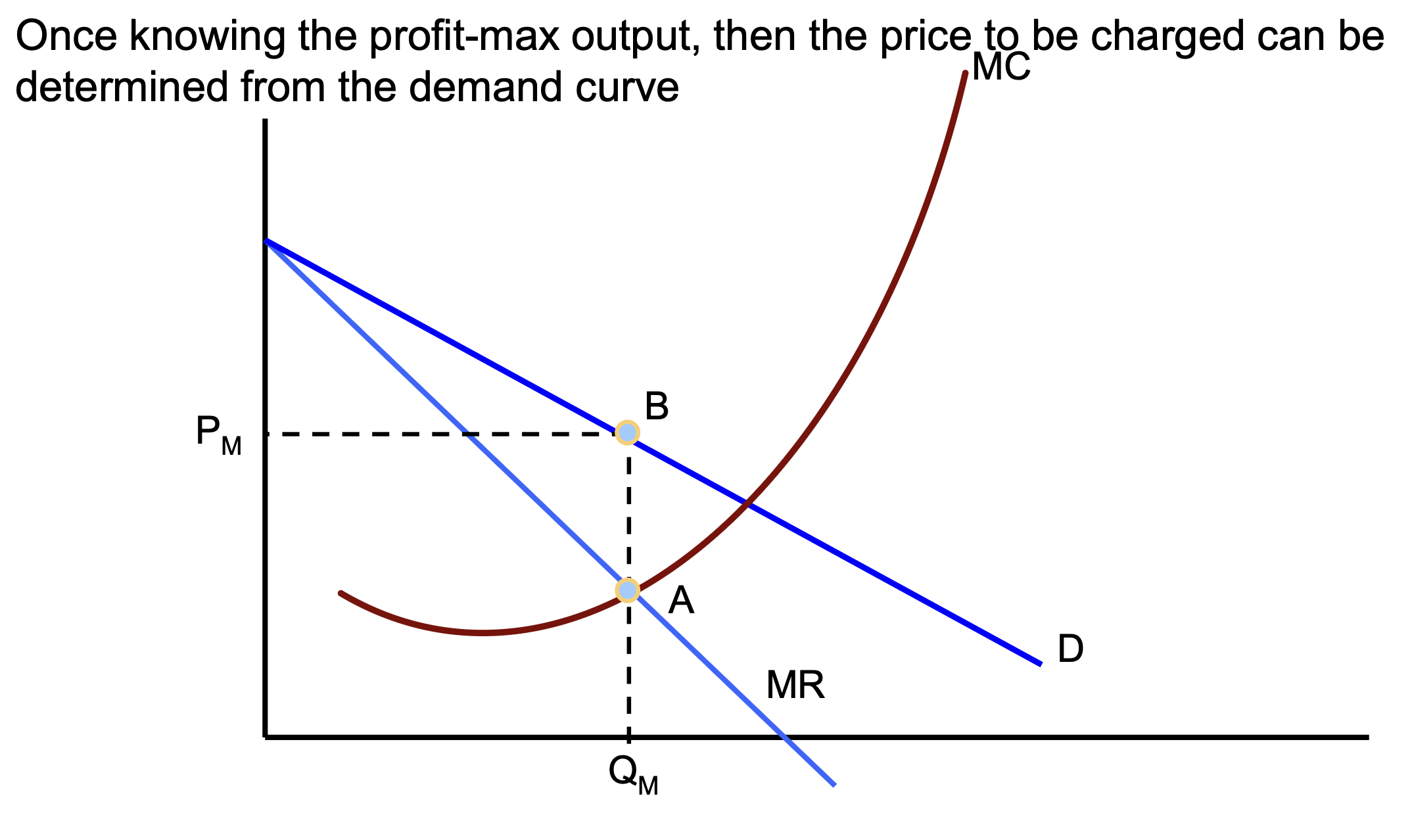

Monopolist’s output and pricing decision

single price monopolist — charges same p to all its consumers

will choose output to max total profits = TR - TC

can alter p in the market by changing q

downward sloping d curve

if increase output by one unit — p will fall by some amt

if prod more — p falls

if prod less — p rises

causes trade off

sell less q for higher p or sell more q for lower p

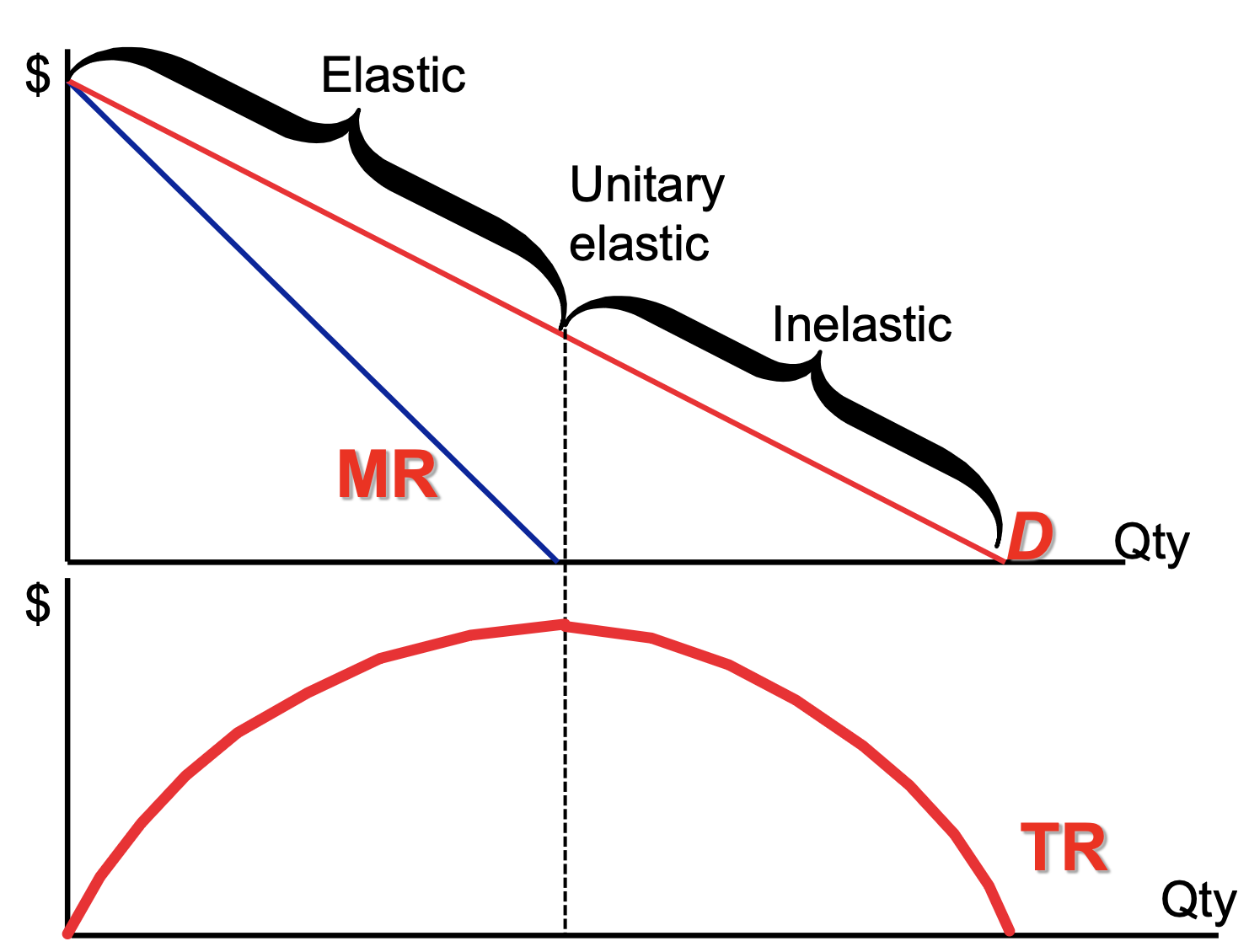

Monopoly MR

MR — additional rev from one extra unit of g sold

for monopolist — MR has 2 effects

output effect

as sell more units, extra rev obtained from add units sold

price effect

sell more units, p fall and rev lost on existing units sold

MR is not the same as market P (always below p)

Elasticity for MR and D curve

slope of MR curve is x2 value of D curve and has same intercept

when d is elastic — small decr in p leads to large incr in qd

TR increase — MR is positive

when d is inelastic — small decr in p leads to small incr in qd

TR decrease — MR is negative

profit max monopolist would never prod at output in inelastic region of d curve

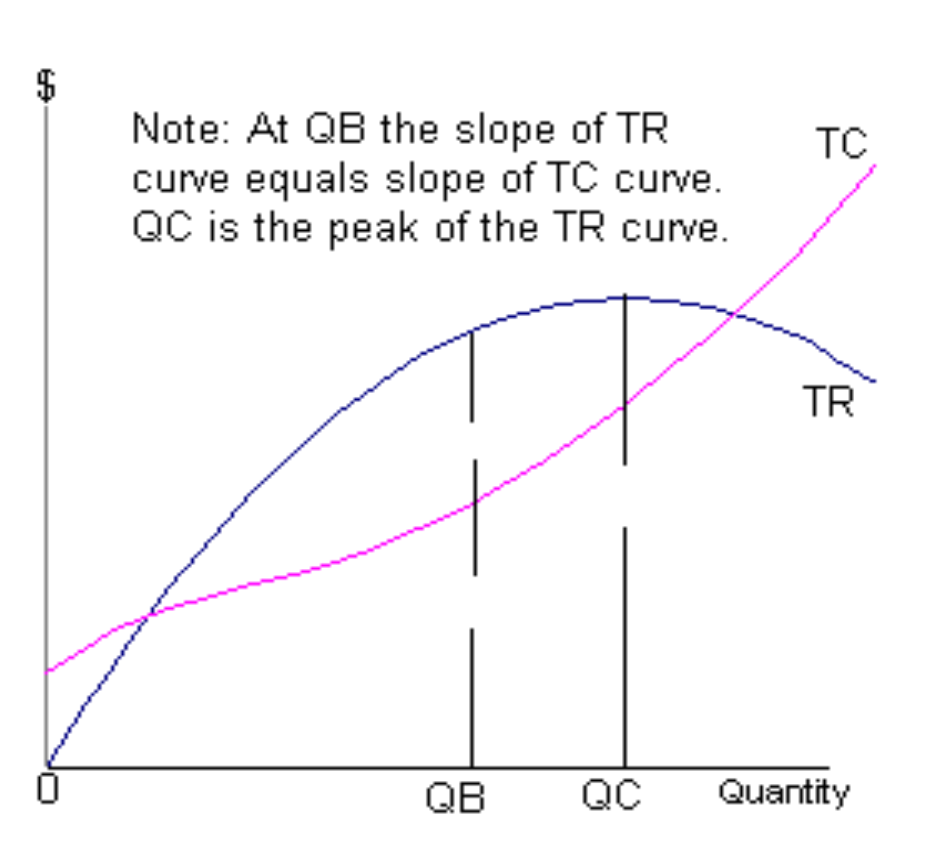

TR and TC curve

profit max is at QB where diff between TR and TC is greatest

TR is concave and upward sloping from 0 to Qc and downward sloping from Q onwards

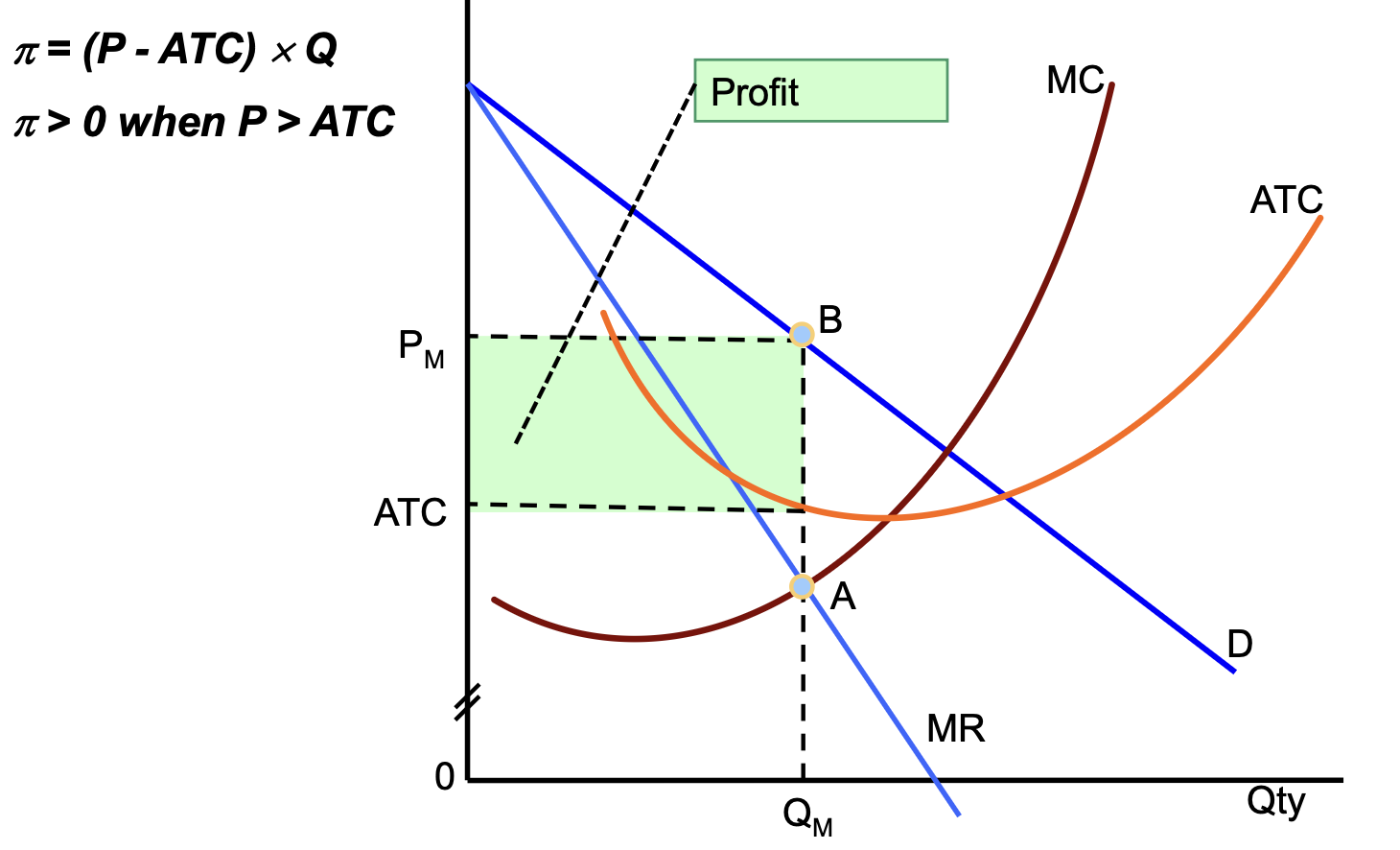

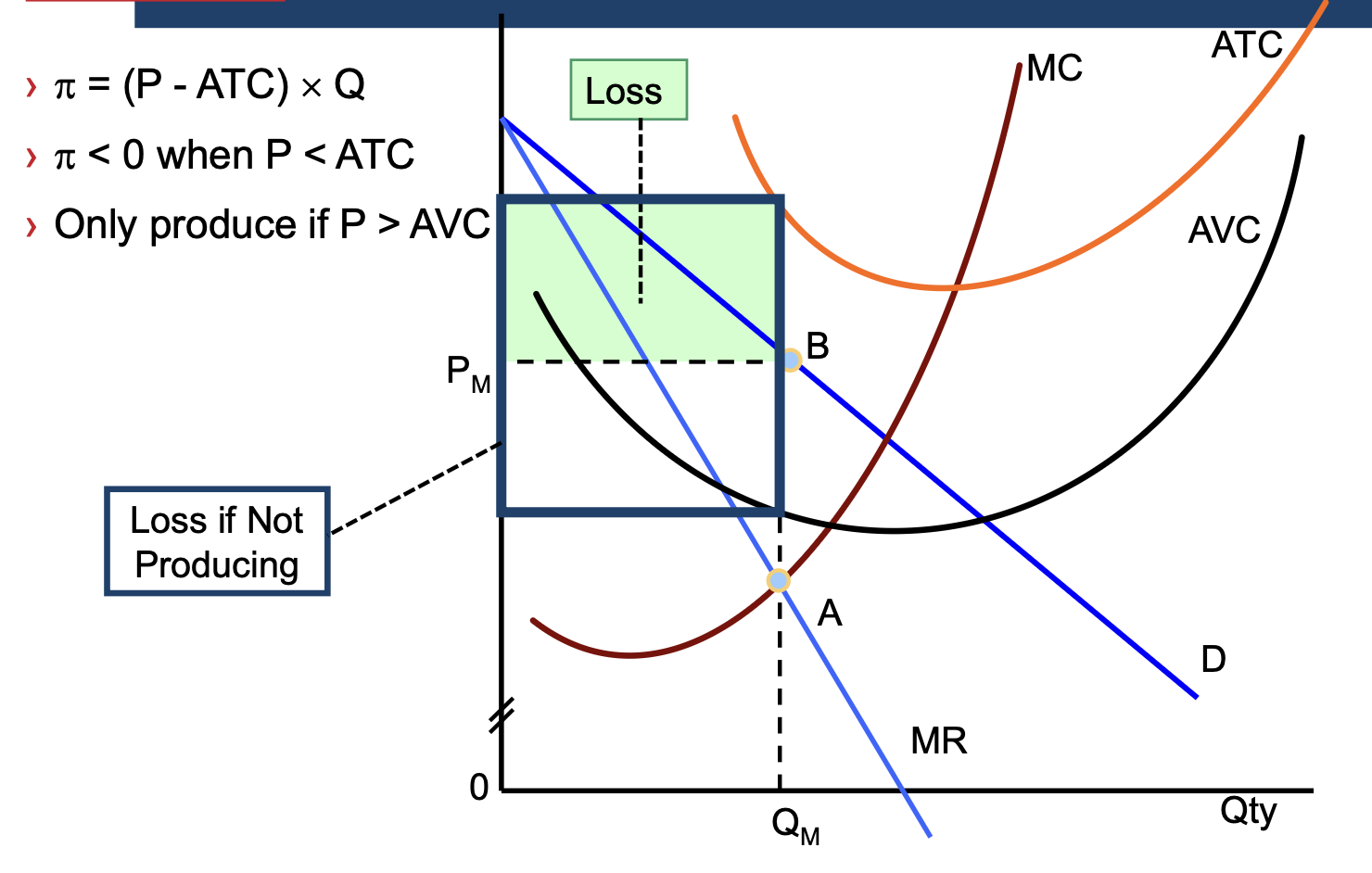

Profit max MR = MC

if MR>MC — monopolists can increase profits by selling 1 extra unit

if MR<MC — profit fall from selling last unit so better off not selling

for a competitive firm — P = MR = MC

for a monopolist — P > MR = MC

for a single price monopoly P > MC at optimal qty supplies

Economic Profits

SR loss minimisation

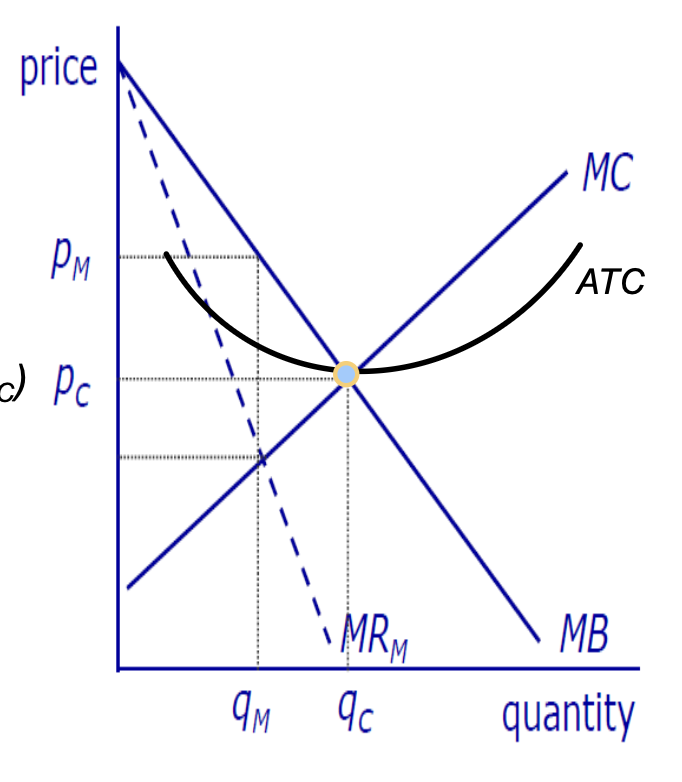

Economic effects of monopoly

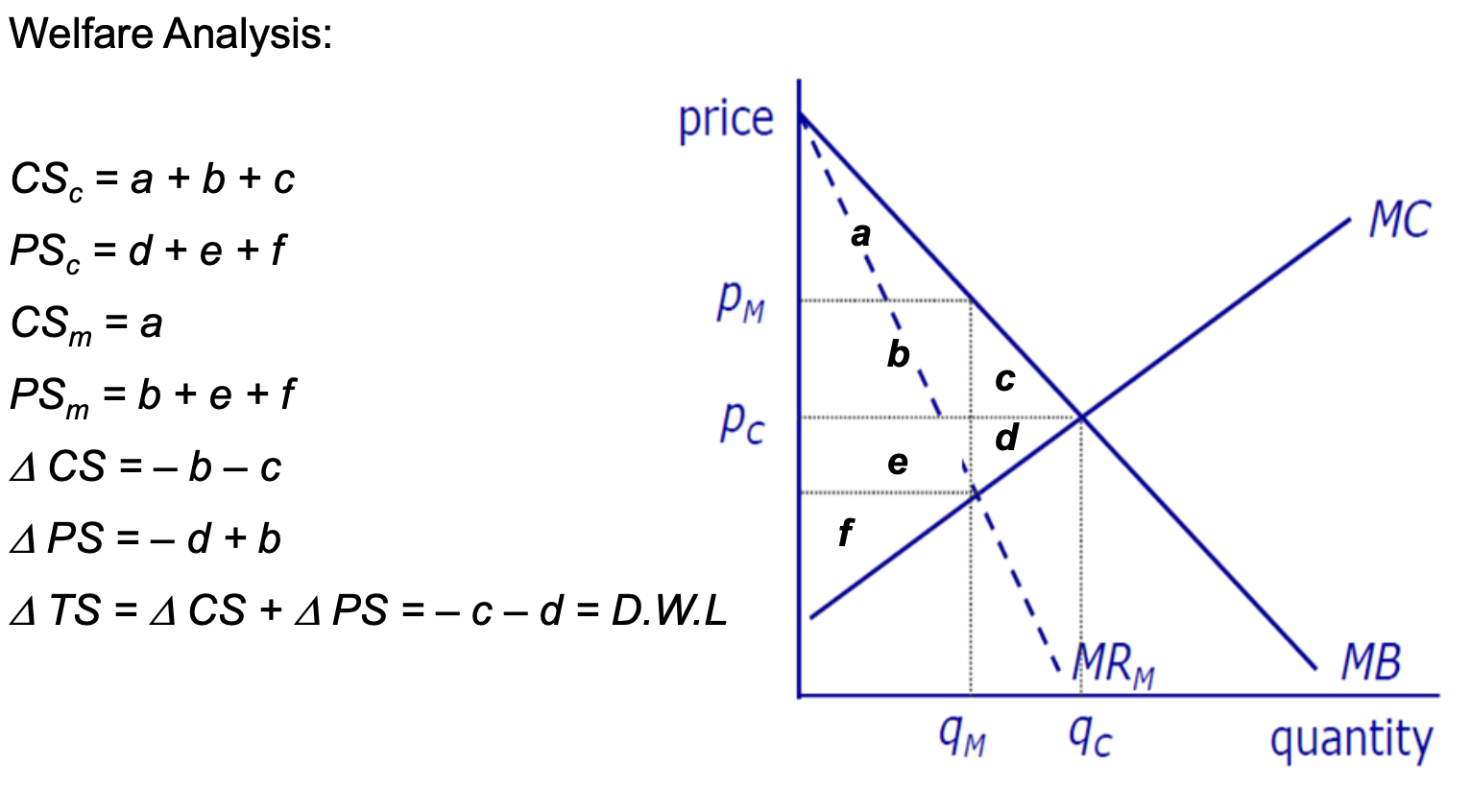

If perfect comp industry becomes a monopoly (assuming same cost curve and no EOS)

monopolist charges higher p (pm) and produces smaller qty (qm) compared to competitive indus (pc,qc)

Welfare Analysis of monopoly on graph

Welfare w monopoly

at competitive qty — all gains from trade exhausted

all potential trades where MB>=MC occur

However monopolist restricts output to Qm<Q*

between Qm and Q* MB>MC so total surplus will increase

but monopolist interested in own profit which is determined by MR not MB

surplus lost from the restriction of output — DWL

occurs because restricted output below the competitive level

Rent seeking behaviour

activity of trying to obtain a monopoly to earn economic profits

firm is willing to spend up the monopoly profit to obtain a monopoly

buying a monopoly — taxies, import quotas

creating a monopoly — lobbying

creating barriers to entry — advertising

Are monopolies that bad?

EOS and scope

may prod at lower avg cost

incentives to innovate

monopolies provided by IPRs may provide an incentive to engage in R&D activities — e.g patents & copyright