AP Micro - Unit 3

1/37

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

38 Terms

inputs v outputs

inputs - 4 factors of production, what is needed

outputs - what we are producing

short run

fixed plant size (land, factory, etc.)

variable usage

variable output

long run

variable plant size (more land, more factories, etc.)

entry and exit (new companies can come, go)

letters

T = total

A = average

M = marginal

P = product (means price when alone)

C = cost

F = fixed (does not change as output changes, taxes, fees, etc.)

V = variable (wages, utility costs, etc.)

MP = change in TP / change in input

AP = TP / number of inputs

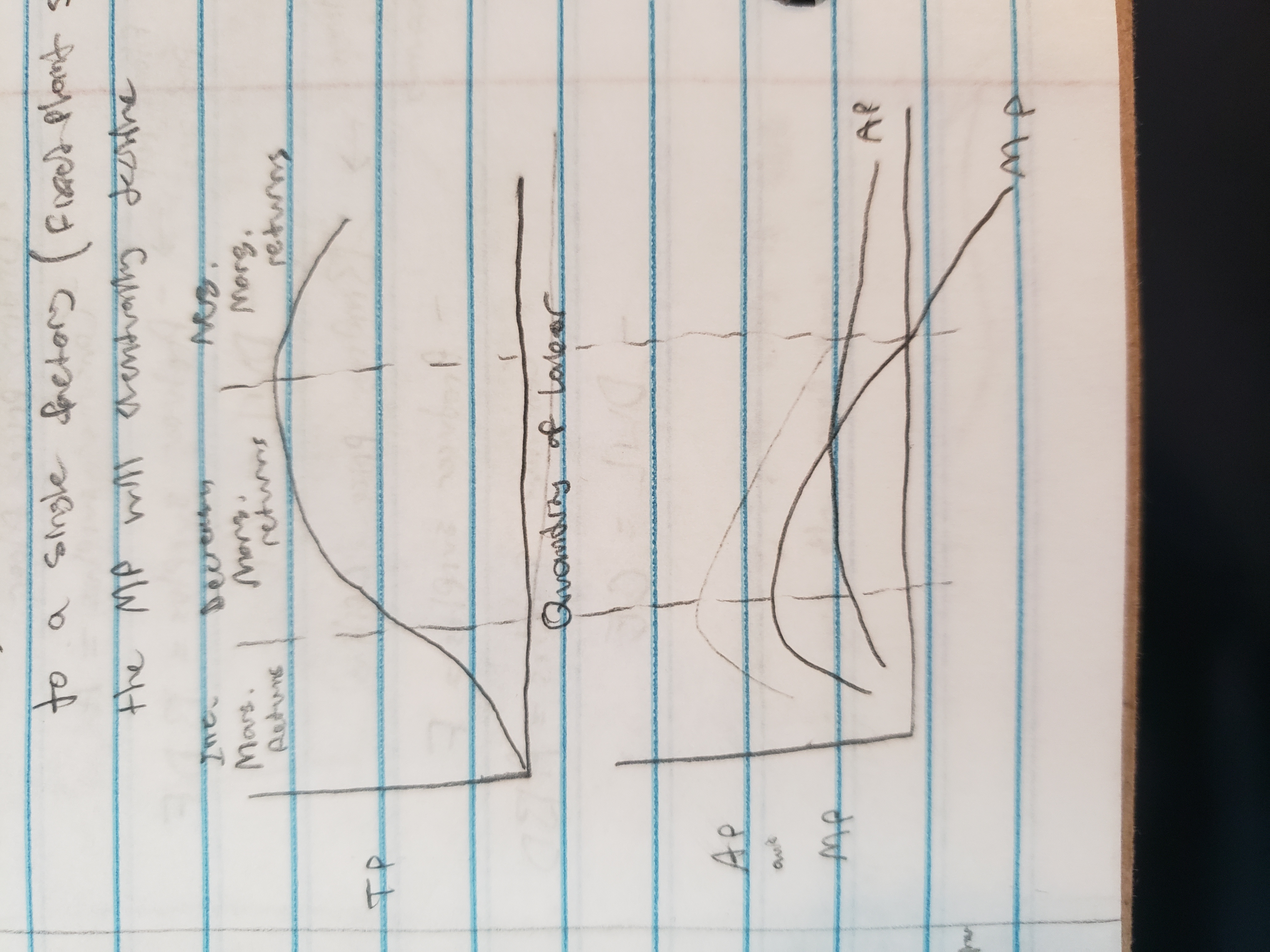

Law of Diminishing Marginal Returns

As more of a variable resource is added to a fixed resource, at some point, the MP of the variable resource will decline

ex, as we add more workers to a single factory (fixed plant), the MP will eventually decline

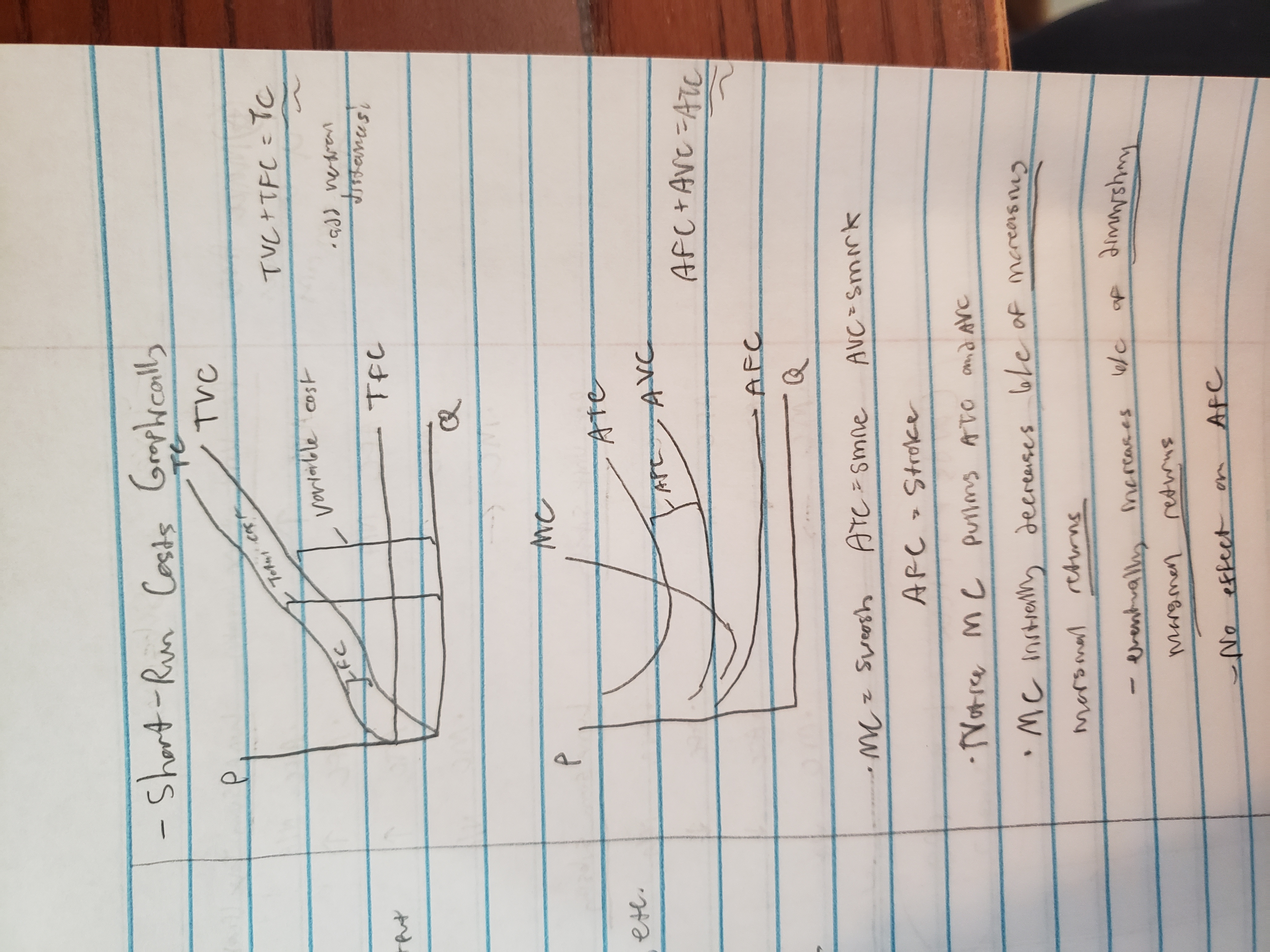

Fixed costs

TFC

average fixed costs = TFC / Q

Variable costs

TVC

AVC = TVC / Q

Total cost

TC = TFC + TVC

ATC = TC / Q

marginal cost (MC)

MC = change in TC / change in Q or change in TVC / change in Q

fixed costs do not affect MC

effect of MP on AP

if MP < AP, AP decreases

if MP > AP, AP increases

MC also controls AVC and ATC the same way

short run costs graphically

determinants of cost curves

Productivity

Specialization

Division of Labor

Tech

Input Prices

Taxes / Subsidies

Shifting Cost Curves

Higher costs will increase AVC and MC shifts left

MC curves = supply curves for a company (which is why they shift left and right like one)

effect of per unit tax on AVC, AFC, ATC, MC

AVC increases

AFC (n/a)

ATC increases

MC shifts left

effect of per unit subsidy on AVC, AFC, ATC, MC

AVC decrease

AFC (n/a)

ATC decrease

MC shifts right

effect of lump sum tax on AVC, AFC, ATC, MC

AVC (n/a)

AFC increase

ATC increase

MC (n/a)

effect of lump sum subsidy on AVC, AFC, ATC, MC

AVC (n/a)

AFC decrease

ATC decrease

MC (n/a)

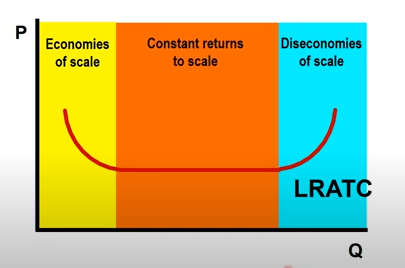

long-run production costs

in the long run, all costs can change! No distinction between VC and FC

P v. Q graph is a single, slightly U shaped LRATC curve (long run avg. total cost)

zones on a LRATC (and when will you see scale and return)

econ of scale: growing businesses, efficient

Increasing output decreases LRATC

vs. increasing returns to scale, doubling input more than doubles output

Constant returns to scale: doubling input doubles output

diseconomies of scale: losing efficiency, doubling input less than doubles output

“scale” = long run, “return” = short run

minimum efficient scale (MES)

Lowest output where costs are minimized

Larger output = industry more concentrated (fewer firms)

on a graph, intersection between yellow and orange zones, or where it firsts hits minimum

explicit v. implicit costs

explicit = monetary payments to others

implicit = opportunity costs to owner, forgone salary, self-owned resources (PC, own car, own room)

forgone interest on static (one-time) payments / savings

accounting profit

TR - explicit costs

economic profit

TR - economic costs

economic costs = explicit + implicit

always smaller than accounting profit

normal profit

implicit costs (what you could have had) (what you would have normally had)

short run profit maximization

MR = MC rule

MR = extra revenue from selling one more unit = P (for now)

only works if you choose to produce

applies to all market models

mr = mc rule on a table

find row where MR is closest to MC, and/or where profit is the highest

mr = mc rule on a graph

MR = D = AR = P line

Study all images, know how to draw these graphs. Minimum of ATC and AVC should intersect with MC line

loss minimization position

short run shut-down point and break-even point

side-by-side graphs (and why)

profit maximization in the long-run

Assumptions

Entry/exit only (profit = entry, loss = exit)

Identical firms and costs

Constant-Cost industry (input prices unaffected by entry/exit)

Results of analysis

MRDARP will end up at minimum ATC, and economic profit = 0

temporary profits, re-establishment of equilibrium (know thought process)

four market models (from most to least efficient)

Perfect competition > monopolistic comp. > oligopoly > pure monopoly

perfect competition

constant-cost industry

increasing cost industry

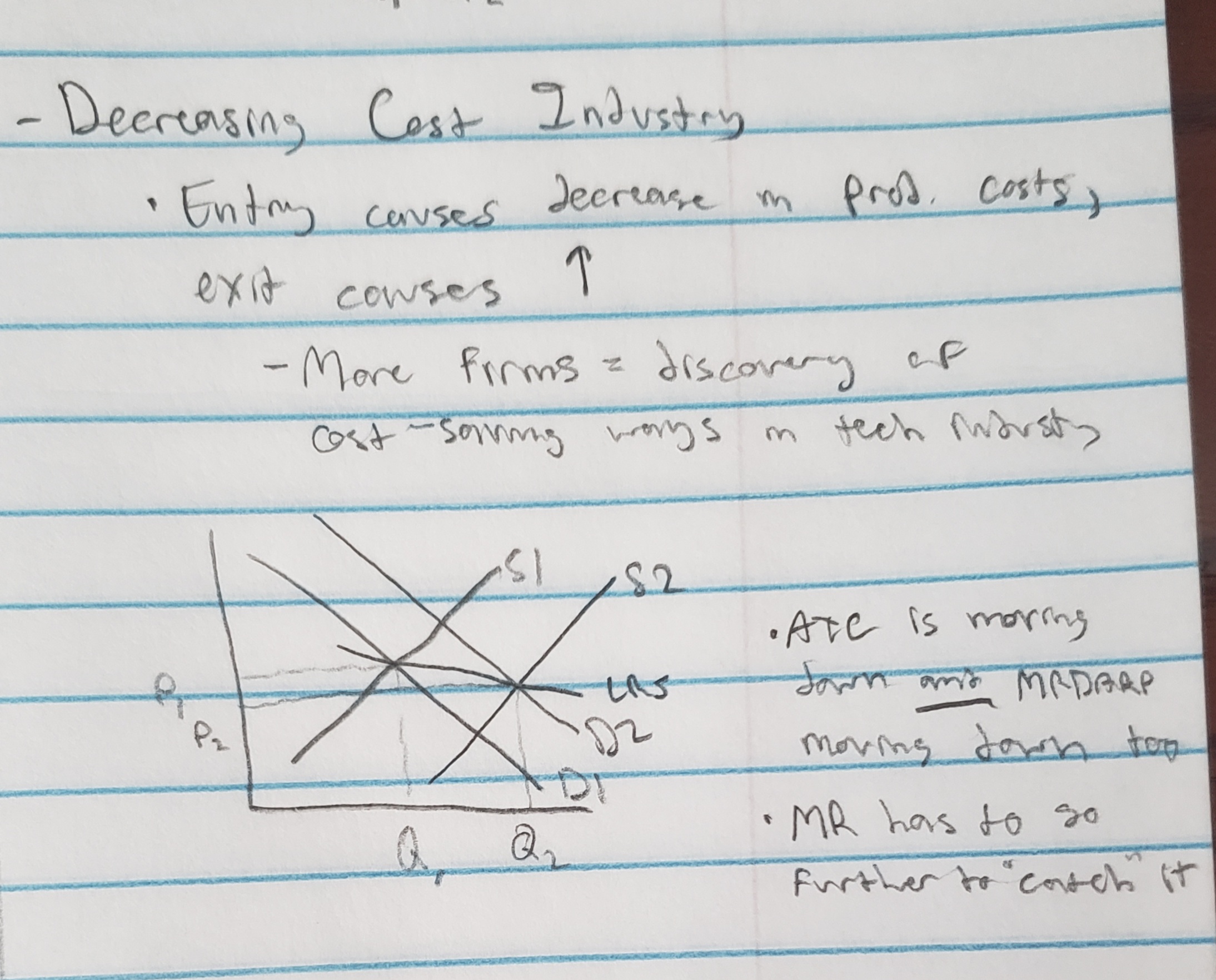

decreasing cost industry

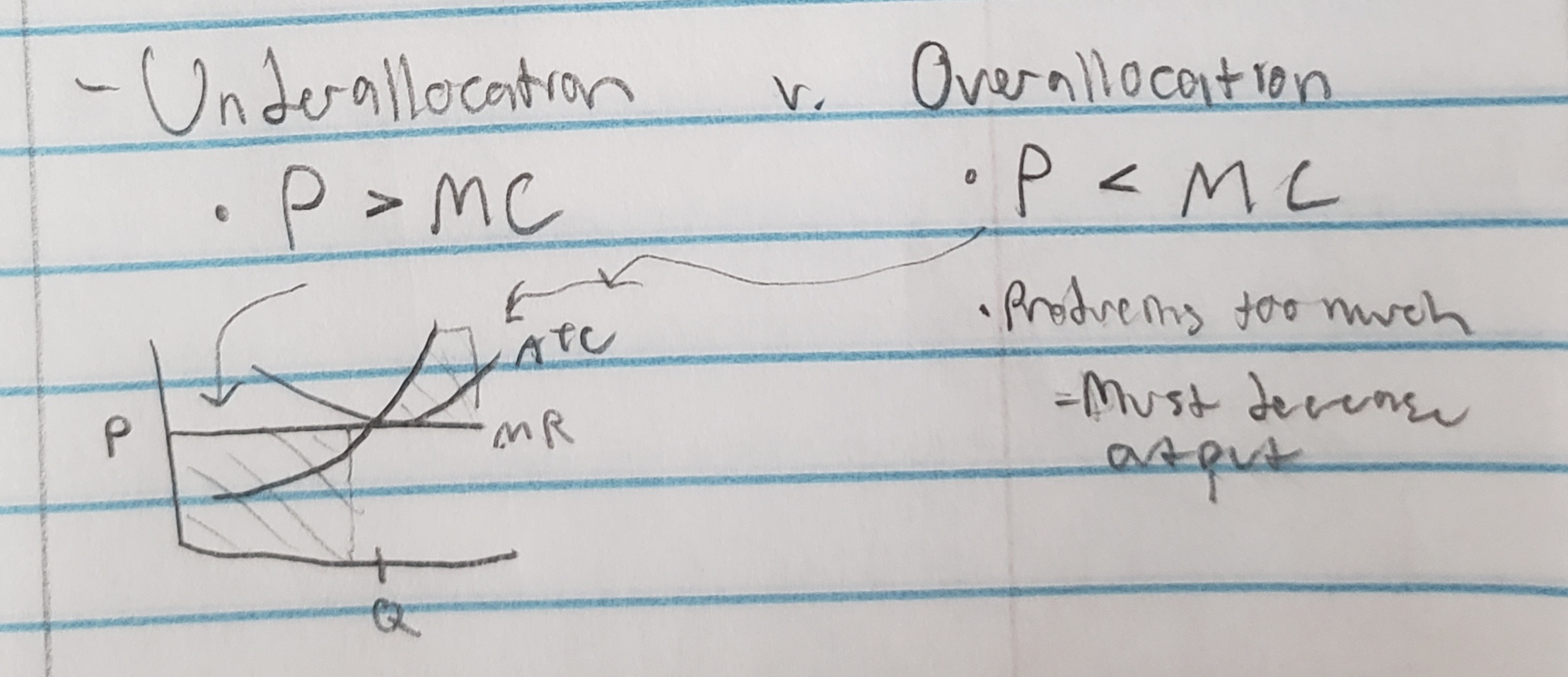

underallocation vs. overallocation, and what guarantees efficiency

Perfect competition = productive efficiency (P = min atc, consumers getting product at lowest possible price) and allocative efficiency (P = MC, producing at the level society wants it to produce)