Economics IB HL - Unit 1 - Market failure

1/83

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

84 Terms

what is an externality

positive or negative effect for third parties. It is where the market fails to achieve allocative efficiency because MSMB is not equal to SMC

Definition of PMB

additional benefits for consumers from consumption of an additional unit of a good

Definition of SMB

additional benefits for society from the consumption of one more unit of a good

Definition of PMC

additional costs to producers from producing one more unit of a good

SMC

additional costs to society from the production of one more unit of a good

When is there no externality

There is no externality when D = S when SMB = SMC

What are the socially optimum price and quantity

the best quantity and best price from the point of view of what is most desirable from society’s point of view

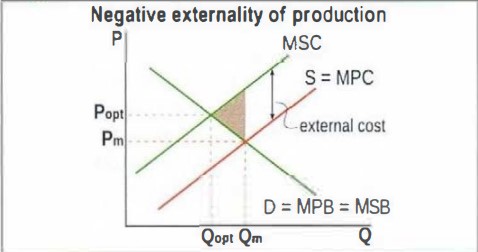

In this diagram what does PM and Qm represents

pm and qm shows the market outcome

What happens in the allocation of resources when there is negative externalities

the market overallocates resources - too much is produced

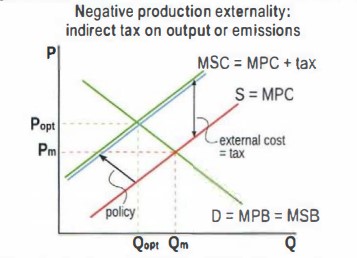

draw and labell a negative externality of production

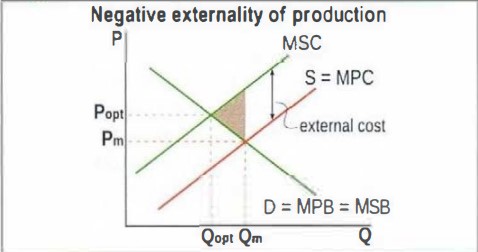

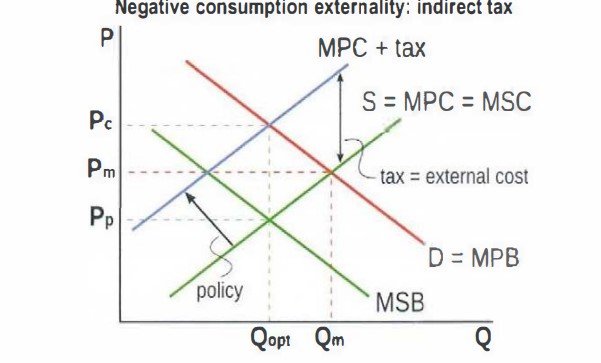

draw and label a negative externality of consumption

What is an example of a negative externality of production

production of goods using fossil fuels leading to carbon emissions, hence there are external costs including pollution of celean air etc

example of neagtive externality of consumption

smoking, where there are negative health effects on non-smokers and increased health care costs.

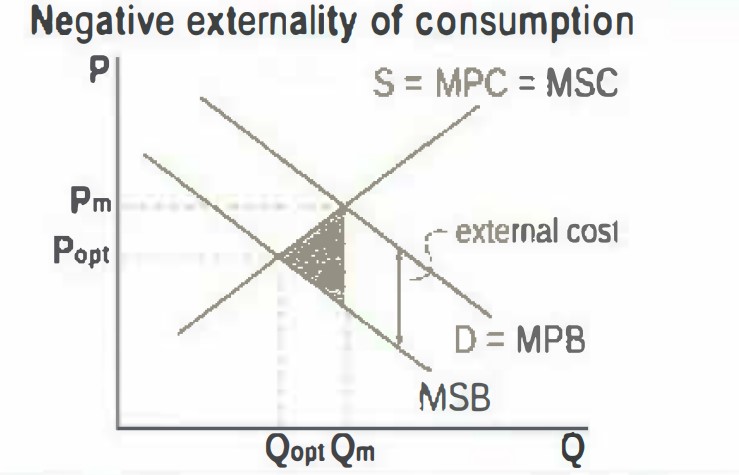

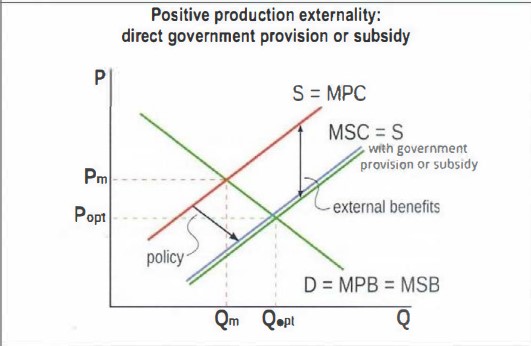

draw a positive externality of production

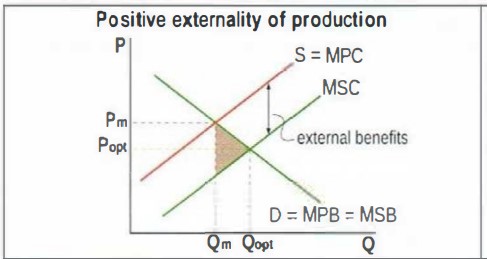

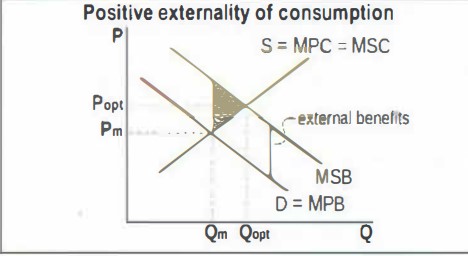

positive externality of consumption

example of positive externality of production

research by firms leaeds to develeopment in new technologies that benefit the whole society

example of positive externality of consumption

education leads to benefits for society including lower unemployment, increased productivity

merit goods

goods when consumed creates positive consumption externalities; are socially desirable but underprovided and consumed in the market.

example of merit goods

education, health care, infrastructure.

demerit goods

goods whose consumption creates negative externalities of consumption. are socially undesirable but are over provided and over consumed by the market

example of demerit goods

cigarettes, fuel for cars

how can the government respond to externalities

using

regulations

legislation

advertising

education

direct government provision

using market based policies how can externalities be addressed.

using

indirect taxes

subsidies

examples of government command approaches - legislation, regulations, and advertising for negative production externalities

impose restrictions on emissions

limit the amount of output produced

Force firms to install non-polluting technologies

Create protected area

restrictions on logging, fishing and hunting

negative advertising to influence consumers to avoid buying products off highly polluting firms

What are three positives of government command responses

Simpler to implement compared to market based policies

effective in partial achievement

in some cases are more appropiate than market solutions

What are 3 negatives of government command responses

involve costs of monitoring and enforcement

do not provide incentives in the market to switch to cleaner technologies

there is incomplete knowledge on extent of damage done by pollutants so hard to tell how much to restrict activities

how does an indirect tax help with negative externalities of production

An indirect tax on output causes the supply curve to shift from PMC towards SMC, leading to the socially optimum P aND Q. This means the externality is eliminated so welfare loss is eliminated.

explain how an indirect tax on emissions also addresses the negative externality of production

this also cause the uspply to shift from PMC TO SMC leading to socially optimum Q and P. This works by creating incentives for firms to reduce emissions and shift to clean technologies to avoid paying tax.

What is a tradable permit and what is an example of one

a max permissible amount of a particular pollutant is determined, and permits to emit this pollutant are distributed to firms by the government. these can then be sold and bought in a market which creates incentives to switch to clean energy to lower production costs. An example is when the european union emissions trading system covering power and heat generation etc

What are 5 positives of using market based policies to address a negative externality of production

Can internalize the externality by making the producers pay for the external cost

greater efficiency (lower cost) in reducing pollution than gov regs

the most efficient policies are (a) taxes on emissions and (b) tradable permits. firms that face low costs of reducing emissions face the incentive to lower emissions and pay lower tax and perhaps sell the permits for profit. SIMILARLY firms with higher costs of reducing their emissions can pay the tax or buy permits

Taxes and tradable permits on emissions can provide incentive to switch to clean technologies

cleaner technologies shifts the SMC to the right so reduces the overall size of the externality

negatives of using market based policies to address a negative externality of production

There are difficulties in identifying the most harmful pollutants and the value of external costs

in case of taxes, hard to find the value of tax that will equal the value of harm

for both indirect taxes and tradable permits there are difficulties in ensuring compliance and enforcement

Draw a graph showing a Negative production externality and the effect of an indirect tax on output or emissions

How can command approaches help negative consumption externalities ?

These can influence the behaviour of consumers and reduce demand so that the PMB curve shifts closer to SMB leading to the socially optimum Q and P

GIVE ME 3 examples of command approaches to address a negative consumption externalities

legislation, no smoking in public places, no drinking and driving

negative advertising to change consumers’ preferences like informing them of the dangers of smoking

educate consumers

What are the positives of government command policies to tackle a negative consumption externality

Simple to implement

effective in at least partially reducing demand for the good

some cases more appropriate like banning smoking in public places

What are the negatives of government command policies to tackle a negative consumption externality

very unlikely to reduce demand to the required level. so only partially eliminates the externality

advertising and education have opportunity costs as funds are diverted from other objectives

How can market-based policies be used to address a negative externality of consumption

An indirect tax on a good causing the negative externality causes supply curve to shift upwards. this causes P to increase and Q to fall. If the tax is exaclty equal to the value of the external cost, ‘PMC+tax’ will intersect PMB at the level of socially optimum quantity.

draw a graph to shows the effect of an indirect tax on a negative consumption externality

what are the positives of using market based policies when correcting a negative externality of consumption

can internalize the externality - make the consumers pay for the external cost

can be more efficient because they are based on price mechanism so uses price incentives for consumers to respond to

if the good being taxed has inelastic demand the tax will result in a higher revenue that can be used to finance government advertising and education programs because as price increases the quantity demanded stays the same

what are the negatives of using market based policies when correcting a negative externality of consumption

difficult to measure the exact value of external costs

therefore difficult to determine the size of the tax that will be equal to the external costs

If the good taxed has inelastic demand the tax is unlikely to result in a significant fall in Q produced and consumed so will not be very effective in eliminating the externality

Indirect taxes are regressive affecting poor people more strongly which could lead to them switching to lower quality substitutes which are cheaper but may be more harmful

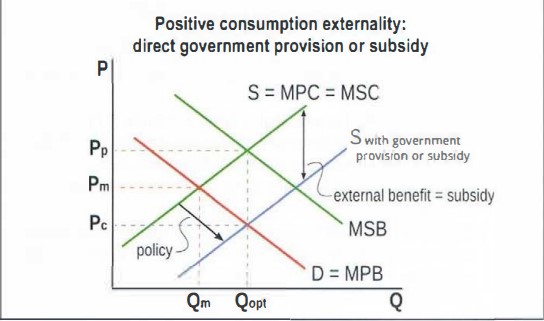

How can direct government provision help with positive production externalities?

This has the effect of shifting PMC curve closer to the SMC curve so therefore help reaches the socially optimum quantity and P.

What is an example of when the government would chose direct provision to correct a positive production externality.

In the case of research and development. For the development of new scientific knowledge, new technologies, new products.

What market side policy could be used to correct a positive production externality?

Provision of subsidies to private firms from the gov involved in reasearch and development shift the PMC closer to SMC

What is a positive of using direct government provision and subsidies

are highly effective in increasing the amount of research and development carried out

What are the negatives of using direct government provision and subsidies

Negatives of using direct gov provision and subsidies

difficulties in estimating the value of the external benefits

Difficult to determine the size of the subsidy or the funds that should be allocated toward direct provision in order to match the value of the external benefits

Government funding involves opportunity costs

The government selection process on what activities to support is often subject to political pressures with choices made on political grounds instead of economics

Draw a graph showing a positive production externality corrected by direct government provision or subsidy

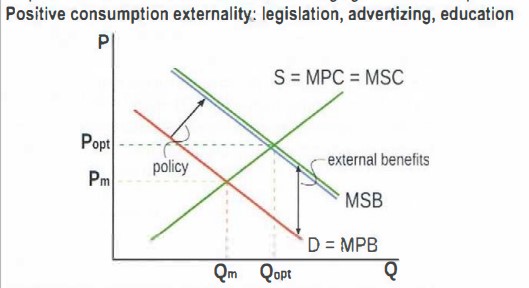

How can command approaches be used to correct positive consumption externalities

command approaches include legislation, advertising and education that aim to influence the behaviour of consumers to INCREASE demand so that the PMB curve shifts closer to the SMB

What are the positives of legislation, advertising and education when tackling positive externality of consumption

Positives of command approaches when tackling a positive consumption externality

simple to implement

effective in partially increasing demand for the good

What are the negatives of legislation, advertising and education when tackling positive externality of consumption

Positives of command approaches when tackling a positive consumption externality

advertizing and education alone are unlikely to increase demand to the required level.

- adverts and education both have opportunity costs as funds are diverted from other objectives

Difficulties of compliance and enforcement of legislation

Increase in demand leads to higher P which makes goods unaffordable for lower income groups. therefore should be used besides direct provision and subsidies

draw a graph showing a positive consumption externality corrected by command approaches

draw a graph showing a positive consumption externality corrected by government direct provision

What are common access resources

natural resources without ownership, so have no price so can be used by anyone. they are non-excludable but are rivalrous because when one person uses them it makes them less available for another

What are some examples of common access resources

forests, rivers, lakes, oceans, soil quality,

What is the definition of sustainability

the use of natural resources at a rate that allows them to reproduce themselves. this results in future generations being able to use the resources to satisfy their wants and needs.

what is the concept of sustainable development

Development which meets the needs of the present without compromising the ability of future generations to meet their own needs.

give one example common access resources pose a threat to sustainability because they are often overused, depleted and degraded

Example 1 - Forests. Anyone can chop down trees which poses a threat to sustainability if trees are chopped down more quickly than new trees can grow. Forests become depleted while the environment is reduced in quality due to a loss of natural habitat for animals, a loss of biodiversity and global warming.

Explain how the use of fossil fuels is a threat to sustainability

The use of fossil fuels in production and consumption creates negative externalities resulting from overuse, depletion and degradation of common access resources which then causes external costs of climate change, depletion of the ozone layer, acid rain, and lots of health care issues that cause a surge in healthcare costs.

how is poverty a threat to sustainability

In economically LDE’s poverty can lead to people uses open access resources unsustainably in order to survive on super low incomes. Also high population growth exerts additional pressures on unsustainable resource use.

What are six ways in which the government can respond to threats to sustainability

ways gov can respond to threats on sustainability

legislation and regulations

funding for clean technologies

carbon taxes

cap and trade schemes - tradable permits

elimination of environmentally harmful subsidies

government subsidies for the development of clean technologies

Why is there a need for international collaboration

Negative environmental externalities extend far beyond national boundaries, and therefore require international collaboration for a solution.

what is a private good

a good that is rivalrous and excludable so people can be prevented from using it by charging a price.

What are some examples of private goods

cars, computers, houses, education, NHS etc

What is a public good?

a good that is both non-rivalrous and non-excludable.

what are some examples of public goods

police force, light house, knowledge, streetlights

What is the free ride problem?

this happens when people use a good without paying for it. This causes a market failure because even though the good may be socially desirable private firms will not produce it because without the ability to charge a price it would be impossible for them to cover the costs.

What are quasi-public goods?

good that are not rivalrous but are excludable.

what is an an example of quasi public goods?

toll roads, museums, public swimming pools.

What is

Asymmetric Information

a type of market failure occurring when one party in a transaction has more information than the other party, leading to allocative efficiency.

give and explain an instance when sellers have more information than the buyers

for example a seller of used cars knows more about the car’s condition than the buyer. Because of this it often leads to an under allocation of resources t