4.4 financial sector

1/10

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

11 Terms

ROLE OF FINANCIAL MARKETS

FACILITATE SAVINGS

Facilitate savings, allows people to transfer their spending power from present to future.

Can be done through a range of assets, such as storing money in savings account and holding stocks and shares.

You can save money in a bank account or pension fund.

ROLE OF FINANCIAL MARKET

LENDING

Second role of financial market is lending.

Lend money to businesses and individuals who need more cash, which allows consumption and investment.

Financial intermediary- institution that takes savings from households and then lends those funds to firms for investment.

ROLE OF FINANCIAL MARKET

EXCHANGE

The third role of financial institutions is creating a payment to facilitate exchange, which makes it easier for individuals and firms to trade.

ROLE OF FINANCIAL MARKET

EQUITY

Sell a percentage of their shares, important for companies to finance expansion.

However, people would be unlikely to buy shares if unable to sell them on in the future.

Financial markets provide ability for shares to be sold in the future, make asset more appealing.

ROLE OF FINANCIAL MARKETS

FORWARD MARKETS

FIX THE PRICE AND DATE OF A FUTURE TRANSACTION NOW.

A forward contract occurs when you fix the price and date of a future transaction now so that you know exactly how much you will pay or receive and when.

the price of copper from Chile is lower in 6 months tine, the firm will have lower costs and more profit.

The price of currency tends to be very volatile, lots of different factors that affect it. interest rates, demand for exports and imports, foreign currency transactions.

WHAT IS EQUITY?

Equity is a way that a firm can raise finance without having to take out a loan (which has to be paid back!). Equity is when a firm sells a percentage of their company to investors in the form of shares. The investors can then receive a percentage of the profits.

Having a market for equities is import as it:

Allows firms to raise finance by selling a share in their company.

It provides investors with an opportunity to make money by buying shares and then selling them when price increases.

MARKET FAILURE IN THE FINANCIAL SECTOR

ASYMMETRIC INFORMATION

Asymmetric information is when one party knows more than another in a transaction.

e.g. Bankers knew much more about their subprime mortgages than the people they were selling to.

Bankers knew far more about banking than the financial regulators who were meant to be monitoring their behaviour.

subprime mortgages- risky mortgages

MARKET FAILURES IN THE FINANCIAL SECTOR

SPECULATION AND MAKRET BUBBLES

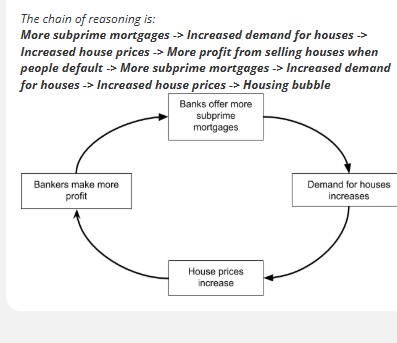

Before the 2008 financial crisis, bankers speculated that house prices would rise, so they sold subprime mortgages, which caused a housing bubble.

Speculation bubbles occur when price of an asset rises above fundamental value due to speculation. Investors see price rise and buy asset in hope of future profit which rises prices.

Eventually confidence collapse, investors determine prices will fall, causes mass selling.

MARKET BUBBLES IN HOUSING MARKET

-lending too much in mortgage, increase demand in houses, bubbles burst, rise in interest rates, fall in demand for houses, negative wealth effect, reduce AD, banks left with loan not repaid in full.

MARKET FAILURE IN THE FINANCIAL SECTOR

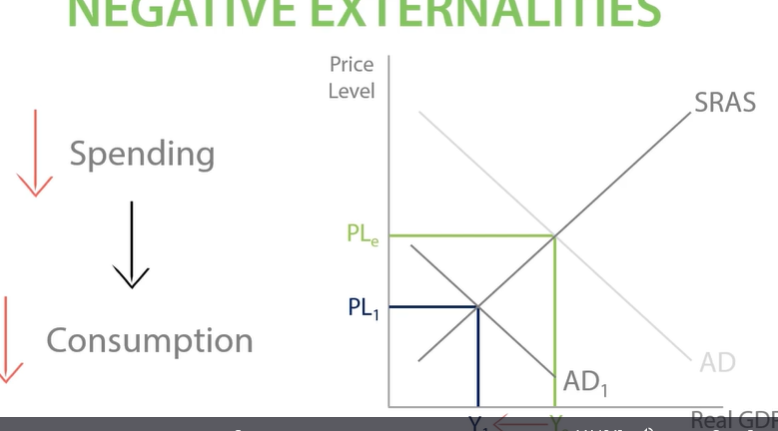

NEGATIVE EXTERNALITIES

Negative externalities are costs which affect third parties outside the price mechanism.

2008 financial crash

After the financial crisis, banks stopped lending

money to people or businesses. Firms couldn’t borrow money, so they had to make cutbacks, which meant that millions of people became unemployed. There was therefore a decrease in real GDP. This is a negative externality because the people who lost their jobs were outside the price mechanism in the financial sector.

MARKET FAILURE IN THE FINANCIAL SECTOR

MORAL HAZARD

Where individuals make decisions in their own best interests knowing there are potential risks.

individual workers take adverse risk in order to increase their salary. Any problems they cause will be the problem of the company and not the individual, the worst will happen they lose their job and company loose millions of pounds.

global financial crisis moral hazard- employees sold mortgages to those who would not be able to pay back. by selling more mortgage, they see higher salaries and bonuses but not negative effects if loan not repaid.

financial institutions may take risk as they know central bank is the lender of the last resort and will not allow them to fail due to impact on economy.

MARKET FAILURE IN THE FINANCIAL SECTOR

MARKET RIGGING

Our fifth example of financial market failure is market rigging. This is where firms unfairly try to control prices which distorts the price mechanism. One of the most famous examples of market rigging is LIBOR.

Barclays caught manipulating the LIBOR.