Ch. 12 Equity Financing & Securities

1/34

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

35 Terms

How do common stockholders usually receive returns?

Usually in the forms of dividends, could also be through stock repurhcases

What are dividends?

cash payments by corporations paid to stockholders

How do common stockholders exercise their right of control?

they have the right to elect a firm’s board of directors who in turn manages the business and controls stockholder’s control

What is the preemptive right?

gives current shareholders the right to purchase any new shares by the firm before they are shared to general public (like a pre-sale)

What is the purpose of the preemptive right?

protect stockholders present position of control, keeps their commitment

What is meant by classified stock?

used to distinguish between stock classes when a business issues more than one type of common stock. Typically type A and B

Give one reason for using classified stock

allow the public to take a position in a conservatively financed company without sacrificing income

Type A: sold to the public, earn no voting rights for 5 years

Type B: retained by organizers and carry full voting rights

What is a rights offering?

when existing shareholders receive right to buy a specific # of new shares at a price below the current market price

What is private placement and what are its primary advantages over public offering?

securities are sold to a few institutional investors who are pre-selected

has lower administrative costs & greater speed since shares do not have to go through registration process

What are employee stock purchase plans?

companies plans that allow employees to purchase stock of the employing firm on favorable terms

What is a dividend reinvestment plan?

a plan under which the dividends paid out to a stockholder is automatically reinvested in the company’s common stock

What is a direct purchase plan?

allows stockholders to purchase additional stock directly from the company

What are some sources of equity (fund capital) available for NFP firms

government grants

charitable contributions

Are NFP corporations at a disadvantage when it comes to raising capital?

on the surface NFPs can appear to be at a disadvantage since charitable contributions aren’t certain BUT for-profits have to suffer from dilution of existing shares

What are three approaches to valuing common stocks?

start-up businesses

young businesses

mature businesses

when does valuing start-up businesses apply?

business in its infancy generally pays no dividends because any earnings must be reinvested to fund growth

when does valuing young businesses apply?

reaches a point at which it has more or less predictable earnings but still requires reinvestment (no dividend)

when does valuing mature businesses apply?

generally pay predictable dividends, future dividend stream can be forecast with reasonable confidence

what are the assumptions of the constant growth model?

the required rate of return must be bigger than expected growth

dividends are predictable and grow at a constant rate, the same required rate of return is used each year

what are the key features of constant growth regarding dividend yield & capital gains yield?

dividend yield = annual dividend/current stock price

capital gains yield = rise in price/original price

What is meant by security market equilibrium?

most securities are neither undervalued or overvalued

What two conditions must hold for markets to be efficient?

expected rate of return = required rate of return

market price = value of security

What is the efficient markets hypotheses?

a theory that stocks are always in equilibrium and it is impossible for investors to beat the market

What are the implications of the efficient markets hypotheses for investors & managers?

investors should not expect to beat the market

managerial decisions should not be based on perceptions about the markets ability to price securities

Explain the risk/return trade-off

higher returns = higher risk

which alternative has a higher return after adjusting for risk

In what markets does this trade-off hold?

hospitals

group practices

healthcare businesses

What are the most important stock holders rights?

claim on residual earnings

Control of the firm

Preemptive right

new common stock maybe sold by for-profit corporations in what 6 ways?

as-needed basis through a rights offering

through investment bankers to the general public in public offering

to a small number of buyers in private placement

to employees through an employee stock purchase plan

to shareholders through a dividend reinvestment plan

and to individual investors by direct purchase

what is a “closely held corporation”?

one that is owned by a few individuals who typically are the firms managers

what is a “publicly owned corporation”?

one that is owned by a large number of individuals, most of whom are not actively involved in its management

Since NFPs do not have access to equity markets, what are unique sources for NFPs to gain equity?

charitable contributions

government grants

How do you find the value of a dividend-paying company stock share?

by discounting the stream of expected dividends by the stock’s required rate of return

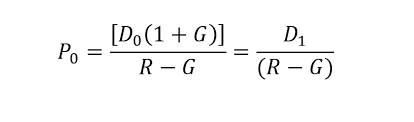

the value of a stock whose dividends are expected to growth at a constant rate for many years is found by applying what model?

the constant growth model

how do you find expected rate on return

expected dividends yield + capital gains yield

dividends yield = D1/ Price

capital gains yield = g