Tax - exam

1/44

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

45 Terms

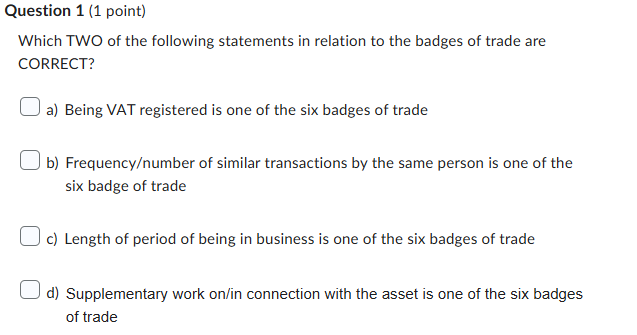

The correct answers are b and d.

The six badges of trade are:

Subject matter of transaction.

Length of period of ownership.

Frequency/number of similar transactions by the same person.

Supplementary work on/in connection with the asset.

Circumstances responsible for realisation.

Motive.

module 5. 2.5

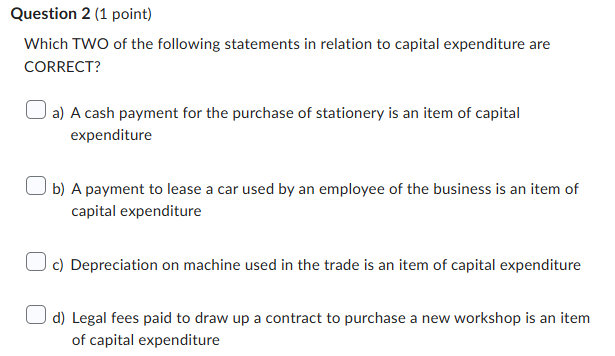

The correct answers are c and d.

Depreciation is always a capital item and the cost of initial set-ups of contracts is a capital-related expense.

If you are not sure of the answer, please see module 5 lesson 3, topic 4: Adjusting amount - what is capital and how is this dealt with under trading income?

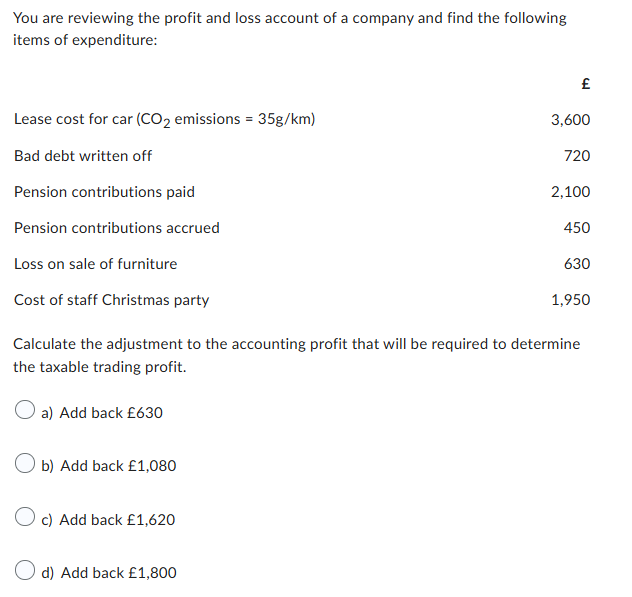

The correct answer is b.

The items requiring adjustment are:

£ | |

Pension contribution accrued | 450 |

Loss on sale of furniture | 630 |

1,080 |

No adjustment is required for the lease payment as the CO2 emissions do not exceed 50g/km.

module 5. If you are not sure of the answer, please see lesson 3, topic 4: Adjusting amount - what is capital and how is this dealt with under trading income? and topic 5: Adjusting amount - what items are dealt with elsewhere in the income tax computation? and topic 6: Adjusting amounts – what are the specific rules in tax law for restricting deductions?

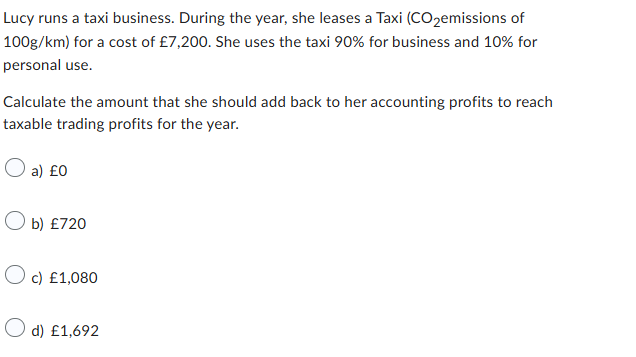

The correct answer is d.

There will need to be an add back for the personal use of £720.

Taxis are included in the leased car restrictions. The business cost of the lease is £6,480 (after deducting the personal use of £720). As the CO2 emissions exceed 50g/km a disallowance of 15% of the business use (£6,480 x 15% = £972) is required. The total amount to add back is £1,692.

module 5. If you are not sure of the answer, please see lesson 3, topic 6: Adjusting amounts – what are the specific rules in tax law for restricting deductions?

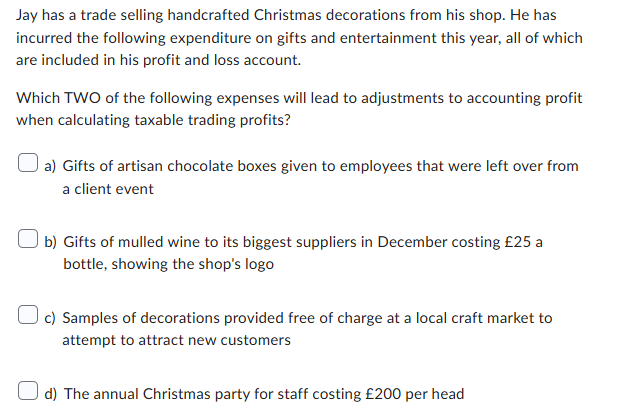

The correct answers are a and b.

Gifts given to employees are not deductible if they are incidental to the provision of others. The chocolate boxes were intended as gifts to clients and only provided to employees as leftovers, and so the cost of these is not allowable.

Gifts bearing the business' logo costing less than £50 are usually allowable, however, not if they are gifts of drink, which the mulled wine is. Therefore an adjustment is needed for this.

Samples of the business' usual trade given away as advertising are allowable, and so the decorations provided at the craft market do not require adjustment.

Staff entertainment is allowable regardless of the cost per head. (Note that the £150 cost per head limit in relation to parties is for determining whether or not a taxable benefit arises for employment income purposes).

If you are not sure of the answer, please see lesson 3, topic 6: Adjusting amounts – what are the specific rules in tax law for restricting deductions?

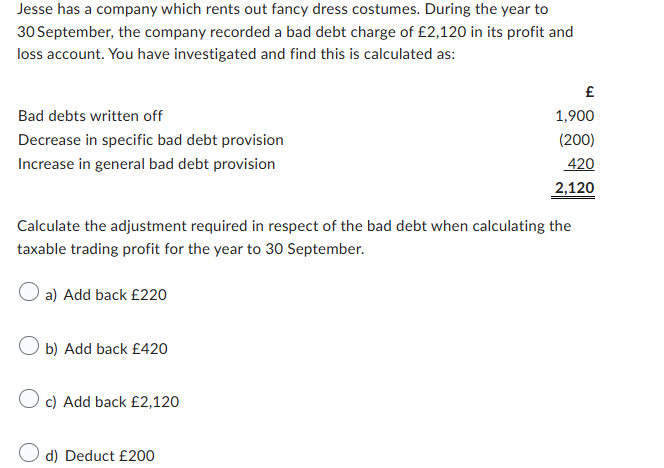

The correct answer is b.

Only the movement in the general bad debt provision requires adjustment.

If you are not sure of the answer, please see lesson 3, topic 6: Adjusting amounts – what are the specific rules in tax law for restricting deductions?

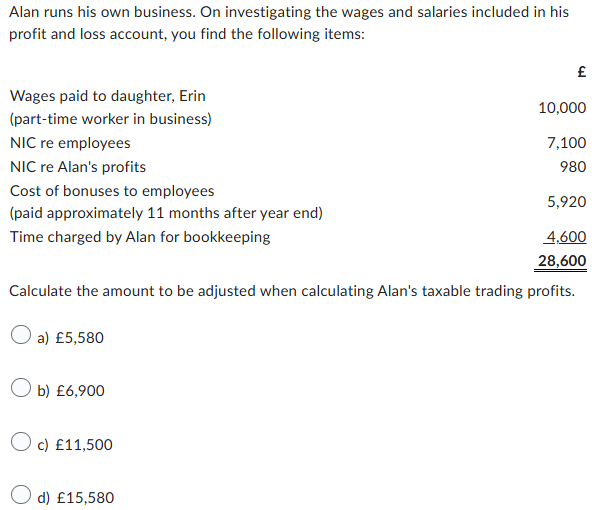

The correct answer is c.

The items requiring adjustment are:

£ | |

NIC re profits (personal) | 980 |

Cost of bonuses (paid more than 9 months after year end) | 5,920 |

Alan's own time | 4,600 |

11,500 |

Personal national insurance liabilities of a sole trader cannot be deducted, and the cost must be added back. Accrued remuneration (including bonuses) is not deductible in the period of accrual if it's paid more than 9 months after the period end. Remuneration paid more than 9 months after the period end will be deductible when it's paid in a later accounting period. An expense recognised in the accounts for the sole trader's own time is not a tax-deductible expense.

If you are not sure of the answer, please see lesson 3, topic 6: Adjusting amounts – what are the specific rules in tax law for restricting deductions?

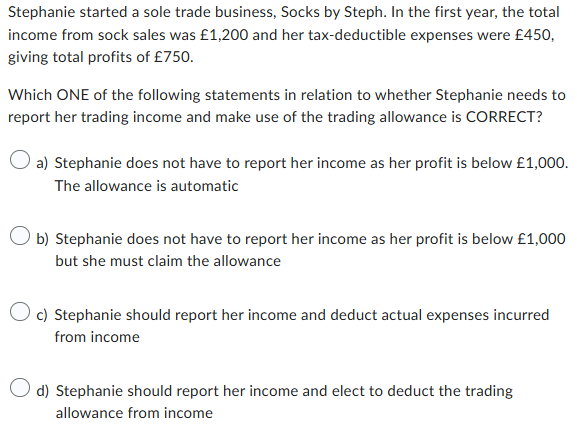

The correct answer is d.

Stephanie needs to report her income as it exceeds the trading allowance of £1,000. She can elect to deduct the allowance from her income to reduce the taxable profit to £200. Using the normal basis and deducting actual expenses, gives rise to a higher taxable profit of £750.

If you are not sure of the answer, please see lesson 2, topic 6: What is the trading allowance?

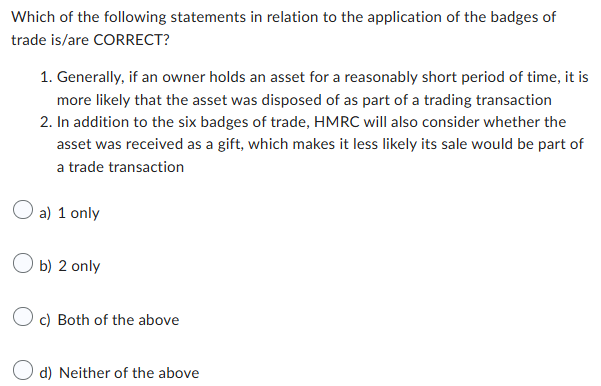

The correct answer is c.

Both statements are correct

f you are not sure of the answer, please see lesson 2, topic 5: What are the main badges of trade?

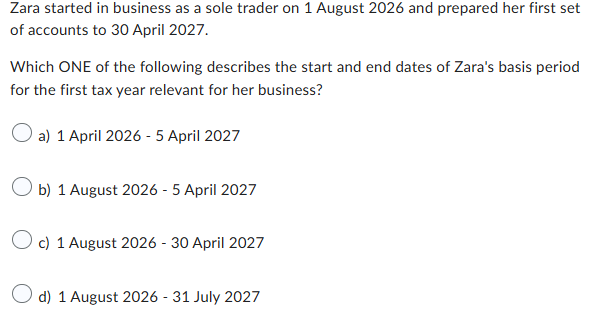

The correct answer is b.

Start date 1 August 2026 and End date 5 April 2027.

Zara's first tax year will be 2026/27 as her first day of trading is 1 August 2026. The basis period for the first year will be from day one of the trade up to the 5 April that follows – 5 April 2027.

If you are not sure of the answer, please see lesson 4, topic 3: Are there any specific rules to follow in the first year of trade?

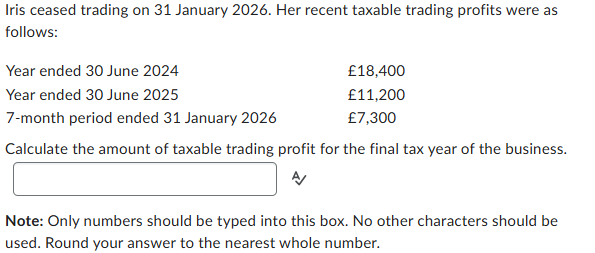

The last tax year for this business will be 2025/26 since the last day of trade is 31 January 2026. The basis period for 2025/26 will be from 6 April 2025 to 31 January 2026, so taxable trading profits for 2025/26 will be: (3/12 x £11,200) + £7,300.

If you are not sure of the answer, please see lesson 4, topic 4: Are there any specific rules to follow in the final year of trade?

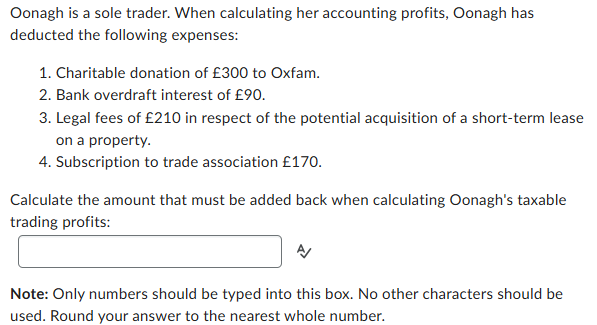

The correct answer is £510

Charitable donations to a national or international charity are not deductible, as they are not wholly and exclusively for the purposes of the trade – need to add back £300. Costs relating to the acquisition (whether it goes ahead or not) of the short-term lease are not deductible – need to add back £210.

If you are not sure of the answer, please see lesson 3, topic 8: What other common items might be included in the accounting profit or loss and what is the tax treatment?

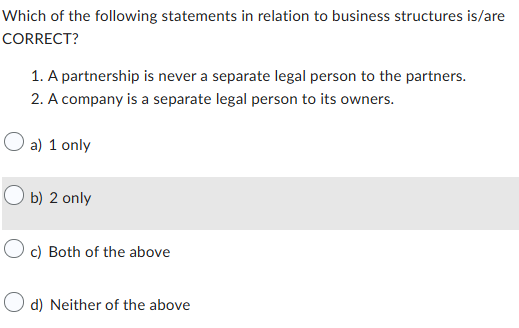

The correct answer is b.

Under Scots Law, a partnership IS recognised as a separate legal person to the partners.

If you are not sure of the answer, please see lesson 1, topic 2: What are the key features of a partnership? and topic 3: What are the key features of a company?

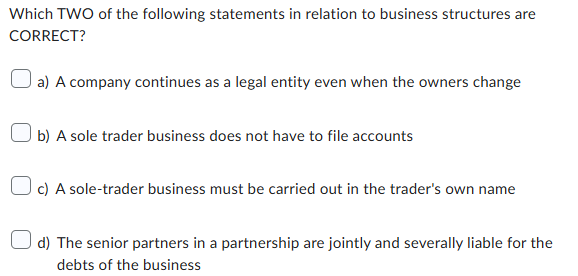

The correct answers are a and b.

A sole trader business may be carried on either in the trader's own name or under another 'business name'. All partners in a partnership are jointly and severally liable for the debts of the business.

If you are not sure of the answer, please see lesson 1 section title, topic 1: What are the key features of a sole trader structure and how is it taxed? and topic 2: What are the key features of a partnership structure and how is it taxed? and topic 3: What are the key features of a company structure and how is it taxed?

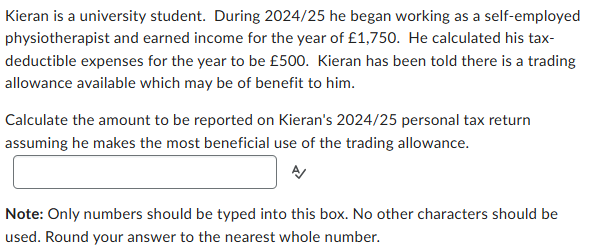

The correct answer is £750

Kieran can either deduct the actual expenses incurred from income received (the normal basis) or elect not to take a deduction from expenses and instead deduct the trading allowance from income received (the alternative basis). In this instance the alternative basis provides a lower, and therefore more tax efficient, result for Kieran: - £1,750 - £1,000 = £750.

If you are not sure of the answer, please see lesson 2, topic 6: What is the trading allowance?

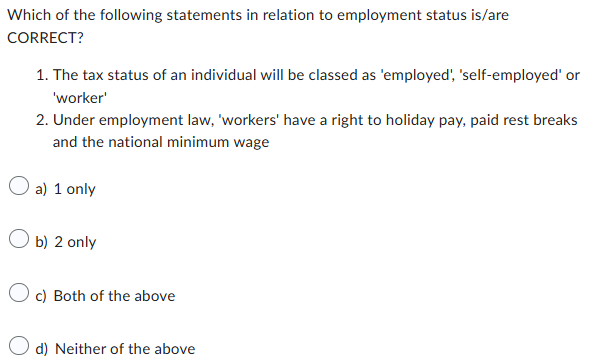

The correct answer is b.

Under employment law, an individual can be classed as employed, self-employed or a worker, whereas for tax purposes an individual can only be classed as either employed or self-employed.

b. If you are not sure of the answer, please see lesson 2, topic 3: What are the different rights under employment law for between someone who is employed, self-employed or a worker?

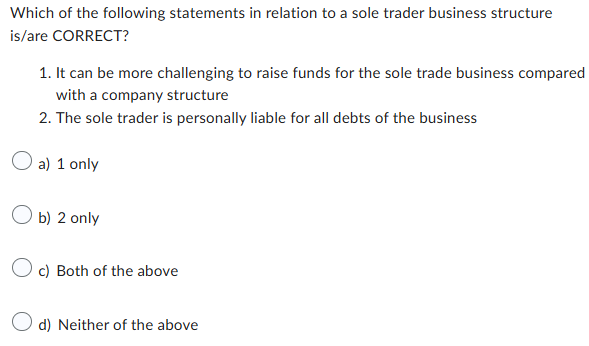

The correct answer is c.

A sole trade business has less regulation compared with a company.

b. If you are not sure of the answer, please see lesson 1, topic 1: What are the key features of a sole trader structure and how is it taxed?

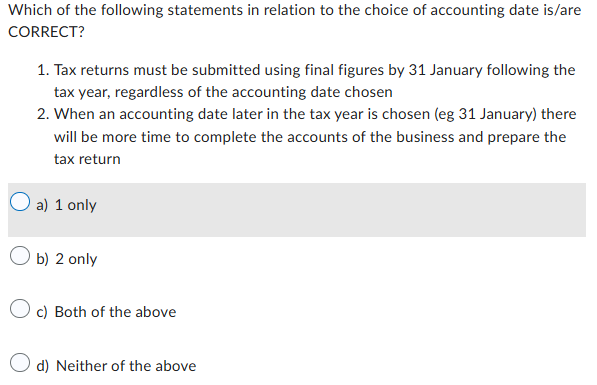

The correct answer is d.

When an accounting date later in the tax year is chosen, there will be less time to complete the accounts and prepare the tax return.

Particularly when a later accounting date is chosen, there may not be time to finalise accounts, and so a tax return can be submitted using estimated figures. These can be corrected at a later date after the 31 January submission deadline.

If you are not sure of the answer, please see lesson 4, topic 2: What impact does the choice of accounting date have on a business owner?

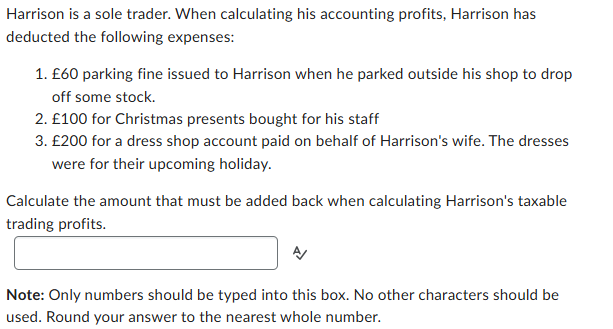

The correct answer is £260

Fines payable on behalf of the business owner are not deductible from trading profits, £60 must be added back.

Gifts to staff are deductible in calculating tax-adjusted trading profits so no adjustment needed here as the accounting treatment matches the tax treatment.

The personal payment of £200 on behalf of a family member is not deductible and must be added back.

If you are not sure of the answer, please see lesson 3, topic 5: Adjusting amount - what items are dealt with elsewhere in the income tax computation? and topic 8: What other common items might be included in the accounting profit or loss and what is the tax treatment?

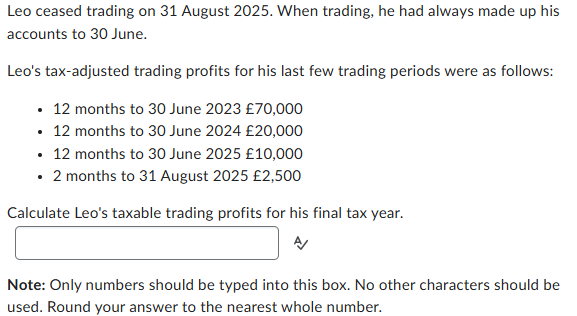

The correct answer is £5,000

Leo's final tax year of trade will be 2025/26 and the taxable trading profits for that year are £5,000 ((3/12 x 10,000) + £2,500) .

If you are not sure of the answer, please see lesson 4, topic 4: Are there any specific rules to follow in the final year of trade?

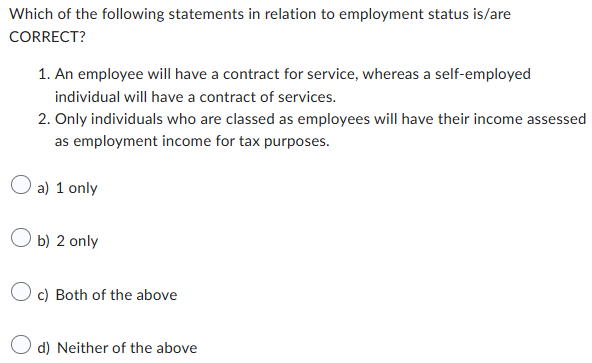

The correct answer is b.

An employee will have a contract of service, whereas a self-employed individual will have a contract for services.

If you are not sure of the answer, please see lesson 2, topic 2: How do we determine if an individual is employed or self-employed?

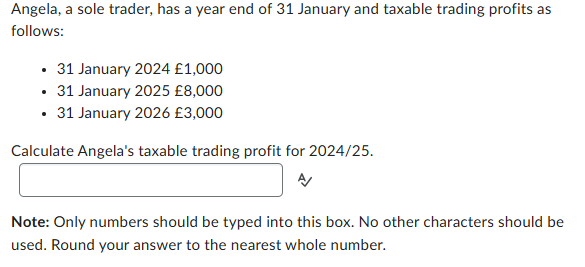

The correct answer is £7,167

As the accounting date is not 31 March, 1 April, 2 April, 3 April, 4 April or 5 April, we need to pro-rate the taxable trading profits:

Accounting period = Basis period | Pro-rated | Tax year 2024/2025 |

1 Feb 2024 – 31 Jan 2025 | 1 April 2024 – 31 Jan 2025 | 10/12 x £8,000 = £6,667 |

1 Feb 2025 – 31 Jan 2026 | 1 Feb 2025 – 31 March 2025 | 2/12 x £3,000 = £500 |

Total: £7,167 |

5. If you are not sure of the answer, please see lesson 4, topic 5: What impact does the choice of accounting date have on a business owner?

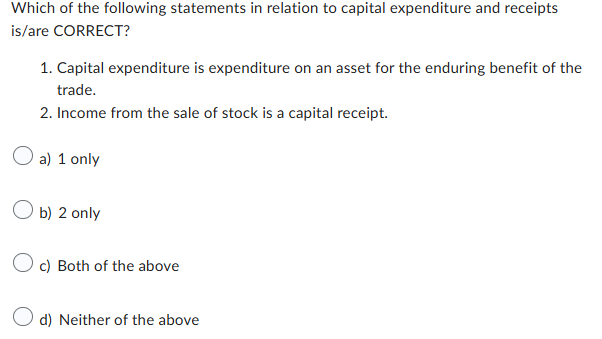

The correct answer is a.

Income from the sale of stock is not a capital receipt.

If you are not sure of the answer, please see lesson 3, topic 4: Adjusting amount - what is capital and how is this dealt with under trading income?

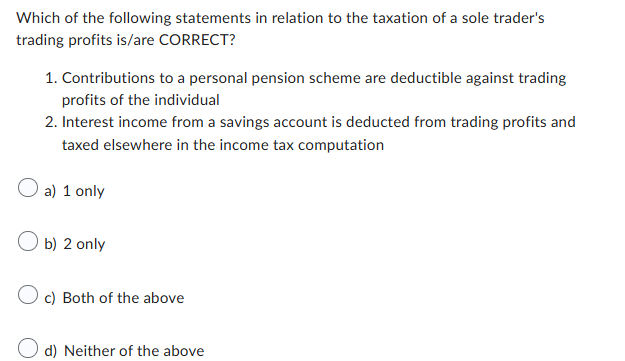

The correct answer is a.

Interest income from a savings account is deducted from trading profits and taxed elsewhere in the income tax computation. Contributions to a personal pension scheme are NOT deductible against the income of the individual. They must be added back to trading profits if they have been expensed.

Rental income from a property is not taxed as trading income. It must be deducted from trading profits and then added in as a separate line in the tax computation.

If you are not sure of the answer, please see lesson 3, topic 5: Adjusting amount - what items are dealt with elsewhere in the income tax computation?

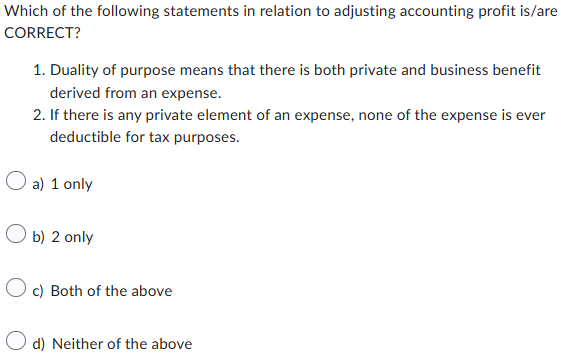

The correct answer is a.

HMRC will generally allow a reasonable pro-rating of an expense that has duality of purpose so that the business-related portion can be deducted.

If you are not sure of the answer, please see lesson 3, topic 6: Adjusting amounts – what are the specific rules in tax law for restricting deductions?

Module 7

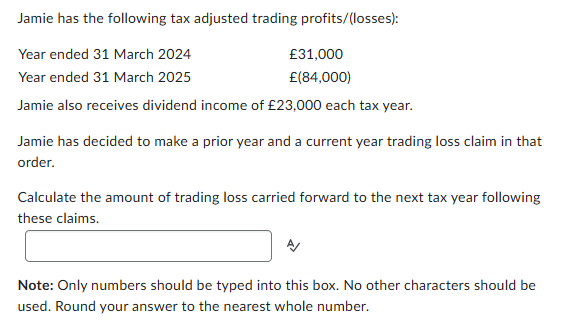

The correct answer is £7,000.

The trading loss may be used in full against trading income of the prior year - £31,000.

There is a restriction on the total value of trading losses which can be offset against non-trading income in the prior year - the higher of £50,000 and 25% of Jamie's total income = £13,500 (25% x (£23,000 + £31,000). As the dividend income is below £50,000, only £23,000 can be claimed.

Loss Memo

£ | |

Available loss | 84,000 |

PY claim (not restricted) | (31,000) |

PY claim (restricted) | (23,000) |

CY claim | (23,000) |

Loss available to C/F | 7,000 |

Module 7

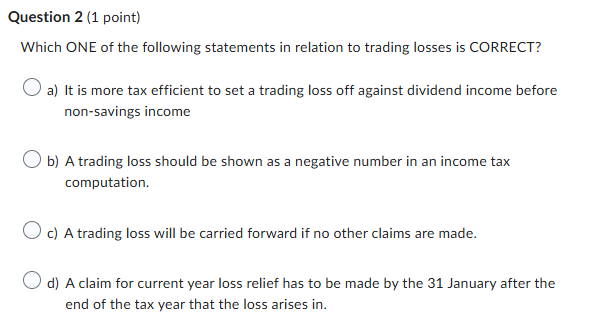

The correct answer is c.

A trading loss is shown as nil in an income tax computation.

A trading loss will automatically be carried forward if no other claims are made.

A claim for current year loss relief must be made by the first anniversary of 31 January after the end of the tax year that the loss arises in.

Module 7

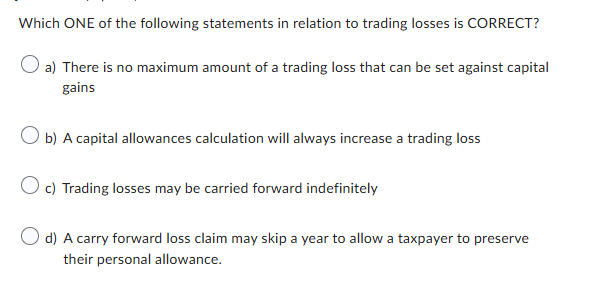

The correct answer is c.

Trading losses may be carried forward indefinitely.

A trading loss may only be set against capital gains net of current and brought forward capital losses.

A taxpayer can claim any amount of capital allowances up to the maximum amount. A taxpayer with a trading loss may choose to claim fewer capital allowances. This will have the effect of reducing the size of the loss, preventing the personal allowance from being wasted.

A carry forward loss claim cannot skip a year to allow a taxpayer to preserve their personal allowance. It must be used at the earliest opportunity.

Module 7

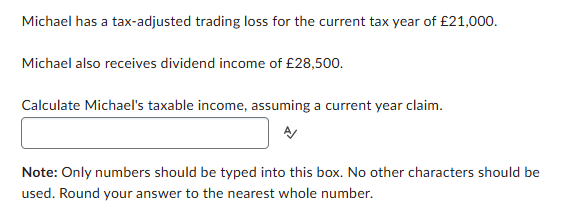

The correct answer is £0.

£ | |

Trading income | 0 |

Dividend income | 28,500 |

Total income | 28,500 |

CY claim | (21,000) |

Net income | 7,500 |

Personal allowance | (7.500) |

Taxable income | 0 |

Dividend income is non-trading income. The loss can be fully relieved in the current year as the loss restriction is the higher of £50,000 and 25% of £28,500 = £7,125 (and there is only £21,000 of a loss available).

Module 7

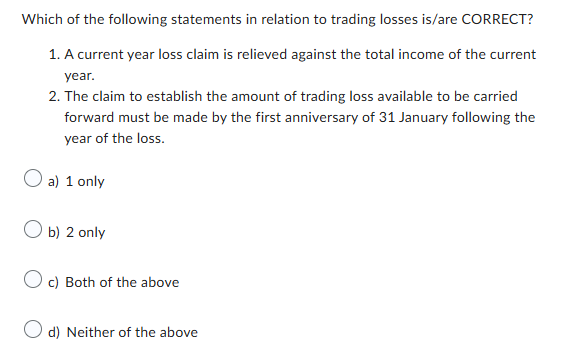

The correct answer is a.

The claim to establish the amount of trading loss available to be carried forward must be made within four years of the end of the tax year of the loss.

Module 7

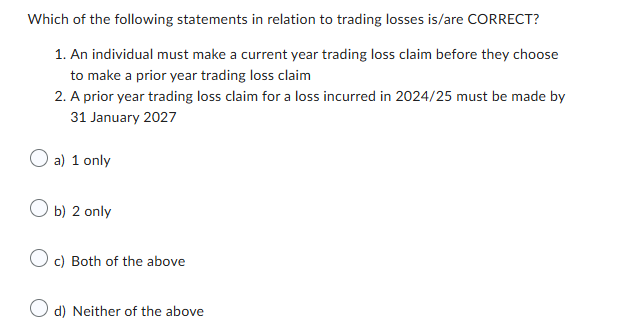

The correct answer is b.

Trading loss claims are relatively flexible. An individual may choose any combination of the prior year and current year loss claims.

Module 7

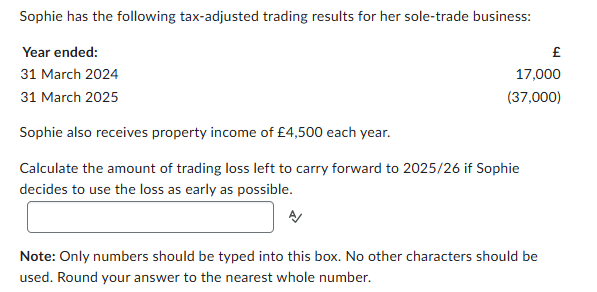

The correct answer is £15,500.

Loss memo

£ | |

Available loss | 37,000 |

PY claim (£17,000 + £4,500) | (21,500) |

CY claim | (Nil) |

Loss available to C/F | 15,500 |

Property income is non-trading income. The loss restriction is the higher of £50,000 and 25% of (£17,000 + £4,500) = £5,375. However total income is less than £50,000, so the loss claim will be £21,500.

Sophie will not make a current year claim as her personal allowance will already reduce her taxable income to £nil.

The balance of the loss remaining will be carried forward against the first available trading income from the same trade in future years.

If you are unsure of the answer, please see lesson 2, topic 3: How can we use a trading loss in the current year? and topic 4: How does carrying a trading loss back to the previous year work? and topic 5: How do we choose which way to use a trading loss?

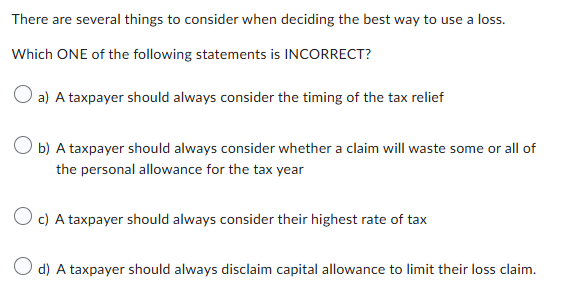

Module 7

The correct answer is d.

A taxpayer should only disclaim capital allowances to limit their loss claim where the loss claim would otherwise waste their personal allowance.

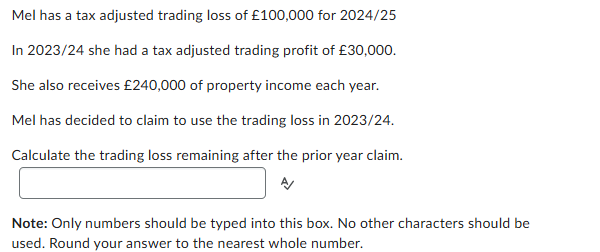

Module 7

The correct answer is £2,500.

The trading loss may be used in full against trading income of the prior year - £30,000.

There is a restriction on the total value of trading losses which can be offset against non-trading income in the prior year. The prior year trading loss will be restricted to the higher of £50,000 and 25% of Mel's total income = £67,500 (25% x (£240,000 + £30,000) against non-trading income. It will be restricted to £67,500 against the property income.

Loss memo

£ | |

Loss available | 100,000 |

PY claim (not restricted) | (30,000) |

PY claim (restricted) | (67,500) |

Trading loss remaining | 2,500 |

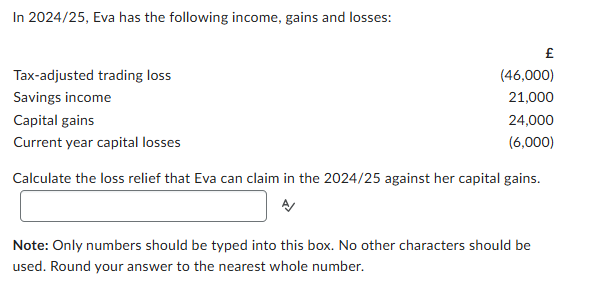

Module 7

The correct answer is £18,000.

Eva must make a current year claim against trading income before claiming to set the loss against her capital gain.

Savings income is non-trading income. Total income is less than £50,000, so the loss claim will be £21,000.

Maximum claim against capital gains

Lower of:

Loss remaining after total income claim for current year | £ |

(£46,000 – £21,000) | 25,000 |

And |

|

Current year capital gains | 24,000 |

Less: capital losses of current year | (6,000) |

18,000 |

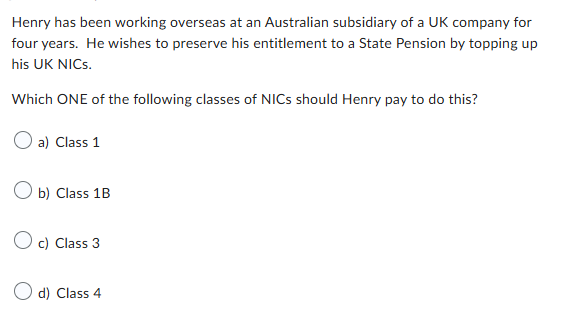

Module 8

The correct answer is c.

Voluntary Class 3 NICs are paid by an individual in order to preserve earnings-related state benefits where the individual has not kept contributions up-to-date, for example, where they have been abroad.

Module 8

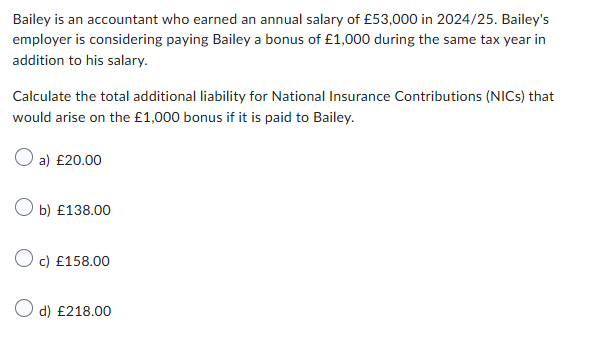

The correct answer is c.

The additional Class 1 primary NICs liability for Bailey are calculated using the 2% rate (as their earnings are already above the UEL), that is, £20.00 (£1,000 x 2%). The additional Class 1 secondary NICs liability for Bailey's employer calculated using the secondary rate of 13.8%, that is, £138.00 (£1,000 x 13.8%).

The total is therefore £158.00 (£20.00 + £138.00).

Module 8

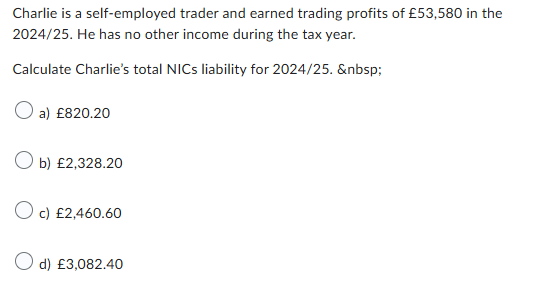

The correct answer is b.

self employed so class 4

Charlie's Class 4 NICs liability is calculated as follows:

£ | |

Between LPL and UPL | |

(£50,270 - £12,570) x 6% | 2,262.00 |

Above UPL | |

(£53,580 - £50,270) x 2% | 66.20 |

Total Class 4 NICs liability | 2,328.20 |

Module 8

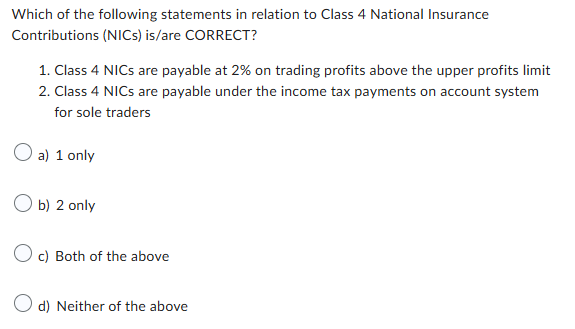

The correct answer is c.

Both statements are correct.

Module 8

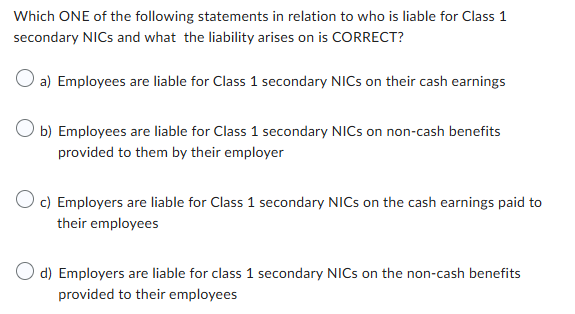

The correct answer is c.

An employee is liable for Class 1 primary NICs only.

Non-cash benefits provided by the employer are subject to Class 1A NICs (or Class 1B NICs if the employer settles the related income tax under a PAYE settlement agreement (PSA)). These benefits are not subject to Class 1 secondary NICs.

Module 8

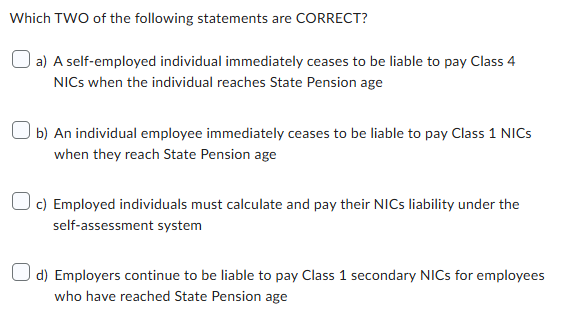

The correct answers are b and d.

When an individual reaches State Pension age they immediately cease to be liable to pay Class 1 NICs, however any Class 4 NICs liability stops at the end of the tax year during which State Pension age is reached.

Self-employed individuals deal with their NICs liabilities under self-assessment, however the employer accounts for and pays the NICs liabilities for employees under the PAYE system.

Module 8

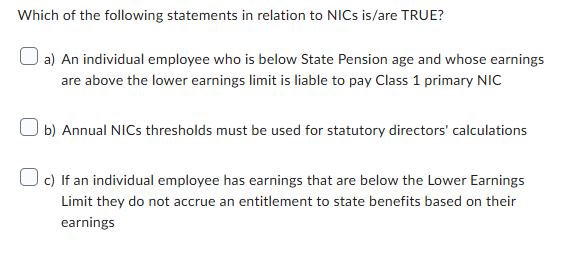

The correct answers are b and c.

Individuals whose earnings are above the Lower Earnings Limit but below the Primary Threshold are not liable to pay Class 1 NICs but do accrue an entitlement to certain state benefits (e.g. State Pension).

Module 8

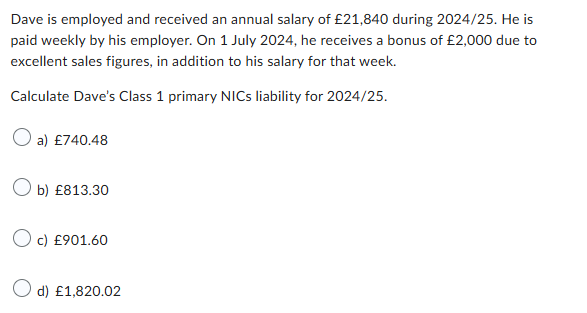

The correct answer is b.

For 51 weeks of the year Dave earns £420.

For one week (when the bonus is paid), Dave earns £2,420.

51 weeks x (£420 - £242) x 8% = 51 x £14.24 = £726.24.

1 week = (£967 - £242) x 8% = £58.00

(£2,420 - £967) x 2% = £29.06.

Total Class 1 primary NICs = £726.24 + £58.00 + £29.06 = £813.30.

Module 8

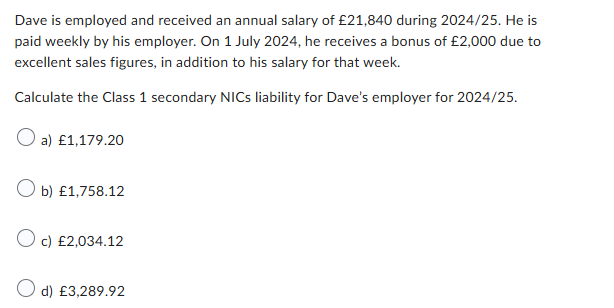

The correct answer is c.

For 51 weeks of the year Dave earns £420. For one week (when the bonus is paid), Dave earns £420 + £2,000 = £2,420. 51 weeks x (£420 - £175) x 13.8% = 51 x £33.81 = £1,724.31.

1 week = (£2,420 - £175) x 13.8% = £309.81

Total Class 1 secondary NICs = £1,724.31 + £309.81 = £2,034.12

Module 8

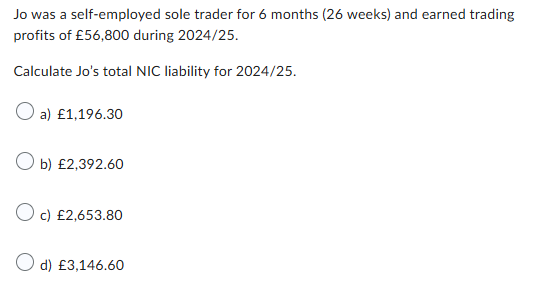

The correct answer is b.

Class 4 NICs are payable if the trading profits during the tax year exceed the Lower Profits Limit (LPL), currently £12,570.

The thresholds are not pro-rated where an individual is self-employed for only part of the tax year.

The Class 4 NIC liability for Jo is therefore calculated as follows:

£ | |

Between LPL and UPL | |

(£50,270 - £12,570) x 6% | 2,262.00 |

Above UPL | |

(£56,800 - £50,270) x 2% | 130.60 |

Total Class 4 NICs liability | 2,392.60 |