3.4.4 Oligopoly

1/42

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

43 Terms

imperfectly competitive

market structures where firms do have some market power and can influence prices

what do most imperfectly competitive industries operate in

oligopoly market structure E.g., Banks, insurance companies, department stores, supermarkets, petrol retailers, sport stores etc.

oligopoly

market structure in which a few large firms dominate the industry with each firm having significant market power

characteristics of an oligopoly market

high barriers to entry and exit

high concentration ratio

interdependent - actions of one firm will directly affect another

highly differentiated products

concentration ratio

reveals what percentage of the total market share a specific number of firms have

10-firm concentration ratio

reveals the total market share (concentration) of the top 10 firms in the industry

5-firm concentration

reveals the total market share (concentration) of the top 5 firms in the industry

when would it be considered an oligopoly

five-firm concentration ratio of around 60%

when would it be pure monopoly

one-firm concentration ratio of 100%

what do CMA define monopoly

firm with more than 25% market share,It prevents mergers or acquisitions from taking place which would give one firm more than 25% market share

how to calculate concentration ratio

identify top n firms by value of sales and value of sales together

calculate percentage of total sales that top n firms have

types of price competition

price wars

predatoy pricing

limit pricing

price wars

competitors repeatedly lower prices to undercut each other to gain or increase market share

example of using price wars

supermarkets

predatory pricing

lowering prices when a new competitor joins the industry to drive them out it is illegal as anticompetitivel

limit prices

firms set a limit on how high the price will go in the industry a lower price reduces profit and disincentives other firms from joining the industry the greater the barriers to entry the higher the limit price is likely to be as firms are already disincentivised

non price competition

competition that is not based on price

examples of non price competition

loyalty cards and rewards

branding

packaging

celebrity/influencer endorsemenet

Corporate sponsorship e.g. Nike sponsoring Rafael Nadal

After sales service

Delivery policies

Product warranties

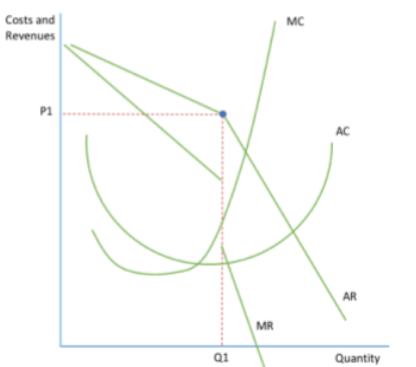

kinked demand theory

if a firm rises it’s prices other firms will not follow wince they know their comparatively lower price means they are more competitive

however if a firm lowers its its price, other firms will follow since they want to remain competitive. Therefore, we assume price starts at P1: above P1 the curve is elastic (since competitors are offering lower prices) and below P1 the curve is inelastic (since other firms lower their prices too so there is a little difference in sales for the original firm). The result is a kink in demand. This kink in demand means that there is a gap in the MR curve and so a rise or fall in costs or demand is likely to have no impact on price or output. Because of this, prices in oligopolistic markets tend to be stable.

problem with kinked demand curve theory

does not explain how optimal price set

deals only with price competition

assumes particular reaction by rivals

firms sell multiple products

what would happen if bp raises petrol prices

rivals do nothing

bp will lose market share as customer chose alternaties

lose revenue and profit

what would happen if bp reduces petrol prices

very quick win

rivals follow with own price reduction

price war leads to loss in revenue and profits for whole market

advantage of oligopoly

competitive oligopoly can elad to price wars which then increases consumer surplus

lower prices

higher levels of research and development

can exploit internal eos which then leads to lower average costs and lower price sin long run

high supernormal profits can be taxed so revenue to help public services

disadvantagesof oligopolies

cartel behavious lesad to high er prices loss of allocative efficient and hurting low income households

high conc ratio limites consumer choice and barriers to enrty may deter innovative smaller firms from pprofitable entry

high levele of spending on branding and advertising can increase production costs passed onto consumers as higher prices

many transnational oligopolies avoid paying tax through shadow or transfer pricing leaving with lower gov revenue

collusive behaviour

occurs when firms cooperate to fix prices and restrict output

non collusive behaviour competitive

when firms actively compete to maintain/increase market share

formal collusion ovet

agreement between firms -cartel usually illegal

informal collusion tacit

happens without an agreement not in firms best interest to compete

reasons for collusion

few firms/competitors

similar costs

similar revenue

high barriers to entry

ineffective regulation

brand loyalty

consequences of overt collusion

Higher prices for consumers

Less output in the market

Poor quality products and/or customer service

Less investment in innovation

what ways does overt collusion happen

Price fixing

Setting output quotas which limit supply and naturally results in price increases

Agreements to block new firms from entering the industry

Agreements to pay suppliers the same price thereby driving down prices in the supply chain (monopsony power)

most common form of tacit collusions

price leadership or price matching

This occurs when firms monitor the price of the largest firm in the industry and then adjust their prices to match

It is difficult for regulators to prove that collusion has occurred

It provides similar benefits to firms as overt collusion, but perhaps not to the same degree

It has similar consequences for consumers as overt collusion, but perhaps not to the same degree

effect of collusion on producers

increased sales revenue and profit

increase in producer surplus

increase of non price competition

increase in ibestment in innovation and research and develoment

effect of collusion on consumers

higher price charged

reduction of consumer surplus

restricted output

increase in non price competiiont benefits customers

apple collusion example

colluded with publishers to increase ebook prices but ahd to py out 450m in court to reimburse consuemrs who were overcharged

efficiency in oligopolies

static inefficient as not productively or allocatively efficient

dynamically efficient as make supernormal profits so have funds to invest

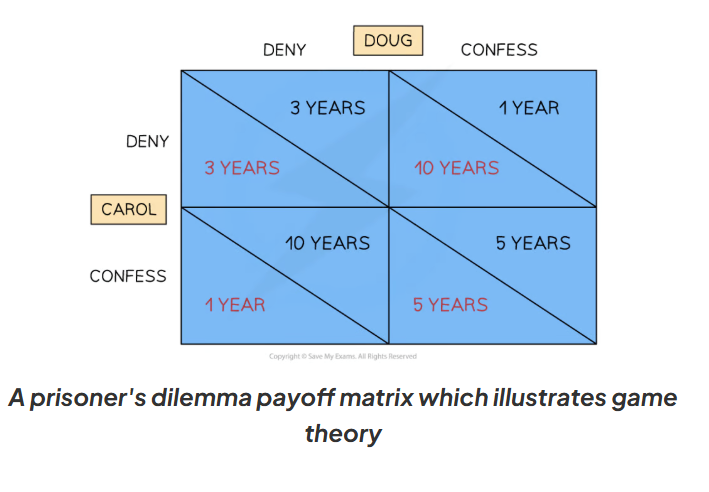

game theory

study of how people make decisions when they are interacting with others and how their choices depend on what others do

why is game theory used in economics

to understand strategic behaviour especially in oligopolies where a few large firms dominate the market

prisoners dilemma

famous idea in game theory that shows why 2 people may not cooperate even if working together is best for both

payoff matrix

outcome of players given different possible strategies

dominant strategy

move that gives a better outcome no matter what the other player does

oligopoly examle suoermarkets

the supermarket industry in the UK operates as an oligopoly with the Big 4

(Tesco, Morrisons, Asda and Sainsbury’s) owning more than 70% of the market share. There are several high barriers to entry that prevent new entrants from seizing any market share. For example, Tesco has been accused of ‘land banking’ - when firms buy a plot of land (without any intentions to build on it) so that their competitors have no space to build stores. The Big 4 supermarkets also boost their market share by contributing to their corporate social responsibility (CSR). For instance, in January 2021 Morrisons became the first supermarket in the UK to pay all staff a minimum of £10 per hour. Tesco have also built several leisure centres in the areas where their stores are based, as this creates several jobs and boosts the local economy.

oligooly examle mobile networks

The UK mobile telecommunications market has long been dominated by four principal operators: EE, O2, Vodafone, and Three. Their collective control over network infrastructure, spectrum, and retail presence created a high‑barrier oligopolistic environment. Businesses and consumers rely on onetime IMEI-locked handsets, lengthy contracts, and national coverage - barriers that deter new entrants and maintain market stability.