Accounting 231 KSU Final

1/119

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

120 Terms

How is budgeting different between merchandisers, manufacturers, service firms, and non-for-profit entities? (Know specifics for each.)

1. Merchandisers Focus on Purchases Budget (no production or DM/DL); driven by expected sales.

2. Manufacturers Include Production, DM, DL, MOH Budgets; compute required production units.

Service FirmsBudget primarily for labor and staffing needs (no inventory or materials).

Non-ProfitsBudget focuses on program spending and cash flow; relies on donor/grant funding.

What's relevant in decision making?

Only costs and revenues that change as a result of the decision are relevant.

What are the decision rules for Special Orders?

Accept if incremental revenue > incremental costs

Fixed costs are often not relevant if they don't change

What are the decision rules for Sell or Process Further?

Process further if additional revenue > additional costs to process further

What are the decision rules for Make or Buy?

Buy if purchase price < cost to make

Consider opportunity costs (e.g., space, labor)

What are the decision rules for Retain or Replace Equipment?

Replace if cost savings + salvage value > cost of new equipment

Ignore book value (it's a sunk cost)

What are the decision rules for Keep or Eliminate a Product?

Eliminate if total avoidable fixed costs > lost contribution margin

Consider if eliminating a product affects sales of others (opportunity cost)

Incremental Costs/Revenues

Costs and revenues that will change as a result of a decision.

opportunity cost

The benefit lost when choosing one alternative over another.

What is the role of opportunity costs in incremental analysis computations?

They are included if they affect the decision outcome—only if they differ between alternatives.

Sunk Cost

A cost already incurred and cannot be changed.

What is the role of sunk costs in incremental analysis computations?

They are not relevant; they should be ignored in decision-making.

What are some examples of sunk costs in incremental analysis?

-Book value of old equipment

-Past research and development costs

-Original cost of inventory already purchased

What is a budget?

formal written statement of management's plans for a specified future time period, expressed in financial terms.

What are the benefits of budgeting?

1.Requires all levels of management to plan ahead

2.Provides definite objectives for evaluating performance

3.Creates an early warning system for potential problems

4.Facilitates coordination of activities within the business

5.Results in greater management awareness of the entity’s overall operations

6.It motivates personnel throughout the organization to meet planned objectives

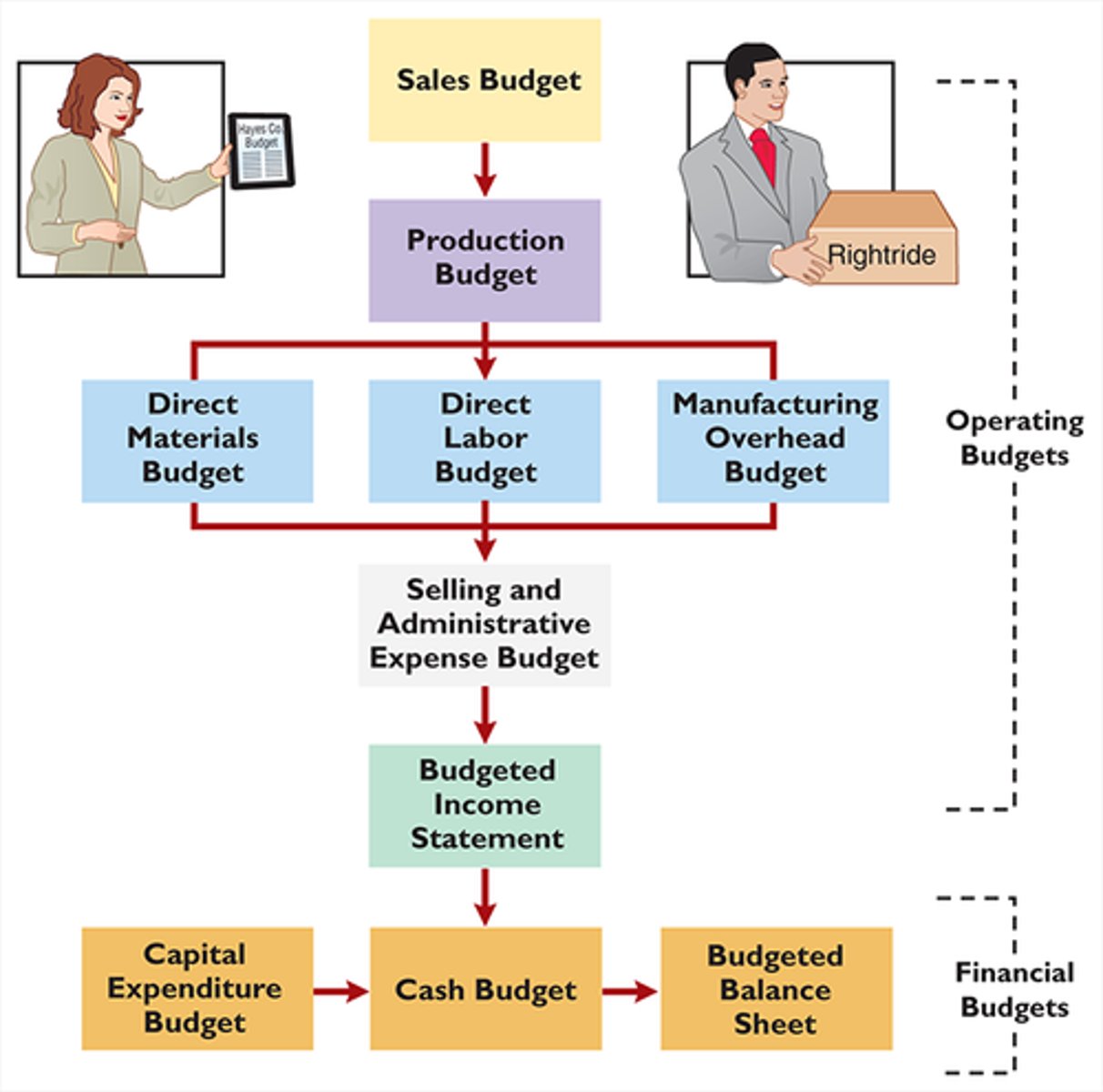

What's the master budget & what's included in it?

•Set of interrelated budgets that constitutes a plan of action for a specified time period

•Contains two classes of budgets:

oOperating budgets

•Result in the preparation of budgeted income statement

oFinancial budgets

•Capital expenditures budget, cash budget, and budgeted balance sheets

How is budgeting different between merchandisers, manufacturers, service firms, and non-for-profit entities? (Know specifics for each.)

1. Merchandisers Focus on Purchases Budget (no production or DM/DL); driven by expected sales.

2. Manufacturers Include Production, DM, DL, MOH Budgets; compute required production units.

3. Service Firms Budget primarily for labor and staffing needs (no inventory or materials).

4. Non-Profits Budget focuses on program spending and cash flow

What are the operating budgets? (7)

1. Sales Budget

2. Production Budget

3. Direct Materials Budget

4. Direct Labor Budget

5. Manufacturing Overhead Budget

6. Selling and Administrative Expense Budget

7. Budgeting Income Statement

Sales budget

An estimate of expected sales revenue for the budget period.

Production Budget

A projection of the units that must be produced to meet anticipated sales.

Direct Materials Budget

An estimate of the quantity and cost of direct materials to be purchased.

Direct Labor Budget

A projection of the quantity and cost of direct labor necessary to meet production requirements.

Manufacturing Overhead Budget

An estimate of expected manufacturing overhead costs for the budget period.

budgeted income statement

An estimate of the expected profitability of operations for the budget period. The budgeted income statement provides the basis for evaluating company performance.

Selling and Administrative Expense Budget

A projection of anticipated selling and administrative expenses for the budget period.

To begin the budgeting process, a ___________ must be created

sales forecast

what is the purpose of an operating budget?

These budgets establish goals for the company's sales and production personnel.

How are the operating budgets related?

The Sales budget is prepared first. It sets the level of activity for the production budget. From the production budget there is the DM budget, DL budget, and MOH budget. These 3 budgets lead to the Selling and Administrative Expense budget. The operating budgets culminate with preparation of the budgeted income statement.

What are the financial budgets (3)?

1. capital expenditure budget

2. cash budget

3. budgeted balance sheet

What is the purpose of the financial budgets?

Ensure the organization can meet capital and cash requirements.

How are the financial budgets related?

Capital Expenditure and cash budgets feed into the budgeted balance sheet.

Capital Expenditure Budget

a financial plan fore making capital expenditure decisions in business.

Cash Budget

A projection of anticipated cash flows.

Budgeted Balance Sheet

A projection of financial position at the end of the budget period.

What are the two budgeted financial statements?

Budgeted Income Statement

Budgeted Balance Sheet

What is the purpose of the budgeted financial statements? what do they tell the users?

To provide an expected financial outlook based on the budget.

Income Statement: Expected profitability

Balance Sheet: Expected financial position

What are the characteristics of the budgeted balance sheet?

the budgeted balance sheet is developed from the budgeted balance sheet for the preceding year and the budgets for the current year.

What are the characteristics of the budgeted income statement?

the budgeted income statement is prepared from the various operating budgets.

What is a standard cost?

predetermined unit costs, which companies use as measures of performance.

How are standards similar & different from budgeting?

Both standards and budgets are predetermined costs, and both contribute to management planning and control.

A standard is a unit amount.

A budget is a total amount.

What is the difference between ideal and normal standards?

Ideal standards represent optimum levels of performance under perfect operating conditions.

Normal standards represent efficient levels of performance that are attainable under expected operating conditions.

what is variance?

the differences between total actual costs and total standard costs

What are the types of variances?

Materials Variance, Labor Variance, Overhead Variance

What causes materials variances? Who is responsible?

differences in the price paid (price variance) for the materials or by differences in the amount of materials used (quantity variance).

- purchasing department is responsible for materials price variances

- Production department is responsible for materials quantity variance

Materials Variance

The difference between the actual quantity times the actual price and the standard quantity times the standard price of materials.

Labor Variance

The difference between actual hours times the actual rate and standard hours times the standard rate for labor.

overhead variance

The difference between actual overhead costs and overhead costs applied to work done, based on standard hours allowed.

What causes labor variances? Who is responsible?

Paying workers different wages than expected.

Misallocation of workers.

-Production department is responsible

What causes overhead variances? Who is responsible?

-over- or underspending on overhead items.

-production department is responsible

What is the balanced scoreboard?

An approach that incorporates financial and nonfinancial measures in an integrated system that links performance measurement and a company's strategic goals.

Who are the users for managerial accounting?

Internal (managers)

Who are the users for financial accounting?

External (investors, creditors)

Managerial Accounting reports

include detailed financial plans and continually updated reports about the operating performance of the company

Financial Accounting reports

Formal reports (e.g., financial statements) following GAAP

Where are journal entries recorded?

general journal

What are the rules of journal entries?

Total Debits = Credits

Debits on the left, Credits on the right

Every transaction affects at least two accounts

How is the General Journal different from the General Ledger?

Journal: Chronological list of transactions

Ledger: Organized by account to show balances

What information is in the Chart of Accounts?

List of all accounts used by the company, grouped by account type and number

What does each financial statement tell the user?

Income Statement: Profitability over a period

Balance Sheet: Financial position at a point in time

Statement of Cash Flows: Cash inflows/outflows by activity

Statement of Retained Earnings: Changes in equity from net income and dividends

asset

a RIGHT TO USE an economic resource which is specific to the entity and can be measured. The economic resource is expected to provide future benefit to the firm.

example of an asset

cash, accounts receivable, inventory

liability

an OBLIGATION TO PROVIDE economic resources which are specific to the entity to a creditor or non-owner.

example of a liability

accounts payable, notes payable

Stockholders' Equity

an OBLIGATION TO PROVIDE economic resources which are specific to the entity to an owner. Activities that alter the wealth of the business impact sub-categories of equity called revenues, expenses, dividends, gains, and/or losses

example of stockholders equity

common stock and retained earnings, capital

expenses

the costs of operating a business

example of expenses

cost of goods sold (cost of inventory sold)

salaries expense

rent expense

utilities expense

interest expense

advertising expense

income tax expense

dividends

payments of cash from a corporation to its stockholders

Accounting Equation

Assets = Liabilities + Owner's Equity

What goes on the balance sheet?

assets, liabilities, stockholders equity

what goes on the income statement?

Revenue - Expenses = Net Income

Debits increase

assets, expenses, dividends

credits increase

Liabilities, Equity, Revenue

how should transactions impact the accounting equation?

Transactions must keep the equation in balance (affect at least two accounts)

Accrual Basis Accounting

companies record transactions that change a company's financial statements in the periods in which the events occur.

Materials Requisition

Source document production managers use to request materials for production; used to assign materials costs to specific jobs or overhead.

job cost sheet

A form that records the direct materials, direct labor, and manufacturing overhead cost charged to a job.

Time ticket

A document that indicates the employee, the hours worked, the account and job to be charged, and the total labor cost.

contribution margins

the amount of revenue remaining after deducting variable costs. It is often stated both as a total amount and on a per unit basis.

Unit Contribution Margin

The amount of revenue remaining per unit after deducting variable costs

Unit Contribution Margin Formula

unit selling price - unit variable costs

contribution margin ratio

Unit Contribution Margin / Unit Selling Price

contribution margin per unit of limited resource

unit contribution margin / machine hours required

DEALOR (acronym)

Debits (Dividends Expenses Assets)

Credits (Liabilities Owners Equity Revenue)

Expanded Accounting Equation

Assets = Liabilities + Common Stock + Revenues - Expenses - Dividends

Financial statement that reports accounting equation

Balance sheet

Cost of Goods Manufactured Formula

Beginning WIP

+ Direct Materials

+ Direct Labor

+ MOH

- ending WIP

= Cost of Goods Manufactured

Cost of Goods Sold Formula

beginning inventory

+ purchases

- ending inventory

Direct Materials Examples

Cotton(for a shirt company) Leather(in a shoe store) Rubber(in a factory)

Direct Materials

Raw materials that can be physically and directly associated with manufacturing the finished product.

Direct Labor

labor costs that can be easily traced to individual units of product

Direct Labor Examples

Wages, taxes, Benefits, Factory Workers, Machine operators, Painters

Manufacturing Overhead

all manufacturing costs except direct materials and direct labor

Manufacturing Overhead Examples

-Depreciation of manufacturing equipment

-Utility costs

-Property taxes

-Insurance premiums incurred to operate a manufacturing facility

Components of Total Manufacturing Cost

DM, DL, MOH

Period Costs

non-manufacturing costs. Selling and administrative expenses and other expenses such as taxes and interest. Not associated with a product

Components of Manufacturing Overhead

Manufacturing overhead consists of all costs of manufacturing that are not DM or DL

Indirect Materials are tangible inputs to the manufacturing process that cannot practicably be traced to the product.

Indirect Labor is the cost of human labor connected with the manufacturing process that cannot practicably be traced to the product.

Factory operating costs, such as utilities, real estate taxes, insurance, depreciation on factory equipment, etc.

Predetermined Overhead Rates

used to apply overhead to products; calculated by dividing the estimated overhead for a cost pool by the estimated units of the cost driver

Predetermined Overhead Rate Formula

estimated annual overhead costs / expected annual operating activity

Relationship to Work In Process and Cost of Goods Sold Expense

WIP becomes COGS when goods are completed and sold.