TERMS Unit 3: Finance and accounts Chapter 17: Profitability and liquidity ratio analysis

1/7

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

8 Terms

liquidity

the ability of a business to pay its short-term debts

profit margin %

this ratio compares operating profit with revenue;

(profit before interest and tax / sales revenue) x 100

profitability

a relative measure of a business's ability to make a profit from sales or a capital investment

gross profit margin %

this ratio compares gross profit (profit before deduction of overhead expenses) with revenue;

(gross profit/sales revenue) x 100

return on capital employed, ROCE %

this compares operating profit and the capital employed in the business;

(profit before interest and tax / capital employed) x 100

capital employed

the total value of all long-term finance invested in the business = non-current liabilities + equity

current ratio

this compares the current assets with the current liabilities of the business; = current assets / current liabilities

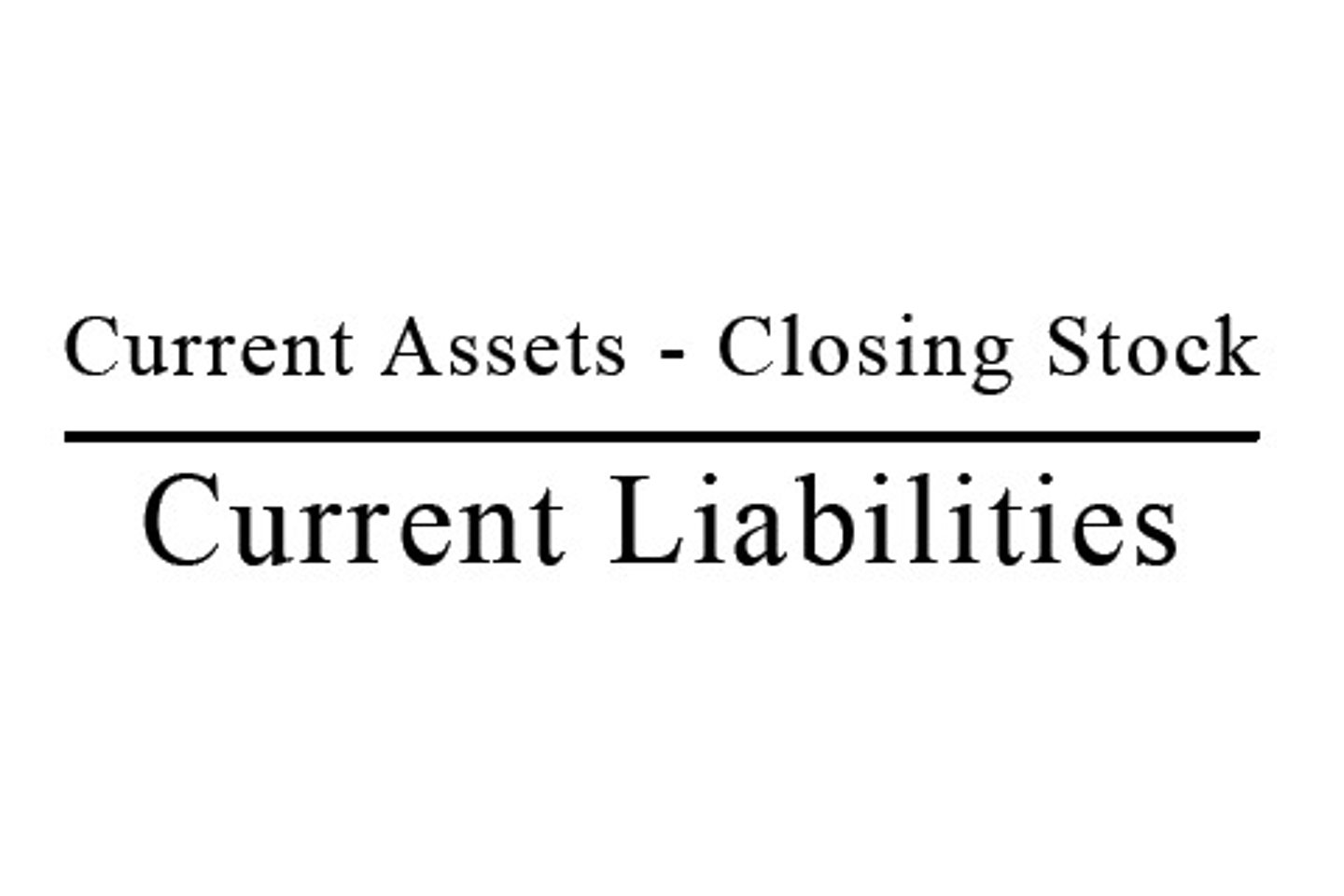

acid test ratio

this compares the liquid assets of a business with its current liabilities. The acid test ratio is calculated using the following formula:

acid test ratio = (current assets - stock) / current liabilities