3.4.5 - monopoly

1/25

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

26 Terms

characteristics of a monopoly market:

how many firms

barriers to entry

products

price maker/taker

single seller

high barriers to entry

unique products (no substitutes)

price maker (total market control)

what kind of monopoly are we referring to here

pure monopoly (100% market share)

how is a legal/working monopoly determined by the UK Competition and Markets Authority (CMA)?

more than 25% market share

how is a dominant firm defined

a firm with 40% or more market share

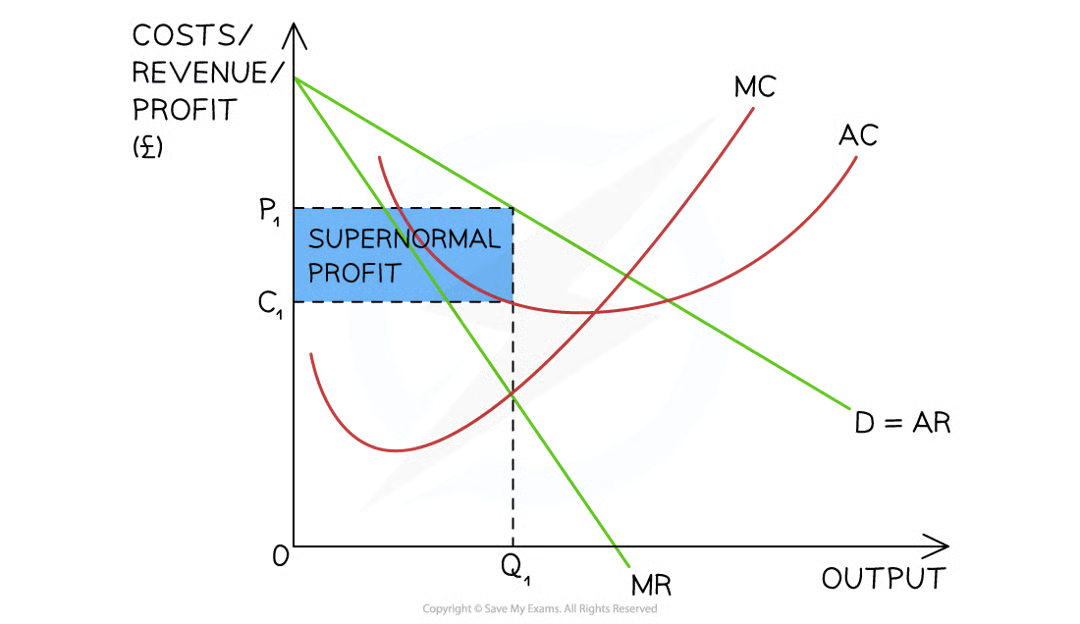

monopoly diagram

same in both long and short run

what is PRICE DISCRIMINATION

when a firm charges a different price for the same g/s in order to maximise its revenue

what is THIRD DEGREE price discrimination

when a firm charges different prices to different consumers for the same g/s

3 conditions to be met for third degree price discrimination to occur:

market power

varying consumer PED

ability to prevent resale

market power

has the ability to change prices (works best when there are no substitutes)

varying consumer PED

different groups (eg based on income) of consumers must be willing to pay more

ability to prevent resale

consumers shouldn’t be able to buy for cheap and sell for more

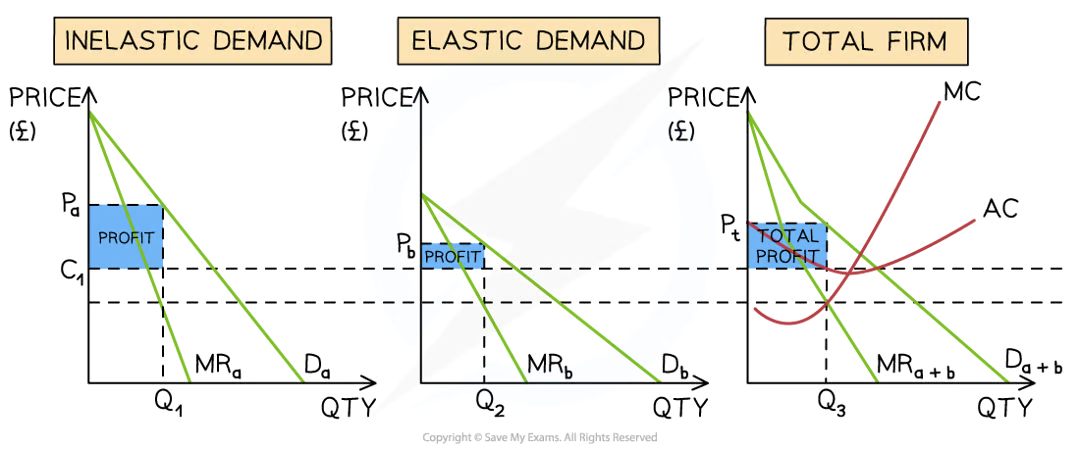

third degree price discrimination in a diagram

EXAMPLE: rail market

inelastic = peak travel

elastic = off-peak

more profit from inelastic obvs bc its priced higher

good and bad about third degree price discrimination - consumers

↑ consumer surplus - lower prices for some

↑ prices = ↓ demand = ↑ utility (eg. train less crowded)

↓ consumer surplus - higher prices for some

good and bad about third degree price discrimination - producers

higher profits

↑ producer surplus

setting up price discrimination = ↑ average costs

good and bad about monopoly - the firm

more supernormal profits

therefore more investment

market power = ↑ global competitiveness

↑ economies of scale

↑ producer surplus

price discrimination = ↑ revenue

no competition = no efficiency incentive

no competition = no innovation incentive

cross subsidisation can lead to inefficiencies

not allocatively efficient (P > MC)

what might incentivise a monopoly to innovate

‘patent box’ - a government tax incentive that allows firms to pay a LOWER rate of corporation tax on profits earned from patented inventions

what is cross subsidisation

using the profit generated by one product to lower the price of another

eg. airlines use first class air tickets to subsidise economy ones (first class more expensive than it should be, economy cheaper than it should be)

good and bad about monopoly - employees

↑ wages

↑ job security

one supplier in the industry = limited opportunity to change employers

good and bad about monopoly - consumers

supernormal profit = investment = ↑ product quality

cross subsidisation will lower prices on some products

economies of scale = lower prices

economies of scale = higher prices

no innovation = worsening product quality

no competition = bad customer service

cross subsidisation will increase prices on some products

↓ consumer surplus

good and bad about monopoly - suppliers

secure contract = ↑ sales volume

monopsony power —> the firm will dictate what price they will pay to the suppliers

this may not be profitable in the long run

what is a natural monopoly

when the optimum number of firms in the industry is one

natural monopoly diagram

.

4 reasons why a natural monopoly could occur

infrastructure —> makes sense to have one company delivering water rather than multiple pipelines

cost of entry/exit in the industry (eg. sunk costs)

economies of scale —> lower average costs by having one firm doing something than many smaller firms (provide for all the demand in the market)

productive efficiency —> if even one firm can’t achieve production at the lowest point on the AC, having more competition would only increase costs + therefore prices

where do natural monopolies usually occur

utility industries

how are natural monopolies dealt with

regulated by the government —> ensure fair prices for consumers

(usually a maximum price)

what advantage might a company have related to how they started

first mover advantage - first firm in a new market