3.4 Final accounts

1/130

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

131 Terms

Final accounts

The published annual financial statements that all limited liability companies are legally obliged to report

Balance sheet

P&L account

2 types of final accounts

Balance sheet

Profit + loss account

Why are final accounts important?

Ensures all payments + receipts of a business have officially been accounted for

Legal requirement

Purpose of final accounts to shareholders

Profit + loss account / income statement

A financial record of a firm's trading activities over the past 12 months, showing all revenues, costs + revenues during this time

Main purpose of profit + loss account

Show the value of profit / loss for a business during a particular trading period

Profit

The positive difference betw a firms revenues + costs

Revenue

Inflows of money from trading activities

Costs

Outflows of money incurred by a business due to the production of g+s

What does profit act as for most business?

Incentive to do well

3 sections of profit + loss account

The trading account

The profit + loss account

The appropriation account

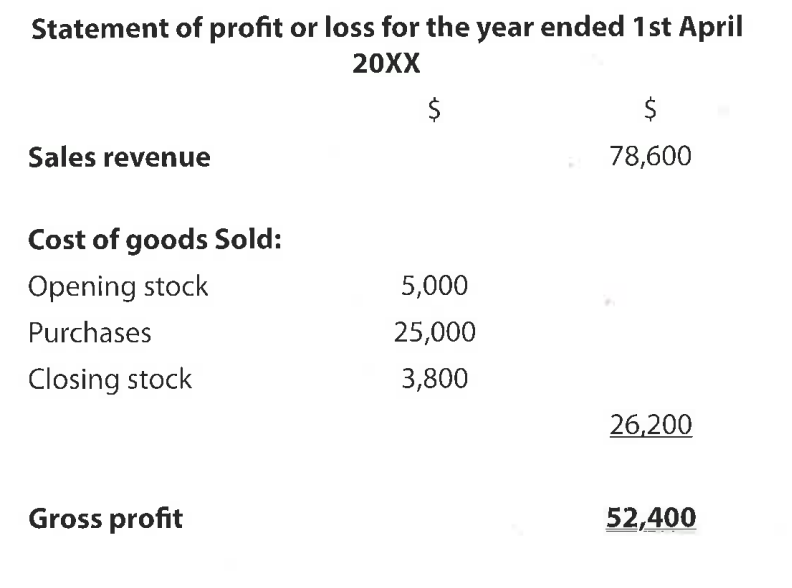

What does the trading account show?

Shows difference betw a firms SR + costs of producing goods sold

Sales revenue

Cost of goods sold

Gross profit

Gross profit

The difference betw the SR of a business + its direct costs incurred in making or purchasing products sold to customers

Gross profit equation

Sales revenue - cost of goods sold

Cost of goods sold (COGS) / cost of sales (COS)

The direct costs of producing or purchasing stock that has been sold to customers

Cost of goods sold equation

Opening stock + purchases - closing stock

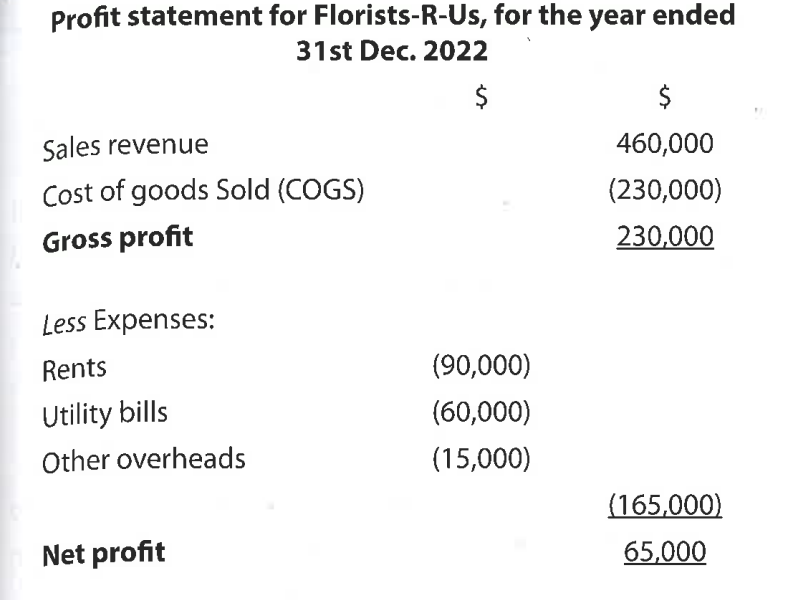

What does the profit + loss section of a profit + loss account show?

Net profit / loss of a business at the end of a trading period

(Net) profit

The surplus (if any) that a business earns after all expenses have been paid for from the firm's gross profit

SR - COGS - expenses

Net profit equation

Gross profit - expenses = net profit

Expenses

The indirect or fixed costs of production

Eg administration charges, management salaries, insurance premiums, rent

How a business increase net profit (using the equation)?

Reduce expenses

Methods to reduce expenses

What does the final section of the P+L account show (appropriation account)?

How net profit after interest + tax is distributed

Dividends

Retained profit

How is net profit after interest + tax distributed?

Dividends

Retained profit

Dividends

Amt of net profit after i+t is distributed to shareholders

Retained profit

The amt of net profit after i+t + dividends have been paid

It’s then reinvested in the business for its own use as an internal SoF

What is retained ‘profit’ known as for a non-profit organization?

Retained surplus

Pros of P&L account

Shows profit / loss after all costs + expenses are accounted for

Doesn’t just show GP- bc if expenses higher than GP → business makes an overall loss

Business can’t survive in LT w/o making actual profit

Cons of P&L account

Shows historical financial performance → doesn’t show future performance

No international standard format for P&L account → difficult to compare P&L for diff firms in diff countries

Window dressing

Window dressing

The legal act of creative accounting by manipulating financial data to make the results appear more appealing

Cost of sales vs expenses

COS

Costs that a business can easily connect to the g/s it has produced

Aka direct costs

RM, packaging

Expenses

Costs that affect the business, not just the g/s

Aka indirect costs

Cleaning staff salaries, utilities, petrol for delivery vehicles

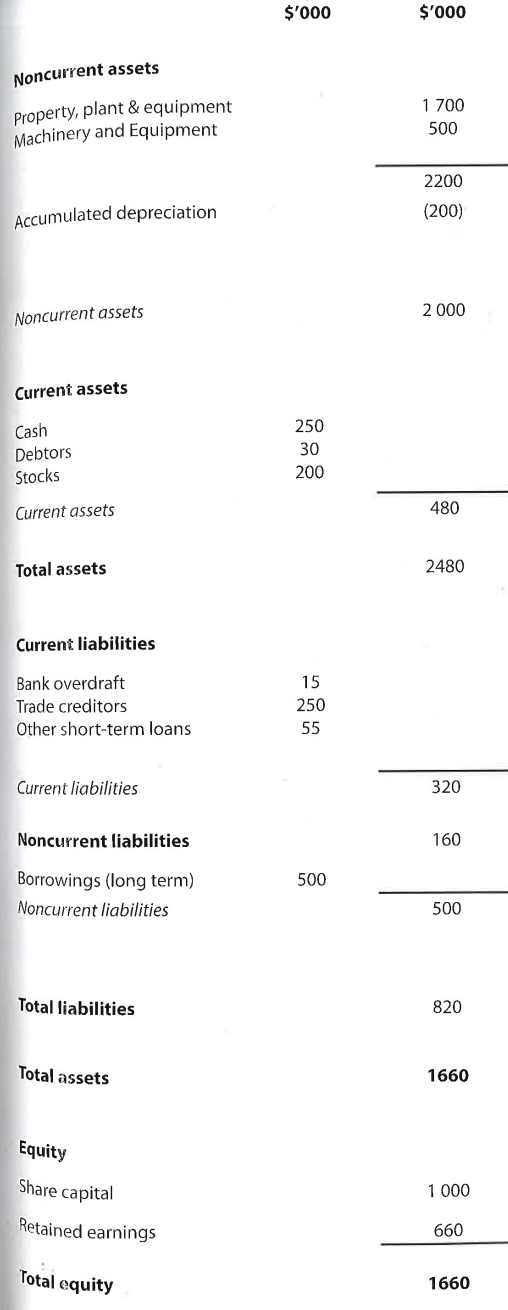

Balance sheet

Contains financial information about an organization's assets, liabilities + the capital invested by the owners, showing a snapshot of the firm's financial situation

3 parts of a balance sheet

Assets

Liabilities

Equity

Assets

Items of monetary value owned by a business

Cash, stocks

Non current assets (fixed assets)

Items of monetary value owned by a business

Not intended for sale within the next 12 months

Used repeatedly to generate revenue for the organization

Eg property, plant, equipment

Current asset

Cash or any other liquid asset that is likely to be turned into cash within 12 months of the balance sheet date

3 main types of current assets

Cash

Debtors

Stocks (inventories)

Cash

Money held in the business / bank

Debtors

People that owe money to the business bc they have purchased goods on credit

Value of debtors = CA bc money is owed to / belongs to the business

Stocks (inventories)

Unsold supplies of RM, semi-finished goods, finished goods

Finished stocks relatively liquid compared to RM

Liability

A legal obligation of a business to repay its lenders / suppliers at a later date

Amt of money owed by the business

Non current liabilities (LT liabilities)

The debts owed by a business, which are expected to take longer than a year from the balance sheet date to repay

Current liabilities

Debts that must be settled within 1 year of the balance sheet date

Eg bank overdrafts, trade creditors, other ST loans

3 main types of current liabilities

Bank overdrafts

Trade creditors

Other ST loans

Bank overdrafts

ST SoF- business can withdraw more from its bank account than the amount that exists

Need to be repaid quickly bc of high IR

Trade creditors

Creditors

Suppliers who allow a business to purchase g/s on trade credit.

Net assets

Show the value of a business to its owners by calculating the value of all its assets minus its liabilities

Net assets ALWAYS EQUALS equity in the balance sheet

Value of TA - TL

2 net asset equations

NA = total assets - total liabilities = equity

NA = (NCA + CA) - (NCL + CL)

An asset belongs to a business, but what does this not necessarily mean?

Doesn’t mean it has been paid for

Equity (capital + reserves)

The value of the business that belongs to the owners

2 parts of equity for limited liability companies

Share capital

Retained earnings

(sum of accumulated retained profit)

1 part of equity for sole traders + partnerships

Only retained earnings

Bc no shareholders

Share capital

The amount of money raised through the sale of shares

Shows the value raised when the shares were first sold, rather than their current market value

Retained earnings / profit

The amount of profit after interest, tax, dividends have been paid.

Reinvested in the business for its own use

In what final account does retained profit appear in?

Balance sheet

Appears as retained earnings

Profit + loss account

Kept within the business for its own use (not distributed as dividends)

From a balance sheet:

Total assets - total liabilities =

TA - TL = net assets = total equity

Means the owners own the value of the assets of the business after deductions have been made for all its debts

Balance sheet layout

NCA

CA

TA

CL

NCL

TL

NA

Equity

TE

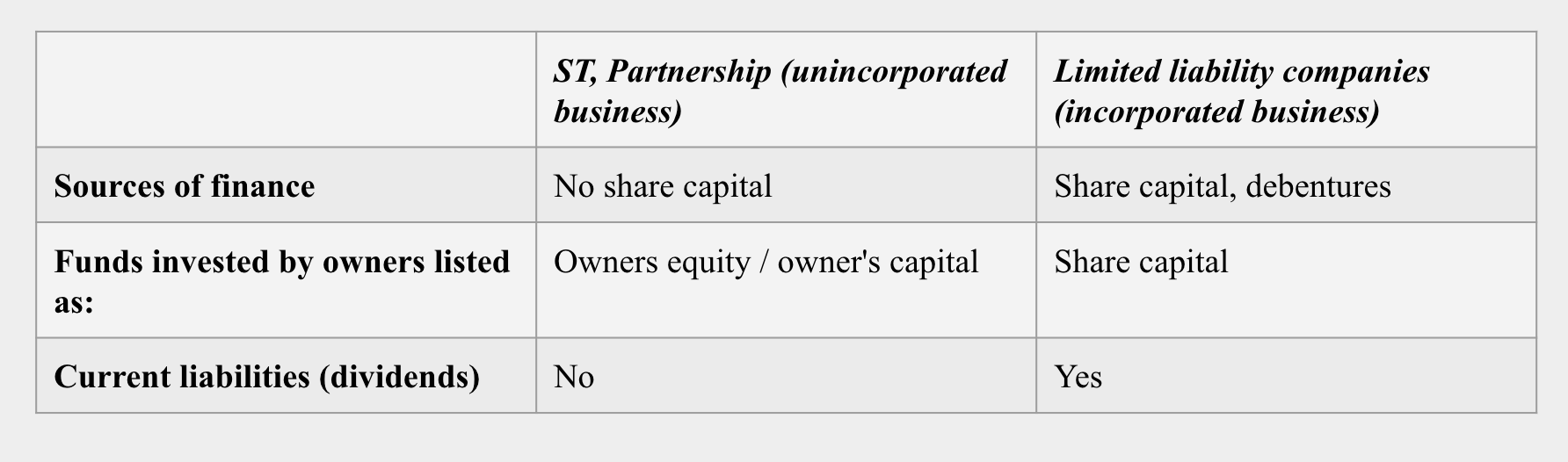

Balance sheet of incorporated vs unincorporated business

Unincorporated business- no shareholders → share capital not part of equity

Balance sheet of unincorporated (ST, partnership) vs incorporated (LLC)

Sources of finance

Funds invested by owners

Dividends

Cons of balance sheets

Static documents

Figures only estimates of the value of assets + liabilities

Market value not same as book value

No universal format → hard to compare financial position of diff firms

Not all assets included (intangible assets, value of human capital)

Intangible assets

NCA that don’t exist in a physical form but are of monetary value + can earn revenue for a business

Legally protected by laws (intellectual property rights)

Examples of intangible assets

Goodwill

Copyrights

Brand names

Patents

Registered trademarks

How much of a firms asset value can intangible assets account for?

A large proportion

But difficult to place an objective + accurate price on them

Goodwill

An intangible asset which exists when the value of a firm exceeds its book value (the value of the firm's net assets)

Why are intangible assets not always recorded in a firms balance sheet?

Bc their value is difficult to measure in an objective / scientific way

Adding value of intangible assets on BS = window dressing to artificially inflate the value of a business

Cons of final accounts

Using only single years data in isolation → can’t find trends

HR ignored when examining final accounts

Doesn’t reveal firms non-financial priorities

Time consuming

Companies will limit the financial info they disclose

Historical accounts

Apreciation

The increase in the value of NCAs

Examples of NCA that appreciate

Property

Land

Depreciation

The fall in the value of NCAs over time due to wear and tear + obsolesence

Do NCA or CA depreciate?

NCA

2 reasons for depreciation

Wear + tear

Obsolescence

Wear + tear

Repeated use of an asset → eventually breaks down

Eg computers, vehicles

Increases maintenance costs

Obsolescence

Outdated, older versions

As newer, better products become available, the demand + value of existing NCA will fall.

Historic cost

The purchase cost of a particular fixed asset

Used to calc depreciation

How does depreciation represent the historic (purchase) cost of NCA?

Spreads the historic cost of fixed assets over their useful lifespan

On which final account is depreciation shown?

Balance sheet- accumulated depreciation

P&L- as an expense

Why does depreciation need to be recorded?

To:

Calculate the value of a business more accurately

Realistically assess the value of NCA over time

Plan for the replacement of NCA in the future

What do depreciating NCA do to the net asset value of a business?

Increase net asset value

2 methodsof calculating depreciation

Straight line method

Units of production method

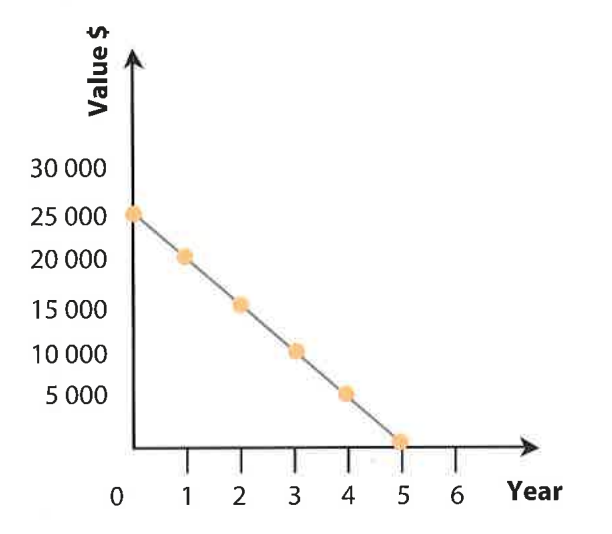

Straight line method

A method of calculating depreciation that reduces the value of a fixed asset by the same value each year throughout its useful life

Which method is more commonly used to calculate depreciation?

Straight line method bc easier

3 key variables to calculate annual depreciation

Life expectancy of the NCA

Scrap value (residual value) of the NCA

Historic (purchase) cost

Life expectancy of NCA

How long it is intended to be used before it needs to be replaced

Scrap (residual) value

An estimate of the value of the NCA at the end of its useful life

Acummulated depreciation

The annual depreciation expense multiplied by the no. of years the asset has been in use