CAPITAL GAINS TAX

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

31 Terms

These are any other assets that does not fall under the definition of ordinary assets

Capital Assets

Ordinary Assets includes:

Stock in trade of the taxpayer, or other property of a kind which would properly be included in an inventory of the taxpayer if on hand at the end of the taxable year.

Properties held by the taxpayer primarily for sale to customers in the ordinary course of business.

Properties used in trade or business of a character which is subject to allowance for depreciation.

Real properties used in trade or business

Asset Classification:

Acquisition to be used in business

Ordinary Assets

Asset Classification:

Asset previously used then abandoned

Automatically become Capital Asset in 2 years, except those who are engaged in realty business

Real Property Developer

Real Property Lessor

Real Property Dealer

Person executed with at least 6 Real Property transaction in the prior year

Scheme of Taxation to be applied:

Sale of Domestic Stock Directly to Buyer

Sale of Real Property (Capital Asset)

Sale of Other Capital Asset

Sale of Domestic Stock Directly to Buyer - 15% CGT

Sale of Real Property (Capital Asset) - 6% CGT

Sale of Other Capital Asset - RIT (Dealings in Property)

Requisites of CGT on Sale of Domestic Stocks

There is a net gain

The capital asset sold is a domestic stock

The sale is made directly to the buyer

Formula of Stock Transaction Tax:

Gross Selling Price x 1% x 60%

Formula for CGT on the Sale of Domestic Stock

SP | xx |

Cost | (xx) |

Selling Expense: Commission Expense DST, if assumed by the seller (silent) | (xx) (xx) |

Net Gain | xx |

x CGT % | 15% |

Tax Due | xx |

When to file the Capital Tax Returns?

Per Transaction Basis:

Annual Basis:

a. For Individual

b. For corporation

Per Transaction Basis: Within 30 days after each transaction

Annual Basis:

a. For Individual - On or before April 15 of the following year

b. For corporation - On or before the 15th day of the fourth month following the close of the taxable year

Identify the asset classification:

a. A lot purchased to be used as a future building site for his business but remained unused for 5 years due to political instability in the area

b. A currently unused back-up equipment.

c. A building that is converted as residence of the taxpayer

d. A used equipment that remained unused for more than 2 years

e. A warehouse building that is abandoned for more than 2 years

f. A brand new machinery acquired for the business but remained unused for more than two years due to delays in the acquisition of permits for the business

g. A fully depreciated truck that is still in used

h. An unsold open lot of a real estate developer who changed business to a hotel and restaurant business

i. Construction equipment of a real estate developer that remained unused for more than 2 years

j. A church building

k. A foreclosed collateral property held by the bank

a. OA

b. OA

c. CA

d. CA

e. CA

f. OA

g. OA

h. OA

i. OA

j. CA

k. OA

Formula for Documentary Stamp Tax

P1.50/200 X Par Value

Compute the DST if the Par Value is 250K and FV is 350K

1.50/200 × 250K = 1,875

On July 1, 2020, Andy sold his domestic stocks with aggregate par value of P250K and acquisition cost of P300K to Betty for P500K. Betty made a downpayment of P50K and signed a note for the balance payable in 9 semi-annual installments starting December 31, 2020. Andy paid for the documentary stamp tax.

Compute for the 2020 CGT

Compute the documentary stamp tax on the sale

DST: 1.50/200 × 250K = 1,875

Selling Price | 500,000 |

Acquisition Cost | (300,000) |

DST | ( 1,875) |

Net Gain | 198,125 |

X GCT (%) | 15% |

CGT | 29,719 |

X Installment (%) | 20% |

CGT, 2020 | 5,944 |

Downpayment | 50,000 |

1st Installment (450K / 9) | 50,000 |

Initial Payment | 100,000 |

Initial Payment / Selling Price (100K / 500K) | 20% |

Deadline of DST

Within 5 days after the close of the month when taxable document was made

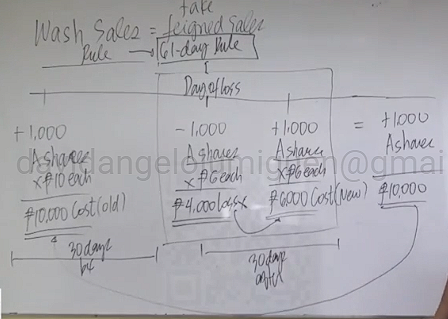

Rules on Wash Sales

No recognition of loss 30 days prior and after the loss occur, if there was identical shares acquired at the same period

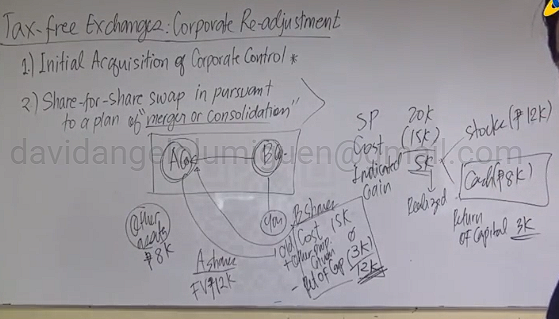

Tax-free Exchanges: Corporate Re-adjustment

Initial Acquisition of Corporate Control (at least 51% 1 or more person)

Share-for-share swap in pursuant to a plan of merger or consolidation

Geo exchanged his A Company shares pursuant to a plan of consolidation where A Company will be integrated with B Company. The following relates to the exchange

Basis of A Company shares given | 1.2M |

Cash paid to B Company | 100K |

FV of A Company shares given | 1.3M |

FV of B Company shares received | 1.1M |

FV of other properties received from B Company | 350K |

Compute for the capital gain tax

What is the tax basis of the B Company received by Geo?

What is the basis of the “boot” or other properties received by Geo?

What is the basis of the A Company shares received by B Company?

A | B | |

Cost | 1.2M | 1.1M |

Other Asset Given Up | 100K | 350K |

FV of Asset Given Up | 1.3M | 1.45M |

Selling Price (FV of Asset Received) | 1.45M |

Cost | (1.3M) |

Indicated Gain | 150K |

Other Asset Received from B Company = 350K = 150K realized gain + 250K Return of Capital

Realized Gain | 150K |

X CGT % | 15% |

CGT | 22,500 |

Cost | 1.2M |

Cash Paid | 100K |

Return of Capital | (250K) |

New Cost of A shares | 1.1M |

Other Asset Given Up by B Company = 350K

Selling Price (FV of Asset Received) | 1.3M |

Cost | (1.45M) |

Indicated Loss | (150K) |

1,450K - 100K (cash received) = 1,350,000

Requisites of Sale of Real Property Classified as Capital Asset:

The real property is located in the Philippines

The property is classified as capital asset

The taxpayer is an individual or a domestic corporation

The taxpayer is other than a foreign corporation

Scope of 6% CGT

All individuals

Domestic Corporation

Formula of CGT on Real Property Classified as Capital Asset

FMV or SP (whichever is higher) x 6%

Fair Market Value is equal to:

Higher amount between:

Zonal Value; or

Assessed Value

Nature of 6% Capital Gains Tax on Capital Asset

Final Tax

Transactional Tax

Formula of DST in 6% CGT

15/1,000 x FMV or SP (whichever is higher); or

1.5 x FMV or SP (whichever is higher)

Deadline of filing of 6% CGT and DST

CGT: 30 days from the date of sale

DST: 10 days End of Month

Exception from 6% CGT:

Exception Rule = CGT = 0 (Replacement of Residence)

Alternative Taxation Rule = 6% CGT or RIT

The sale of Capital Asset may be exempted from CGT provided that the following conditions are met:

The seller is an individual citizen or resident alien

The real property sold is his principal residence

The full proceed of the sale is utilized in acquiring another residence

A new residence must be acquired or constructed within 18 calendar months from the date of sale.

The BIR is duly notified by the taxpayer of his intention to avail of the tax exemption within 30 days from the date of sale through a prescribed return

The capital gains tax thereon is held in escrow in favor of the government

The exemption can only be availed once every 10 years

Buyer of principal residence shall deduct 6%, deposit in cash or manager’s check in an interest-bearing account with an Authorized Agent Bank under an Escrow Agreement

The historical cost or adjusted basis of the real property (principal residence) sold shall be carried over to the new principal residence built or acquired.

Requisites for Alternative Taxation:

The seller is an individual

The buyer is the government, its political subdivisions or agencies or GOCCs

Andy sold his principal residence for 2.5M. He immediately repurchased a new residence for 2M. The FV of his residence is 3.5M. Compute for the CGT

3.5M > 2.5M = 3.5M x 6% = 210K x 0.5M / 2.5M = 42K

Compute for the basis of the cost if:

Old Residence | New Residence |

SP 4M | PP 4M |

FMV 5M | |

Cost 2M | Cost? |

2M (carryover)

Compute for the basis of the cost if:

Old Residence | New Residence |

SP 4M | PP 5M |

FMV 5M | |

Cost 2M | Cost? |

2M + 1M = 3M

Compute for the basis of the cost if:

Old Residence | New Residence |

SP 4M | PP 3M |

FMV 5M | |

Cost 2M | Cost? |

2M x ¾ = 1.5M