Lesson 1: Consumer & Producer Surplus

1/22

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

23 Terms

Market Failures

Situations where a market overproduces or underproduces economically desired goods

Two types of Market Failures

Demand-Side market failures

Supply-side market failures

Demand-Side market failures

these happen when demand curve do not reflect consumers’ full willingness to pay (WTP) for a good or service; these arise because it is impossible in certain cases to charge consumers what they are willing to pay for a product (ex. Fireworks show)

Supply-side market failures

these occur when supply curves do not reflect the full cost of producing a good or service; these arise in situations in which a firm does not have to pay the full cost of producing its output (ex. pollution of factories invading neighborhoods)

TWO conditions that must hold if a competitive market is to produce efficient outcomes

The demand curve in the market must reflect the consumers’ willingness to pay (WTP)

The supply curve in the market must reflect ALL the costs of production

*If these conditions hold, then the market will produce only units for which benefits are at least equal to costs. It will also maximize the amount of “benefits surpluses” that are shared between consumers and producers

Difference between value and price

Value/Marginal Benefit/ Willingness to Pay is what we get from something

Price is what we pay for something

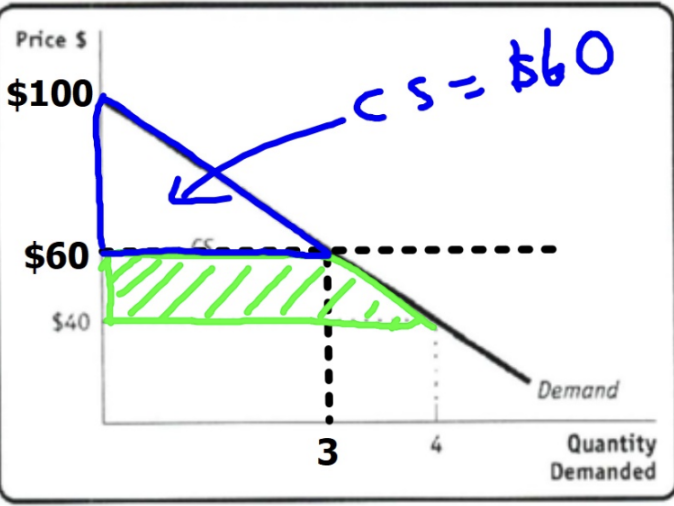

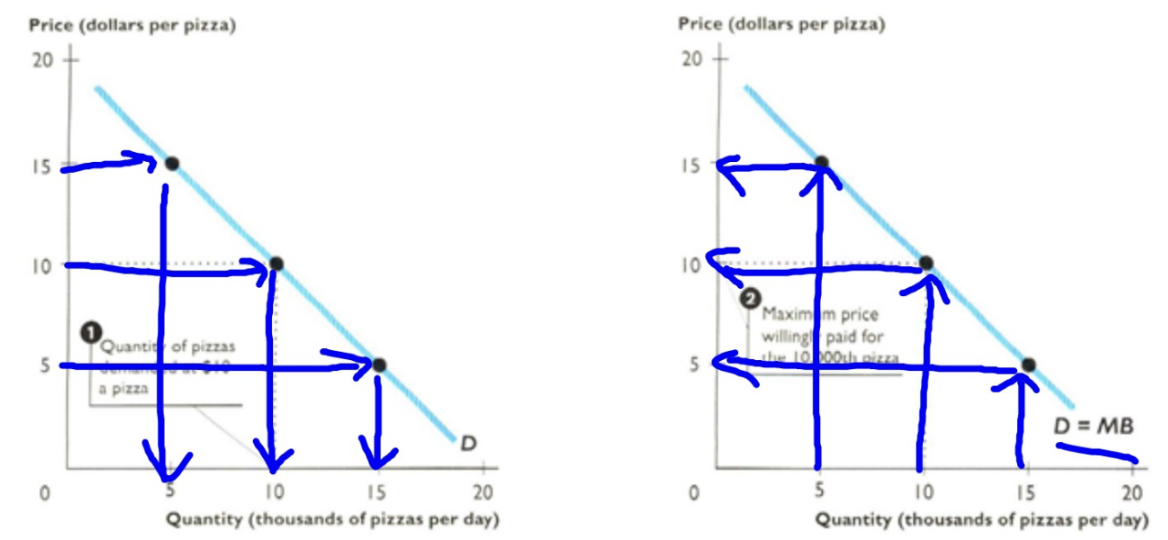

Marginal Benefit

In economics, this is the everyday idea of value which we measure as the maximum price that people are willing to pay for another unit of the good or service

Consumer Surplus

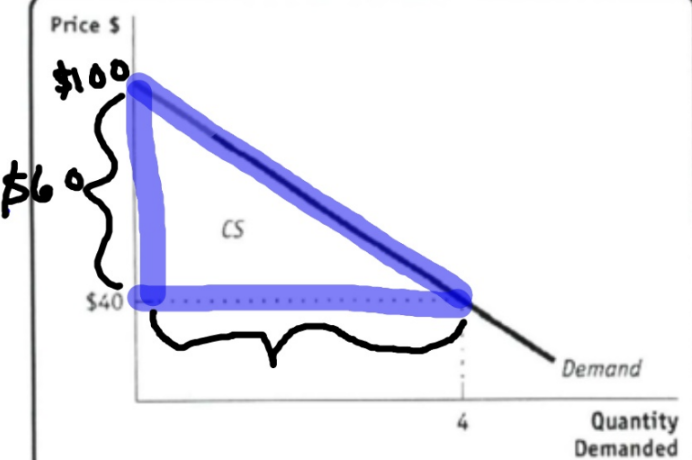

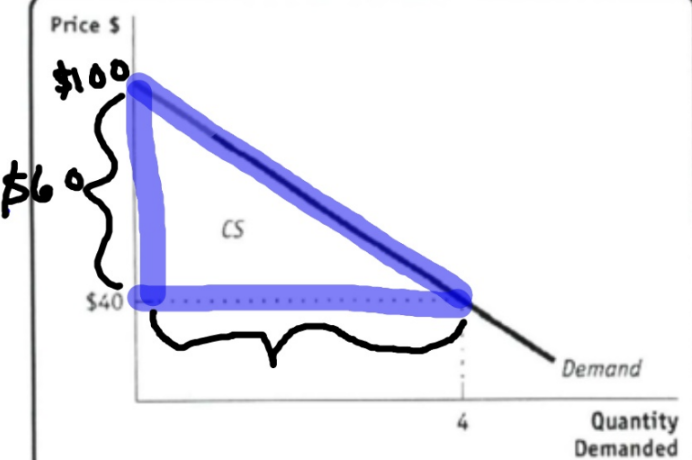

What people receive when they buy something for less than it’s worth to them; net gain in happiness for a consumer measured in dollars (WTP-P) or (1/2 quantity x price (triangle found under the demand curve, above the price, and against the vertical axis)); the marginal benefit from a good/service MINUS the price paid for it, summed over the quantity demanded.

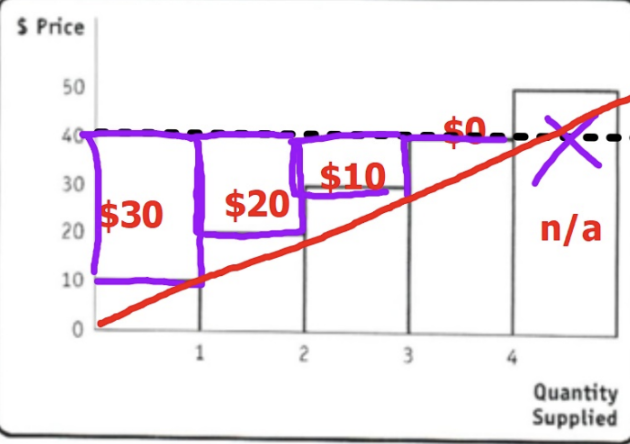

WTP Numbers

Can be used as a demand schedule and graphed like a step-wise demand curve. The height of the rectangles represents the WTP

How changing prices affect consumer prices

At a higher price, there is a smaller triangle of CS

Demand, Willingness to Pay, and Marginal Benefit

Price determines quantity demanded

Quantity determines willingness to pay

The Demand Curve is also the marginal benefit curve (MB=D)

Expenditure of a product

Price of each unit x quantity bought

Total Benefit

The amount paid plus consumer surplus

Difference between cost and price

Cost is what you give up to supply some good/service

Price is what is received for supplying some good/service

Marginal Cost

In economics, the cost of producing one more unit of a good or service

When is it worth producing one more unit of a good or service

If the price for which it can be sold equals marginal cost

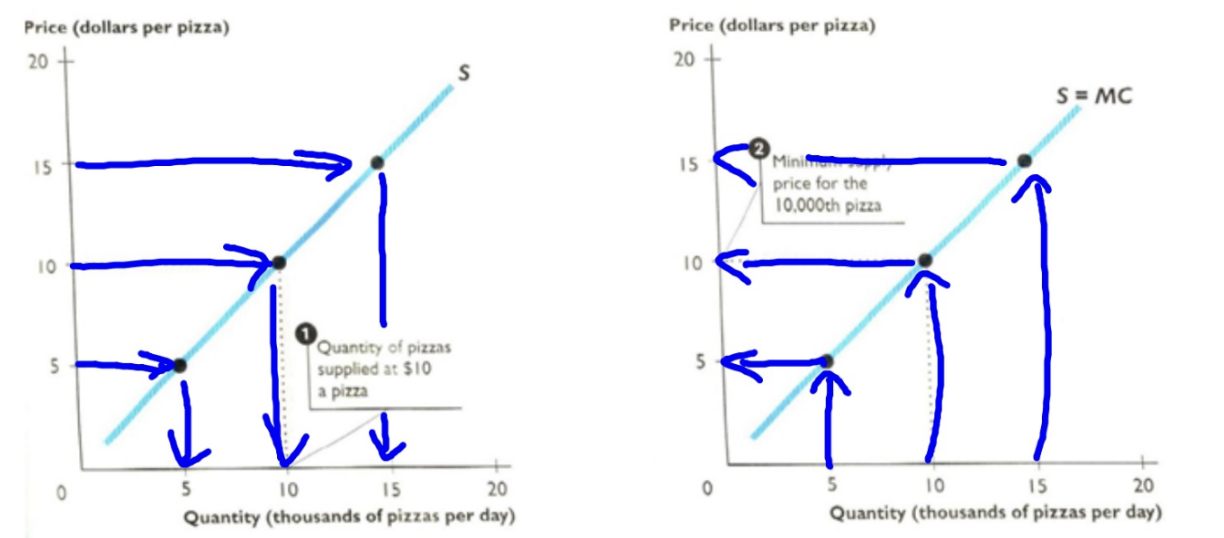

Producer Surplus and the Supply Curve

Sellers enjoy higher prices and the benefit they receive is equal to the difference between the price received from the sale and the cost of producing each unit. This cost represents the minimum price the seller must receive to offer that unit to the market. As the price rises higher and higher above this cost, the seller earns more and more benefit (consumer surplus/profit (not really))

Cost and the Supply Curve

There’s a positive relationship between price and quantity supplied which reflects the Law of Supply. So costs to produce units serve as a supply schedule and a step-wise supply curve can be drawn

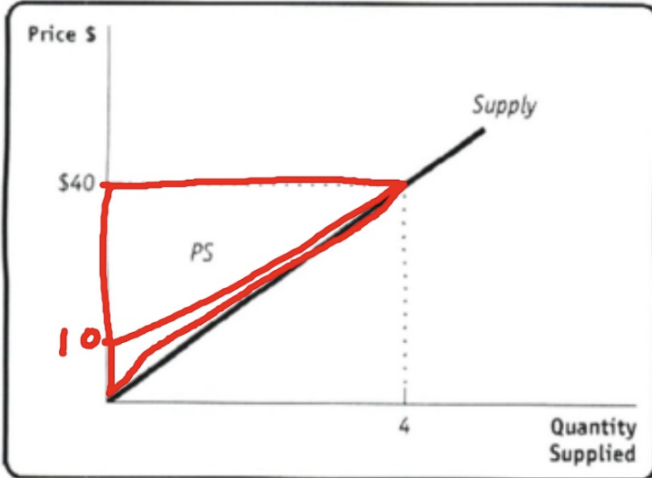

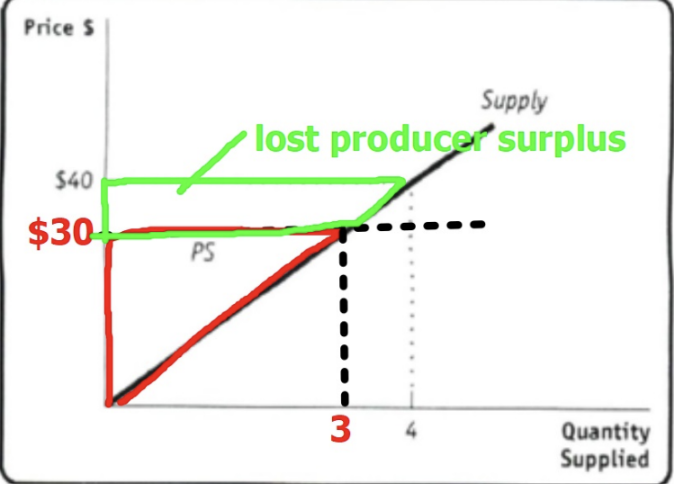

Producer Surplus

(P-Cost) or (1/2 quantity x price (area of triangle above the supply curve, under the price, and against the vertical axis)); the price of a good in excess of the marginal cost of producing it, summed over the quantity supplied

Total Revenue

Price per unit x Quantity sold

How Changing Prices Affect Producer Surplus

At lower prices, the triangle of PS gets smaller

Supply, Minimum Supply Price, and Marginal Cost

Price determines Quantity Supplied

Quantity determines minimum supply price (marginal cost/supply)

When the price exceeds marginal cost, the firm obtains a producer surplus

Total Cost

The amount recieved from selling it minus producer surplus