Ethics and professional conduct in wills and the administration of estates.

1/33

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

34 Terms

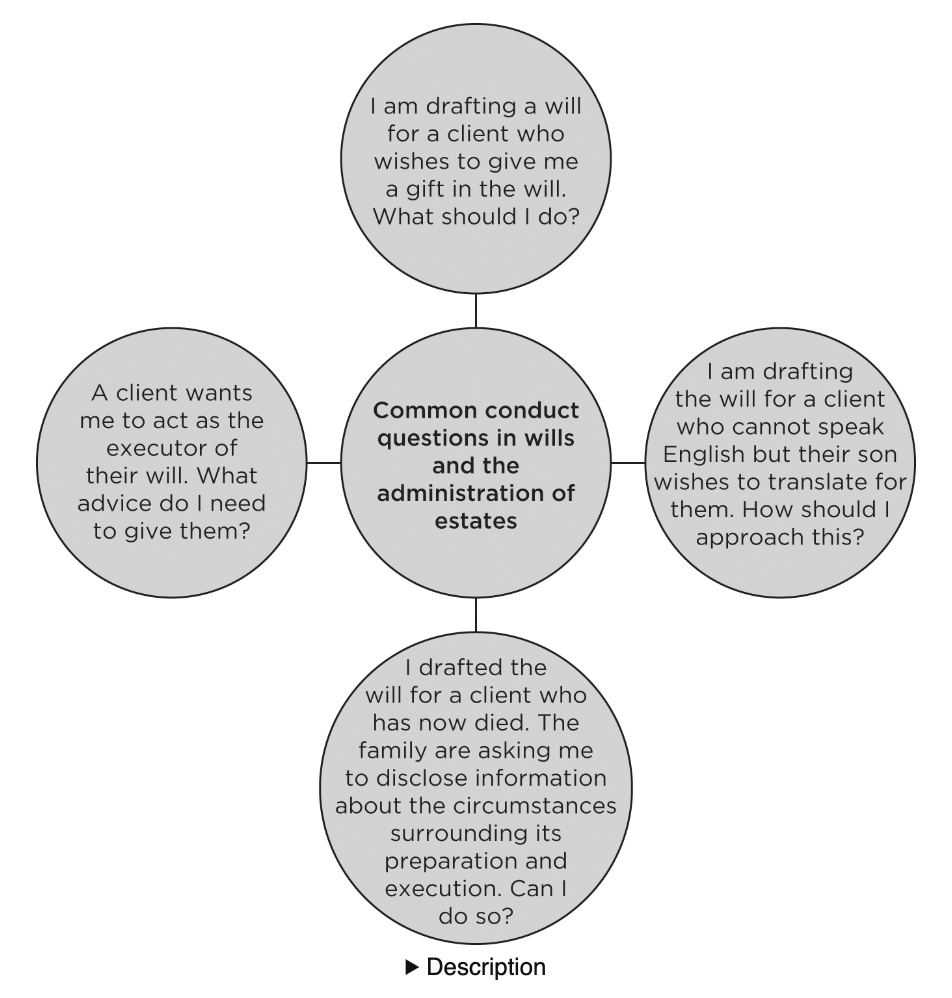

What are ethics issues in wills?

This chapter will cover the application of the Solicitors Regulation Authority (SRA) Principles and Code of Conduct to wills and the administration of estates. The chapter will allow you to observe how ethical issues and professional conduct matters are likely to arise when clients make wills, apply for probate, and personal representatives administer the estate of the deceased.

What are wills issues?

Everyone dies, and so advising on the administration of the estates of the deceased is a major area of work for solicitors.

This chapter should be read in conjunction with Revise SQE: Trusts Law and Revise SQE: Wills and the Administration of Estates. In those guides, you will find many Key terms and important substantive topics to assist you in furthering your understanding of your ethical and professional obligations.

There are an increasing number of disputes about wills and inheritance and although there are many laws that govern this area, many ethical considerations are also raised by disputes between members of warring families.

This chapter considers some of these ethical issues and provides guidance on how you might answer questions in your SQE1 assessment on the appropriate professional conduct relating to wills and the administration of estates.

Revision tip

Throughout this chapter, we will be making numerous references to the STEP Code for Will Preparation in England and Wales (STEP 2016). The STEP Code is a set of ethical principles that demonstrate the standard of transparency and service expected when a will is drafted. Make sure you read the STEP Code in full to understand best ethical practice in will drafting. You can view the STEP Code here: www.step.org/public/step-will-code.

In the present guide, Chapters 1 and 2 set out the SRA Principles (the ‘Principles’) and Code of Conduct (the ‘Code’) respectively. This chapter will consider how relevant headings operate in the context of wills and the administration of estates. The headings used reflect the headings of the Code of Conduct.

What is maintaining trust and acting fairly?

When dealing with wills and the administration of estates, you must maintain trust and treat your clients fairly. The Code requires that:

you do not unfairly discriminate

you do not mislead your client or others

you do not abuse your position by taking unfair advantage of clients

you perform all undertakings within an agreed or reasonable time.

For the purposes of this chapter we shall focus on the duty to not mislead or to abuse your position. For examples of unfair discrimination and the provision of undertakings, see the other chapters in this guide.

What is para 1.2 - you do not abuse your position by taking unfair advantage of clients or others?

You do not abuse your position by taking unfair advantage of clients or others (Para 1.2)

The SRA in its guidance Drafting and Preparation of Wills (2019) advises that a solicitor ‘must not exploit a client’s lack of knowledge by leading them to believe that appointing a solicitor as an executor is essential or that it is the default position for someone making a will’. This statement reflects Principle 7, which requires the solicitor to act in the best interests of the client, meaning that a solicitor must not encourage a client to appoint them, or their firm, as their executor unless it is clearly in the client’s best interests to do so. This obligation is especially important given that a solicitor would wish to charge for their services (see client information and publicity below). It is for this reason that the STEP Code stipulates that ‘the preparation of a will must not be conditional on the will drafter being appointed executor and/or trustee’.

However, it is common for solicitors to act as executors for an individual’s will. In some professionally drafted wills, the executors will also be identified as trustees where the circumstances require a trustee. This means that they have statutory powers and duties as defined by statute and common law. We shall consider some of these issues now.

What is duty of care and exclusion clauses?

By s 1 Trustee Act (TA) 2000, a solicitor who acts as trustee under a will must act with such care and skills as is reasonable in the circumstances. Should a solicitor fall below this standard, they will be in breach of trust (see Revise SQE: Trusts Law for more detail on this). It is common, therefore, for a professionally drafted will to exclude liability to the client or intended beneficiaries for loss arising out of the work, or lack thereof, of the solicitor drafting the will. Importantly, liability cannot be excluded in all circumstances (eg one cannot exclude liability for their own fraud). It is important that a solicitor does not attempt, therefore, to exclude all liability.

Exclusion clauses for negligence are permissible, however. The STEP Code advises that ‘any limited exclusions of duty or liability must be clearly drawn to the attention of the client, explained and then agreed with the client’. This advice is closely linked with Principle 4 (acting with honesty) and Principle 7 (acting in the best interests of each client).

Revision tip

SQE1 assesses not just your knowledge of the law, but also how ethical considerations from the SRA’s Code of Conduct intertwine with the law. We have just read how the law allows the exclusion of liability, but that it would not be ethical to do this without informing the client. In some MCQs, you will need to carefully assess whether you are being asked about the law or about ethics.

What is payment for services?

As with exclusion clauses, a solicitor who has been asked to act as an executor will likely want to insert a clause in the will allowing them to be paid for their services. The TA 2000 allows trustees to charge for ‘reasonable remuneration’, though many will precedents will often not refer to ‘reasonable’ in their charging clause (see Revise SQE: Wills and the Administration of Estates).

Again, a solicitor drawing up the will must make this clear to the client and must advise them of the other options available in selecting an executor. In practice, a solicitor would draw the client’s attention to such a clause by going through the will with them. By doing so, the solicitor can identify the clause and explain the basis of charges (this being in addition to the client being sent the will in draft with explanations prior to signing).

What is you do not mislead or attempt to mislead your clients (Para 1.4)?

You do not mislead or attempt to mislead your clients (Para 1.4)

A client (testator/testatrix) may draw up their own will. However, a solicitor would likely advise that it would be better for them (or another solicitor) to draft the will to avoid unforeseen legal problems. The solicitor must clearly specify what they will charge for preparing the will and warn that the cost will increase depending on the complexity of the will, eg number of beneficiaries, nature of bequests, whether the client wants to set up a trust in their will etc.

What is service and competence?

A solicitor acts on the instructions of their client and must deliver the service requested in a timely and competent manner based on an up-to-date knowledge of the law. Wills are quite often disputed, so the solicitor must ensure that they have understood and upheld the wishes of the testator/testatrix.

What is you only act for clients on instructions from the client (Para 3.1)?

When acting for a client in will drafting, a solicitor must ensure that the client has the capacity to make a will and is not subject to any undue influence.

What is mental capacity?

A testator/testatrix must have mental capacity (also known as ‘testamentary capacity’) to make a will. If the testator/testatrix lacks mental capacity, the will can be challenged and declared invalid. Please refer to Revise SQE: Wills and the Administration of Estates for a discussion of the Banks v Goodfellow test for mental capacity to create a will. The issue here is: How should a solicitor deal with a concern regarding the capacity of a client? This issue is explored in Practice example 6.1.

Practice example 6.1

Frances is 80 years of age and wishes to change her will. Her former will divided her property equally between her daughter and her son. She now wishes to make a new will, leaving all her property to her daughter, who has been living with her and caring for her. Her son claims that Frances is suffering from Alzheimer’s disease and lacks the capacity to change her will.

How should Frances’ solicitor deal with this problem?

The following details the process that is recommended in the STEP Code:

STEP 1: The solicitor must not prepare a will if they know, or have reasonable grounds for concluding, that Frances lacks the necessary mental capacity.

STEP 2: The solicitor must endeavour to ascertain if, with their assistance, Frances would be capable of making a valid will.

STEP 3: Where there is doubt as to capacity, the solicitor should seek expert advice to help them make their decision on Frances’ capacity (referred to as the ‘golden rule’). The solicitor should ask a medical practitioner to undertake a capacity assessment and to be present when Frances makes her new will. The medical practitioner must satisfy themselves that Frances understands the nature and effect of the new will.

STEP 4: Most importantly, a solicitor should keep a written record of the steps taken, their conclusions as to capacity (including their reasons for reaching those conclusions) and a written record from the medical practitioner. These would be important evidence if the will is challenged.

What is undue influence?

A solicitor must also try to ensure that a will really does represent the wishes of their client. If the client has been subject to force or fear in order to make or change their will, that will will be invalid. A solicitor should be on their guard if a relative or other person has persuaded the testator/testatrix to alter the will. This issue has become especially prominent following the COVID-19 pandemic and the use of remote witnessing of wills. According to Para 3.1, the solicitor must satisfy themselves that the client’s instructions represent the client’s wishes. This may prove more difficult with remote meetings and witnessing.

To ensure that the risk of undue influence is removed/mitigated, the STEP Code prescribes that when taking instructions from a client, the solicitor must endeavour to ensure that ‘no member of the testator’s family, or an intended beneficiary under the will, is present during the meeting’. The STEP Code goes on to say that:

It is understood that in some circumstances this may not be possible, and if the solicitor feels able to proceed with the interview they must:

a. provide a careful explanation of the potential for challenge to the terms of the will, and

b. take careful note of the third party’s participation in the meeting in order to assist with any later dispute.

What is You ensure that the service you provide to clients is competent and delivered in a timely manner (Para 3.2)?

By Para 3.2, a solicitor must ensure that the service they provide to clients is competent and delivered in a timely manner. One question that arises here is: How long should a solicitor take to draft a will?

The Law Society, in their publication Wills and Inheritance Protocol (Law Society 2013) provide the following guidance:

When a solicitor receives instructions from the client, they should agree a date for the preparation of the will that is acceptable to the client, and reflects any need for urgency (for example, to take into account the health condition of the client).

Unless otherwise agreed, once the client has provided all the information needed to complete the agreed instructions, the solicitor should:

send the draft will to the client within seven working days, and

send the final version to the client for execution within seven working days of receiving approval of the draft, or if a draft is not supplied, send the will to the client for execution within ten working days.

Revision tip

There is no legal regulation of wills in England and Wales. Practitioners rely on guidance from the Law Society and other organisations such as STEP. It is advised that you follow this guidance carefully. For instance, STEP do not dictate a timeframe to be followed for the drafting of a will, but do advise that the task must be undertaken ‘expeditiously’. Make sure you use this guidance as part of your revision for SQE1.

What is You consider and take account of your client’s attributes, needs and circumstances (Para 3.4)?

The will that is prepared must be appropriate for the client’s circumstances. This means that the will must be drafted in such a way that is clear and understandable. Inappropriately complex wills must be avoided.

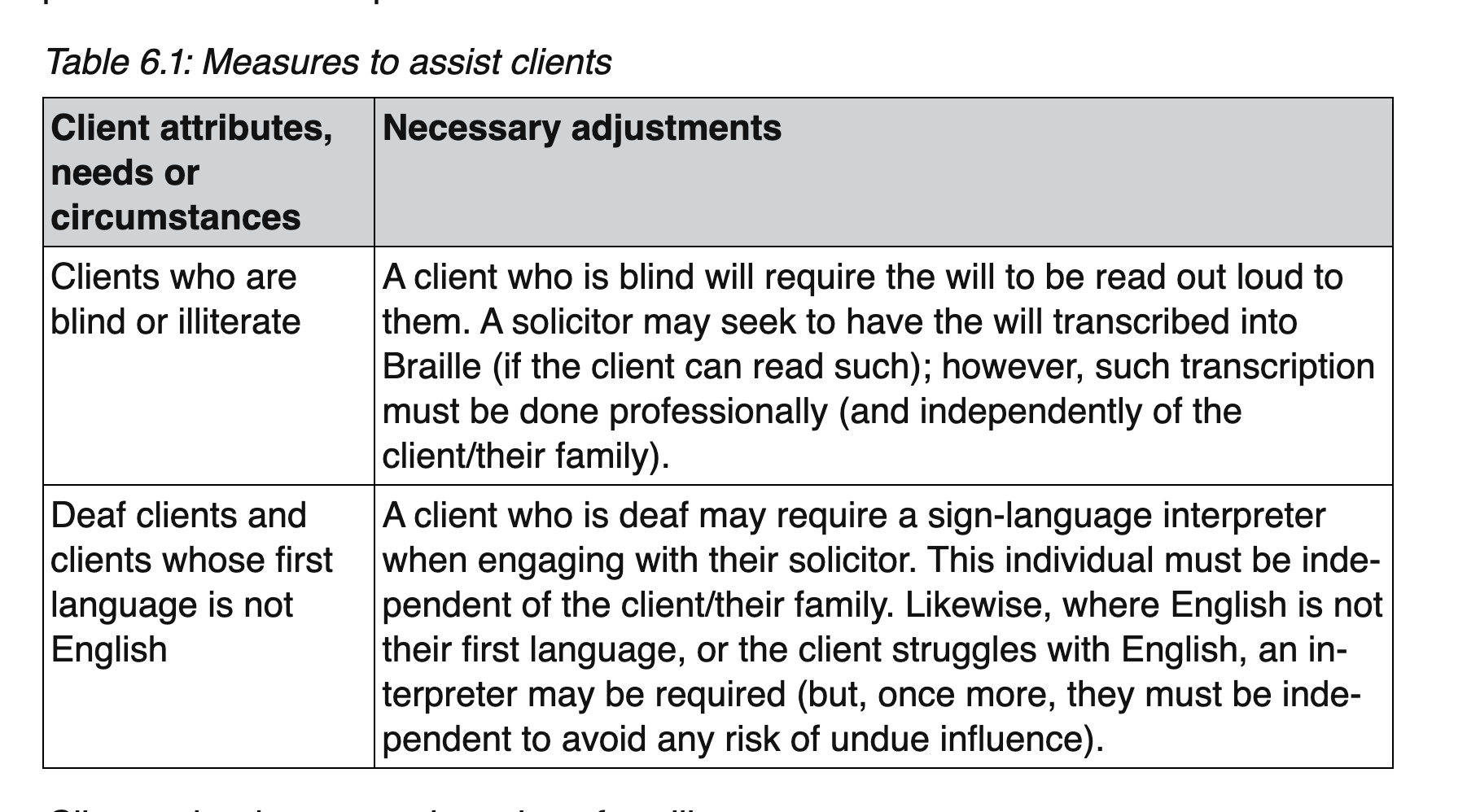

What are particular circumstances of clients?

A solicitor specialising in private client law will undoubtedly come into contact with clients who require a greater level of assistance than their average client. For example, a client may be blind, illiterate or English may not be their first language. In these circumstances, the solicitor must ensure that they tailor their services to suit the needs of the client (this also ensures that a firm avoids claims for unlawful discrimination in respect of their provision of services to clients with a disability). Table 6.1 provides some examples of what measures could be taken.

What is Clients who do not see the value of a will?

Many clients, including those who are not particularly wealthy, think that they do not need to make a will, because their property will automatically go to their closest relatives when they die. This is true up to a point, but clients need to be warned that, under the intestacy rules, property may not pass to their intended recipients. For instance, a client must be advised that property cannot pass via the intestacy rules to:

a cohabitant upon death

stepchildren, or

children who have not been formally adopted.

Should a client wish for any of the above individuals to benefit from their estate, they should be advised to make a will.

What are client money and assets?

Executors derive their authority from the will itself. In the majority of cases, once the testator/testatrix has died, the executors will apply to the court for a grant of probate. Depending on the assets in question, a grant of probate may not be required, but in the majority of cases it is. The grant of probate confirms their authority to collect the assets of the deceased and then distribute them to the beneficiaries named in the will. The executors may be solicitors or lay people, but often lay executors will employ solicitors to apply for probate. Probate is usually obtained within a year of the date of death.

What is You safeguard money and assets entrusted to you by clients and others (Para 4.2)?

The executors’ first duty is to collect and secure the assets of the deceased. They then have powers to administer that property and even to sell, mortgage or lease it, which may be necessary to pay debts or taxes, and distribute the property to the beneficiaries.

A solicitor may have to advise an individual as to how the estate will be distributed and the timeframe for this. An illustration of how this might work in practice can be seen in Practice example 6.2.

Practice example 6.2

Mark has just died and your firm of solicitors are the executors of his will. His widow consults you in great distress because she claims to have no money. She is sure that Mark left all his property to her and asks whether the executors can let her have some of the money now.

What advice would you give her?

You would have to tell Mark’s widow that she might have access to property that is not governed by the will, such as a joint bank account with Mark or rights under a pension. If her home with Mark was held as a joint tenancy, irrespective of the will, it now belongs to her under the right of survivorship.

What is CONFLICT, CONFIDENTIALITY AND DISCLOSURE?

Part 6 of the Code of Conduct sets out a series of rules relating to when a solicitor should decline to act for particular clients. This section sets out how situations involving these rules may apply in the context of wills and the administration of estates.

What is Own interest conflict (Para 6.1)?

In line with the Code of Conduct, a solicitor must not act for a client where there is a significant risk of a conflict of interest, either an own interest conflict or a conflict of interest (return to Chapter 2 for a full discussion and to remind yourself of these Key term definitions). Solicitors must be aware of the potential risks involved in acting for a private client.

What are Gifts made to solicitors in the will?

It is common, especially when a solicitor who is a family friend of the testator is involved, for a will to make a gift of significant value to the solicitor, a member of their family, another employee of the firm, or their family member. What should a solicitor do in this situation?

STEP 1: The solicitor must satisfy themselves that the client has first taken independent legal advice with regard to making the gift.

STEP 2: The solicitor should make a record of the advice provided and seek written confirmation from the client that they have obtained such independent legal advice.

STEP 3: If the client refuses to take independent legal advice, the solicitor should cease to act for the client where the client still wishes to include the gift in their will.

In a similar situation, where benefit under the will is to pass to a body, such as a charity, with which the solicitor has substantial involvement, the STEP Code provides that best practice is for the solicitor to decline to draft the will, and to arrange for another suitably qualified individual to assist the client.

Exam warning

The rule on ceasing to act is not absolute. Whether a solicitor ceases to act is a decision for them and it will depend on the specific circumstances within which they find themselves. For example, a solicitor who is drafting a will for their parents, where the parents intend to leave their estate equally to the solicitor and their siblings may consider it acceptable that they continue to act. However, these circumstances will be limited, and the STEP Code strongly advises against solicitors acting in this situation.

What is the rule against self-dealing?

Executors hold the legal title to all the assets of the deceased and so are in a good position to know the value of those assets, which may not be obvious to the beneficiaries. For that reason, executors are not permitted to buy or otherwise acquire any of those assets. This is known as the rule against ‘self-dealing’. The rule is strict, and any transaction entered into by a solicitor, acting as executor, is voidable (ie the beneficiaries can request the transaction to be set aside). See Revise SQE: Trusts Law for a greater insight into the rule against self-dealing.

What is conflict of interest?

Conflict of interest (Para 6.2)

A solicitor is not permitted to act if they have a conflict of interest or a significant risk of such a conflict. The SRA defines a conflict of interest as ‘a situation where your separate duties to act in the best interests of two or more clients in the same or a related matter conflict’. This can be a particular problem in wills and the administration of estates, where family members quite often dispute the provisions of a will.

Common examples of conflicts arising include:

If a solicitor receives instructions from more than one client, in a meeting regarding more than one will, a conflict may arise where the wills come into conflict.

If a solicitor drafted the will, or is the executor, or is acting for the executors, the solicitor should not act for potential clients disputing the will.

If a solicitor acts for a client disputing the will, they cannot act for a client with a different claim about the same will. A solicitor would, however, be able to act for a group of clients if they had the same claim about the will and they consented.

What is confidentiality and disclosure (Paras 6.3–6.5)?

A solicitor must keep the affairs of the client confidential unless the client consents.

Confidentiality generally

In line with Para 6.3, a solicitor must not inform anyone else of the contents of a will unless the client consents. This duty continues after death, as the right to confidentiality passes to the personal representatives of the client. After probate has been granted, however, a will becomes a public document, available from the Probate Registry to anyone. However, the duty of confidentiality continues in respect of any matter covered by the retainer (see Chapter 2 for the Key term) (eg communications between the client and solicitor when drafting the will).

Exam warning

Whilst the contents of the will become a public document upon the grant of probate, solicitors must maintain the confidentiality of their client for any other matters connected to the retainer. Do not allow the publication of the will to confuse your understanding of a solicitor’s obligation of confidence in respect of any information obtained from the client and advice given to the client.

Some information might still be private. Wills may contain discretionary trusts to give flexibility as to how the estate is to be distributed, eg the trustees, often the same people as the executors, have discretion to distribute property amongst the deceased’s children and grandchildren. These beneficiaries have no right to know what others in their category are receiving. Family members often want to know about wills and their contents. Practice example 6.3 illustrates how the Code applies.

Practice example 6.3

Richard and David are two brothers. The pair are concerned that their elderly parents, Bert and Molly, might have changed their wills. They know that you are Bert and Molly’s usual solicitor and ask you to tell them what is in their parents’ wills.

What should you do?

Unless Bert and Molly give their permission, you cannot inform the brothers of the contents of the will. In fact, you cannot even inform them that you were the individual who drafted the will (if you did). If you did draft the will, you may consider speaking to Bert and Molly to make them aware of the request and seek instructions accordingly. Further, you should have already ensured that you were satisfied that Bert and Molly had the mental capacity to make wills when you first drafted the will. See Mental capacity above.

What is Confidentiality and disputed wills?

A solicitor may be faced with a situation where a will that they have prepared is disputed. In these circumstances, a solicitor may be asked to disclose information about the circumstances surrounding its preparation and execution (known as a Larke v Nugus request (taken from a case of the same name)). The issue becomes: under what circumstances can, and should, a solicitor do so?

STEP 1: A solicitor is not obligated to comply with a Larke v Nugus request, but it is considered best practice in order to avoid potentially costly litigation.

STEP 2A: If a solicitor chooses not to respond to a Larke v Nugus request, they should consider that they may be compelled to do so by the court (which is not only inconvenient, but also costly).

STEP 2B: If a solicitor chooses to respond to a Larke v Nugus request, their conduct depends on whether the solicitor is named as an executor in that will:

If the solicitor is named as the executor, they should provide the requested statement and relevant documents, so long as no other person has a sustainable claim to legal privilege (ie there is not another person who can claim privilege/confidentiality) in the material.

If the solicitor is not named as the executor, they should obtain the consent of the executors before making any disclosure. If the executors do not wish to give consent, the solicitor must advise them of the potential for the court to subpoena them to produce some or all of the documents requested.

STEP 3: The SRA Code of Conduct does not prohibit charging for the preparation of a Larke v Nugus statement. However, those charges should be reasonable, in accordance with a solicitor’s duty to treat others fairly under Paras 1.1 to 1.4 of the Code.

What is disclosure?

When a solicitor acts for a client, Para 6.4 of the Code obliges them to ‘make the client aware of all information material to the matter of which you have knowledge’. That leads to a conflict of interests where that information comes from another client or former client and is confidential. If the ‘new’ client has an adverse interest to the other client, and there is a risk that the confidential information could be disclosed, the solicitor must not act for the new client, unless the solicitor obtains written permission from the former or other client.

Therefore, a solicitor should carefully check the provisions of the Code if they are asked to act in a family dispute about a will or inheritance. The solicitor might well have confidential information from one member of a family which they cannot disclose to other members of the family. See Conflict of interest above.

Revision tip

Conflicts of interest are common in wills and the administration of estates, but as we have explained, they are not always as straightforward as they might seem. It is quite likely that this sort of MCQ will occur in the SQE1 assessment.

What happens WHEN YOU ARE PROVIDING SERVICES TO THE PUBLIC OR A SECTION OF THE PUBLIC?

A number of issues can be identified as relevant to wills and the administration of estates under this heading of the Code.

What is Client identification (Para 8.1)?

Para 8.1 obligates a solicitor to identify who they are acting for in relation to any matter. In the context of will drafting, the solicitor must take all reasonable steps to identify the client in order to prevent fraud by impersonation of a client. See Revise SQE: The Legal System and Services of England and Wales for more detail on the Money Laundering Regulations 2007.

What is Complaints handling (Paras 8.2–8.5)?

Paras 8.2–8.5 detail the obligations imposed on solicitors in respect of the handling of complaints. Particularly, solicitors providing service to the public must have a complaints system and inform clients, in writing, of how it works at the time of engagement. If the client is not satisfied within eight weeks, they must be informed, in writing, of their right to appeal to the Legal Ombudsman (see Key term in Chapter 2).

What is CLIENT INFORMATION AND PUBLICITY?

Under paras 8.6–8.11, a solicitor owes a number of obligations to their client. This includes an obligation to provide information to clients on their case and costs.

What is You give clients information in a way they can understand (Para 8.6)?

Will drafting, and the administration of estates, is a complex business. A solicitor must be in a position to provide information to their clients clearly and effectively. Below are some examples of the type of information relevant to a client seeking advice on wills and the administration of their estate.Transcription of all provided pages is complete. If you require any additional pages or specific content from these chapters, please upload or specify it as needed.

What is the Appointment of executors?

A will should have executors, usually with a minimum of two people and a maximum of four (you can technically have more than four executors; however this is unworkable and only four may go on the grant of probate). Most testators/testatrixes appoint two people or alternatively a professional body (such as a trust corporation or a partnership of solicitors). A solicitor must advise a client to choose trusted and competent friends or relatives as executors, as discussed above (see You do not abuse your position by taking unfair advantage of clients or others).

Before a solicitor drafts a will which appoints them, or their firm, as the executor, the solicitor must satisfy themselves that the client has made this decision on a fully informed basis. This means that the solicitor should:

STEP 1: Explain the options available to the client regarding their choice of executor.

STEP 2: Ensure the client understands that an executor does not have to be a professional person or a business. The solicitor should explain that the executor could instead be a family member or a beneficiary under the will.

STEP 3: Reassure a client that lay executors can subsequently instruct a solicitor to act for them if this proves necessary (and can be indemnified out of the estate for the solicitors’ fees).

STEP 4: Record any advice that is given concerning the appointment of executors, including a recording of the client’s decision.

What is the storage of wills?

Before a will is admitted into probate, it is a private document; it is not readily available for public sight. Indeed, many wills remain hidden until a client dies. In light of this, clients are best advised to consider the use of an official storage of their original will. His Majesty’s Courts and Tribunals Service (HMCTS) offers a low-cost wills storage service which clients should be informed about.

Many solicitors’ firms charge clients for the safe storage of their original will, whilst others will not. In any regard, a solicitor must properly advise their client as to the options available for the storage of their will. Storage in a central official service, such as with the Probate Registry, may make it convenient for executors to access the will. Alternatively, storage with the solicitor may be more appropriate, allowing for easy access by executors and by the creator of the will.

Regardless of whether the will is officially stored or not, the SRA, in their guidance Drafting and preparation of wills, state that a solicitor should advise their client to:

make sure that all their executors know where to find the original version of the will

keep a copy of the will at their home with the relevant details

keep the solicitor informed of any changes to their address or contact details, and

review their will regularly to make sure it still reflects their wishes and circumstances.

What is You ensure that clients receive the best possible information about how their matter will be priced (Para 8.7)?

You ensure that clients receive the best possible information about how their matter will be priced (Para 8.7)

As can be seen in Chapter 2, Paras 8.6–8.11: client information and publicity, Para 8.7 of the Code requires a solicitor to ensure that their client receives the ‘best possible’ information about the price of their service and the likely overall costs. This provision is particularly important in will drafting when ‘standard fees’ are often given by solicitors for work done.

Revision tip

You may want to look at the pricing information which now has to be published by each firm on their websites. Firms are required to publish an estimated price for estate work. This will help you put Para 8.7 into practice.

The STEP Code requires that the basis of charging must be reasonable for the work being undertaken and the client’s requirements. STEP advises that it is reasonable for charges to ‘reflect complexity, time spent, risk and the qualification of the will drafter’.

If the client chooses the solicitors’ firm to be the executor, the solicitor must warn the client of the fees that they will charge for applying for probate on the death of the client and for administering the will. This could be a fixed fee or, more likely, the fee will depend upon the amount of work required. An illustration of this can be seen in Practice example 6.4.

Practice example 6.4

Harry has just died, and your firm of solicitors are the executor of his will. You advise his son, Ken, who is the only beneficiary of the will, that it will cost him £3,000 plus VAT and disbursements for your firm to apply for probate and administer the will. However, Sarah, who claims to have been a cohabitant of Ken, informs your firm that she is going to make a claim under the Inheritance (Provision for Family and Dependants) Act 1975 (a statute that you are required to know for SQE1, see Revise SQE: Wills and the Administration of Estates).

What advice should you give to Ken?

You must advise Ken that this claim by Sarah makes the matter contentious and could result in the case going to court. This will be more expensive, and you should provide an update on your fees and advise on the likely cost (remember that your duty to provide the ‘best possible information’ is a continuing duty). As your firm was only appointed as executor, you should also advise Ken that he is free to employ a different solicitor to deal with this matter.

What is the final advice?

The issues that may arise in wills and the administration of estates are diverse and wide ranging. This chapter has covered issues that are specific to this area of practice, but you must remain vigilant and aware of more general conduct issues that may occur (eg on costs and client care). Using Revise SQE: Wills and the Administration of Estates, you should review the substantive law relating to wills and the administration of estates and identify occasions when ethical and professional conduct issues may arise.