11/4 buad 280 exam 2

1/97

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

98 Terms

land

tangible

land improvements

tangible

buildings

tangible

equipment

tangible

natural resources

tangible

patents

intangible

trademarks

intangible

copyrights

intangible

franchises

intangible

goodwill - intangible or tangible

intangible

appraisal fee

cost to provide opinion on market value of property

fair value

estimated stand alone selling price

as natural resources are used, cost is allocated to an expense through a process called

depletion

land capitalized costs

purchase price + closing costs - sale of salvaged materials

closing costs

attorney fees, agent commissions, title, title search, recording fees, back taxes, other obligations, clearing, filling, leveling, removing old buildings

how to record amount for fair values for basket goods

estimated fair value / allocation % out of total fair values

multiply by amount of basket purchase (price when sold together)

record amount

purchase of intangible assets

purchase cost + legal fees

how are internally developed intangible assets recorded?

expensed on income statement as incurred

when is goodwill recorded

when part of the acquisition of another business

when the purchase price exceeds the fair value of net identifiable assets

how to calculate goodwill

fair value of assets acquired - fair value of liabilities assumed = fair value of identifiable net assets

purchase price - fair value of identifiable net assets = goodwill

when to capitalize

expenditures are capitalized if it benefits future periods

when to expense

expenditures are expensed if it benefits only the current period

repairs and maintenance - capitalize or expense?

when maintaining a given level of of benefits → minor → current → expense

making major repairs that increase future benefits → capitalize

addition - capitalize or expense?

adding a new major component → capitalize

improvement - capitalize or expense?

replacing a major component → capitalize

legal defense of intangible assets - capitalize or expense?

incurring litigation costs to defend the legal right to the asset → capitalize

if defense is unsuccessful → expense

depreciation

the process of allocating the cost of an asset to an expense over its service life

accumulated depreciation

contra asset account that represents total depreciation since the equipment was purchased

entry to record annual depreciation for equipment

debit depreciation expense, credit accumulated depreciation

book value

cost of asset - current balance in accumulated depreciation

depreciable cost

asset’s cost - residual value

straight line method when reestimating

depreciation expense = (cost - residual value) / initial service life

depreciation after x years = depreciation expense * x

book value after x years = cost - depreciation after x years

depreciation expense in the reestimate year = (book value after x years - residual value) / number of more years

double-declining balance method (depreciation rate)

calculate straight-line rate: 100 / useful life = x

2x = double-declining

depreciation rate per unit

(asset’s cost - residual value) / total units expected to be produced

when does impairment occur

book value > future cash flows or benefits

impairment loss

book value - fair value

what does the impairment loss entry look like

entry reduces net income and total assets by amount of impairment loss

net realizable value

market price - any additional costs necessary to sell it

estimating value of lost inventory

gross profit = gross profit ratio % * net sales

cogs = net sales - gross profit

ending inventory = beginning inventory + purchases - cogs

depreciation expense

total capitalized costs / useful life

adjusting net income from lifo to fifo

cogs under lifo - lifo reserve = cogs under fifo

income tax expense under lifo + (lifo reserve * tax rate) = income tax expense under fifo

net income under fifo = revenue - cogs - income tax expense

writing off uncollectible balance

debit allowance for doubtful accounts, credit accounts receivable

when costs are increasing, fifo results in

lower cogs, higher ending inventory values, higher net income

times interest earned (tie)

measures a company’s ability to meet its interest obligations with operating income

how to record an increase in the allowance for doubtful accounts

debit bad debt expense, credit allowance for doubtful accounts

ending allowance balance =

beginning balance + bad debt expense - write offs

activity based depreciation

depreciable base = cost - salvage value

depreciable rate per mile = depreciable base / total estimated miles

depreciation expense = miles driven * depreciable rate per mile

ammortization expense

depreciation rate * cost = expense

cost - expense = book value end of year one

book value end of year 1 * depreciation rate = book value end of year 2

repeat as necessary

under accrual accounting, revenue is recognized…

when earned

big bath accounting

taking large write offs in one period

when does depreciation stop?

when book value reaches salvage value

vertical analysis

income statement items as a percentage of net sales

balance sheet items as a percentage of total assets

horizontal analysis

percent change = (second year amount - base year amount) / base year amount

liquidity ratios

short-term

current ratio

quick ratio

operating cash flow to current liabilities

solvency ratios

long-term

debt-to-equity

times interest earned

profitability ratios

measures earnings or operating effectiveness of a company

accounts receivable turnover

how many times receivables have been collected during the period

inventory turnover

shows how quickly a company sells its products and restocks them over a period of time

ppet

how effectively a company uses its property, plant, and equipment to generate sales

sales allowance

contra revenue account - reduces revenue and current assets

2/10, net 30

customer will receive a 2% discount if amount owed is paid within 10 days

if customer does not take the discount, full payment is due within 30 days

nonrecurring items

employee layoffs

consolidating production facilities

reorganizing sales operations

outsourcing some activities

terminating or relocating employees

write-down of long-term assets

benefits of credit sales

increased sales

customer loyalty

competitor advantage

disadvantages of credit sales

loss of time value of money

risk of non-collection

allowance method

establish an allowance

debit bad debt expense, credit allowance for doubtful accounts

write off actual bed debts

reduce accounts receivable and allowance for doubtful accounts

re-estimate ending allowance balance and make adjusting journal entry

debit bad debt expense, credit allowance for doubtful accounts

percentage of receivables method

amount in accounts receivable * percentage uncollectible

aging of accounts receivable method

based on estimated uncollectible per aging bucket

more accurate than using a single percentage

accounts receivable write off

debit allowance for uncollectible accounts, credit accounts receivable

record collection of accounts receivable previously written off

debit accounts receivable, credit allowance for uncollectible accounts

debit cash, credit accounts receivable

inventory cost

sum of all the direct costs to bring the inventory to salable condition

inventory cost includes

purchase price

shipping costs

insurance while in transit

fees or taxes paid to get the inventory ready to sell

less returns, allowances, and discounts

inventory cost does not include

most administrative costs (liability insurance, utilities, salaries)

most marketing costs

research and development costs

balance sheet approach

fifo - amount it reports for ending inventory (which appears in the balance sheet) better approximates the current cost of inventory

when costs are increasing, lifo results in

higher cogs, lower ending inventory, lower net income, lower income taxes

income statement approach

lifo - the amount it reports for cogs (which appears in the income statement) more realistically matches the current cost of the inventory needed to produce current revenues

lifo conformity rule

requires a company that uses lifo for tax reporting to also use lifo for financing reporting

fob shipping point

ownership of goods transfers to the buyer when it is placed on the truck/carrier

fob destination

ownership of the goods transfers to the buyer when it is delivered at its destination

consignment inventory

supplier (consigner) physically provides inventory to a retailer (cosignee) for sale, but the supplier retains ownership of the inventory until the goods are sold to the end customer

tangible and not subject to depreciation

those with indefinite useful lives - land

intangible and subject to ammortization

those with finite useful lives

patents

copyrights

trademarks (with finite life)

franchises

intangible and not subject to amortization

those with indefinite useful lives

goodwill

trademarks (with indefinite life)

service life, useful life

estimated use the company expects to receive from the asset before disposing of it

residual value, salvage value

the amount the company expects to receive from selling the asset at the end of its service life

straight-line depreciation method

Depreciation base: cost - residual value

Depreciation rate: 1/estimated useful life

Depreciation base * depreciation rate = depreciation expense

double-declining balance method

depreciation expense = (cost * 2) / useful life

activity-based depreciation

Depreciation base: cost - residual value

Depreciation expense: depreciation base / total life in units

most companies use for depreciation

straight line for financial reporting

accelerated for tax reporting

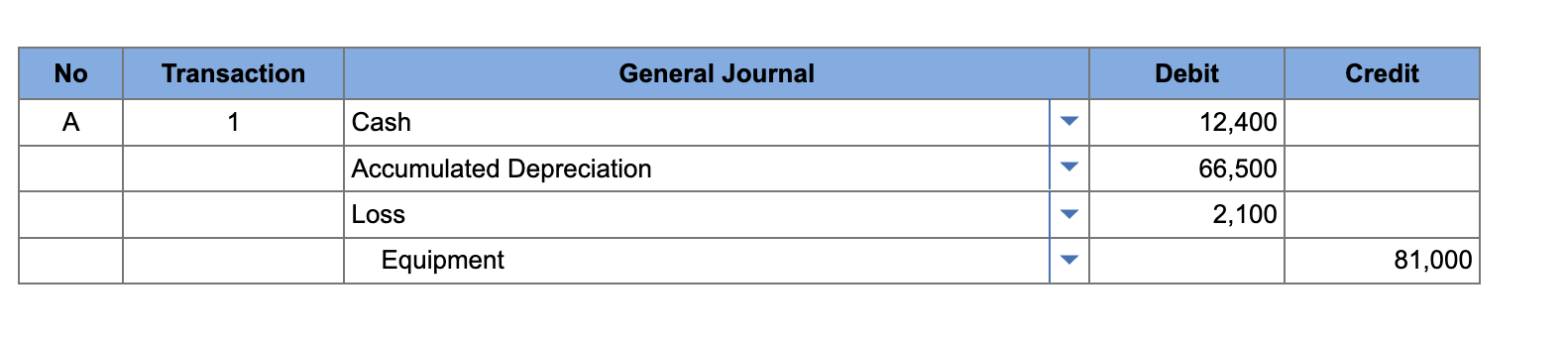

Hot Stone Creamery sold ice cream equipment for $12,400. Hot Stone originally purchased the equipment for $81,000, and depreciation through the date of sale totaled $66,500.

Record the gain or loss on the sale of the equipment.

debit cash 12400

debit accumulated depreciation 66500

debit loss 2100

credit equipment 81000

cash = sale amount

accumulated depreciation = amount depreciated

loss: purchase price - accumulated depreciation = book value → book value - sale amount = loss

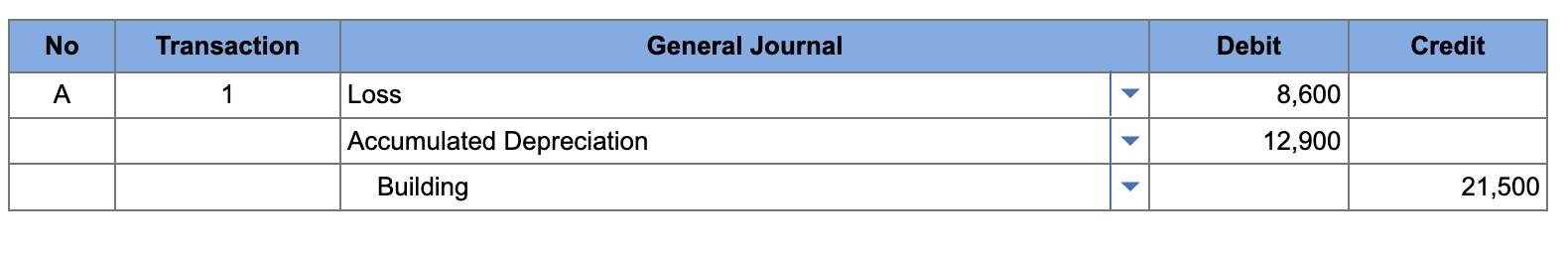

On January 1, Masterson Supply purchased a small storage building for $21,500 to be used over a five-year period. The building has no residual value. Early in the fourth year, the storage building burned down.

Record the retirement of the remaining book value of the storage building.

debit loss 8600

debit accumulated depreciation 12900

credit building 21500

loss = (purchase price / useful life) * years unused

accumulated depreciation = (purchase price / useful life) * years used

building = purchase price

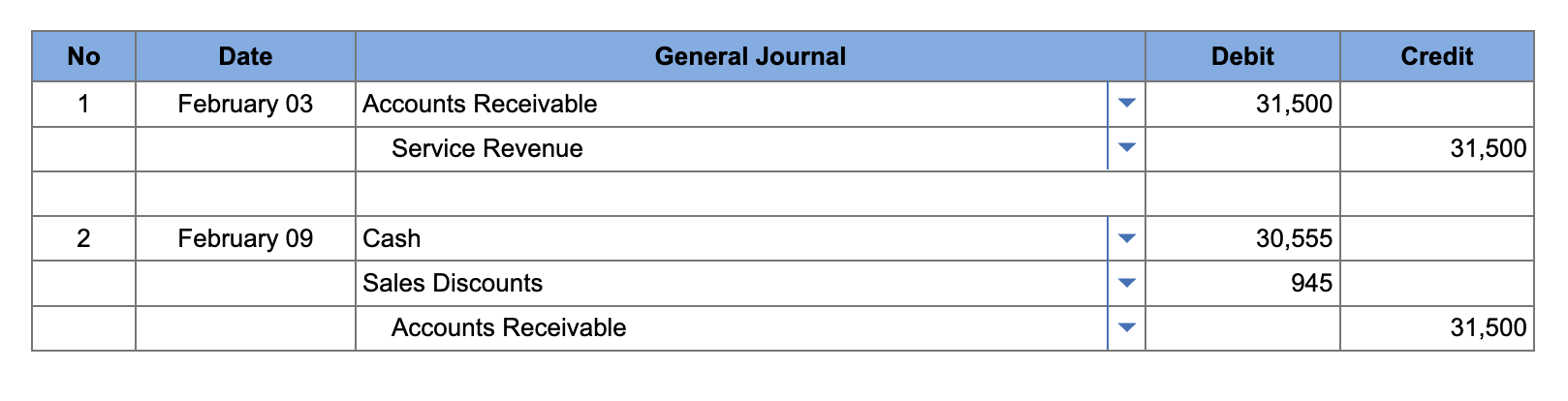

On February 3, a company provides services on account for $31,500, terms 3/10, n/30. On February 9, the company receives payment from the customer for those services on February 3.

Record the service on account on February 3 and the collection of cash on February 9.

feb 3

debit accounts receivable 31500

credit service revenue 31500

feb 9

debit cash 30555

debit sales discounts 945

credit accounts receivable 31500

A company has the following account balances at the end of the year:

Credit Sales = $400,000

Accounts receivable = $80,000

Allowance for Uncollectible Accounts = $400 credit

The company estimates future uncollectible accounts to be 4% of accounts receivable. At what amount would Bad Debt Expense be reported in the current year’s income statement?

2800

At the end of the year, an adjusting entry is recorded to reduce ending inventory from its recorded cost to net realizable value (NRV). The adjusting entry involves

Debit Cost of Goods Sold; credit Inventory

cogs =

beginning inventory + purchases - ending inventory

lower of cost/net realizable value method

multiply quantity by whichever is lower (unit cost or unit nrv)

add for each item

When a company determines that the net realizable value of its ending inventory is lower than its cost, what would be the effect(s) of the adjusting entry to write down inventory to net realizable value?

decrease total assets, decrease net income, decrease retained earnings

a trade discount results in…

revenue being recorded for the discounted price

closing costs acronym

arya always takes time roller blading on concrete floors like roads