ACYAFAR1: Partnership (Formation, Operations, Dissolution, Liquidation)

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Which of the following statements concerning the formation of partnership business is correct?

a. Philippine Financial Reporting Standard (PFRS) allows recognition of goodwill arising from the formation of partnership

b. The juridical personality of the partnership arises from the issuance of certification of registration

c. The parties may become partners only upon contribution of money or property but not of industry or service

d. The capital to be credited to each partner upon formation may not be the amount actually contributed by each partner

d. The capital to be credited to each partner upon formation may not be the amount actually contributed by each partner

The asset contributions of partners to a partnership are initially measured

at

a. Fair value

b. Original cost to the partner

c. Tax basis

d. Any of these

a. Fair value

Under the bonus method, any increase or decrease in the capital credit of a partner is

a. Deducted from or added to the capital credits of the other partners

b. Recognized as goodwill

c. Recognized as expense

d. Deferred and amortized to profit or loss

a. Deducted from or added to the capital credits of the other partners

Mr. X and Mr. Y agreed to form a partnership. The fair values of the partner’s net contribution vary; however, the partners agreed to have equal capital credits. Cash settlement shall be made between them for the difference. Which of the following statements is correct?

a. The asset contributions of the partners shall be debited to equal amounts

b. The cash settlement between the partners will either increase or decrease the total partnership capital

c. The cash settlement between the partners will not be recorded in the partnership books

d. Mr. X shall pay Mr. Y to have their capital balances equal

c. The cash settlement between the partners will not be recorded in the partnership books

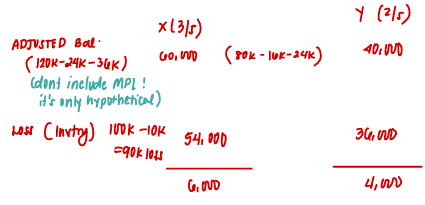

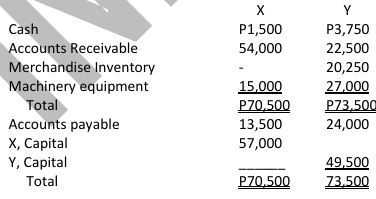

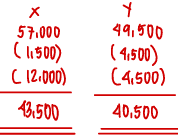

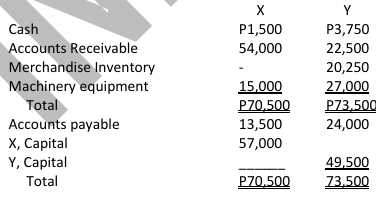

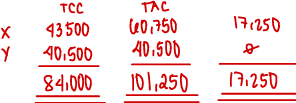

On July 1, 2025, X and Y decided to form a partnership. Their balance sheets on this date (see image)

The partners agreed that the machinery and equipment of X is under depreciated by P1,500 and that of Y by P4,500. Allowance for doubtful accounts is to be set up amounting to P12,000 for X and P4,500 for Y

If the capital contribution of each partner is the net amount of his assets and liabilities taken over by the partnership, the capital accounts of X and Y would be

a. P43,500 and P40,500, respectively

b. P46,500 and P49,500, respectively

c. P57,000 and P49,500, respectively

d. None of the above

a. P43,500 and P40,500, respectively

On July 1, 2025, X and Y decided to form a partnership. Their balance sheets on this date (see image)

The partners agreed that the machinery and equipment of X is under depreciated by P1,500 and that of Y by P4,500. Allowance for doubtful accounts is to be set up amounting to P12,000 for X and P4,500 for Y

Assume that the partnership agreement provides for profit and loss sharing of 60% to X and 40% to Y, and that the new capital of the partnership is to be agreed on the profit and loss ratio based on the adjusted capital of Y. How much additional cash must be invested by X in order to bring the partner’s capital balances proportionate to the profit and loss ratio

a. P14,250

b. P5,250

c. P17,250

d. None of the above

c. P17,250

How should the partners in a business partnership share in the profits or losses of the partnership?

a. Equally

b. At whatever basis of allocation that the dominating partner deems reasonable

c. In accordance with the partnership agreement

d. None of the above

c. In accordance with the partnership agreement

According to the Philippine Civil Code, if only the share of each partner in the profits has been agreed upon, the share of each in the losses shall be

a. In equal amounts

b. In equal amounts, but excluding the industrial partner

c. In proportion to the partners’ contributions

d. The same as the sharing in profits

d. The same as the sharing in profits

According to the Philippine Civil Code, in the absence of a stipulation on the sharing of profits or losses, partnership profits and losses shall be shared by the partners

a. Equally

b. In accordance with the partnership agreement

c. In proportion to what the partners may have contributed

d. In proportion to what the partners may have contributed, but the industrial partner shall not be liable for the losses

d. In proportion to what the partners may have contributed, but the industrial partner shall not be liable for the losses

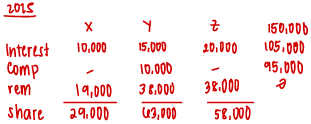

X, Y and Z formed a partnership on January 1, 2025, with investments of P100,000, P150,000 and P200,000 respectively. For division of income, they agreed to (1) interest of 10% of the beginning capital balance of each year, (2) annual compensation of P10,000 to Y and (3) sharing the remainder of the income or loss in a ratio of 20% for X and 40% each for Y and Z.

Net income was P150,000 in 2025 and P180,000 in 2026. Each partners withdrew P1,000 for personal use every month during 2025 and 2026

What was Y’s share of income for 2025?

a. P63,000

b. P53,000

c. P58,000

d. P29,000

a. P63,000

X, Y and Z formed a partnership on January 1, 2025, with investments of P100,000, P150,000 and P200,000 respectively. For division of income, they agreed to (1) interest of 10% of the beginning capital balance of each year, (2) annual compensation of P10,000 to Y and (3) sharing the remainder of the income or loss in a ratio of 20% for X and 40% each for Y and Z.

Net income was P150,000 in 2025 and P180,000 in 2026. Each partners withdrew P1,000 for personal use every month during 2025 and 2026

What was Z’s capital balance at the end of 2025?

a. P200,000

b. P224,000

c. P238,000

d. P246,000

d. P246,000

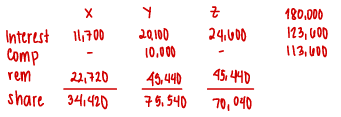

X, Y and Z formed a partnership on January 1, 2025, with investments of P100,000, P150,000 and P200,000 respectively. For division of income, they agreed to (1) interest of 10% of the beginning capital balance of each year, (2) annual compensation of P10,000 to Y and (3) sharing the remainder of the income or loss in a ratio of 20% for X and 40% each for Y and Z.

Net income was P150,000 in 2025 and P180,000 in 2026. Each partners withdrew P1,000 for personal use every month during 2025 and 2026

What was X’s share of income for 2026?

a. P34,420

b. P75,540

c. P65,540

d. P70,040

a. P34,420

X, Y and Z formed a partnership on January 1, 2025, with investments of P100,000, P150,000 and P200,000 respectively. For division of income, they agreed to (1) interest of 10% of the beginning capital balance of each year, (2) annual compensation of P10,000 to Y and (3) sharing the remainder of the income or loss in a ratio of 20% for X and 40% each for Y and Z.

Net income was P150,000 in 2025 and P180,000 in 2026. Each partners withdrew P1,000 for personal use every month during 2025 and 2026

What was Y’s capital balance at the end of 2026?

a. P201,000

b. P263,520

c. P264,540

d. P304,040

c. P264,540

Which of the following statements pertains to partnership dissolution?

a. If refers to the process of converting the non-cash assets of the partnership and distributing the total cash to the creditors and the remainder to the partners

b. It refers to the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on of the partnership

c. It refers to the extinguishment of the juridical personality of the partnership

d. It refers to the end of the life of the partnership

b. It refers to the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on of the partnership

Which of the following will result to the dissolution of a partnership?

a. Insolvency of the partnership

b. Admission of a new partner in an existing partnership

c. Retirement of a partner

d. All of the above

d. All of the above

The admission of a new partner effected through purchase of interest from (an) existing partner(s) is

a. Recorded in the partnership’s books as a debit to cash or other asset and credit to the incoming partner’s capital account

b. Recorded in the partnership’s books as a transfer within equity

c. Recorded in the partnership’s books as a transfer from equity to liability

d. Not recorded in its entirety

b. Recorded in the partnership’s books as a transfer within equity

After the admission of a new partner, the total partnership capital increased by the fair value of the new partner’s net contributions to the partnership. The admission was accounted for

a. Under the goodwill method

b. As partnership formation

c. As a purchase of interest

d. As an investment in the partnership

d. As an investment in the partnership

If a partner who retired from the partnership receives less than the capital balance before retirement which also resulted to decrease in the capital balance of remaining partners, which is correct?

a. The retiring partner receives bonus from remaining partner

b. A loss is recognized before the retirement

c. Revaluation surplus is recognized before the retirement

d. The retiring partner gives bonus to the remaining partner

b. A loss is recognized before the retirement

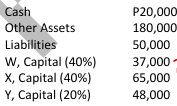

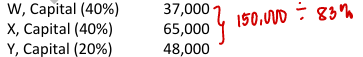

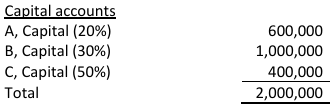

A partnership has the following capital balances (see image)

If the assets are fairly valued on this balance sheet and the partnership wishes to admit Z as a new one-sixth interest partner without recording bonus. Z should contribute cash or other assets of

a. P40,000

b. P36,000

c. P33,333

d. P30,000

d. P30,000

A partnership has the following capital balances (see image)

If assets on the initial balance sheet are fairly valued. W and X give their consent, and Z pays Y P51,000 for his interest, the revised capital balances of the partners would be

a. W, P38,000; X, P66,500; Z, P51,000

b. W, P38,500; X, P66,500; Z, P48,000

c. W, P37,000; X, P65,000; Z, P51,000

d. W, P37,000; X, P65,000; Z, P48,000

d. W, P37,000; X, P65,000; Z, P48,000

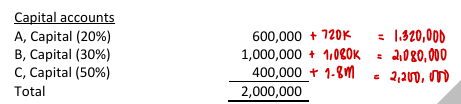

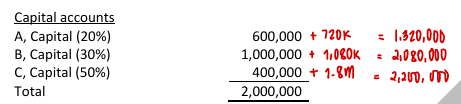

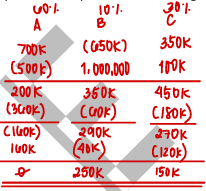

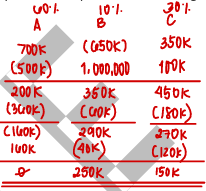

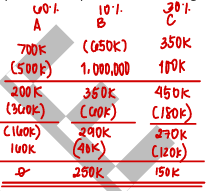

The capital account balances of the partners in ABC Partnership on June 30, 2025 before any necessary adjustments are as follows (see image):

The partnership reported profit of P3,600,000 for the six months ended June 30, 2025.

On July 1, 2025, C withdraws from the partnership when he was bought-out by his co-partners for P2,480,000 cash. How much is the capital balance of A immediately after the withdrawal of C?

a. 1,480,000

b. 1,880,000

c. 1,320,000

d. 2,200,000

d. 2,200,000

The capital account balances of the partners in ABC Partnership on June 30, 2025 before any necessary adjustments are as follows (see image):

The partnership reported profit of P3,600,000 for the six months ended June 30, 2025.

C retires on July 1, 2025. It was agreed that C shall receive P2,480,000 cash from the partnership in settlement of his interest. How much is the capital balance of B right after the withdrawal of C?

a. 2,080,000

b. 1,912,000

c. 1,642,000

d. 2,120,000

b. 1,912,000

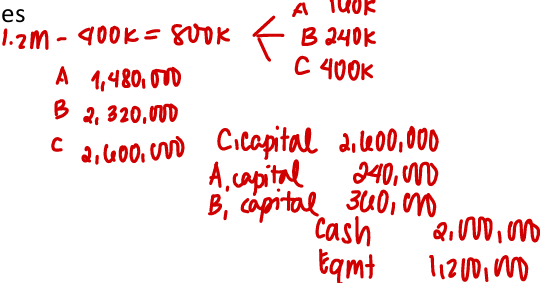

The capital account balances of the partners in ABC Partnership on June 30, 2025 before any necessary adjustments are as follows (see image):

The partnership reported profit of P3,600,000 for the six months ended June 30, 2025.

C retires on July 1, 2025. It was agreed that C shall receive cash of P2,000,000 and equipment with carrying amount of P400,000 and fair value of P1,200,000 as settlement of his interest in the partnership. The entry in the partnership’s books to record the retirement of C includes

a. a debit to C’s capital for P400,000

b. a debit to C’s capital for P2,200,000

c. a debit to A’s capital for P240,000

d. The transaction is not recorded in partnership’s books

c. a debit to A’s capital for P240,000

It refers to the process of converting the non-cash assets of the partnership and distributing the total cash to the creditors and the remainder to the partners.

a. Dissolution

b. Termination

c. Liquidation

d. Operation

c. Liquidation

The following is the priority sequence in which liquidation proceeds will be distributed for a partnership

a. Partnership drawings, partnership liabilities, partnership loans, partnership capital balances

b. Partnership liabilities, partnership loans, partnership capital balances

c. Partnership liabilities, partnership loans, partnership capital balances, partner’s creditors

d. Partnership liabilities, partnership capital balances, partnership loans

b. Partnership liabilities, partnership loans, partnership capital balances

X and Y are partners of XY Company which is undergoing liquidation. After XY Company’s assets were realized and its liabilities settled, X’s capital account has a negative balance. Which of the following statements is correct?

a. Y shall absorb X’s capital deficiency if X is solvent

b. X shall make an additional contribution if X is insolvent

c. X and Y shall make pro rata contributions to eliminate X’s capital deficiency

d. Y shall absorb X’s capital deficiency if X is insolvent

d. Y shall absorb X’s capital deficiency if X is insolvent

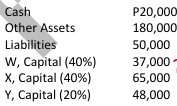

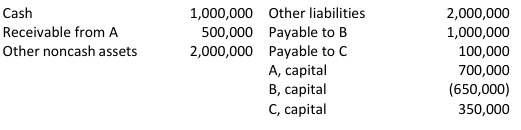

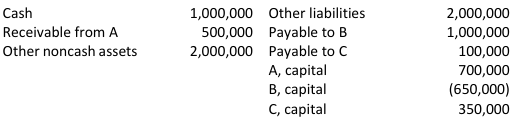

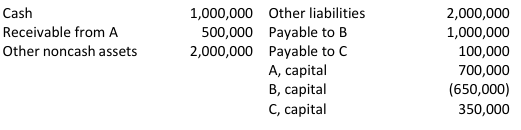

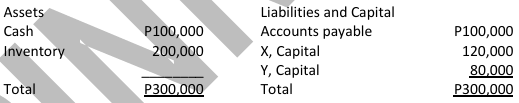

On December 31, 2025, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data (see image):

On January 1, 2026, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other noncash assets were sold for P1,500,000. Liquidation expenses amounting to P100,000 were incurred

How much cash was received by A at the end of partnership liquidation?

a. 840,000

b. 700,000

c. 160,000

d. 0

d. 0

On December 31, 2025, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data (see image):

On January 1, 2026, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other noncash assets were sold for P1,500,000. Liquidation expenses amounting to P100,000 were incurred

How much cash was received by B at the end of partnership liquidation?

a. 250,000

b. 150,000

c. 290,000

d. 270,000

a. 250,000

On December 31, 2025, the Statement of Financial Position of ABC Partnership with profit or loss ratio of 6:1:3 of partners A, B and C respectively, revealed the following data (see image):

On January 1, 2026, the partners decided to liquidate the partnership. All partners are legally declared to be personally insolvent. The other noncash assets were sold for P1,500,000. Liquidation expenses amounting to P100,000 were incurred

How much cash was received by C at the end of partnership liquidation?

a. 270,000

b. 150,000

c. 350,000

d. 220,000

b. 150,000

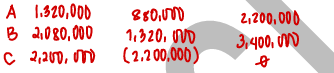

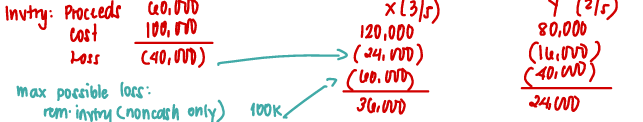

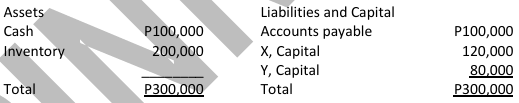

Partners X and Y have decided to liquidate their business. The following information is available (see image)

X and Y share profits and losses in a 3:2 ratio. During the first month of liquidation, half the inventory is sold for P60,000, and P60,000 of the accounts payable is paid. During the second month, the rest of the inventory is sold and the remaining accounts payable are paid. Cash is distributed at the end of each month, and the liquidation is completed at the end of the second month

Using a Safe Payments Schedule, how much cash will be distributed to X at the end of the first month?

a. P64,000

b. P60,000

c. P24,000

d. P36,000

d. P36,000

Partners X and Y have decided to liquidate their business. The following information is available (see image)

X and Y share profits and losses in a 3:2 ratio. During the first month of liquidation, half the inventory is sold for P60,000, and P60,000 of the accounts payable is paid. During the second month, the rest of the inventory is sold and the remaining accounts payable are paid. Cash is distributed at the end of each month, and the liquidation is completed at the end of the second month

Assume instead that the remaining inventory was sold for P10,000 in the second month. What payments will be made to X and Y at the end of the second month, respectively?

a. P0 P0

b. P10,000 P0

c. P5,000 P5,000

d. P6,000 P4,000

d. P6,000 P4,000