PF Quest #1

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

16 Terms

What is the difference between discretionary (trivial) and non discretionary expenses. What are examples

🔹 Non-Discretionary Expenses

These are essential expenses you must pay to live and function. They're often fixed or recurring and hard to avoid.

Examples:

Rent or mortgage

Utilities (electricity, water, gas)

Groceries (basic food items)

Insurance (health, auto, home)

Transportation (gas, public transit for work)

Think: "Needs" — expenses that are required for daily living.

🔸 Discretionary Expenses

These are non-essential or optional expenses—things you choose to spend money on when you have extra funds.

Examples:

Dining out

Entertainment (movies, streaming services, concerts)

Travel and vacations

Hobbies or subscriptions

Luxury items (designer clothes, tech gadgets)

Think: "Wants" — expenses you can cut back on if needed.

1) 2 examples of athletes or celebrities who have demonstrated successful money management or spending practices (4 marks)

2) 2 examples of athletes or celebrities who have demonstrated poor money management or spending practices (4 marks)

Lebron James, Seneria Williams

Bad:

Mike Tyson, Allen Iverson

What is a RRSP

. A RRSP is really just a special investment holder or account

you get two tax benefits - first, you can move some of your income into a RRSP without it being taxed. Second, once inside a RRSP the money grows tax-free

What are the benefits of a RRSP?

RRSPs have two major advantages: tax-deferred contributions and tax-sheltered growth.

How much can I put into a RRSP?

There are three factors that affect how much you can contribute to a RRSP:

A percentage of your previous year's earned income (18% of your gross income)

A maximum dollar contribution ( $27,230)

An adjustment for your pension (18% of your previous year's earned income)

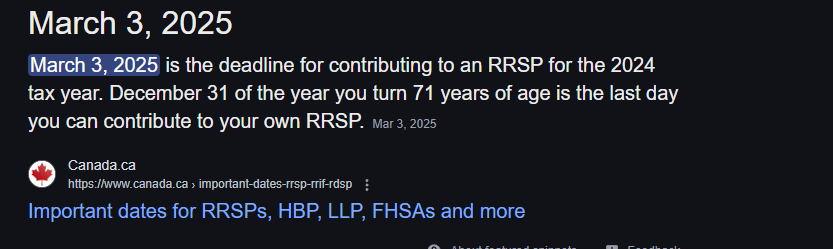

When is the deadline for making a contribution?

The deadline for RRSP contributions is the sixtieth day following the tax year. For instance, the RRSP deadline for the 2021 tax year is March 1, 2022.

Yourr RRSP money is added to your taxable income

How long can I have a RRSP for?

You have to close your RRSP by the end of the year in which you turn 71.

Explain RRIF and its benefits

Transfer the holdings to a Registered Retirement Income Fund (RRIF)

If you move money directly from a RRSP to a RRIF, you don't have to pay tax.

This option offers the most choice and flexibility. A RRIF is very similar to a RRSP. You can generally invest in the same range of investments, and your money can grow tax-free.

The main difference is you can't make contributions to a RRIF. Instead, you are required to withdraw a set minimum amount from your RRIF each year. This money, like withdrawals from a RRSP, is added to your regular income and taxed at your marginal tax rate. If your cash needs fluctuate, you can take out more than the minimum. You can even use money from your RRIF to buy an annuity.

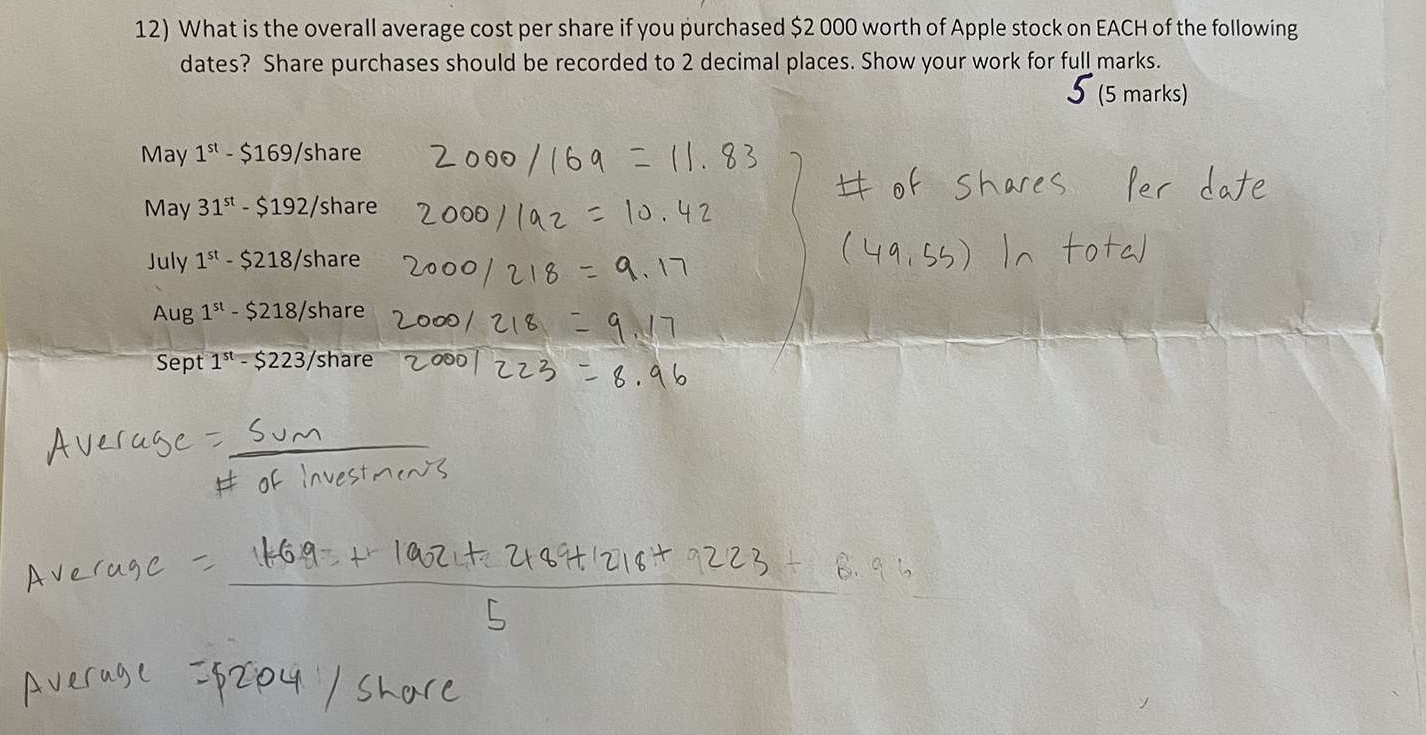

What is the average price per share formula

A = Sum price of shares / number of investments

FIVE Reasons Students Should File a Tax Return

1. Tax refund

Every Canadian has a personal tax exemption amount (for 2021, it’s $13,808). That means you don’t pay tax on any earnings equal to or less than this amount. But if you worked during the year, your employer may still have deducted federal and provincial income taxes from your pay. If so, then you’re eligible to get some or all of it back. (Note: scholarships are tax exempt – you don’t even have to note them on your tax return.)

2. Tax credits

Canada’s Tuition Tax Credit lets you claim the cost of your tuition on your tax return. If you don’t have enough income to claim this deduction, then you can carry the credits forward to future years when you’re earning more. Or, provided your own tax has been reduced to zero, you can transfer the credits to a parent, grandparent, spouse or common-law partner.

3. Student loans

You can claim interest on qualifying student loans, such as those made to you under the Canada Student Loans Act or the Canada Student Financial Assistance Act. If you don’t use the credit, you can carry it forward for five years. You can’t transfer it to anyone else.

4. GST/HST credit

Even if you didn’t have a job during the school year, you may be eligible for the GST/HST credit program aimed at helping low- and modest-income Canadians handle the added cost of the tax on goods and services. It’s a credit that’s paid out four times a year. If you don’t file your taxes, though, you won’t be eligible. (Note: you have to be 19 or over to qualify for this one.)

5. RRSP contribution room

Sure, saving for retirement may be the last thing on your mind right now. But by filing a tax return you are building up RRSP contribution room that you can carry forward to claim during future years of higher income.

Finally ready to file your tax return? Good – but before you get to work, make sure you have these key items handy:

The official tax slip from your school (T2202A): It shows you’re a student and the amount of tuition you paid. If you don’t plan to claim the tuition tax credit this year, then hang on to these slips so you can use them in the future.

Remember, the deadline for Canadians to file their tax returns is April 30.

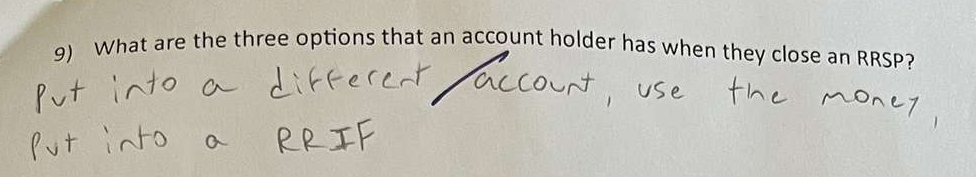

You have three choices:

Take the money in cash.

Use the funds to buy an annuity.

Transfer the holdings to a Registered Retirement Income Fund (RRIF).

1. Tax refund

Every Canadian has a personal tax exemption amount (for 2021, it’s $13,808). That means you don’t pay tax on any earnings equal to or less than this amount. But if you worked during the year, your employer may still have deducted federal and provincial income taxes from your pay. If so, then you’re eligible to get some or all of it back. (Note: scholarships are tax exempt – you don’t even have to note them on your tax return.)

2. Tax credits

Canada’s Tuition Tax Credit lets you claim the cost of your tuition on your tax return. If you don’t have enough income to claim this deduction, then you can carry the credits forward to future years when you’re earning more. Or, provided your own tax has been reduced to zero, you can transfer the credits to a parent, grandparent, spouse or common-law partner.

3. Student loans

You can claim interest on qualifying student loans, such as those made to you under the Canada Student Loans Act or the Canada Student Financial Assistance Act. If you don’t use the credit, you can carry it forward for five years. You can’t transfer it to anyone else.

4. GST/HST credit

Even if you didn’t have a job during the school year, you may be eligible for the GST/HST credit program aimed at helping low- and modest-income Canadians handle the added cost of the tax on goods and services. It’s a credit that’s paid out four times a year. If you don’t file your taxes, though, you won’t be eligible. (Note: you have to be 19 or over to qualify for this one.)

5. RRSP contribution room

Sure, saving for retirement may be the last thing on your mind right now. But by filing a tax return you are building up RRSP contribution room that you can carry forward to claim during future years of higher income.

Finally ready to file your tax return? Good – but before you get to work, make sure you have these key items handy:

The official tax slip from your school (T2202A): It shows you’re a student and the amount of tuition you paid. If you don’t plan to claim the tuition tax credit this year, then hang on to these slips so you can use them in the future.

Remember, the deadline for Canadians to file their tax returns is April 30.

what is a vesting period

how long to wait to gain full ownership of stock