3.3 - Costs & Revenues

1/15

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

16 Terms

Business expenditure

Business expenditure is the money you spend 'wholly and exclusively' for your business

All businesses have to spend money in order to earn money.

These are referred to as costs.

i.e. the expenditure in producing a good/service

Businesses need to pay for:

Set-up costs – items of expenditure needed to start a business.

Running costs – the ongoing costs of running the business.

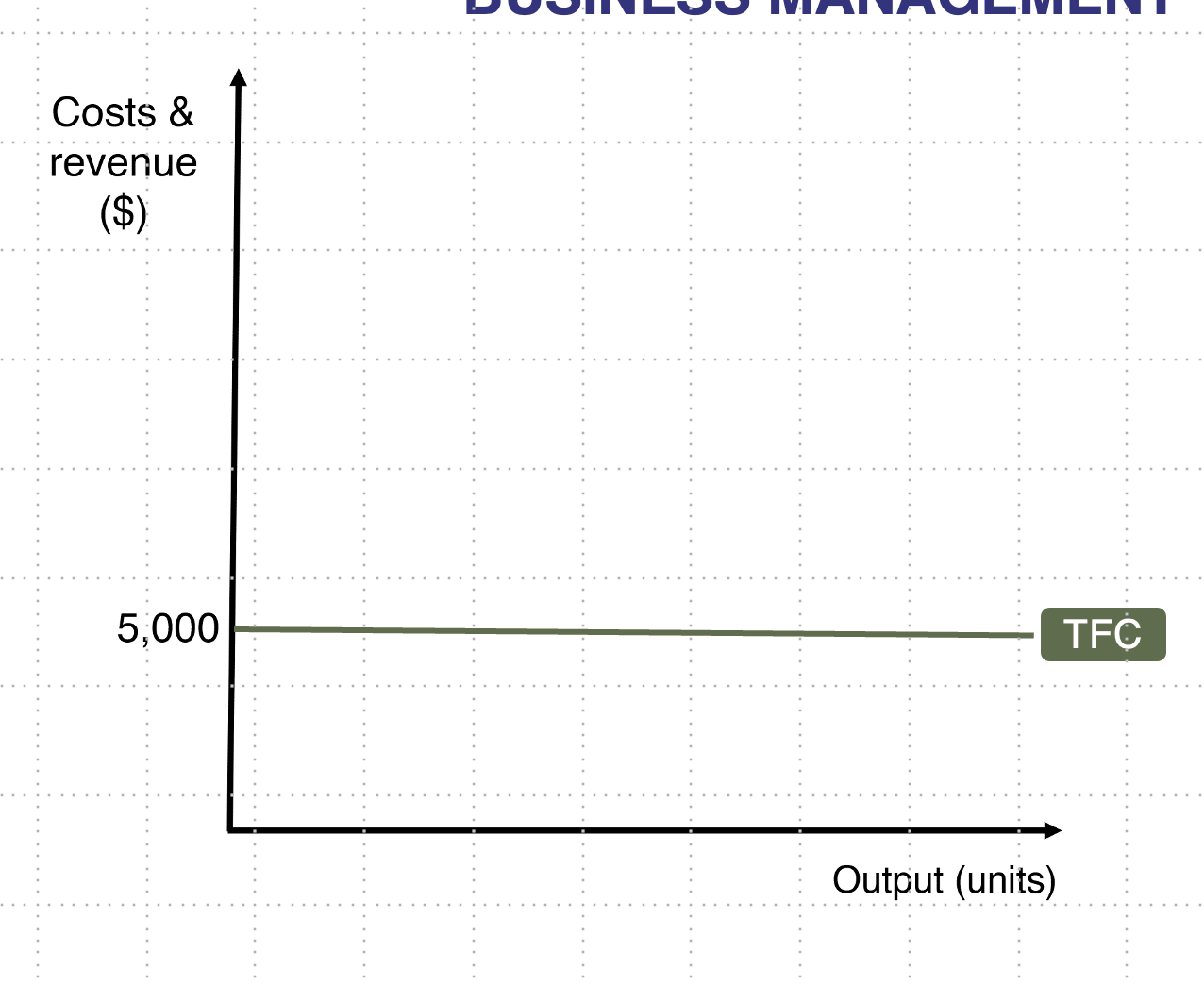

Fixed Costs

Fixed costs are the costs that do not vary with the level of output. They exist even if there is no output.

Examples of Fixed Costs

Rent on leased premises

Market research

Interest payments on bank loans

Management salaries

Advertising expenditure

Security

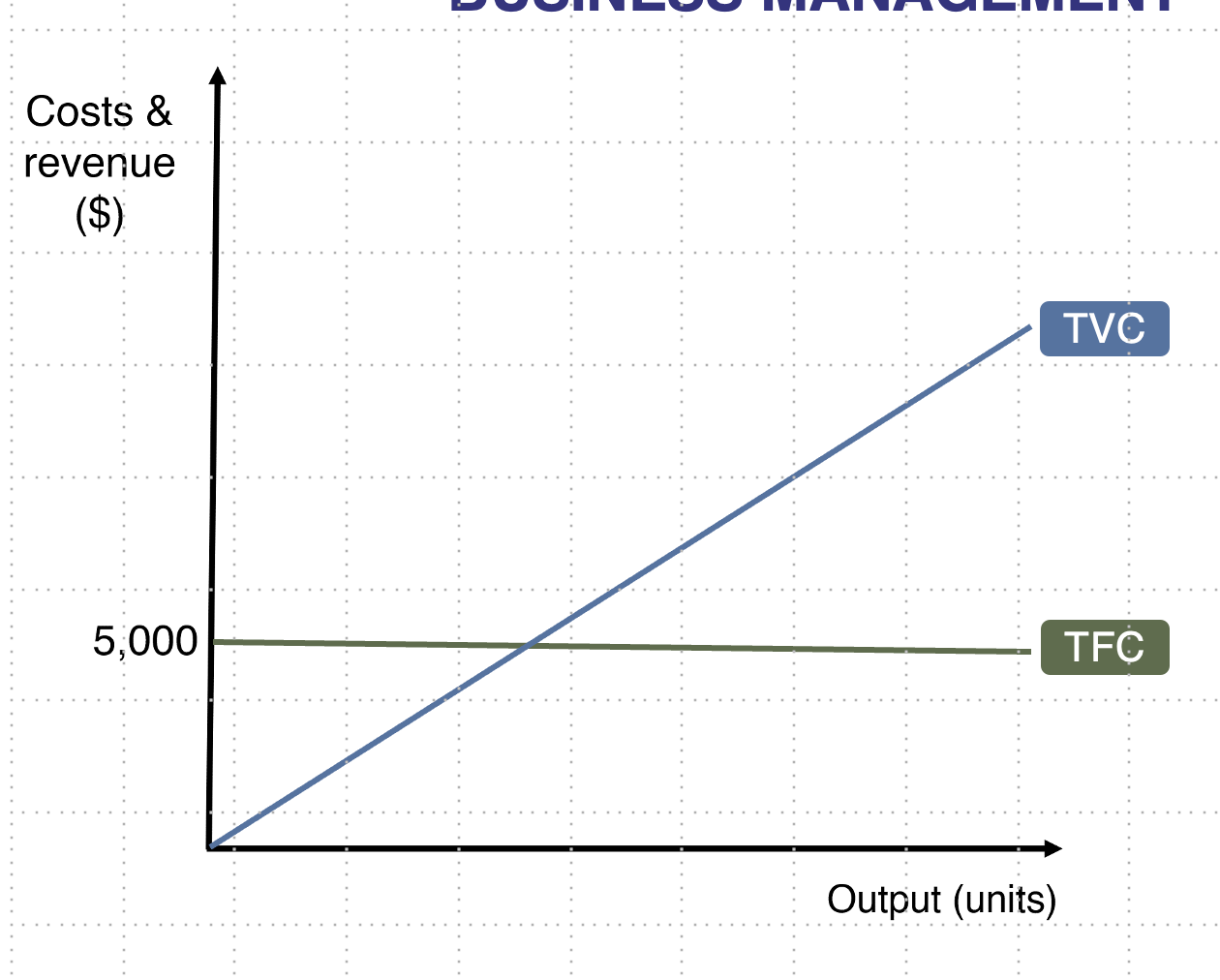

Variable Costs

Variable costs are the costs of production that change in proportion to the level of output, such as raw materials and hourly wages of production workers.

If output is zero, then total variable costs are zero

Examples of Variable Costs

Raw materials

Wages

Commission payments to staff

Utilities

Packaging

Repair and maintenance

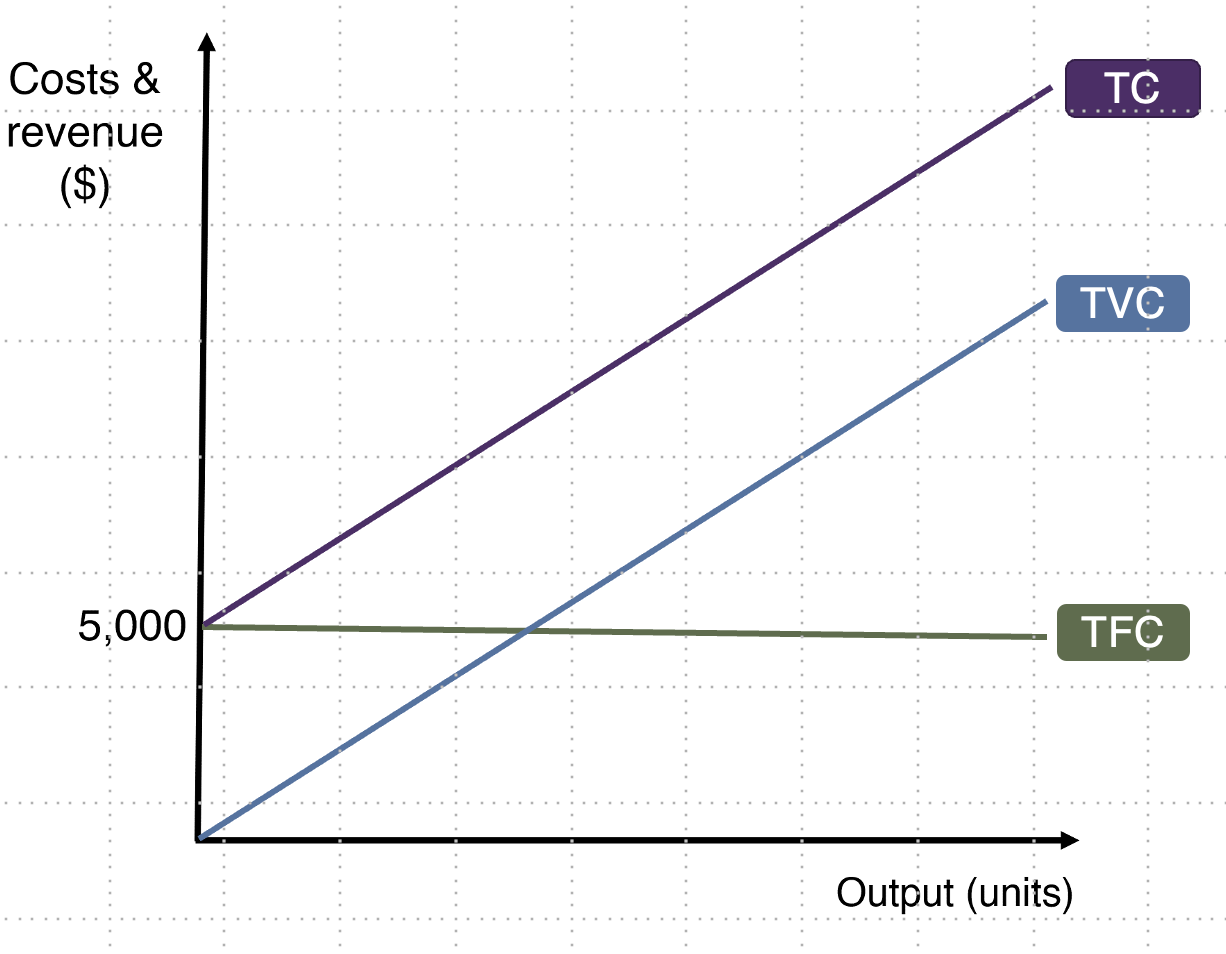

Total costs

the sum of all variable costs and all fixed costs of production

Direct versus indirect/overhead costs

Direct costs

These are costs specifically attributed to the production or sale of a particular good or service

Typically, these are also variable costs.

Indirect (overhead) Costs

These are costs that do not directly relate to the production or sale of a specific product

Typically, these are also fixed costs.

However, unlike fixed costs, overheads are difficult to identify with a particular business activity

Fixed/variable and direct/indirect costs for a coffee house

Cost |

1. Rent for premises |

2. Advertising costs |

3. Wages for baristas |

4. Legal expenses |

5. Utilities |

6. Salaries for administrative staff (e.g. finance manager, marketing manager) |

7. Raw materials (e.g. coffee beans, milk, paper cups) |

8. Insurance |

Fixed or variable | Direct or indirect |

Fixed | Direct |

Fixed | Indirect |

Variable | Direct |

Fixed | Indirect |

Variable | Direct |

Fixed | Indirect |

Variable | Direct |

Fixed | Indirect |

Calculating total revenue

Refers to the money coming into a business. usually from the sale of good and/or services.

This is known as sales revenue.

The formula for sales revenue is:

Sales Revenue = Price x Quantity Sold

Revenue streams

refers to the money coming into a business from its various business activities, such as sponsorship deals, merchandise and receipt of royalty payments.

Examples of Revenue Streams

Advertising

Transaction fees

Franchise costs and royalties

Sponsorships

Subscriptions

Merchandise

Dividends

Donations

Interest earnings

Revenue

is the money that a business earns from the sale of goods and/or services. It is calculated by multiplying the unit price of each product by the quantity sold.

Profit

exists if there is a positive difference between a firm's total revenues and its total costs

Price

refers to the amount of money a product is sold for. It is the sum paid by the customer to purchase a good or service.

Running Costs

the ongoing costs of operating the business

Set-up costs

items of expenditure needed to start a business