Lesson 6.3: Taxes and Spending in Fiscal Policy

1/11

Earn XP

Description and Tags

Flashcards made from a presentation segment created as a lesson on taxes and spending in fiscal policy.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

12 Terms

Fiscal policy

Policies the government adopts to speed up or slow down economic growth for stable aggregate supply and aggregate demand

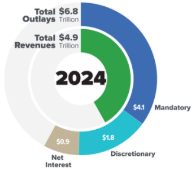

Government revenue

Funds that flow into the government from personal income, social insurance, and corporate profit taxes

Education and defense

The largest purchases of the United States using tax revenue

Medicare and Social Security

The largest transfers of the United States using tax revenue

GDP

The sum total of net exports, consumer spending, government spending, and investment spending

Government spending

Spending performed by the government as it purchases goods and services

Consumer spending

Spending performed by consumers

Can be influenced by the government through effects on disposable income with taxes and government transfers

Expansionary fiscal policy

Fiscal policy that increases aggregate demand, decreasing a recessionary gap to shift aggregate demand rightward for a restoration to LRAS

Seen through:

Increasing government spending

Reducing taxes

Increasing government transfers

These all indirectly boost consumer, investment, and government spending

Contractionary fiscal policy

Fiscal policy that reduces aggregate demand, decreasing an inflationary gap to shift aggregate demand leftward for a restoration to LRAS

Seen through:

Reducing government spending

Increasing taxes

Reducing government transfers

These all indirectly lower consumer, investment, and government spending

Discretionary fiscal policy

Fiscal policy that is the result of deliberate actions by policy makers, which can modify taxes or legislation to shift AD to the left or the right

Often used sparingly due to the problems associated with time lags

Time lag

The time between an incident and the adoption of discretionary fiscal policy, caused by:

Delays in the realization of an output gap

The time used to agree on an expansionary or contractionary plan

The time taken to adjust its spending

This can result in a significant delay, potentially even long enough for a market self-correction

Automatic stabilizers

Government spending and taxation rules that cause fiscal policy to be automatically expansionary or contractionary when the economy contracts or expands

Progressive tax policies are an example of this, where lowered tax rates and aid programs apply to the lower income

These can allow for aggregate demand to shift according to this increased or reduced spending