Business Test #3

1/70

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

71 Terms

Small Business

one that is independent (not part of a larger business) and that has relatively little influence in its market

Small Business Administration (SBA)

government agency charged with assisting small businesses

The importance of small businesses in the US

Job Creation

Innovation

Contributions to big businesses

Entrepreneur

businessperson who accepts both the risks and the opportunities involved in creating and operating a new business venture

Entrepreneurship

the process of seeking business opportunities under conditions of risk

Entrepreneurial Characteristics

Resourcefulness

Concern for goods, personal customer relations

Strong desire to be their own bosses

Deal with uncertainty and risk

Understanding Distinctive Competencies

Established Market

Niche

First-mover advantage

Established Market

one in which many firms compete according to relatively well-defined criteria

Niche

a segment of a market that is not currently being exploited

First-mover advantage

any advantage that comes to a firm because it exploits an opportunity before any other firm does

Business Plan

document in which the entrepreneur describes her or his business strategy for the new venture and demonstrates how it will be implemented

Crafting a Business Plan

setting goals and objectives

sales forecasting

financial planning

Starting the Small Business triangle

Buying an existing business (small)

Franchising (medium)

Starting from Scratch (large)

Starting from Scratch questions

Who and where are my customers?

How much will those customers pay for my products?

How much of my product can I expect to sell?

Who are my competitors?

Why will customers buy my products rather than the product of my competitors?

Financing a Small Business

Personal resources

Loans from family and friends

Bank loans

Venture capital companies

Minority Enterprise Small-Business Investment Companies (MESBICs)

SBA financial programs

Small-Business Investment Companies (SBICs)

Venture Capital Company

group of small investors who invest money in companies with rapid growth potential

Small-Business Investment Company (SBIC)

government-regulated investment company that borrows money from the SBA to invest in or lend to a small business

Franchise

arrangement in which a buyer (franchisee) purchases the right to sell the good or service of the seller (franchiser)

Franchising Advantages

-proven business opportunity

-access to management expertise

Franchising Disadvantages

- Start-up costs

- Ongoing payments

- Management rules and restrictions

Trends in Small Business Start-ups

Emergence of E-commerce, Crossovers from Big Businesses, Opportunities for Minorities and Women, Global Opportunities, and Better survival rates

Emergence of E-commerce

The Internet provides fundamentally new ways of doing business - growing every year

Crossovers from Big Business

More businesses are being started by people who have opted to leave big corporations and put their experience to work for themselves

Opportunities for Minorities and Women

More small businesses are also being started by minorities and women

Some reasons women give in starting businesses

gain control over my schedule

saw a market opportunity and decided to pursue it

frustrated with "glass ceiling" at big companies

Global Opportunity

many entrepreneurs are also finding new opportunities in foreign markets

Better Survival Rates

Today, 44 percent of new start-ups can expect to survive for at least four years

Popular Areas of small-business enterprise

service, retailing, construction, wholesaling, finance and insurance, manufactoring, other

Reasons for failure

managerial incompetence or inexperience, neglect, weak control systems, insufficient capital

Reasons for Success

Hard work, drive, and dedication

Market demand for the products or services being provided

Managerial competence

Luck

Business Forms

sole proprietorship, general partnership, corporation

Noncorporate Business Ownership

sole proprietorship and general partnership

Sole proprietorship

business owned and usually operated by one person who is responsible for all of its debts

General Partnership

business with two or more owners who share in both the operation of the firm and the financial responsibility for its debts

Sole Proprietorship Advantages

Freedom

Simple to form

Low start-up costs

Tax benefits

Sole Proprietorship Disadvantages

Unlimited liability

Limited resources

Limited fundraising capability

Lack of continuity

General Partnership Advantages

More talent and money

More fundraising capability

Relatively easy to form

Limited liability for limited partners

Tax benefits

General Partnership Disadvantages

Unlimited liability for general partners

Disagreements among partners

Lack of continuity

Alternatives to General Partnerships

Limited Partnership & Master Limited Partnership

limited partnership

- Allows for limited partners who invest money but are liable for debts only to the extent of their investments

- General (or active) partners run the business

Master Limited Partnership

- Master partner has majority ownership and runs the business; - minority partners have no management voice

cooperatives (co-ops)

- combine the freedom of sole proprietorship with the financial power of corporations

- groups of sole proprietorships or partnerships agree to work together for their common benefit

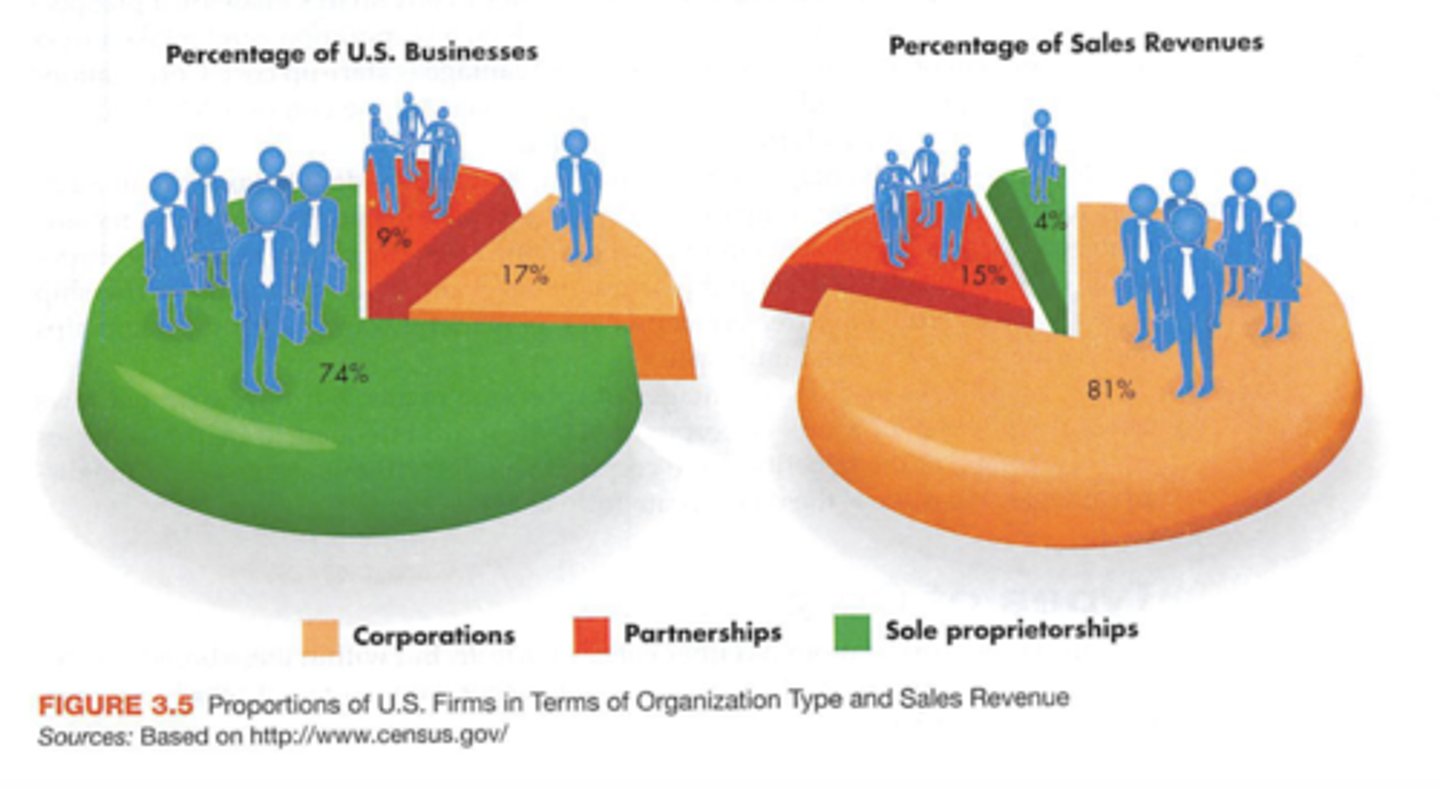

Proportions of US firms in terms of organization type/sale revenue

Percentage of US businesses - (SP,C,P)

Percentage of Sale revenue - (C,P,SP)

Corporation

- business that is legally considered an entity separate from its owners and is liable for its own debts

- owners' liability extends to the limits of their investments (shareholders)

Corporation Advantages

limited liability

continuity

stronger fundraising capability

Corporation Disadvantages

Can be taken over against the will of its management via tender offer

Double taxation of profits

Complicated and expensive to form

Tender Offer

offer to buy shares made by a prospective buyer directly to a target corporation's shareholders, who then make individual decisions about whether to sell

Double Taxation

taxes may be payable BOTH by a corporation on its profits and by shareholders on dividend income

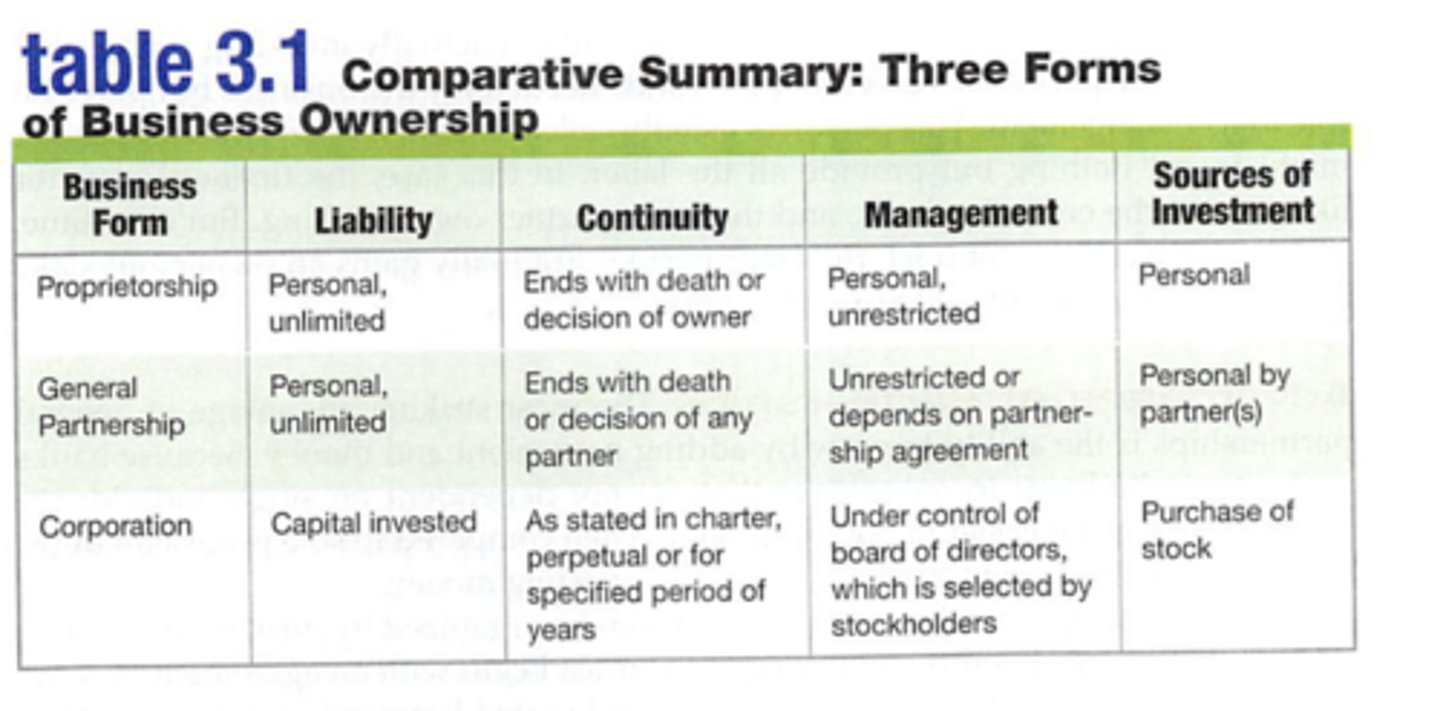

Comparative Summary : Three Forms of Business

Types of Corporations

Closely Held (or Private) Corporation

Publicly Held (or Public) Corporation

S Corporation

Limited Liability Corporation (LLC)

Professional Corporation

Multinational (or Transnational) Corporation

Closely Held (or Private) Corporations

corporation whose stock is held by only a few people and is not available for sale to the general public

Publicly Held (or Public) Corporation

corporation whose stock is widely held and available for sale to the general public

S Corporation

hybrid of a closely held corporation and a partnership, organized and operated like a corporation but treated as a partnership for tax purposes

Limited Liability Company (LLC)

hybrid of a publicly held corporation and a partnership in which owners are taxed as partners but enjoy the benefits of limited liability

Professional Corporation

form of ownership allowing professionals to take advantage of corporate benefits while granting them limited business liability and unlimited professional liability

Multinational (or Transnational) Corporation

form of corporation spanning national boundaries

Managing a Corporation

Corporate Governance

Corporate Governance

roles of shareholders, directors, and other managers in corporate decision making and accountability

Corporate Governance roles

Stockholders (Shareholders), Board of Directors, Officers

stockholders/shareholders

owners of shares of stock in a corporation

Board of Directors (BOD)

governing body of a corporation that reports to its shareholders and delegates power to run its day-to-day operations while remaining responsible for sustaining its assets

Officers

top management team of a corporation

Relationship between Corporate Governance roles

Shareholders elect the BOD and BOD talk with officers about ideas/opinions

Special Issues in Corporate Ownership

- Joint Ventures and Strategic Alliances

- Employee Stock Ownership Plans

- Institutional Ownership

- Mergers

- Acquisitions

- Divestitures

- Spin-offs

joint venture

strategic alliance in which the collaboration involves joint ownership of the new venture

Employee Stock Ownership Plan (ESOP)

arrangement in which a corporation holds its own stock

institutional investors

large investor, such as a mutual fund or a pension fund, that purchases large blocks of corporate stock

Merger

the union of two corporations to form a new corporation

Acquisition

the purchase of a company by another company

Divestiture

strategy whereby a firm sells one or more of its business units

Spin-offs

strategy of setting up one or more corporate units as new, independent corporations