Microeconomics- Cost revenue & profit maximization

1/17

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

18 Terms

Different cost variables

Fixed costs:

Costs that must be paid even when the firm produces nothing. Typical examples include cost of capital equipment or long-term leases, which cannot easily be reduced in the short run

Variable costs:

Costs that change with the level of output(x). Examples include wages of production worker, raw materials and energy used in the production process, and the wear and tear on machinery from actual use.

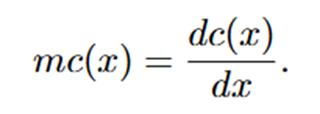

Marginal cost formula

The change in total cost, when we produce one more unit ot output.

Geometrically: marginal cost corresponds to the slope of the total cost curve at a given level of output

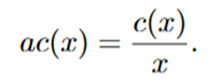

Average cost explantion and formula

AC is the total cost per unit of output. Geometrically, it is a slope from the origin to a point on the cost curve

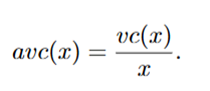

Average variable cost (AVC)

Variable cost per unit of output

Geometrically is it the slop of a line drawn from the fixed cost intercept of the total cost curve to the point on the curve corresponding to output

Inverse demand function

Function p(x)

The function p(x) is called the inverse demand function. It tells us “If the firm wants to sell x unit, what price must it charge?”. In other word, the price depends on the quantity, because demand is downward sloping.

Why is the inverse demand function important

· A monopolist can’t just decide both the price and the quantity independently. If it sets a high price, it will sell fewer units. If it wants to sell more unit, it must lower price

· A monopolist = a single firm that is the only seller of a product in the marked.

Average revenue formula and explantion

AR is the total revenue per unit of output.

Formula: ar (x) = r(x) / x

R(x) = total revenue = p(x) * x’

Divided by x → gives revenue per unit

So:

ar (x) = p(x) * x / x = p(x)

This means average revenue = price. This is always true; the money the firm gets per unit is just the price it charges. This rule is not only for monopolists, it is true for any marked structure

Marginal revenue

Extra revenue a firm earns from selling one more unit of output.

Profitt maximization

Profit is the difference between a firm’s revenue from sales of its output, r(x) and the cost of producing output c(x)

Formula: π(x)=r(x)−c(x) =p(x)x - c(x)

Meaning: the firms earn money from selling unit: p(x) * x but is also spends money to produce them c(x). Profit is simply the difference between these two’

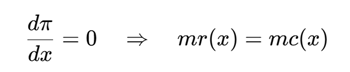

Profitt-maximizing condition

1) Set the derivate equal to 0

Marginal Revenue (MR) = dp/dx * x +p

Marginal Cost (MC) = c’(x)

RULE

The firm maximizes profit by choosing the output level where MR = MC

Intutiton behind: MR>MC, MR<MC and MR=MC

If MR > MC → selling one more unit adds more to revenue than it costs → increase output. This is not the stopping point, they should continue, eventually producing more causes MC to rise - diminshin returns, and MR fall-

If MR < MC → selling one more unit cost more than it earns → reduce output.

At MR = MC → the firm is at the sweet spot: maximum profit. Stop point, maximum profitt

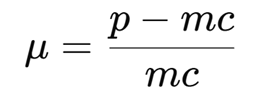

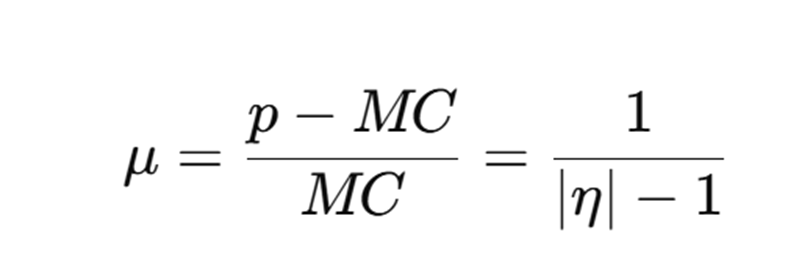

Markup

The percentage by which the price a firm charge is above its marginal cost.

Formula for mark-up ratio:

o If p = mc you get μ=0, then markup = perfect competition (no single firm has market power)

o If p > mc, then markup > 0 → firm has market power

In words: markup measures how much a firm can “markup “its price over the actual cost of producing one more unit.

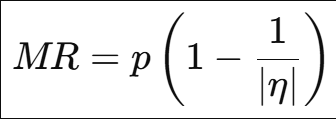

Why do we have “marginal revenue with elasticity”?

We use the MR–elasticity formula because it shows how a monopolist’s ability to raise price depends on the elasticity of demand, and it determines where the monopolist will operate.”

How does elasticity determine a monopolist markup and maket power

A monopolist sets MR = MC, and this leads to a markup that ONLY depens on elasiticty.

From the formula, we understand elasticity controls the markup and determines market power

Controls the markup

If demand is elastic ( large) → markup is small

→ firm cannot raise price much, they have weak market power, because consumers react a lot when price changes. Example: travel, resturant, luxury itemsIf demand is inelastic (∣η∣ close to 1) → markup is huge

→ firm can raise price a lot. Strong market power,charge far above marginal cost. Example: insulin,cigrattes, nessesities

Determines market power

Market power = ability to set price > MC.

If inelastic demand → strong market power (big markup).

If elastic demand → weak market power (small markup).

If p = MC → no market power (perfect competition).

η = tells us how much quantity changes when price changes. It is downward sloping, therefor negativ, meaning when price goes up, quantity goes down. We use ∣η∣, to talk about elasiticity as a positive number, even though mathmatically it is negative

Can a monopolist produce where demand is inelastic, basically will a monopolist ever choose |η| < 1

Why a monopolist never chooses |η| < 1 (inelastic demand)

If ∣η∣<1, demand is inelastic → consumers barely react to price changes.

When the monopolist lowers the price to sell more units, total revenue falls because:

You gain a little from extra units sold

But you lose a lot because the lower price applies to all units

This makes MR < 0.

A monopolist maximizes profit by setting MR = MC, and since MC ≥ 0, MR cannot be negative.

So the monopolist will never choose a quantity where ∣η∣< 1. Instead, it improves profit by raises price and reduces output until it is on the elastic part of demand.

Rule:

Less elastic (|η| slightly above 1) → allowed

MR > 0

Monopolist can charge a high markup

Inelastic (|η| < 1) → impossible

MR < 0

Cannot satisfy MR = MC

Monopolist wants consumers to be and otuput to be

A monopolist wants consumers to be inelastic (for high markup- bascially so that they can raise price above cost) but must choose an elastic output level (because MR must be positive). Meaning monopolist would love to be in the inelasticregion, but monopolist cannot produce there become MR is negativ

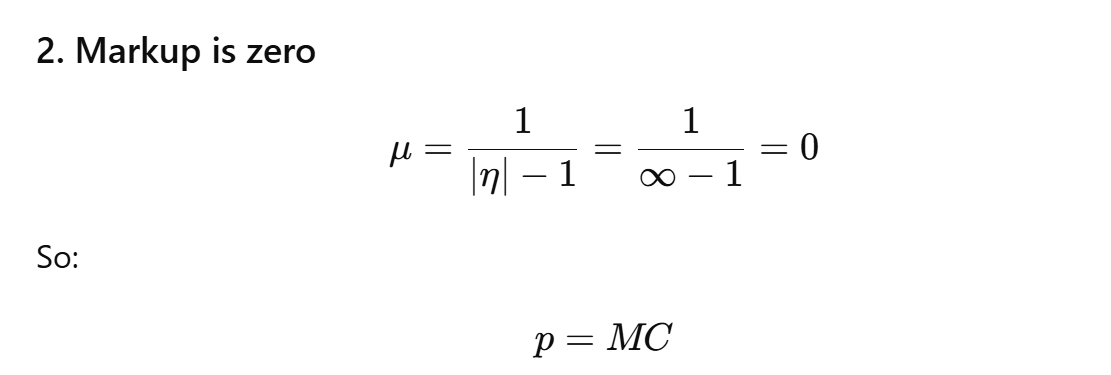

What happens when ∣η∣=∞

This is perfect competition

Firms have no market power.

They cannot charge above marginal cost.

They simply sell as much as they want at the market price.

|η| = ∞ means perfectly elastic demand, zero markup, price equals marginal cost, and the firm behaves as a price taker in perfect competition.

Difference between revenue formula and profitt formula

Revenue is price × quantity, while profit is revenue − total cost.