Chapter 11: IFRS 16 Leases

1/6

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

7 Terms

Why might an entity enter into a lease agreement instead of purchasing an asset outright?

What is the definition of a lease under IFRS 16?

Who is the lessor in a lease agreement?

Who is the lessee in a lease agreement?

What is a right-of-use asset?

What two items must a lessee recognise at the commencement of a lease under IFRS 16?

How is the lease liability initially measured?

What should be included in the lease payments used to calculate the lease liability?

What discount rate is used to calculate the present value of lease payments?

How is the right-of-use asset initially measured?

What is included in the initial cost of a right-of-use asset?

What is the definition of the lease term under IFRS 16?

🔹 Basic Idea of IFRS 16

Under IFRS 16, when a lease starts, the lessee has to put two things on their balance sheet:

Lease liability – what they owe in future lease payments

Right-of-use (ROU) asset – the value of the asset they get to use

✅ Think of it like taking out a loan to use an asset:

You owe payments (the liability), and in return, you get the asset to use (the ROU asset).

🔹 Step 1: Measuring the Lease Liability

This is how much you owe for future lease payments — but you don’t just add up the payments. You calculate their present value (PV), which adjusts future payments to today’s value using a discount rate.

💡 Lease Payments Include:

✅ Fixed payments (like a regular monthly rent)

✅ Variable payments based on an index (e.g., inflation-linked increases)

✅ Payments to guarantee a certain value at the end (e.g., if you promise the asset will be worth £5,000 when returned)

✅ Purchase option (if you're likely to buy the asset at the end)

✅ Penalties for cancelling the lease early

🧠 Which Discount Rate to Use?

Ideally: Use the implicit rate in the lease (often not given)

If not known: Use your incremental borrowing rate (the rate you’d pay to borrow the money needed to buy a similar asset)

🔹 Step 2: Measuring the Right-of-Use Asset

This is what you record as the value of the asset you get to use.

ROU Asset Includes:

The initial lease liability amount

Any lease payments you made before the lease started

Direct costs to set up the lease (e.g., legal fees)

Expected costs to remove, restore, or dismantle the asset later (e.g., returning a property to its original state)

🔹 The Lease Term – What Counts?

You need to know how long the lease is to calculate values. The lease term includes:

✅ The non-cancellable period (the time you have to lease it)

✅ Any optional extension periods – if you're likely to use them

✅ Any early termination options – if you're unlikely to cancel

💡 Example:

If you lease a machine for 3 years, and you have an option to extend for 2 more years (which you’re very likely to use), the lease term is 5 years.

Under IFRS 16, what must a lessee recognise at lease commencement?

How is the lease liability calculated when the implicit rate is unknown?

What components are included in the right-of-use asset at initial recognition?

What is the journal entry for initial lease recognition on 1 December 20X5 in this example?

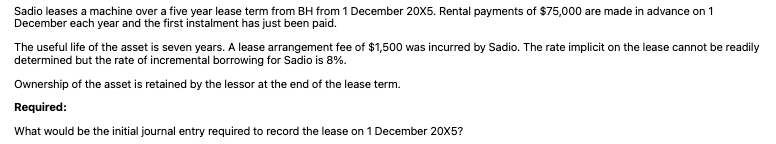

✅ Initial Lease Recognition – Step-by-Step (IFRS 16)

Scenario Recap:

Lease term = 5 years

Annual payment = $75,000 (in advance)

1st payment already made

Incremental borrowing rate = 8%

Lease fee (direct cost) = $1,500

Present Value (Lease Liability) – Summary Workings

Scenario:

Lease payments: $75,000 per year

Term: 4 years (1st payment already made, so 4 payments remain)

Discount rate: 8%

Payments made in arrears (end of each year)

Step 1: Use the present value of annuity formula

PV = Payment × [(1 − (1 + r)^−n) / r]

Step 2: Plug in values

= 75,000 × [(1 − (1.08)^−4) / 0.08]

= 75,000 × [0.265 / 0.08]

= 75,000 × 3.312

Step 3: Calculate

Lease liability = $248,400

This is the present value of the future lease payments and represents the initial lease liability under IFRS 16.

![<p><span data-name="check_mark_button" data-type="emoji">✅</span> <strong>Initial Lease Recognition – Step-by-Step (IFRS 16)</strong> </p><p><strong>Scenario Recap:</strong></p><p> </p><ul><li><p>Lease term = 5 years</p></li><li><p>Annual payment = $75,000 (in advance)</p></li><li><p>1st payment already made</p></li><li><p>Incremental borrowing rate = 8%</p></li><li><p>Lease fee (direct cost) = $1,500</p></li></ul><p> <strong>Present Value (Lease Liability) – Summary Workings</strong></p><p>Scenario:</p><ul><li><p>Lease payments: $75,000 per year</p></li><li><p>Term: 4 years (1st payment already made, so 4 payments remain)</p></li><li><p>Discount rate: 8%</p></li><li><p>Payments made in arrears (end of each year)</p></li></ul><p>Step 1: Use the present value of annuity formula<br>PV = Payment × [(1 − (1 + r)^−n) / r]</p><p>Step 2: Plug in values<br>= 75,000 × [(1 − (1.08)^−4) / 0.08]<br>= 75,000 × [0.265 / 0.08]<br>= 75,000 × 3.312</p><p>Step 3: Calculate<br>Lease liability = $248,400</p><p>This is the present value of the future lease payments and represents the initial lease liability under IFRS 16.</p>](https://knowt-user-attachments.s3.amazonaws.com/5dc5529a-b44c-4ddb-91ed-7a36282303c0.png)

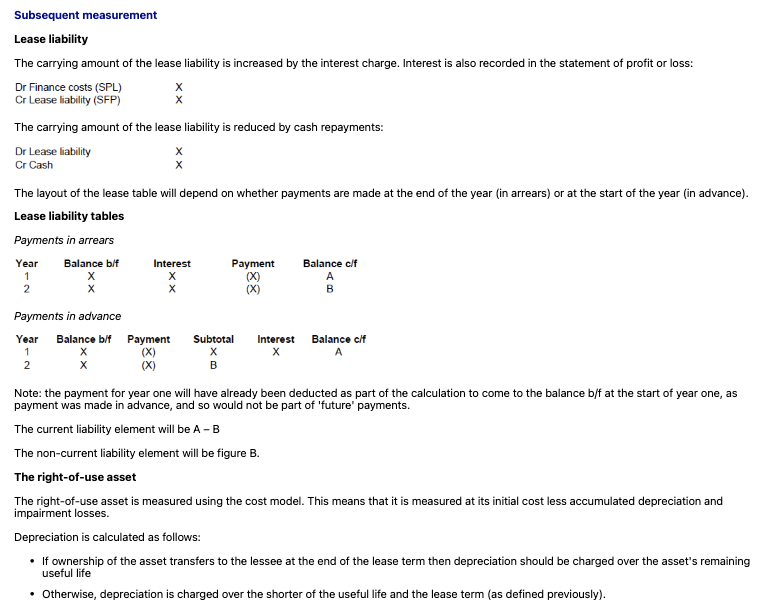

How is the lease liability measured after initial recognition under IFRS 16?

What is the key difference in lease liability tables for payments in arrears vs. in advance?

How are lease liabilities split between current and non-current portions?

How is the right-of-use asset measured and depreciated after initial recognition?

When can a right-of-use asset be measured using models other than the cost model under IFRS 16?

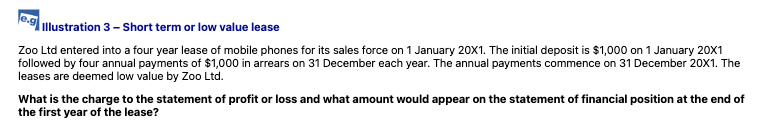

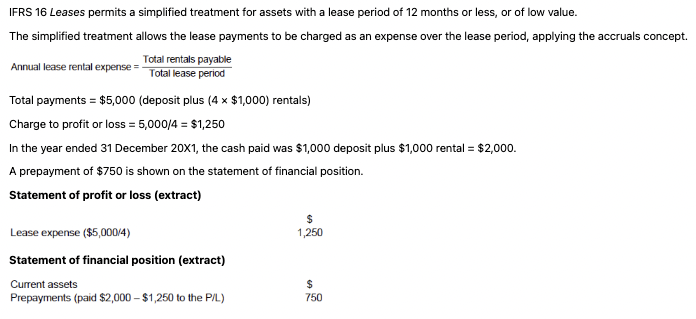

What is the simplified accounting treatment for short-term leases or low-value assets under IFRS 16?

What qualifies as a short-term lease under IFRS 16?

What are examples of low-value assets under IFRS 16?

When assessing if an asset qualifies as low value under IFRS 16, what value is used?