Flashcards for inflation from the slides and the readings

What is inflation? (S)

Inflation can be described as the rise in overall prices and the cost of living and a decline in the purchasing power of money.

How does the GDP deflator measure the overall price level? (S)

It measures the prices of all final goods and services produced withing a country by comparing nominal GDP to real GDP. It includes exports but does not include imports. It can be found by dividing nominal GDP by real GDP and multiplying the value by 100.

How does the CPI measure the overall price slevel? (S)

The CPI measures the cost of purchasing a fixed basked of goods and services relative to its cost in the base year including imports (that are consumed by the residents of a country) but not exports (not consumed by the residents of a country). It is found by dividing the former by the later and multiplying the result by 100.

What is the CPI? (S and Textbook)

An index that tracks the average price consumers pay over time for a representative “basket” of goods and services. It measures the cost of this basket of goods and services relative to its price in the base year.

What is the formula to find the CPI? (S)

(Second Year Prices x First Year Quantity/First Year Pirices x First Year Quantity)x100

Between prices and quantities, what is held fixed in the real GDP calculation and the CPI calculation? (S)

real GDP: prices held fixed over different years

CPI: quantities held fixed over different years

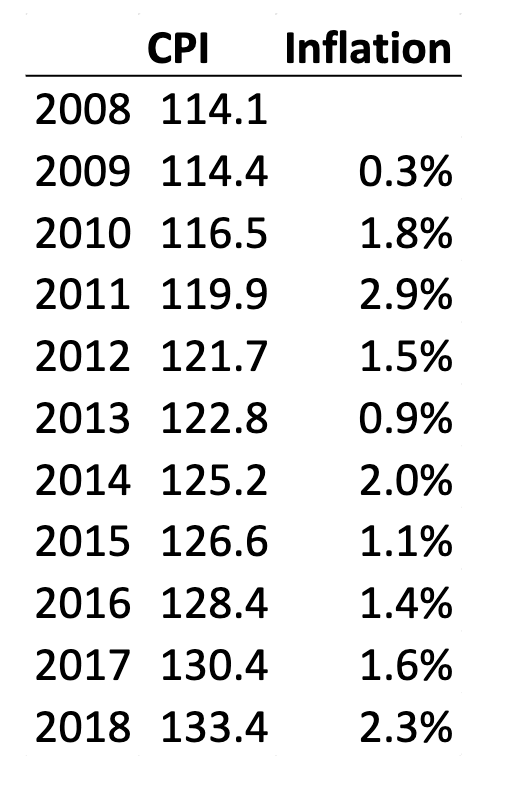

What is the inflation rate? (S)

Inflation rate is the percentage change in the CPI from the preceding year to the current year.

What is the the formula for inflation rate? (S)

((CPICurrent - CPILast Year)/CPILast Year) x 100

How do we use the CPI to find inflation? (S)

Inflation (π) = CPIfinal year-CPIbase year/CPIbase year

What do we mean by adjusting for inflation? (S)

Adjusting for implies removing the effects of price changes by using the formula:

Real Amount = Nominal Amount/ Price Level

Deflating nominal values - How much is $1000 from the base year worth in 2018? (S)

Value in 2018 = Base Amount x Base CPI/ Final CPI

= 1000 × 100/133.4

= $749.6

Converting Dollars across time - Convert $1000 from the base year into 2018 dollar equivalent. (S)

= Base Amount x Final CPI/ Base CPi

If the inflation rate in 2018 is 2.3% and you wage is $1000, what should your wage increase to, to compensate for inflation? (S)

Your wage should increase to:

= (1+inflation rate) x Amount

= (1 + 0.023) x 1000

= $1023

What is the nominal interet rate? (S)

It is the rate of interest on financial assets in nominal terms.

What is the real interest rate?

The real interest rate is the change in purchasing power of a financial asset.

What is the formula for real interest rate?

1 + r = (1+i)/(1+π)

where:

r = real interest rate

i = nominal interest rate

π = inflation rate

What is the money illusion? (S)

The money illusion is the tendency to focus on nominal dollar amounts of inflation adjusted amounts.

True or False: Does inflation in itself reduce the people’s real purchasing power.

False

What are the costs of expected inflation? (S)

Distortions in the tax and benefit system if it is not indexed

Price adjustments by firms

Tax on holders of money

Confusion and inconvenience

What are menu costs? (S)

Menu costs are the increase in prices by firms as a response to inflation.

What are shoe-leather costs? (S)

Shoe-leather costs are the tax on holder of money as a result of money.

What are the costs of unexpected inflation? (S)

Loss in real wages: as wages are adjusted to increase with expected inflation, unexpected inflation greater than expected inflation would result in a fall in their real wages.

When inflation is higher than expected, it is good for borrowers, while lenders, who set loan terms nominally, suffer, leading to redistribution between borrowers and lenders.

What is deflation? (S)

Deflation is the generalised decrease in the overall level of prices.

What are the downsides of deflation? (S)

Households postpone consumption knowing prices will fall later leading to further reduction in production and employment

Wage rigidity as people resist the idea of wage cuts

Less willingness to invest

Redistribution from borrowers to lenders

What is disinflation? (S)

Disinflation is the decrease in the rate of inflation.

What is hyper inflation? (S)

Hyper inflation is when the monthly inflation is more than 50%.