ACYAFAR6: Forex and Derivatives

1/19

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

20 Terms

Under PAS 21, which of the following statements pertains to functional currency?

a. It refers to the currency of the primary economic environment in which the entity operates

b. It refers to the currency in which the financial statements are presented

c. It refers to the currency other than the functional currency of the entity

d. It refers to the type of currency in a given jurisdiction which a creditor may be compelled to accept

A

When a foreign currency transaction occurred in one period and settled in another period,

a. The exchange differences between the transaction date and the date of settlement is recognized in the period of settlement

b. Exchange differences between the transaction date and the end of reporting period is recognized in the period of transaction

c. Exchange differences between the end of the previous reporting period and the date of settlement is recognized in the period of settlement

d. B and C

D

When translating the financial statements of a foreign operation, which of the following translation procedures is inappropriate

a. Assets, liabilities, and equity, including any goodwill and FVAs, are translated at the closing rate

b. Income and expenses are translated at the spot exchange rates. For practical reasons, income and expenses may be translated at the average rate

c. All resulting exchange differences shall be recognized in profit or loss

d. All resulting exchange differences shall be recognized in other comprehensive income

C & A

Which of the following contracts is not considered a derivative instrument?

a. Futures contract

b. Option contract

c. Forward contract

d. Lease contract

D

A critical characteristic of a derivative is that the instrument

a. Derives its value from a related asset or liability

b. Derives its value from changes in value of a related asset or liability

c. Requires that the related asset or liability be sold or bought at settlement

d. Requires the holder of the derivative instrument to make a significant investment

B

In case of hedging transaction designated as fair value hedge, which of the following statements is correct?

a. The gain or loss from remeasuring the hedging instrument/derivative designated as fair value hedge shall be recognized in profit or loss

b. The gain or loss on the changes in fair value of hedged item attributable to the hedged risk shall adjust the carrying amount of the hedged item and be recognized in profit or loss

c. Both A and B

d. Neither A nor B

C

Gain or loss arising from changes in fair value of derivatives designated as cash flow hedge pertaining to the effective portion shall be recognized in

a. Other comprehensive income with reclassification adjustment

b. Other comprehensive income without reclassification adjustment

c. Retained earnings

d. Profit or loss

A

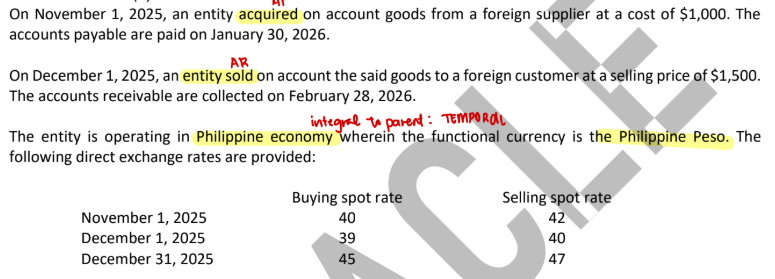

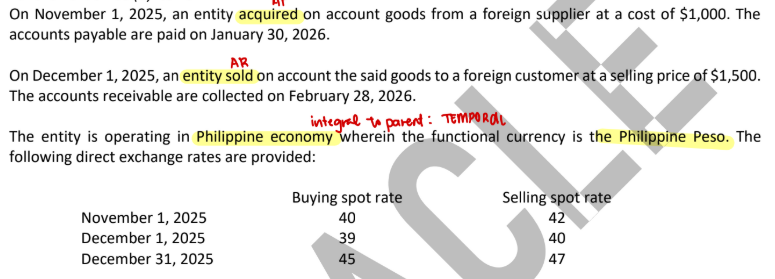

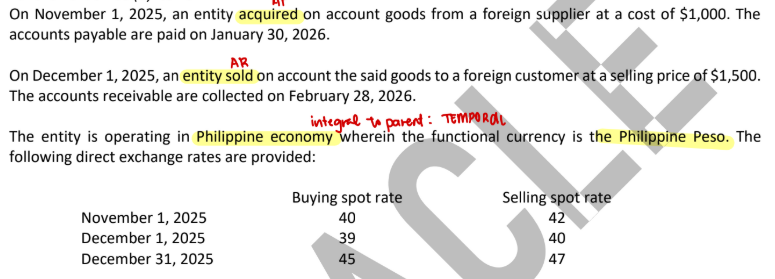

What is the sales revenue for 2025?

a. 58,500

b. 60,000

c. 67,500

d. 72,000

A

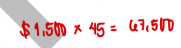

What is the carrying amount of accounts receivable on December 31, 2025?

a. 58,500

b. 60,000

c. 67,500

d. 72,000

C

What is the carrying amount of accounts payable on December 31, 2025?

a. 40,000

b. 42,000

c. 45,000

d. 47,000

D

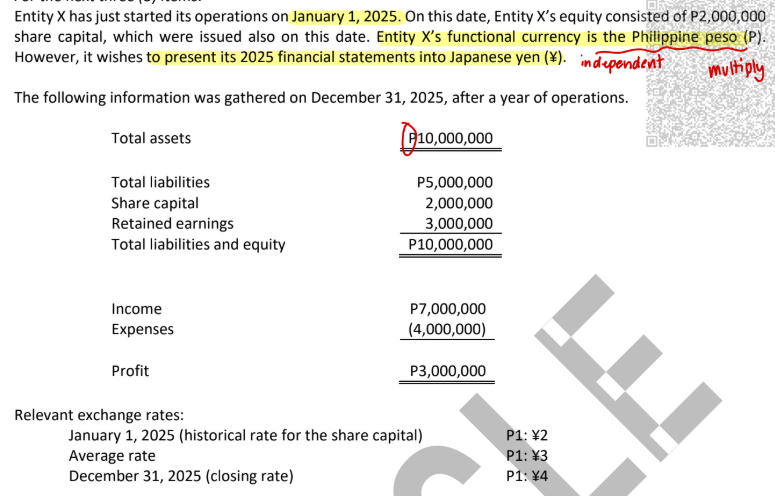

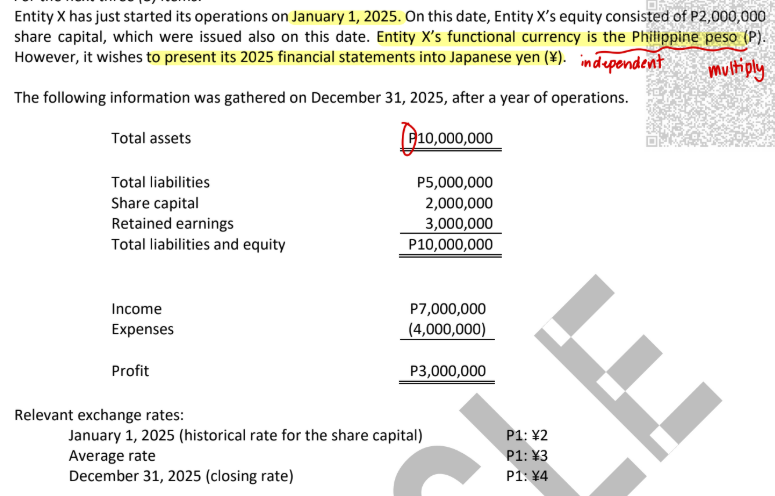

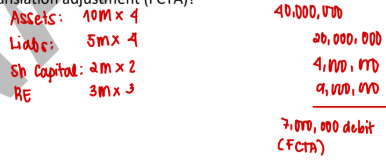

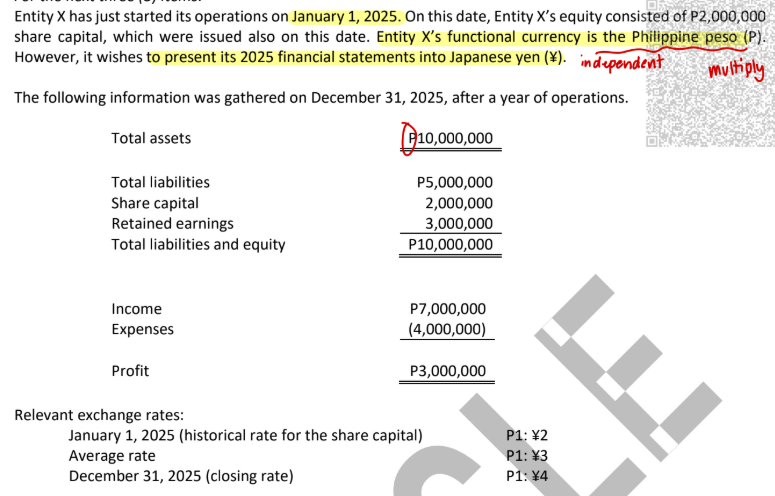

How much is the translated total assets?

a. ¥40,000,000

b. ¥36,000,000

c. ¥20,000,000

d. ¥18,000,000

A

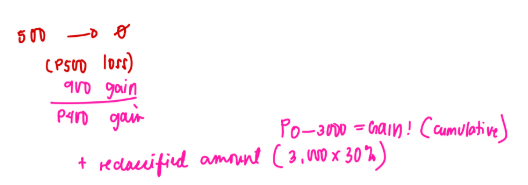

How much is the cumulative foreign currency translation adjustment (FCTA)?

a. ¥10,000,000 debit

b. ¥10,000,000 credit

c. ¥7,000,000 debit

d. ¥7,000,000 credit

C

How much is the translated profit or loss?

a. ¥9,000,000

b. ¥7,000,000

c. ¥6,000,000

d. ¥12,000,000

A

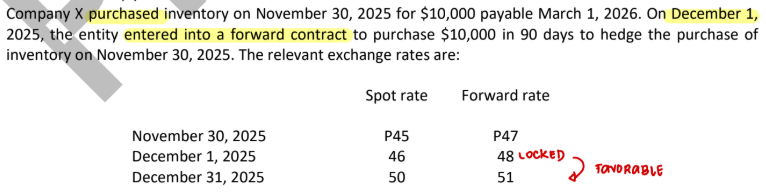

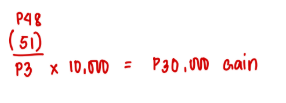

What amount of foreign currency transaction gain from the forward contract should be included in net income for 2025?

a. 50,000

b. 40,000

c. 30,000

d. 0

C

What amount of foreign currency transaction loss should be included in income from the revaluation of accounts payable for 2025?

a. 40,000

b. 50,000

c. 10,000

d. 0

B

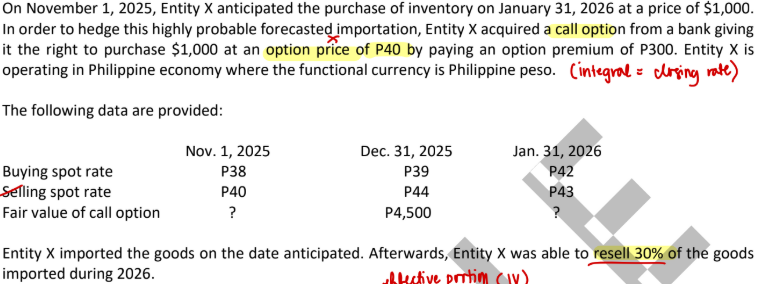

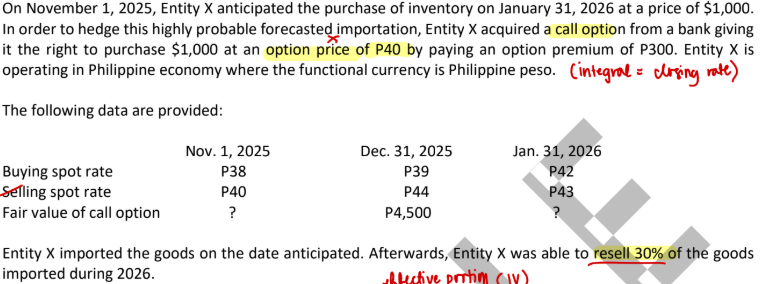

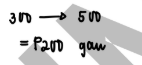

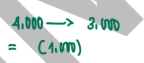

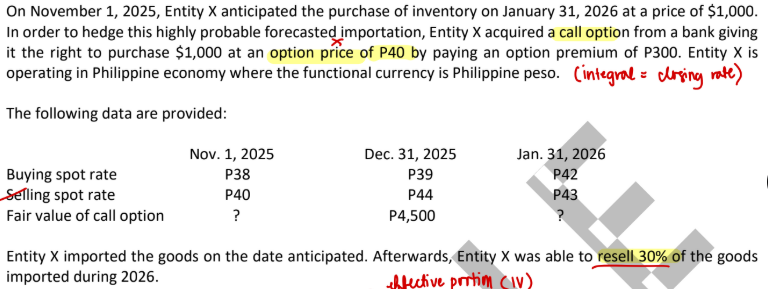

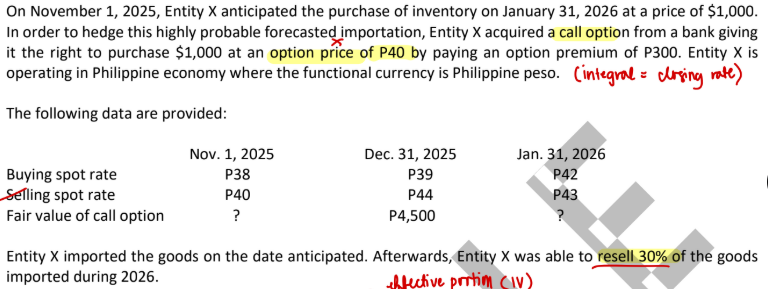

What is the gain or loss to be recognized as OCI in the Statement of Comprehensive Income for the year ended December 31, 2025?

a. P4,000

b. P4,500

c. P4,300

d. P4,200

A

What is the gain or loss to be recognized in the Profit or Loss for the year ended December 31, 2025?

a. P300

b. P200

c. P500

d. P100

B

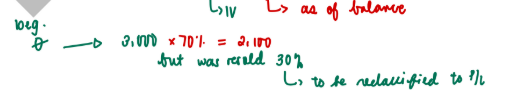

What is the gain or loss to be recognized as OCI in the Statement of Comprehensive Income for the year ended December 31, 2026?

a. (P3,000)

b. (P2,000)

c. (P1,000)

d. (P4,000)

C

What is the cumulative credit (or debit) in the OCI of Statement of Financial Position as of December 31, 2026?

a. P4,000

b. P3,000

c. P1,000

d. P2,100

D

What is the net effect on Profit or Loss to be recognized by the entity for the year ended December 31, 2026?

a. (P500)

b. P900

c. P300

d. P400

D