Chapter 19: Professional Conduct, Independence, and Quality Control

1/24

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

25 Terms

what is ethics

Refers to a system or code of conduct

based on moral duties and obligations

that indicate how an individual should

interact with others in society

what is professionalism

Refers to the conduct, aims, or qualities

that characterize a profession or

professional person

what are the 3 levels

ethical

unethical but not illegal

unethical and illegal

Which of the following statements best explains why public

accounting, as a profession, promulgates ethical standards and establishes means for ensuring their observance?

A. Vigorous enforcement of an established code of ethics is the best way to prevent unscrupulous acts.

B. Ethical standards that emphasize excellence in performance over material rewards establish individual reputations for competence and character.

C.Ethical standards are established so that users of accounting services know what to expect and accounting professionals know what behaviors are acceptable, and so that discipline can be applied when necessary.

D.A requirement for a profession is to establish ethical standards that primarily stress responsibility to entities and colleagues.

C

Integrity and Objectivity Rule

In the performance of any professional service, a member shall

maintain objectivity and integrity, shall be free of conflicts of interest,

and shall not knowingly misrepresent facts or subordinate his or her

judgment to others.

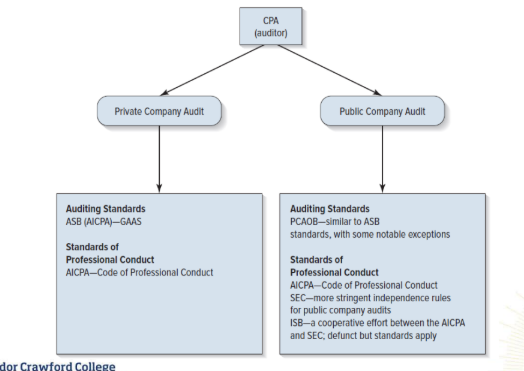

Independence Rule

A member in public practice shall be independent in the

performance of professional services as required by standards

promulgated by bodies designated by Council.

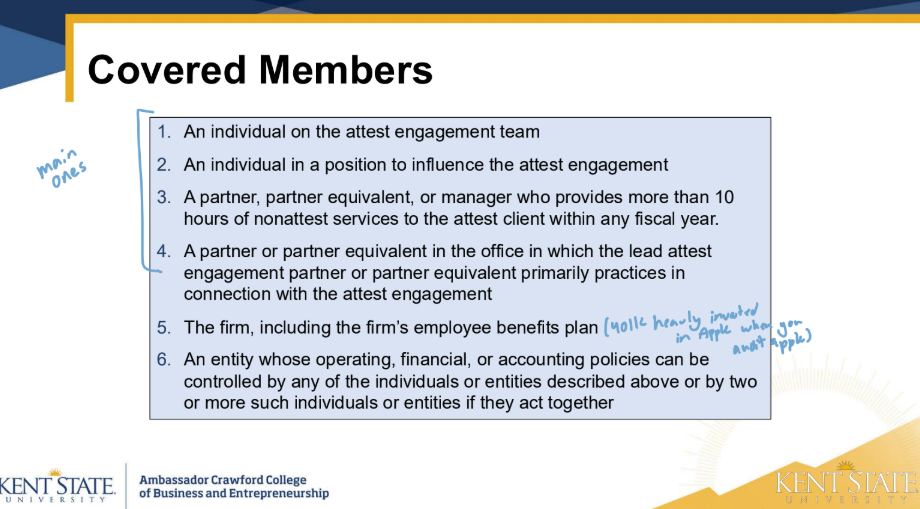

who needs to be independent

covered members

what is a direct financial relationship

financial interest

what is material indirect financial relationship

financial interest in an entity that is

associated with an attest

delete

delete

Could unpaid fees be considered an outstanding debt by the

entity to the auditor – a direct financial interest on the part of the

auditor?

yes if over 12 months (can cause a independance problem)

The Independence Rule and related guidelines say that a CPA is not considered independent if they take on a management or key role in an organization during the time covered by an audit or similar engagement.

are a auditor’s imimidate family affected by the independence rule

yes

Two major situations with close relatives that can impair

independence:

financial interest in the enitity that is material and the CPA are aware of the interest

close relative have significant influence over financial and accounting policies

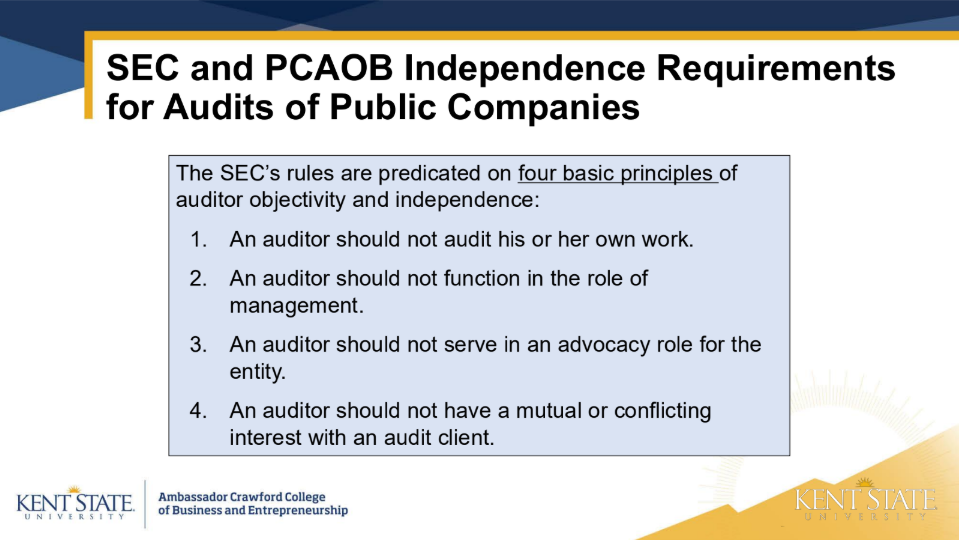

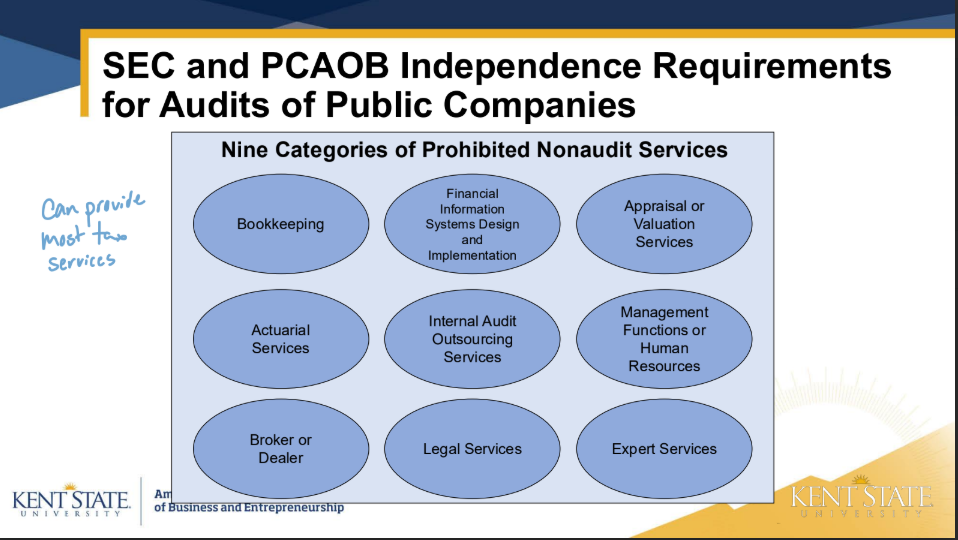

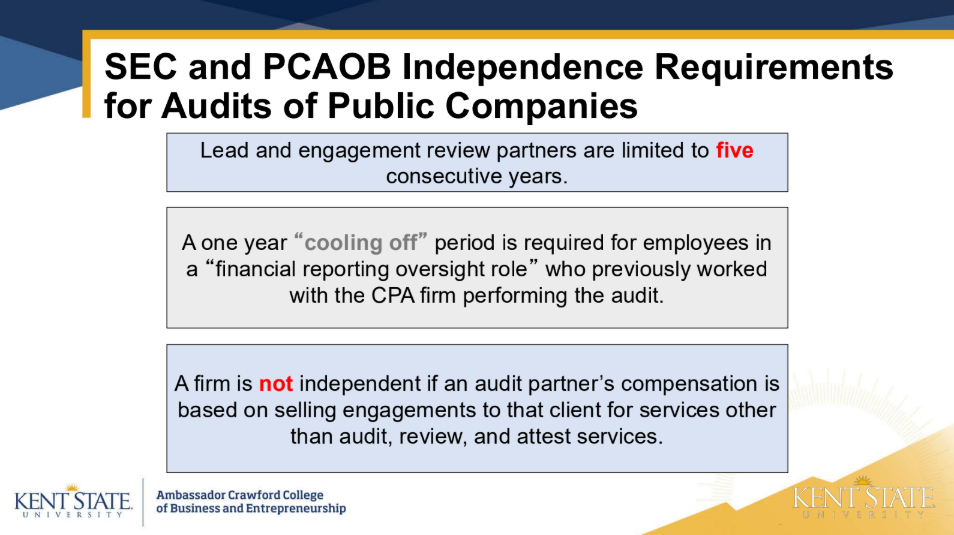

The AICPA Code of Professional Conduct

restricts the types of _____ _____ that can

be provided to attest entities.

The SEC has even _____ ______

independence rules for audits of public

companies.

nonaudit services

more restrictive

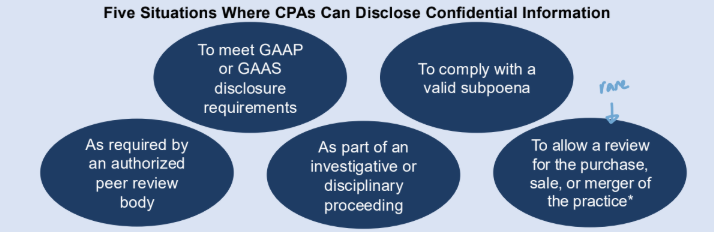

Confidential Client Information Rule

A member in public practice shall not disclose any confidential information

without the specific consent of the client.

Without the consent of the entity, a CPA should not disclose

confidential entity information contained in working papers to

a(n):

A. Authorized quality control review board

B. Successor CPA firm that has been engaged to audit the former audit

entity

C. Federal court that has issued a valid subpoena

D. Disciplinary body created under state statute

B

can auditors collect contingent fees?

NO

Acts Discreditable Rule

A member shall not commit an act discreditable to the

profession.