ACYMANS9: Cost of Capital

1/8

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

9 Terms

Cost of capital is

a. The amount the company must pay for its plant assets

b. The dividends a company must pay on its equity securities

c. The cost the company must incur to obtain its capital resources

d. The cost the company is charged by investment bankers who handle the issuance of equity or long-term debt securities

C

In computing the cost of capital, the cost of debt capital is determined by

a. Annual interest payment divided by the proceeds from debt issuance.

b. Interest rate times (1 – the firm’s tax rate)

c. Annual interest payment divided by the book value of the debt.

d. The capital asset pricing model.

B

The basis for measuring the cost of capital derived from bonds and preferred stock, respectively, is the

a. After-tax rate of interest for bonds and stated annual dividend rate for preferred stock

b. Pretax rate of interest for bonds and stated annual dividend rate less the expected earnings per share for preferred stock

c. Pretax rate of interest for bonds and stated annual dividend rate for preferred stock

d. After-tax rate of interest for bonds and stated annual dividend rate less the expected earnings per share for preferred stock

A

When calculating the cost of capital, the cost assigned to retained earnings should be

a. Zero

b. Lower than the cost of external common equity

c. Equal to the cost of external common equity

d. Higher than the cost of external common equity

B

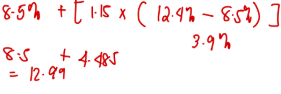

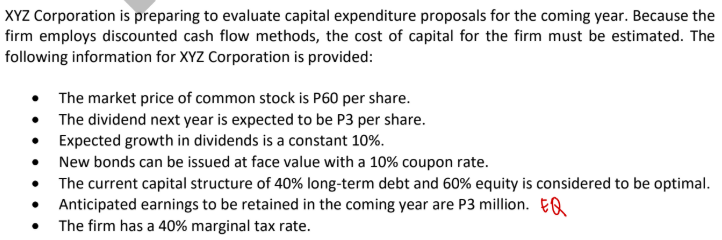

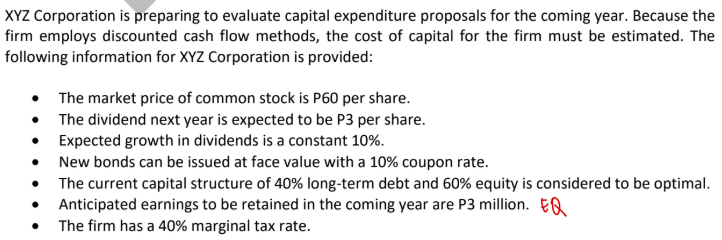

Mr. Accounting, Inc. is planning to use retained earnings to finance anticipated capital expenditures.

The beta coefficient is 1.15, the risk-free rate of interest is 8.5%, and the market return is estimated at 12.4%. By using the Capital Asset Pricing Model (CAPM) model, the cost of equity to finance the capital expenditures is

a. 12.40%

b. 12.99%

c. 13.21%

d. 14.26%

B

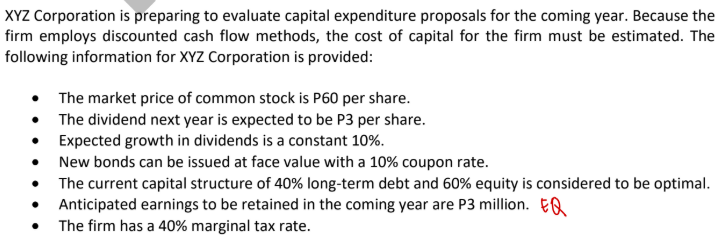

The after-tax cost of the new bond issue is

a. 4%

b. 6%

c. 10%

d. 14%

B

The cost of using retained earnings for financing is

a. 5%

b. 9%

c. 10%

d. 15%

D

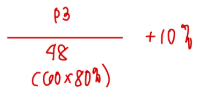

If the company must assume a 20% flotation cost on new stock issuances, what is the cost of new common stock?

a. 6.25%

b. 10%

c. 15%

d. 16.25%

D

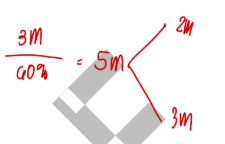

The maximum capital expansion that can be supported in the coming year without resorting to external equity financing is

a. P2 million

b. P3 million

c. P5 million

d. Cannot determine from the information given

C