IB SL Economics - MACROeconomics

1/152

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

153 Terms

Five macroeconomic goals

- unemployment

- inflation / price stability

- GDP / GNP / income distribution

- economic growth

- balance of trade

Acronym: TIGERS

Trade (balanced trade)

Inflation (low and stable)

Growth (strong and sustained)

Employment (low unemployment)

Redistribution of income

Stability

Households

those who buy the nation's outputs of goods and services

Owners

those who own all of the economy's factors of production

Injections

money going into the economy

Leakages

money flowing out of the economy

What are the three main ways of measuring economic growth?

- Output method => real GDP ( added value of all goods and services in economy)

- income method

- Expenditure method (C + I + G + (X-M))

All measurements are technically equal in terms of the final figure calculated.

Boom

when there is economic growth

Recession

when there is negative economic growth for two consecutive quarters

Aggregate Demand

the total spending on goods and services in a period of time at a given price level

Consumption (C)

total spending by consumers on domestic goods and service

Durable goods

goods that are used by consumers over a period of time

non-durable goods

goods that are used up immediately or over a relatively short period of time

Investment (I)

the addition of capital stock to the economy

Replacement investment

when firms spend on capital in order to maintain the productivity of their existing capital

induced investment

when firms spend on capital to increase their output to respond to higher demand in the economy

Government spending (G)

the money spent on goods and services by a government.

examples of government spending

healthcare, education, defence

Net export (X-M)

the difference between exports and imports

Exports (X)

domestic goods and services that are bought by foreigners

Imports (M)

goods and services that are bought from foreign producers

AD =

C + I + G + ( X - M )

difference between aggregate demand and demand

demand is for a specific market while AD is the quantity for the entire economy and all markets in it

wealth

the assets that people own

What causes changes in consumption?

- income

- interest rate

- wealth

- consumer confidence

- household indebtedness

How does income affect C?

income up = more disposable $ = higher consumption

how do interest rates affect C?

lower interest = higher consumption

How does wealth affect C?

wealth up = spending up

- house pricing up > feel more wealthy

- stock value up = ""

What causes changes in investment?

- interest rates

- national income

- technological change

- business confidence

What causes changes in government spending?

- subsidy commitments

- market failure corrections

- new public service policies

What causes changes in exports?

- income of foreign countries

- currency value

- relative inflation rates

How do relative inflation rates change G?

a relatively higher inflation rate makes a firm less competitive in a market

What causes changes in imports?

- income

- exchange rate

- trade policies

Monetary policy

The use of interest rates and money supply to achieve economic targets

Money supply

the actual amount of money circulating in the economy

Demand-side policy

policies that control AD to maintain the money supply

Contractionary policy

increasing interest rates

Direct impacts of contractionary policies

- Consumer spending increasing > unsecured lending caused recession

- Import vs export > reduce imports

- Cost-push inflation

Expansionary interest rate

decreasing interest rates

Direct impacts of expansionary policies

- Threat of inflation below target > boost spending/AD

- Keep it controlled

- Weak business investment

Base rate

the interest rate set by the central bank

central bank

public non-profit bank but is essentially the government's bank and the ultimate authority in control of the money supply in an economy

Fiscal policy

the use of taxation and government spending to achieve economic targets

expansionary fiscal policy

decrease in taxes

contractionary fiscal policy

increase in taxes

Direct impact of expansionary fiscal policy

increases disposable income

> increased AD (consumption and investment)

Aggregate Supply (AS)

the total amount of goods and services that all industries in the economy will produce at every given price level

Short-run Aggregate Supply (SRAS)

the AS over the period of time when the prices of the factors of production do not change

why does SRAS slope upwards

as prices increase, it becomes more profitable for firms to increase their output and new firms start producing

Factors that shift SRAS

- Changes in resource prices (labor, raw materials)

- Changes in corporate taxes and subsidies

- Supply shocks

LRAS

Long-Run Aggregate Supply

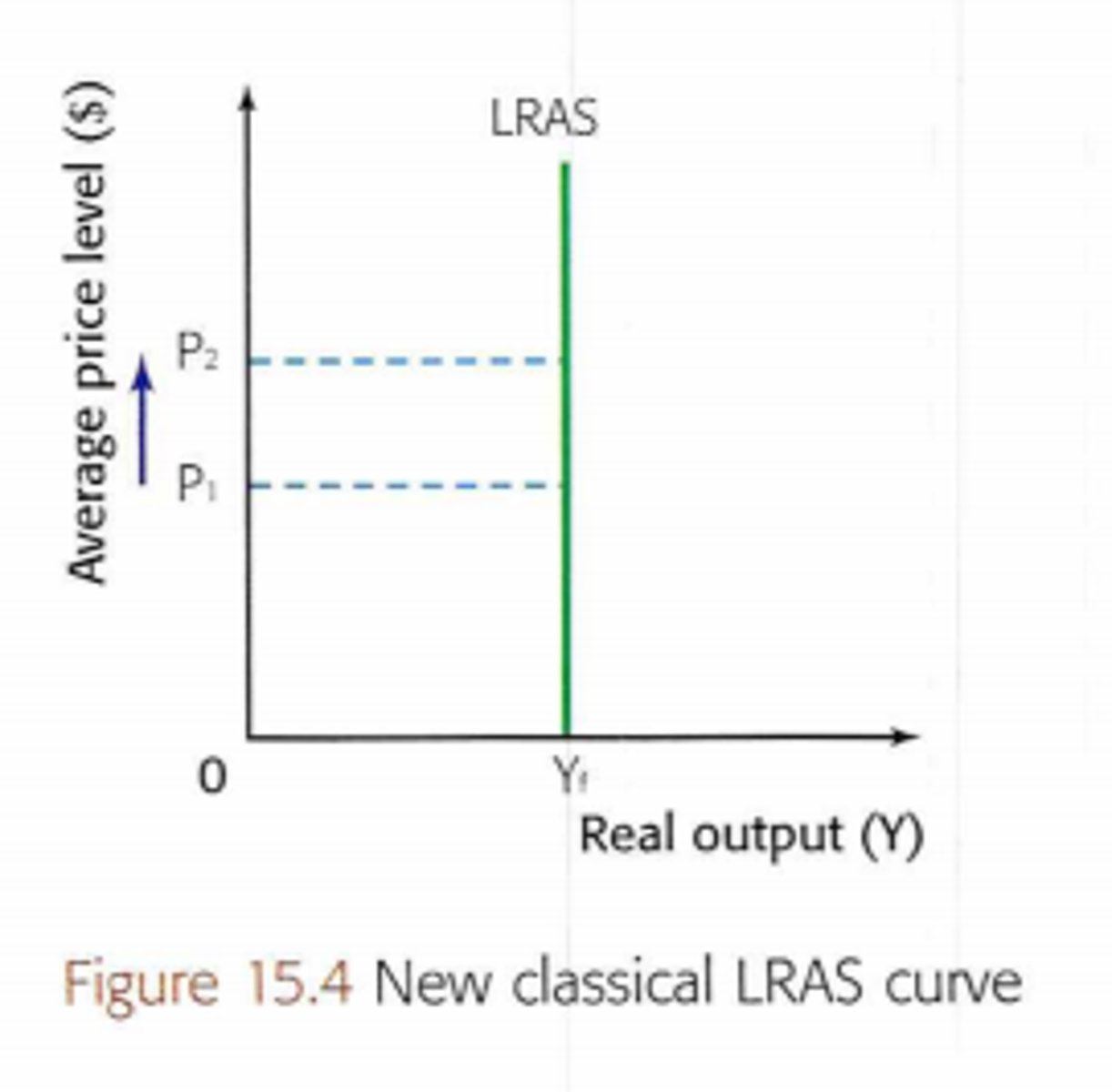

Monetarist/New Classical LRAS

LRAS is vertical at full employment level of output at full capacity and potential output.

Why is the Monetarist LRAS vertical

Potential output based on factors of production quantity and quality > the price level does not affect the Long Run Aggregate Supply.

Monetarist LRAS diagram

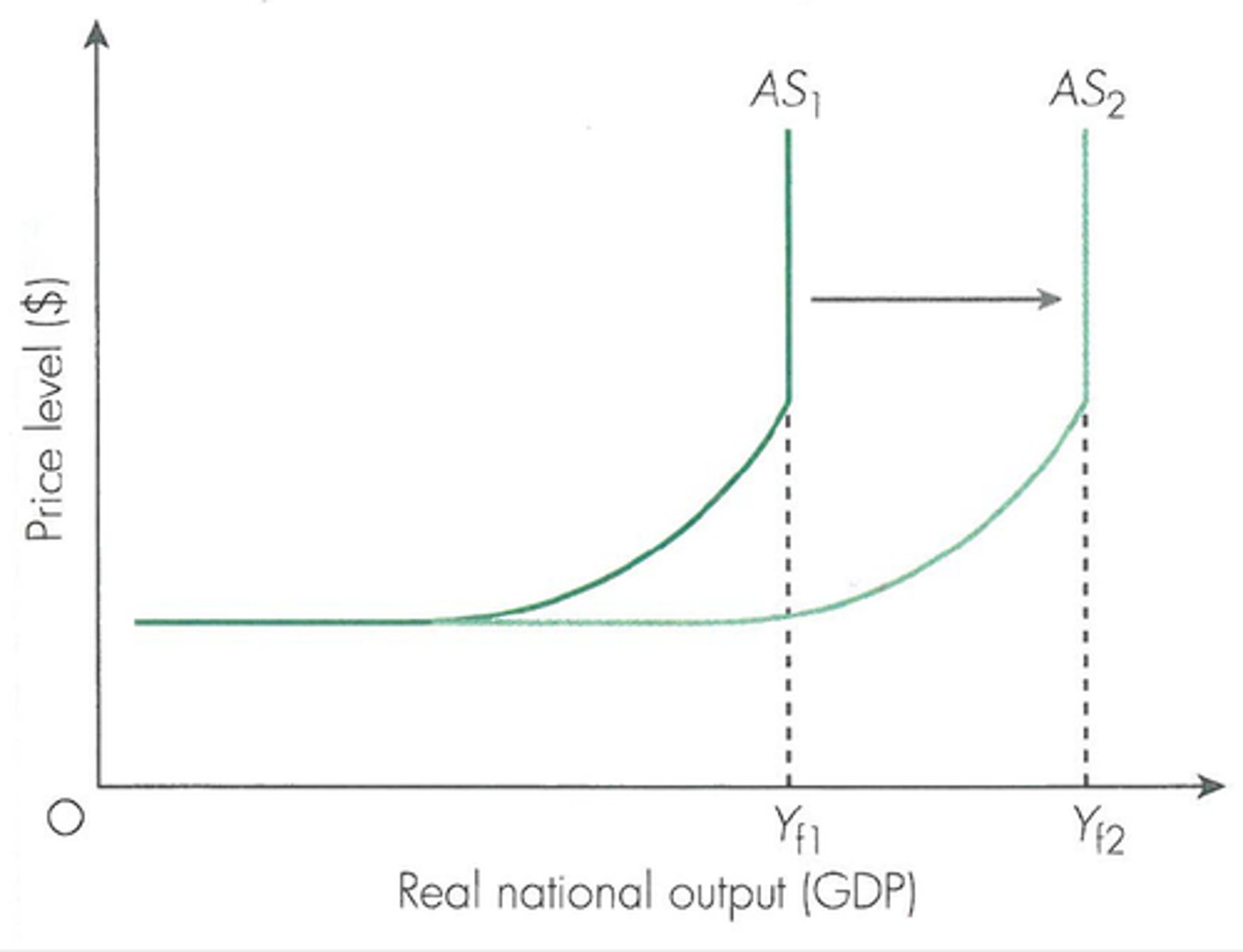

Keynesian LRAS

an economy has 3 different sections on the AS curve

Keynesian LRAS diagram

Keynesian LRAS - stage 1

there is assumed to be spare capacity so the average PL does not increase

Keynesian LRAS - stage 1 Characteristics

- high unemployment

- under-utilised capital

Keynesian LRAS - stage 2

the economy is approaching full capacity, hence costs for hiring the scarce resources begin to rise

Keynesian LRAS - stage 2 characteristics

- factors such as unemployment are used up

- producers have to bid for left over resources

Keynesian LRAS - stage 3

the economy is at full employment (in LR at full capacity) > attempts to increase production will only cause price level to rise.

Reasons for shift in LRAS

- Changes in the stock of resources

- Changes in technology

- Changes in quality of factors of production leading to improvements in efficiency/productivity

- Institutional changes

Difference between SRAS and LRAS

- SRAS has spare capacity > have resources to employ & increase supply

- LRAS - full employment > cannot make anymore, unless PPC is increased

Supply-side policies

policies that a government uses to increase the quantity or improve the quality of the factors of production in order to increase potential output

Interventionist policies

policies based on the idea that the government has a fundamental role to play in actively encouraging growth

Examples of interventionist policies

- investment in human capital

- R&D

- provision and maintenance of infrastructure

- Direct support for industrial/business policies

Name three ways in which the government can invest in human capital

- Give training for necessary knowledge/skills in labour force

- Subsidise/give tax benefits to private schools

- Support firms giving apprenticeship programmes

Name two ways in which the government can incentivise R&D

- Give tax incentives to firms to do R&D

- Tax credit - profit used on R&D not taxed

Infrastructure

the large scale capital, usually provided by the government, which is necessary for economic activity to take place

Name ways which a government can use to increase competitiveness of businesses

- improving the competitive nature of industries through the maintenance of anti-monopoly laws

- helping small and medium enterprises to become established and to grow

- supporting export companies in their access to markets abroad

- advising government on the ways in which education can meet the needs of businesses.

Issues surrounding interventionist policies

- they would be underprovided

- Effectiveness - lengthy time-lag between the implementation of these policies and their effect on the potential output

- Budgets - extent to which they can be provided may be limited by budget constraints as each item of spending in a government budget involves an opportunity cost

- Government body - the extent to which each is provided depends on the ideological aims of the government at the time and the power of various interest groups

- controversies

Market-based policies

policies focusing on allowing markets to operate more freely, with minimal government intervention

Examples of market-based policies

- Reduction in household & corporation taxes

- labour market reforms

- deregulation

- privatisation

- policies to increase competition

Examples of trade union reforms

- Reduction in trade union - Trade unions cost extra money > reducing trade union > lower cost of labour > more available jobs

- Reduction/elimination of minimum wage - keeps price of labour above free-market level > reduction/elimination of this will decrease cost of labour > cost of production down

- Reduction of unemployment benefits - generous benefits == less incentive to work, lower benefits > encourages unemployed to search for jobs (granted that they're available)

Deregulation

- Regulations may increase CoP, eg environmental laws, health and safety regulations, or laws concerning working hours, leave, and holidays

- So take it out or reduce severity > decrease CoP > increase AS

Privatisation

Sell gov-owned firms > priv. owned are more efficient > increase potential output

Issues surrounding market-based policies

- Reduced standard of living

- Income inequality

- Environmental impact

- Worker safety

- Working hours

Macroeconomic equilibrium

the equilibrium level of national income is where aggregate demand is equal to aggregate supply.

Natural unemployment

the portion of unemployed caused not by a shift in ADL

Full employment

when the unemployment that exists in the economy is only the natural employment

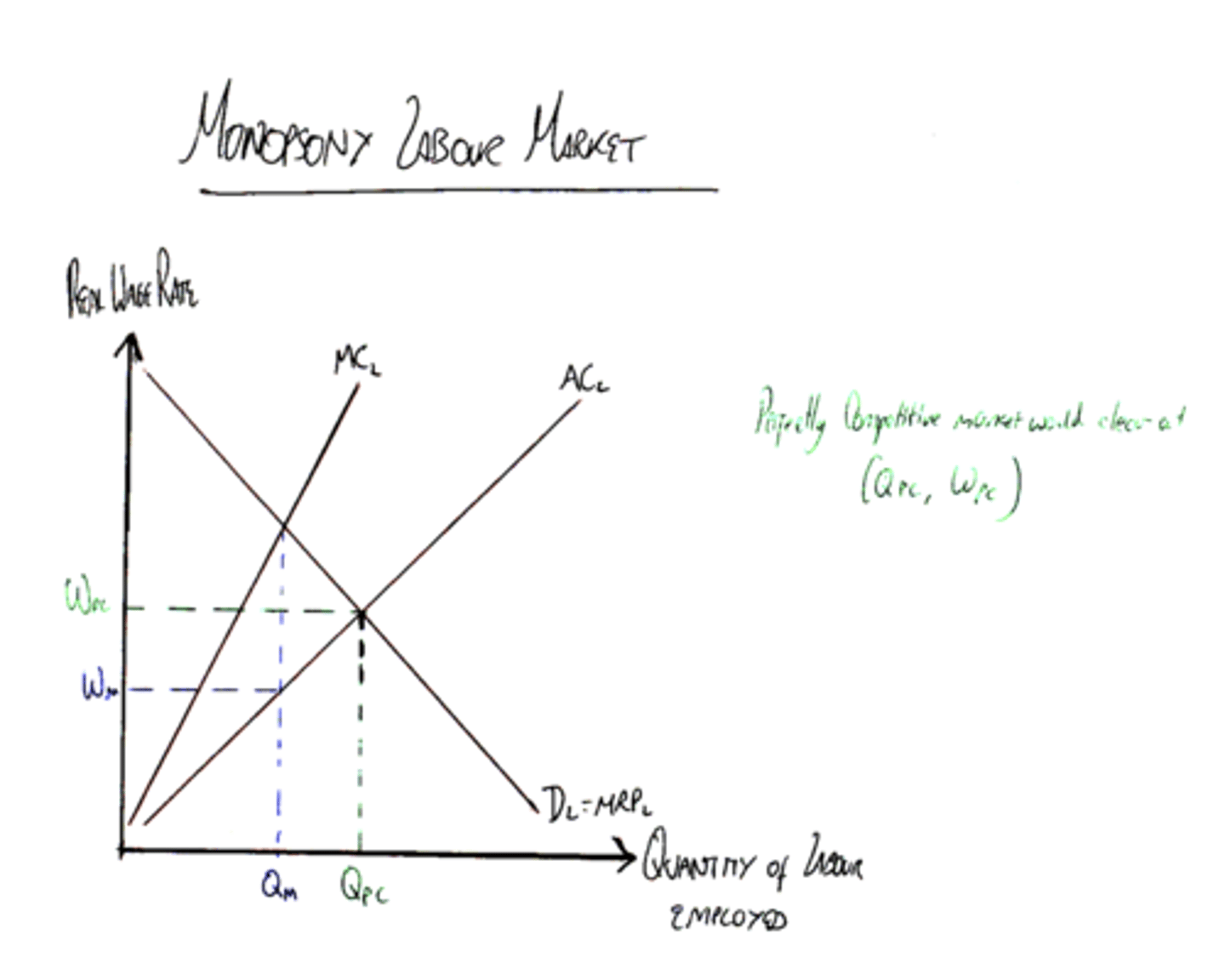

Labour market diagram

- LF = total labour force (AS + unemployed)

- ASL = aggregate supply of labour

Why the ASL and LF get closer as real wage increases

more of the people looking for work (in the

space) will be willing and/or able to work at that wage.

Demand-deficient unemployment

When a lack of demand is insufficient to generate full employment

Seasonal unemployment

unemployment caused by jobs that are there for only part of the year

Frictional unemployment

the time of unemployment between two jobs

structural unemployment

when a whole industry closes and leaves people unemployed > results in long-term unemployment

Cyclical unemployment

unemployment occurring due to an economic downturn > 'bezuinigingen'

Costs of unemployment

Individual:

- lower standard of living

- dependance on social benefits

- loss of skills

- mental health problems

Community:

- antisocial behaviour

- area run down

- pressure for lower-priced housing

- increased crime

Economy:

- lower output

- reduced spending

- tax revenue down

- reduced confidence

Claimant count

the number of people receiving unemployment benefits

Labour force survey

a survey which asks whether you're unemployed and actively seeking for a job

Labour force

the percentage of the population which is able to work > 16-65 not incl. students, stay-at-home, retired

Problems with measuring unemployment

- incentives are usually the only reason people will list as being unemployed

- hidden unemployment

- distribution of unemployment > national averages mask local inequalities

Hidden unemployment

groups of people who aren't considered unemployed due to them having a part-time job and who have given up searching but who are overqualified

Pool of unemployment

group of people who are unemployed

Aggregate Demand for Labour (ADL)

the total number of jobs demanded by the economy

Aggregate Supply for Labour (ADS)

the total number of people who are willing and able to work in the economy at the given average wage rate

difference between structural and demand-deficient unemployment

- Demand-deficient unemployment = general, temporary fall in ADL as a result of a slowdown in economic growth or a recession.

- expectation = once AD picks up > ADL should also increase.

- Structural unemployment is caused by a permanent fall in the demand for one* type of labour and requires a different set of solutions

Interventionist policies for solving structural unemployment

- Long-term - an education system that trains people to be more occupationally flexible.

- Spending on adult retraining programmes to help people acquire the necessary skills to match available jobs

- subsidies to firms that provide training for their workers

- Provide subsidies or tax breaks to encourage people to move to areas where jobs suitable to them are available

- Support apprenticeship programmes so potential workers can acquire the skills needed in the labour force.

Issues of interventionist policies solving structural unemployment

- High opportunity cost as governments will have to forego spending in other areas in order to be able to afford the strategies.

- Long-term impacts

Market-based solutions for solving structural unemployment

- reduce unemployment benefits to give unemployed people the incentive to take the jobs that are available.

- Reduce/remove legislations for hiring, firing and employment practices in order to increase labour market fexibility.

Issues of market-based solutions to solve structural unemployment

- Lower standard of living for those who lose their unemployment benefits

- Increases inequality

- May allow unfair treatment of workers eg, being unfairly fired

- Regulations also guarantee conditions of work, so working conditions may be worsened

- High cost for workers themselves