Monetary Policy and Aggregate Demand Curves 20

1/21

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

22 Terms

Federal Funds Rate

Interest rate banks charge each other for loans.

Real Interest Rate

Nominal interest rate adjusted for inflation.

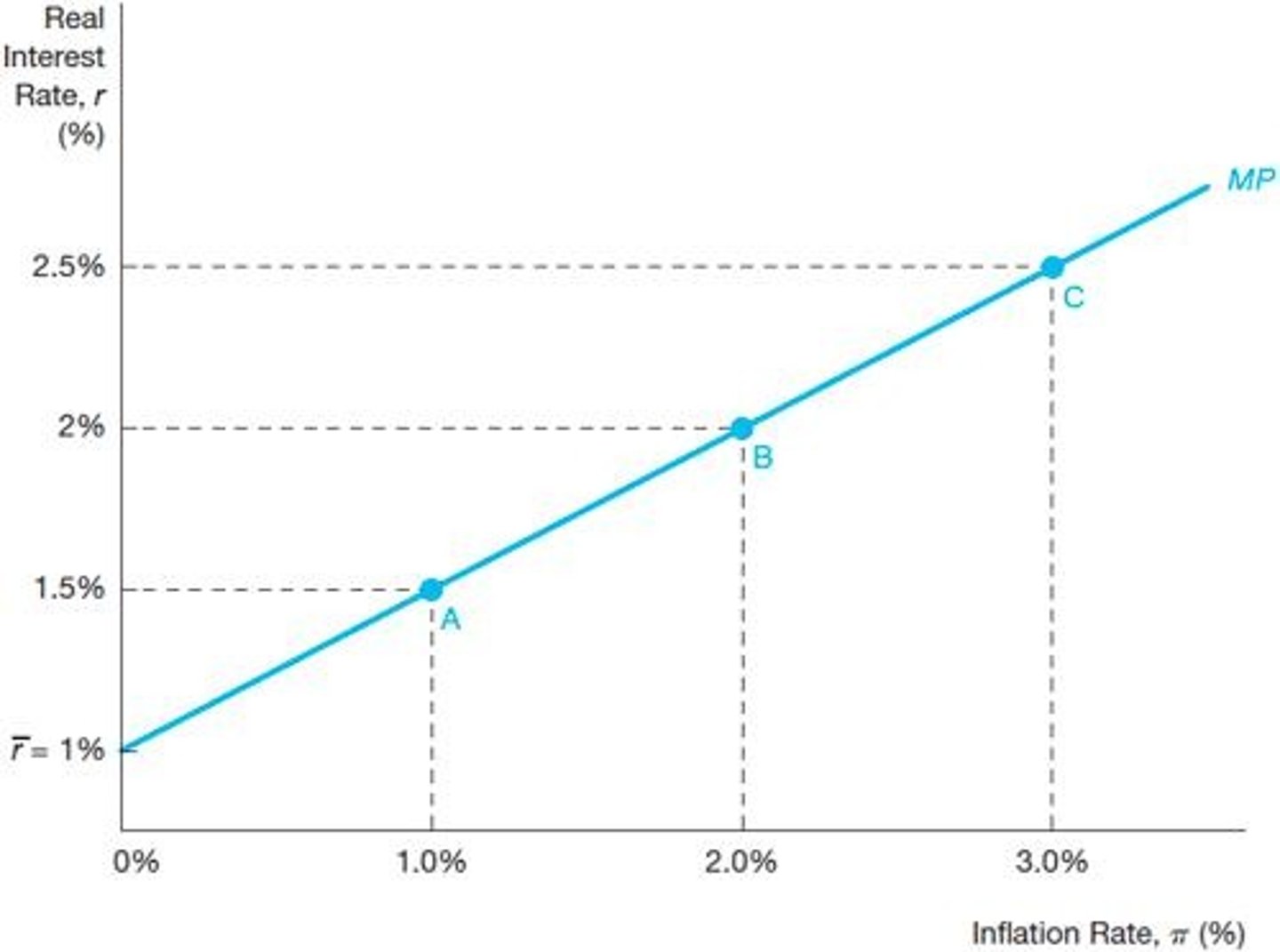

Monetary Policy Curve

Shows relationship between real interest rates and inflation.

Upward Sloping MP Curve

Real interest rates rise with increasing inflation rates.

Taylor Principle

Nominal rates must rise more than expected inflation.

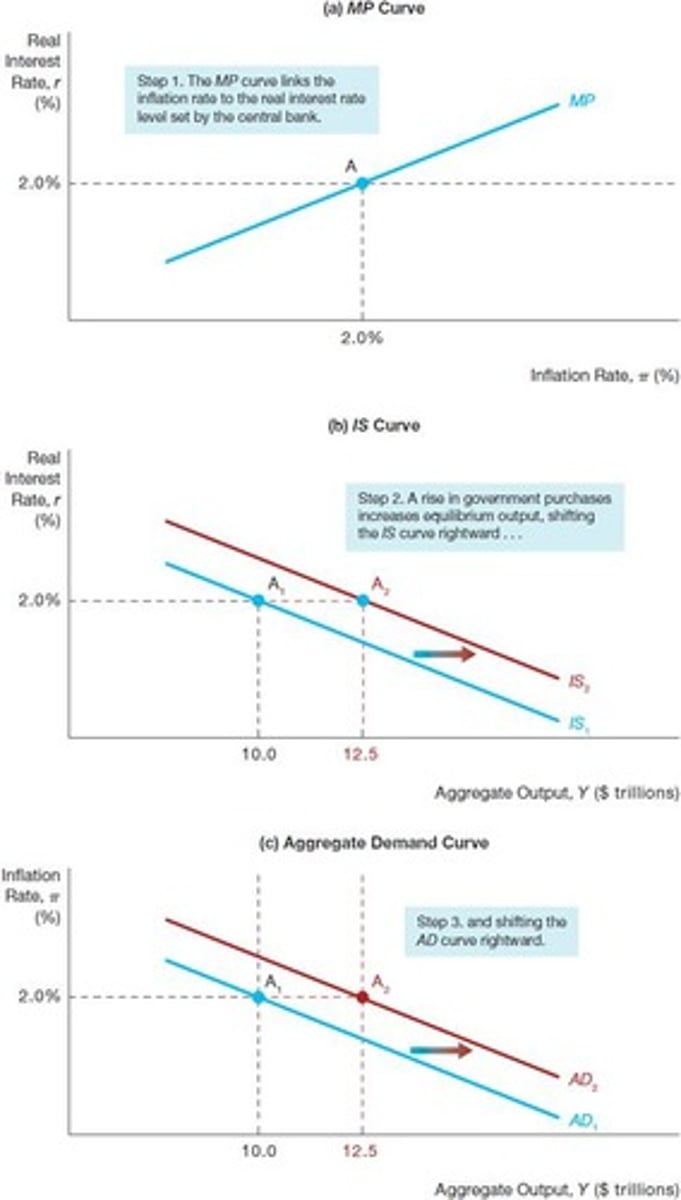

Aggregate Demand Curve

Relationship between inflation rate and aggregate demand.

Downward Sloping AD Curve

Higher inflation leads to lower aggregate output.

IS Curve

Represents equilibrium in the goods market.

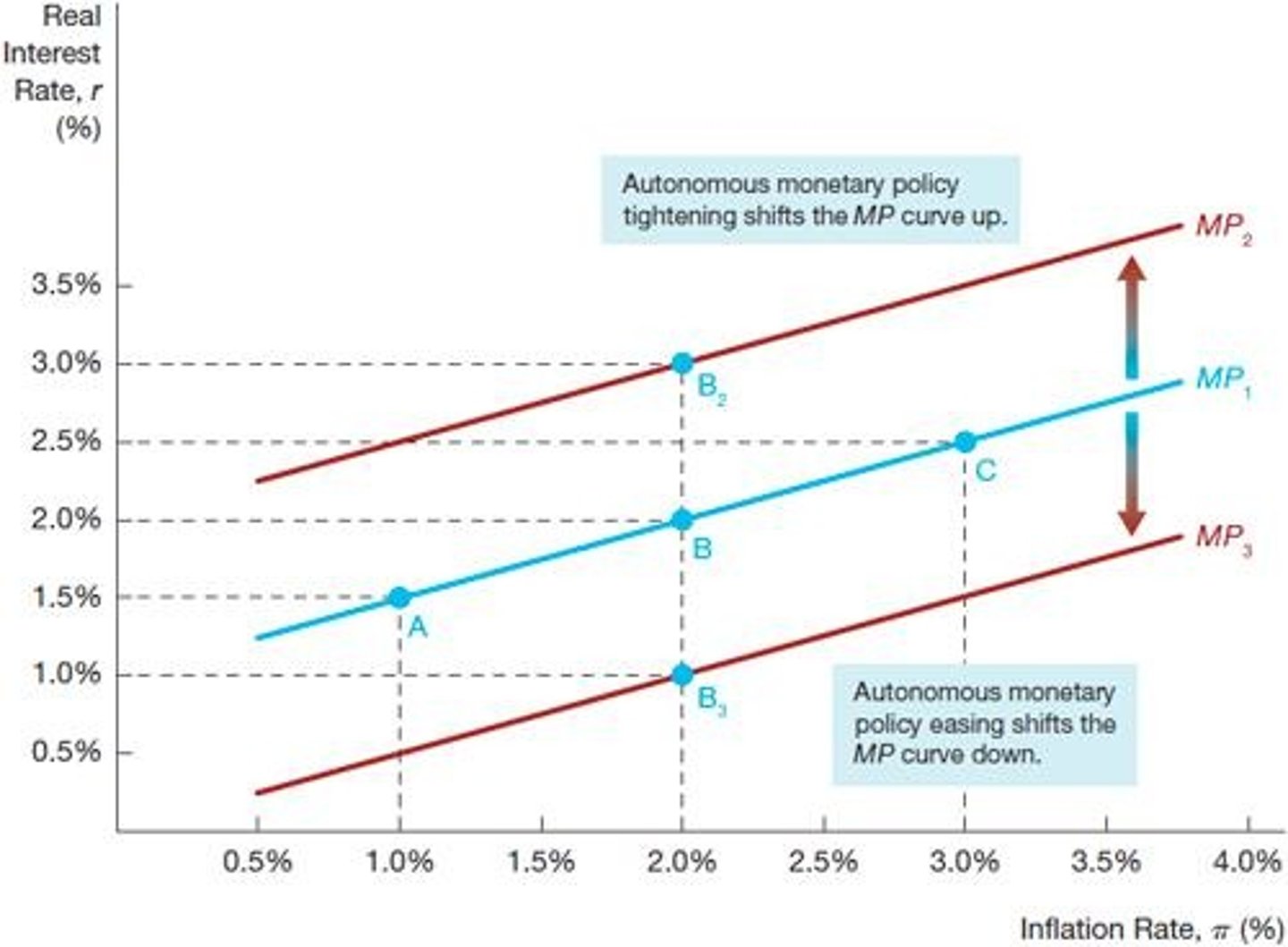

Autonomous Changes

Policy shifts that directly affect the MP curve.

Automatic Changes

Changes along the MP curve due to the Taylor principle.

Monetary Policy Tightening

Raising interest rates to reduce inflation.

Monetary Policy Easing

Lowering interest rates to stimulate the economy.

Shifts in the AD Curve

Changes in aggregate demand due to various factors.

Factors Shifting AD Curve

Include consumption, investment, government spending, and taxes.

Equilibrium Aggregate Output

Level of output where aggregate demand equals supply.

Inflation Rate (π)

Rate at which general price levels rise.

Nominal Interest Rates

Interest rates not adjusted for inflation.

Short-term Real Interest Rates

Real interest rates over a short period.

Aggregate Demand and Supply Analysis

Explains short-run fluctuations in output and inflation.

Equilibrium in Goods Market

Condition where supply equals demand in the market.

Autonomous Net Exports

Exports minus imports that shift the AD curve.

Government Purchases

Spending by government that affects aggregate demand.