3. FED Monetary Policy Tools and Intro to Financial Markets

1/30

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No analytics yet

Send a link to your students to track their progress

31 Terms

Dual Mandate

Refers to the FED’s responsibility to ensure maximum employment and price stability

Maximum employment is the highest level of employment an economy can sustain with low and stable levels of inflation

Price stability is low and stable inflation, often set at a target of around 2%

FED Committee

Consists of 12 reserve bank presidents and 7 governors

Voting consists of 5 reserve bank presidents and 7 governors

The Federal Funds Rate (FFR)

Banks that need funds from other banks borrow from another’s reserves in what is called a Federal Funds transaction

The Federal Funds Rate is the agreed interest rate in the transaction, which is also the FED’s ‘policy rate’; it has a knock-on influence on the wider economy

The FOMC sets a target for the FFR which is generally 25 base points wide

What does FOMC stand for?

The Federal Open Market Committee

Basis points

A unit which is 1/100th of a percentage point

25 basis points is 0.25%

What 4 tools does the FED have for implementing monetary policy?

Interest on reserve balances

Overnight reverse repurchase agreement facility

Discount window

Open market operations

What are the three types of administered rates the FED can use?

Interest on reserve balances rate (IORB rate)

Overnight reverse repurchase rate (ON RRP rate)

Discount rate

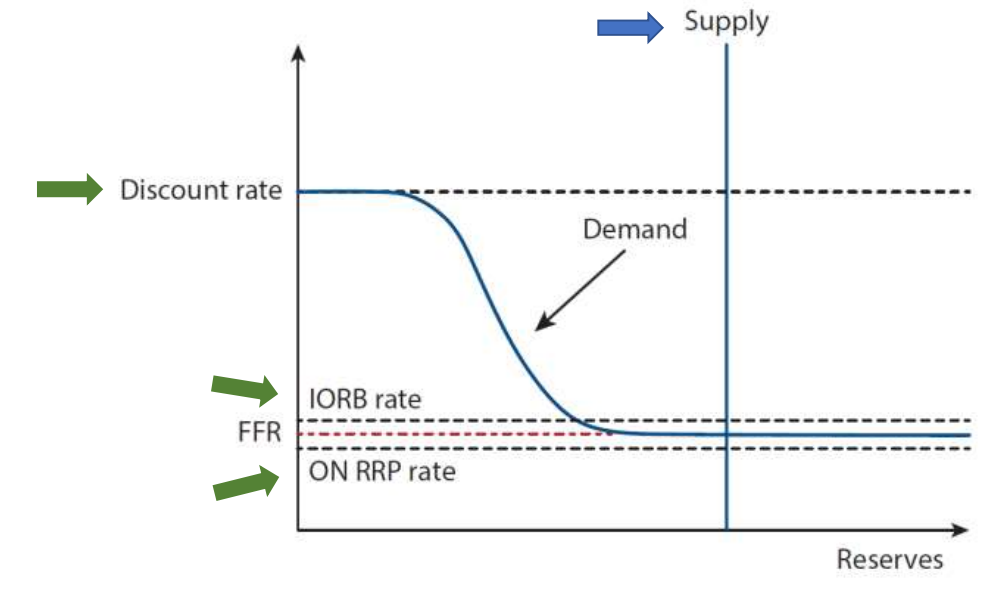

Policy when there is ample reserves

The federal funds rate is no longer determined by reserve scarcity, but is instead determined by the three administered rates the FED has at its disposal

The IORB rate anchors the FFR, the ON RRP rate provides a lower bound, and the discount rate provides an upper bound

How does the IORB rate control the FFR?

The FED pays banks interest on the balances that they reserve at the FED to incentivise them to reserve money there

This helps to control the FFR, because banks can always earn interest on their reserve balances at the FED with zero risk

If the FFR is not satisfactory, banks will just store money at the FED instead, so it steers the FFR into the target range

When the FED raises the FFR target, they also raise the IORB rate, and vice versa

How does the ON RRP rate act as a supplementary tool for controlling the FFR?

This is when the FED temporarily borrows cash from non-bank institutions overnight

To guarantee repayment, it temporarily sells some treasuries as collateral and repurchases them the next day, paying a small amount of interest on top (which is the ON RRP rate)

Non-bank institutions will not lend their money in the market at a rate lower than they can earn by lending to the FED, so this is why this provides a lower bound for the FFR

It’s safe because there is no credit risk and US Treasuries are extremely stable and reliable assets

How does the discount window and discount rate work as policy tools?

A rate set by the FED above the FOMC’s target range for the FFR, which serves a ceiling for it

The discount rate is the interest banks pay when they borrow directly from the FED’s discount window

What are open market operations?

The purchasing of securities by adding reserves to the banking system by the FED to ensure ample reserves

This is done periodically and shifts the supply curve to the right

How does the FED move the FFR?

The FED increases the FFR by also increasing its administered rates, where IORB is the primary tool and ON RRP is supplementary (typically the discount rate moves in concordance)

It is worth noting, that generally, if the FED wants to increase inflation they lower the FFR and to increase it they raise the FFR

A higher FFR rate means less borrowing meaning there is less incentive to buy and invest in the market as it is more costly

What are characteristics of debt instruments in capital markets?

Loans granted by banks and bonds issued by government and businesses

Contractually fixed return (interest per period, principal at maturity)

No voting rights

What are characteristics of equity in capital markets?

May receive annual share of profit as dividends

Ownership of the company

Prices vary depending on supply and demand

Types of financial markets

Exchanges and Over-the-counter (OTC) markets:

Exchanges like the NYSE, Chicago Board of trade

Money markets deal in short-term debt instruments with short times until maturity, the least price fluctuations and least risky

Capital markets deal with longer-term debt and equity instruments, with maturities longer than 1 year

What is a bond?

A bond is a fixed income instrument that a government or business uses to raise capital by borrowing from investors

It is a debt security which promises to make fixed payments for an amount of time

Advantages of bonds

Receive income through interest payments

Hold the bond to maturity to get all of the principal back

Profit if you can resell the bond at a higher price

Different types of bonds

Simple loan: You lend money, get the same amount bank after maturity

A fixed payment loan: borrowed funds must be paid back at the same time each period, the amount consists of part of the principal and interest

A coupon bond: Pays the owner a fixed interest payment every year until the maturity date, when a specified final amount (face value or par value) is repaid

A discount (or zero-coupon) bond: A bond bought at a price below its face value, the face value is repaid at maturity; there are no interest payments, just the face value at the end. US treasury bills are discount bonds

What is the yield to maturity?

The interest rate which equates the present value of cash flow payments received from a debt instrument with its value today

Yield to maturity on a simple loan

The calculation is PV = CF / (1 + i)n where PV is amount borrowed, CF is cash flow in one year and n is the number of years; rearrange for i

‘i’ is the yield to maturity

Yield to maturity on a fixed payment loan

LV = FP/(1 + i) + FP/(1 + i)2 + … + FP/(1 + i)n

Where LV is Loan Value, FP is fixed yearly payment, and n is the of years it is held for

How to find the fixed yearly payment using a financial calculator

LV = $100,000, annual interest rate, i = 0.07%, and n = no. of years

Enter -100,000 and press the PV key

Enter 0 and push the FV key

Enter 20 and push the N key

Enter 7 and push the %i key

Push the CPT and PMT keys

What is face value?

The face value is the value assigned to a bond and is the amount loaned to the issuer

What is the coupon rate?

Compensation for buying a bond and investing

This is the annual rate of interest paid by the issuer annually or semi-annually

Yield to maturity of a coupon bond

P = C/(1 + i) + C/(1 + i)2 + … + C/(1 + i)n + F/(1 + i)n

P is the price of the coupon bond, C is the yearly coupon payment, F is the face value of the bond, n is the years to maturity, and i is the yield to maturity

Coupon rate formula

Coupon Rate = (Annual Coupon Payment / Face value of the bond) x100

Yield to maturity on a zero-coupon (discount) bond

Face value / (1 + i)n

Par value

When a bond is sold for how much it is worth

Premium bonds

Bonds which are sold for a value higher than their face value

What is the relationship between yield to maturity and price?

As price increases, yield to maturity decreases

If a bond price sells above face value, then the yield to maturity is less than the coupon rate

If a bond sells at a discount, the yield of maturity is greater than the coupon rate