elgawly- final spring 2022

1/93

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced | Call with Kai |

|---|

No study sessions yet.

94 Terms

Opportunity Cost

Whatever must be given up to obtain some item

Normal Good

Demand increases as income increases

Inferior Good

Demand decreases as income increases

Substitutes

Price of Good X decreases as demand of Good Y to decrease

Complements

Price of Good X decreases as demand of Good Y increases

Equilibrium effect when demand AND supply shift left

Quantity decreases, price is constant

Equilibrium effect when demand AND supply shift right

Quantity increases, price is constant

Price Ceiling

A legal maximum on the price at which a good can be sold

Price Floor

A legal minimum on the price at which a good can be sold

Price Ceiling is effective when ______ the equilibrium

below

Price Floor is effective when ______ the equilibrium

above

Price Ceiling produce a ______

Shortage

Price Floor produce a ______

Surplus

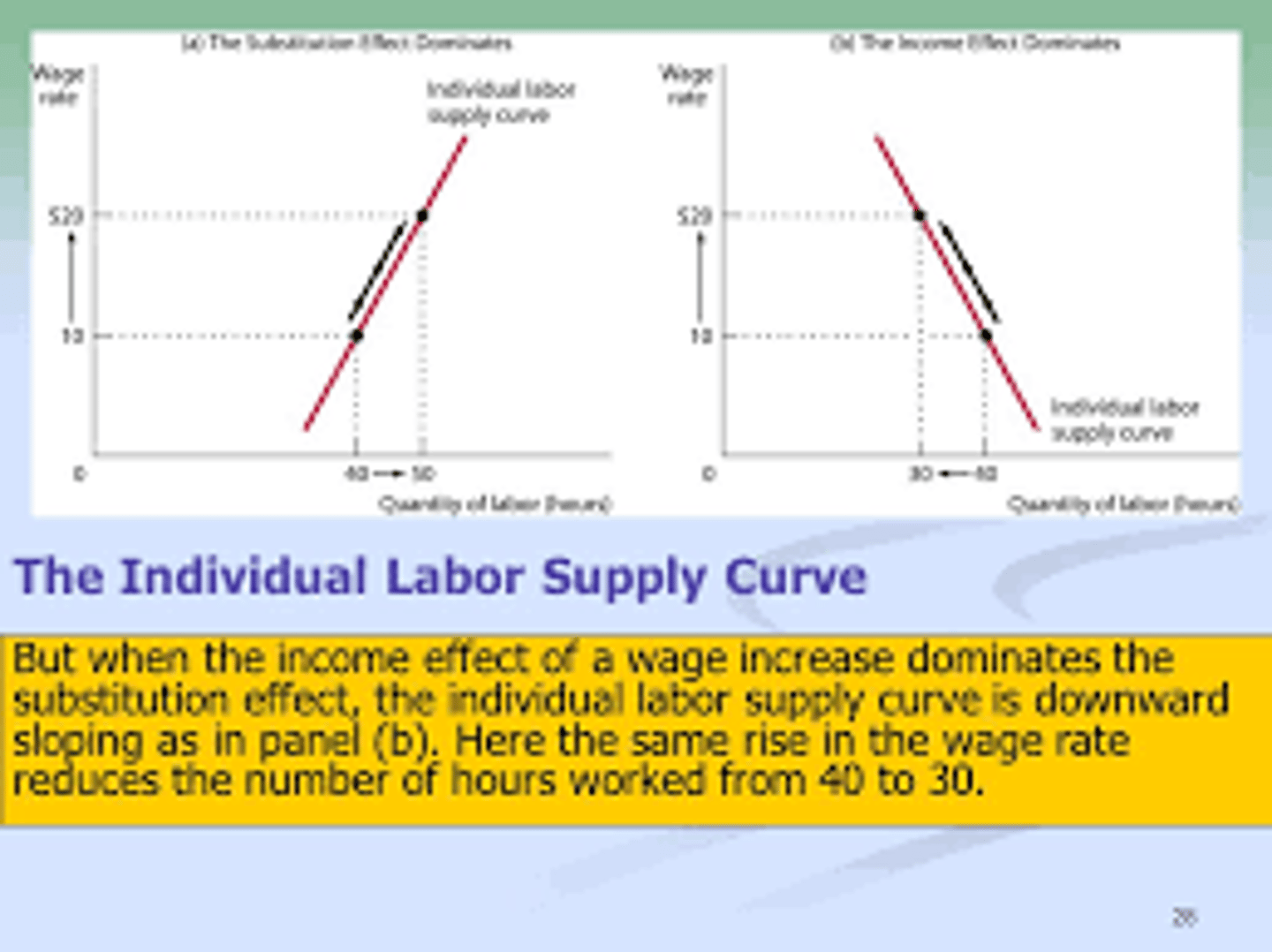

Individual Labor Supply Curve

shows how the quantity of labor supplied by an individual depends on that individual's wage rate

Elasticity of Demand

Percentage change in quantity demanded divided / Percentage change in price

The relationship between total revenue and price when a product is elastic

As total revenue increases, the price decreases

The relationship between total revenue and price when a product is inelastic

As total revenue increases, the price increases

When does a firm start to minimize losses?

When price is less than the average total cost.

When does a firm shut down?

When price is less than the average variable cost.

Ricardian Model

The level of a country's technology affects the wages paid to labor, such that countries with better technologies have higher wages.

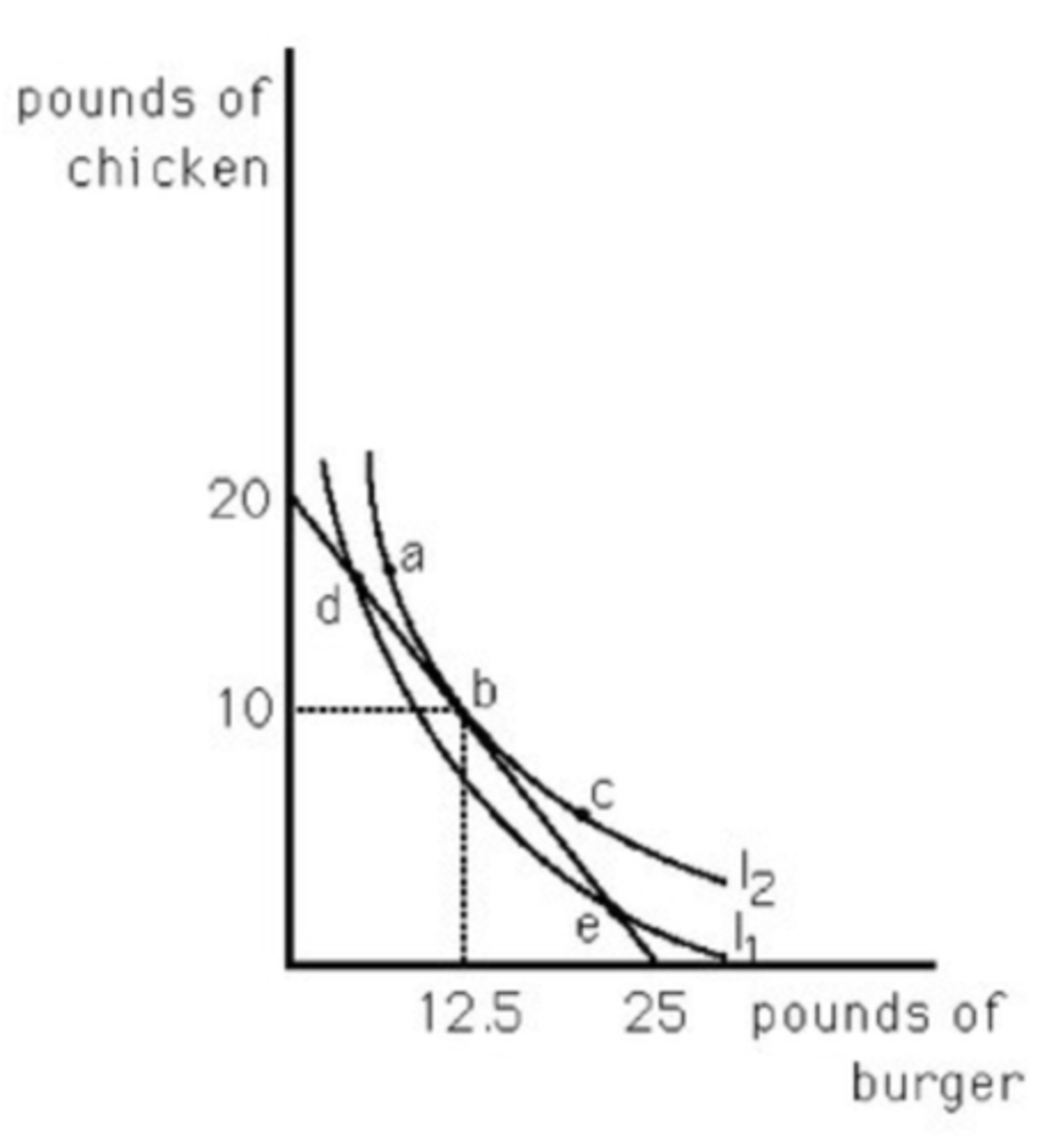

How do you determine comparative advantage on a graph?

Set the intercepts equal to each other. Whatever variable you're isolating is what you are producing (Ex: 1C = 20P indicates that for every C you produce, you give up 20 P). Whichever one gives up less is the one that the country specializes in.

Comparative Advantage

The ability to produce a good at a lower opportunity cost than another producer

Where does a firm determine its maximum output?

Marginal Revenue = Marginal Cost

Increasing returns to scale

When long-run average total cost declines as output increases

Constant returns to scale

When long-run average costs remain constant as output increases

Decreasing returns to scale

When long-run average total cost increases as output increases

Economic Profit

Profit = Total Revenue - Explicit Costs - Implicit Costs (Remember that the word economic has E and I in it, hence Explicit and Implicit Costs are factored in!)

Accounting Profit

Profit = Total Revenue - Explicit Costs

Average Variable Cost

Variable Cost / Quantity

Total Cost

Fixed Cost + Variable Cost

Fixed Cost

A cost that does not change, regardless of quantity

Barriers to Entry of the market

Patents and copyrights,

Increasing returns to scale

Network Externality

Technological superiority

Control of natural resources

Perfect Competition Curve is at the profit maximizing point when...

P = MC

Perfect Competition in the Long Run

Price is equal to the ATC

Oligopolies and Monopolies in the Long Run

Price is greater than the ATC

Dominant Strategy

A strategy that is best for a player in a game regardless of the strategies chosen by the other players

Dominant Strategy with collusion

Pick the highest payoff

Heckscher-Ohlin Model

a country has a comparative advantage in a good whose production is intensive in the factors that are abundantly available in that country (You will export that product).

When equilibrium is above autarky, you are _________

Exporting

When equilibrium is below autarky, you are _________

Importing

How to find how much something is imported or exported?

Find the difference in quantity when (Demand = World Price) - (Supply = World Price)

Tariff

Government tax on imports or exports

Neoclassical view on consumer behavior

Assumes that consumers are rational

Behavioral view on consumer behavior

Assumes that consumers are irrational

"How much" decision

Analyzes the marginal benefit of a decision

"Either or" decision

Pick one or the other, nothing in between.

Status Quo bias

Do nothing when faced with making a decision

Mental accounting

categorizing decisions into "accounts" mentally designated for specific consumption transactions, goals, or situations.

Loss aversion

We care more about losses than wins

Marginal Utility

Change in total utility / Change in quantity

Properties of an indifference curve

Downward sloping, never criss cross, shows diminishing marginal utility, convex to the origin

Income effect (wages)

As wage increases, the labor decreases

Substitution effect (wages)

As wage increases, labor increases (to substitute labor for leisure)

Nonrival

One person's consumption does not interfere with another person's consumption

Nonexcludable

The supplier cannot prevent consumption by people who do not pay for it

Rival

One person's consumption interferes with another person's consumption

Excludable

The supplier can prevent consumption by people who do not pay for it

Two causes of income inequality

Single-Family housing and Education & Training

Private goods

Excludable and Rival

Public goods

Non-excludable and non-rival

Artificially Scarce goods

Excludable and non-rival

Common resource goods

Nonexcludable and rival

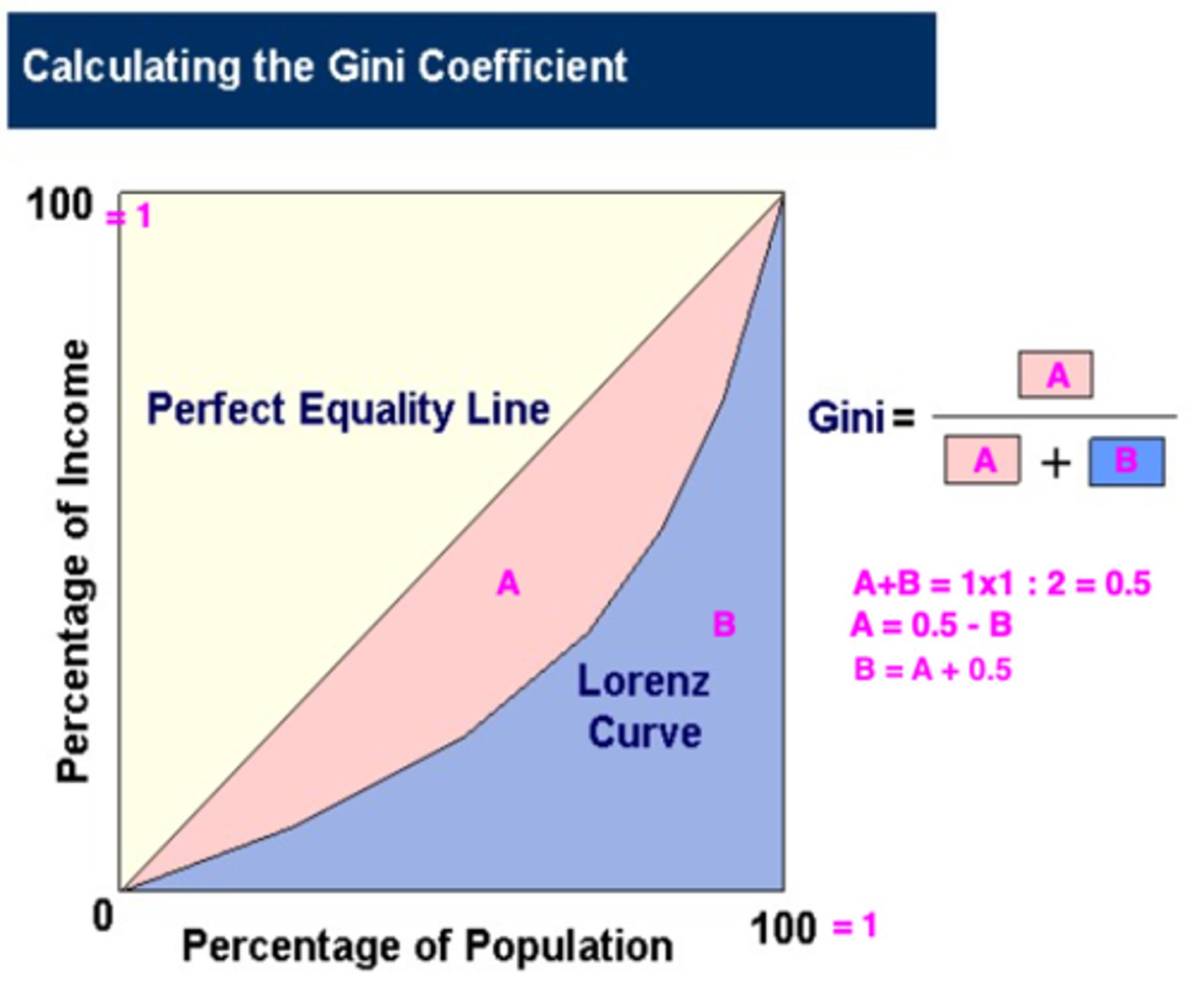

Gini Coefficient

A measure of income inequality within a population, ranging from zero for complete equality, to one if one person has all the income.

Gini Coefficient Formula

(Area A)/(Area A+B)

Transfer Payment

Government payments to individuals where no goods or services are exchanged.

Monetary transfers

money or a check transfer (There are no restrictions on how the transfer can be spent).

In-kind benefits

Goods and services provided for free or at greatly reduced prices

Means-tested program

A program in which an individual's income and assets must not exceed specified levels

Non-means-tested programs

Programs that provide cash assistance to qualified beneficiaries, regardless of income.

Poverty (welfare) programs

A government program designed to aid the poor. Always means-tested.

Social insurance programs

Programs to help the elderly, ill, and unemployed. NEVER means-tested.

Social welfare programs

Government programs that provide the minimum living standards necessary for all citizens. Means-tested

Median

The middle value in a distribution; half the values are above it and half are below it

Mean

The average value in a distribution

Negative income tax

A government program that supplements the income of low-income working families.

Temporary Assistance for Needy Families

state-run program that provides assistance and work opportunities to needy families; Means-tested Monetary Transfer

Food Stamps

Government coupons that can be used to purchase food; Means-tested In-Kind Benefits

Supplemental Security Income

Provides a minimum income to seniors and the disabled who do not qualify for social security; Means-tested Monetary Transfer

Medicaid

A federal and state assistance program that pays for health care services for people who cannot afford them; Means-tested In-Kind Benefit

Earned Income Tax Credit

Also known as the EITC, a refundable federal income tax credit for low- to moderate-income working individuals and families, even if they did not earn enough money to be required to file a tax return; Means-tested Monetary Transfer

Affordable Care Act

Most of employers must provide health insurance, have insurance or face surtax, prevents rejection based on pre-existing condition; Means-tested In-Kind Benefit

Social Security

Federal program of disability and retirement benefits that covers most working people; Non Means-tested Monetary Transfer

Medicare

A federal program of health insurance for persons 65 years of age and older; Non Means-tested In-Kind Benefits

Unemployment Insurance

A government program that partially protects workers' incomes when they become unemployed; Non means-tested Monetary Transfer

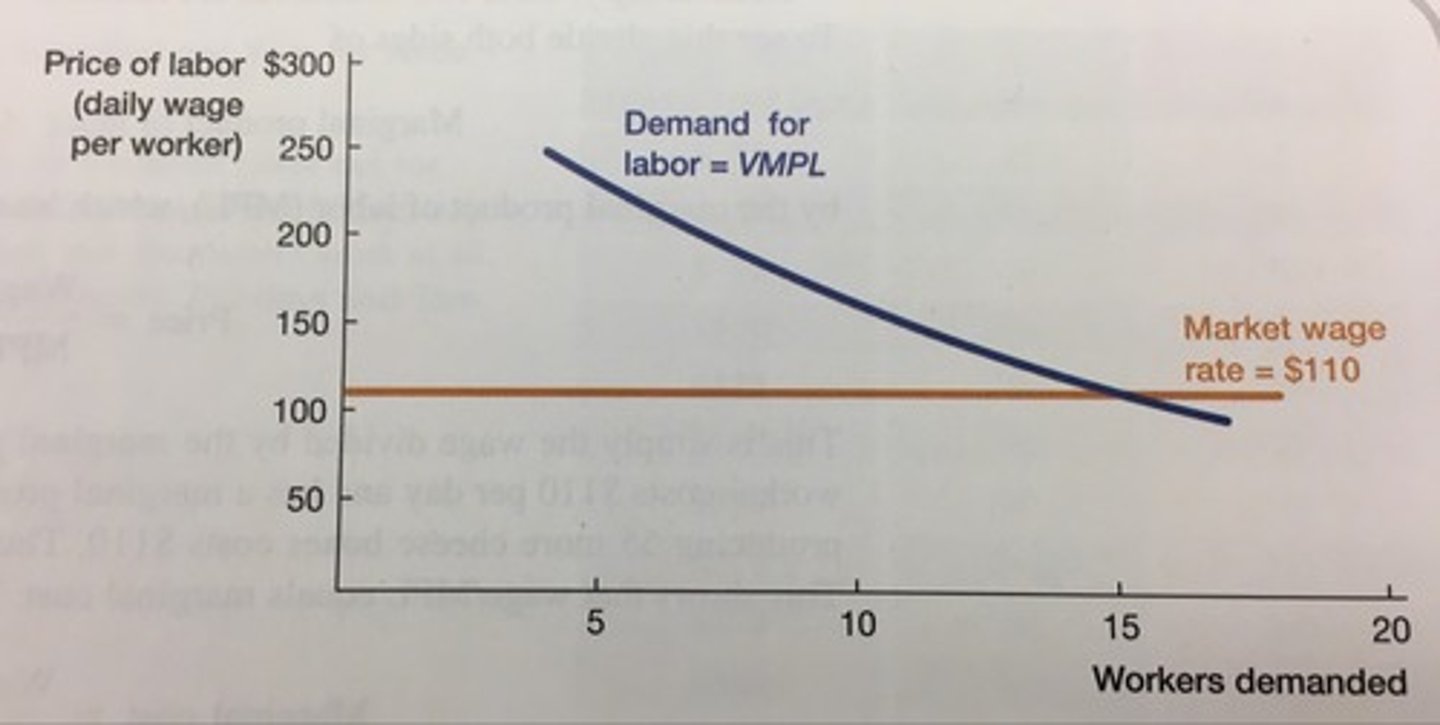

In terms of VMPL, when do we stop hiring?

Stop until VMPL = wage OR when VMPL < wage

Adverse Selection problem

a problem that occurs when buyers and sellers have different amounts of information about the good for sale and use that information to the detriment of the other.

Moral Hazard

When the act of insuring an event increases the likelihood that the event will happen

How to solve the adverse selection problem

Screening and Signaling

Screening

Describes the efforts of the less informed party to gather information about the more informed party.

Signaling

Describes the efforts of the more informed parties to reveal information about themselves to the less informed party.

How to solve the moral hazard problem

Require a deductible

Efficiency Wage

A wage that is deliberately set above the market rate to increase worker productivity. Less labor turnover, higher pool of workers, more productive workers, and productivity is higher.

Compensating differentials

Higher wages that compensate workers for unpleasant aspects of a job

Time Allocation Line

Determine the effects from A to B, then B to C, then A to C.