Theory of the Firm (Theme 3 CC1)

1/51

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

52 Terms

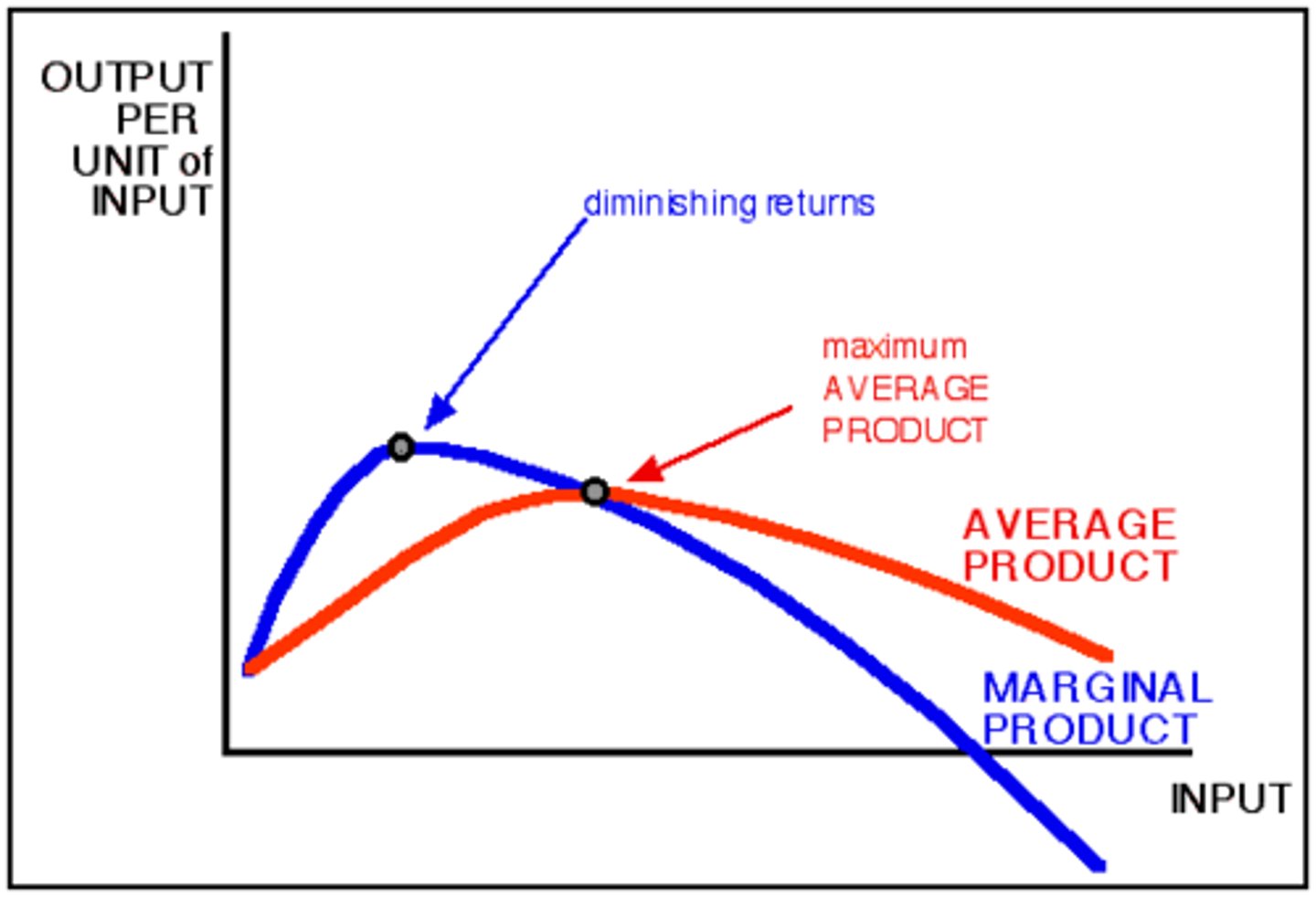

Marginal Product

The extra output or change in total product caused by the addition of one more unit of variable input.

Marginal Product Formula

change in total product/change in labor input

Diminishing Marginal Returns

A level of production in which the marginal product of labour decreases, and the total product increases less quickly as the number of workers increases. This is because workers may get in each other's way and workers have to wait for capital to become free. This means that each worker adds less to TP than the previous worker.

Increasing Marginal Returns

A level of production in which the marginal product of labour increases as the number of workers increases. This is due to better use of capital equipment and specialisation resulting in each worker adding a bit more than the last.

Average Product

The average amount produced by each unit of a variable factor of production. Different to marginal product as it measures just TP / L and the average level of output.

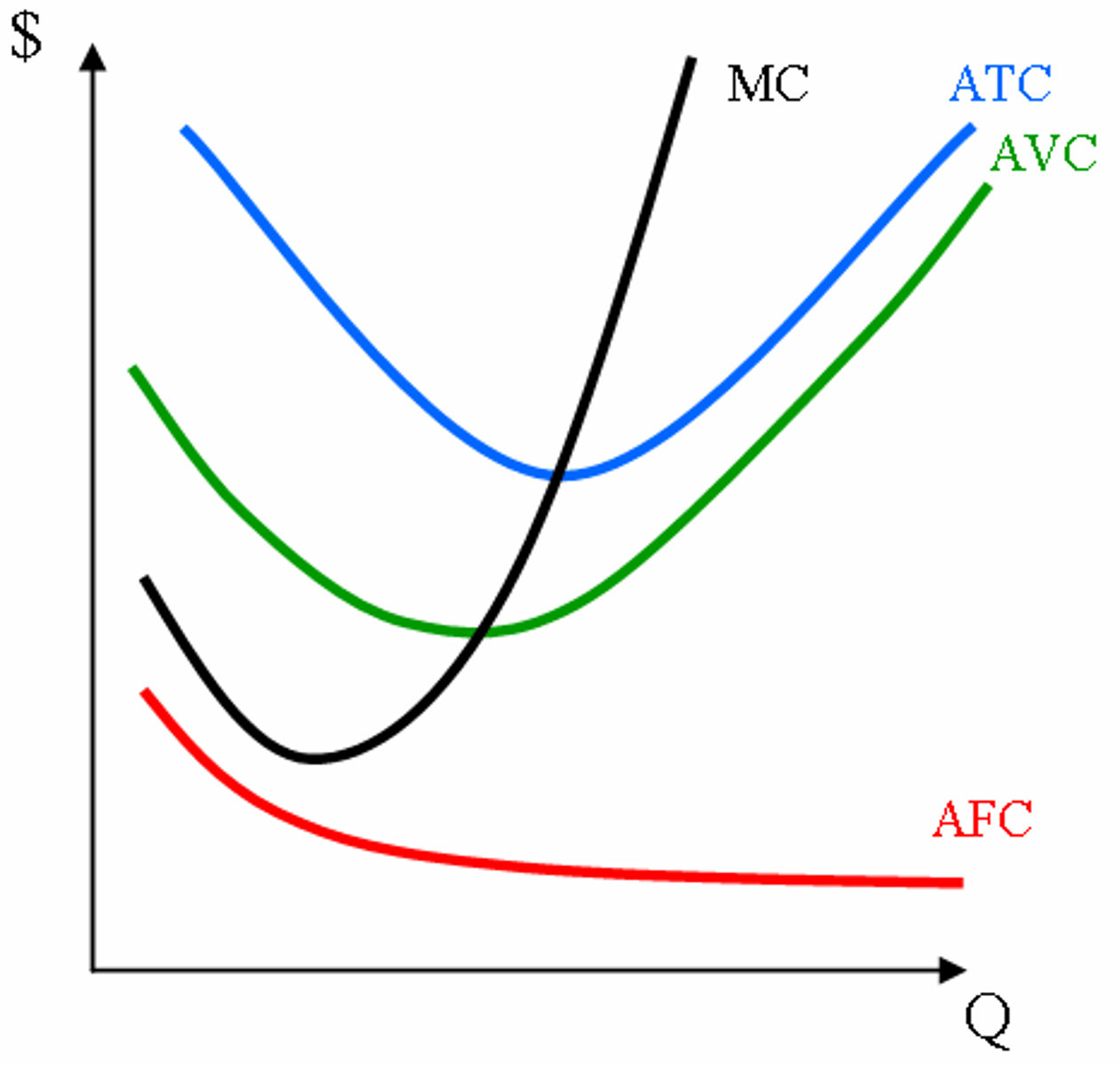

Fixed costs

Costs that do not vary with the quantity of output produced, such as rent, insurance and salaries.

Variable Costs

Costs that change with the quantity of output produced such as raw materials, zero hours labour and packaging.

Semi-variable costs

Costs that have both a fixed and a variable cost element which depend on your usage such as labour (permanent staff which take overtime) mobile phone contracts, gas, electricity and commission/bonuses

Total Cost

the sum of fixed and variable costs; the cost of producing any given level of output.

Total variable cost

The total cost of the firm's variable factor of production - the cost of labour and others relating to output.

Total fixed cost

The sum of those costs that are fixed in total - no matter how much is produced

Average Total Cost

Total cost divided by the quantity of output produced

Law of Diminishing Marginal Returns

As more of a variable resource is added to a given amount of a fixed factors of production, total and marginal product eventually declines and could become negative.

Average Variable Cost

variable cost divided by the quantity of output

Marginal

The impact on consumer or firm behaviour following a small change in another variable. For example marginal product is the change in output following a change in labour.

Long run

The period of time when the firm is able to vary the inputs of all of its factors of production.

Internal economies of scale

The cost reductions enjoyed by a single business as output rises, due to advantages internal to the firm.

Internal diseconomies of scale

Higher unit costs of production that occur due to internal problems of mismanagement as a business organisation grows, potentially too large or expanding too quickly.

Purchasing economies of scale

A reduction in unit costs as a result of buying in bulk; these are sometimes called buying economies of scale.

Risk bearing economies of scale

Large firms diversifying into more products/markets reducing the risk of collapse and risk to investors, meaning they can take more risks and endure greater losses. This means that investors demand a lower rate of return on their investment, reducing LRAC.

Financial economies of scale

A situation where large firms are able to borrow money on lower interest rates than smaller firms as larger firms tend to be more 'credit worthy', which makes the cost of financing investment and therefore unit costs lower.

Managerial economies of scale

Reductions in average cost as a result of being able to employ specialist managers who are more productive using specialist equipment.

Technical economies of scale

Refer to the production process itself,

-large scale, expensive capital inputs

-specialisation of the workforce as a larger firm can afford to employ more.

-the law of increased dimensions.

The law of increased dimensions

Size and cost doesn't increase at the same rate i.e twice as big is not twice as expensive. This leads to technical economies of scale as the costs of transport per good in a larger container is cheaper than the costs of transport per good in a smaller container.

Marketing economies of scale

Large firms are more able to afford larger, more effective advertising campaigns.

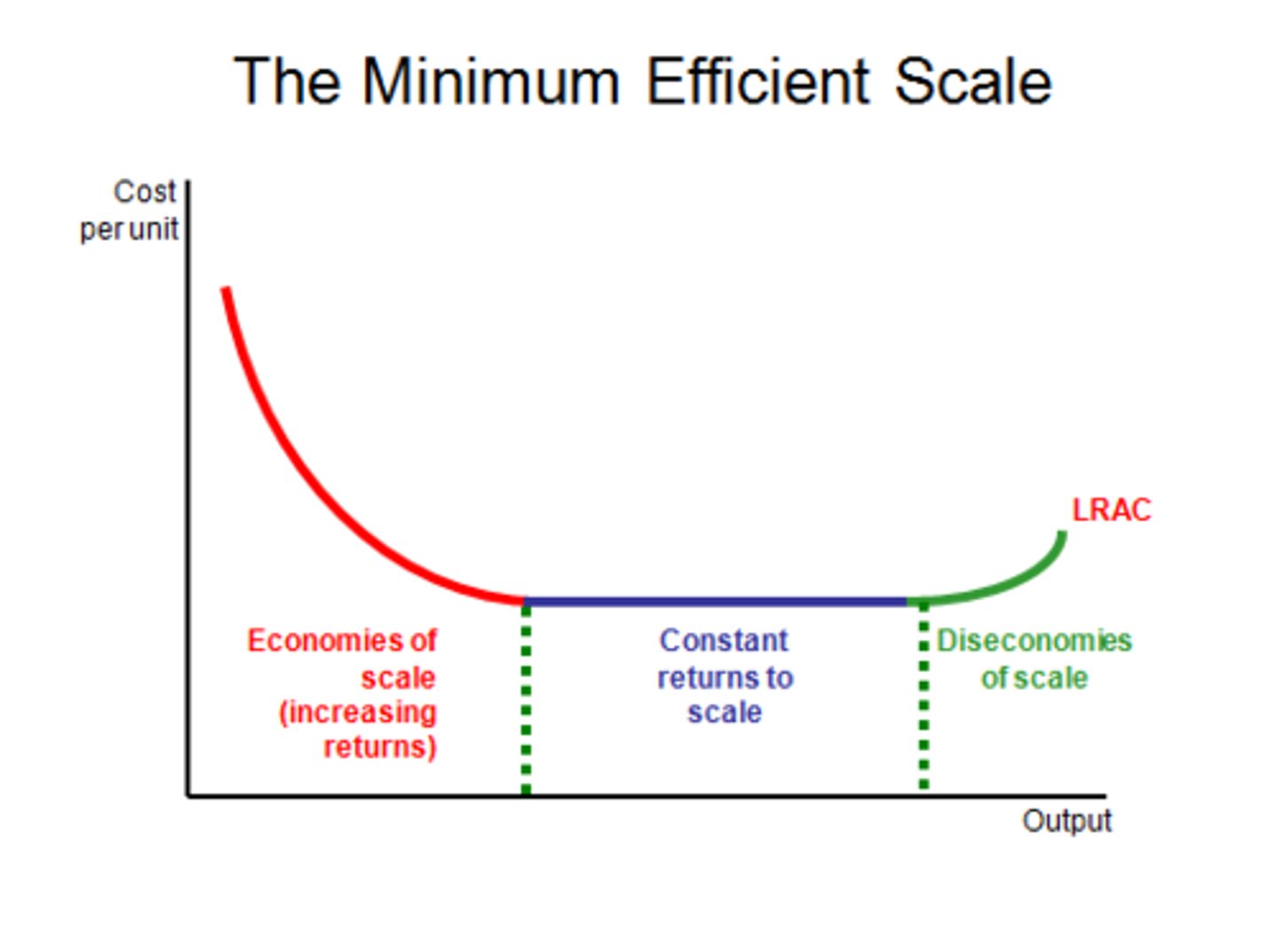

Minimum efficient scale / MES

The lowest point on a cost curve where a company can produce a product at a competitive price and with the lowest possible unit cost. It's the point where a company can achieve the economies of scale needed to compete effectively in its industry

Economies of scale diagram

Diagram depicting economies of scale, the MES is achieved at the start of the plateau (where red meets blue)

Short run cost curves

Diagrams showing how it is only possible to increase output by adding more units of the variable factor to the fixed factors. NOTE: The MC curve always intersects the ATC and AVC curves at their lowest points as this is when the marginal cost is equal to the average, an increase in marginal cost will drag the average up. Each successive worker adds less and less output due to the law of diminishing returns.

Product Curve

Show how the firm's total product, marginal product, and average product change as the firm varies the quantity of labour employed.

Economic Cost

The opportunity cost of production which includes both the real costs of production and also the value that could have been generated by the next best alternative foregone.

Diminishing Average Returns

As an extra unit of a variable factor is added to a given quantity of a fixed factor, the output per / divided by the unit of the variable factor will eventually decrease due to interruptions in the production process with a fixed number of capital with more labour employed.

External economies of scale

The cost benefits that all firms in the industry can enjoy when the industry expands, which results in a falling LRAC, regardless of the size of the firm.

External diseconomies of scale

Rising average costs of production, shown by a rise in LRAC, as an industry grows either too quickly for the derived demand to keep up with, or beyond its optimal size.

Price taker

A firm that faces a given market price and whose quantity supplied has no effect on that price; a perfectly competitive firm with a low share in the market. Their TR curve will have a constant gradient.

Price maker

A firm with some market power to set the price because the demand curve for its output slopes downward as the market it operates in is imperfect; a firm with market power. Inverted U shaped Total Revenue Curve.

Dilution

When the market has a higher amount of firms competing against each other within it, leading to the market becoming diluted and a greater share of price takers.

Total Revenue

the amount paid by buyers and received by sellers of a good, computed as the price of the good x the quantity sold

Average Revenue

total revenue divided by the quantity sold, identical to price per unit.

Marginal Revenue

the additional income from selling one more unit of a good; sometimes equal to price

0

Total Revenue is maximum when Marginal Revenue =

Normal Profit

The economist version of break even, is only earned where Total Revenue = Total Cost. This is when the firm earns back the financial cost and the opportunity cost. The firm/industry is said to be in equilibrium, meaning that the firm is said to be in equilibrium.

Supernormal profit

Profit above normal profit, when the Average Revenue exceeds the Average Costs. Supernormal profits are the pull for new firms to join the industry.

Subnormal profit

Profit below normal profit, when total costs are greater than total revenue, meaning that the revenue is insufficient to cover the opportunity cost.

Marginal Profit

Profit of one more unit of output, computed as marginal revenue minus marginal cost

Increasing returns to scale

When output increases more than in proportion to an increase in all inputs and a decline in long run average costs.

Constant Returns to scale

the property whereby long-run average total cost and output stays the same as the quantity of output changes

Decreasing returns to scale

when long-run average total cost increases as output increases, or when the increase in output is less than proportionate to the increase in input.

AC or MC

A change in fixed costs won't affect

Profit Satisficing

Making just enough profit to satisfy the demands of owners eg. shareholders while minimising the damage to other stakeholders, such as workers (Wage depression), the government (Excess pricing for consumers) and environmental pressure groups (Resource degradation and waste)

Revenue Maximisation

An alternative goal of firms (as opposed to profit maximization). Happens for economies of scale benefits (due to greater Q produced), predatory pricing (to undercut other firms) and the principal agent problem. This occurs when marginal revenue is equal to zero (MR = 0).

Predatory Pricing

Selling a product below cost for a short period of time to drive competitors out of the market

Sales Maximisation

An attempt to sell as much as possible in a given time period (or an attempt to generate as much sales revenue as possible in a given time period)