FAR Chapter 12 - Leases

1/39

There's no tags or description

Looks like no tags are added yet.

Name | Mastery | Learn | Test | Matching | Spaced |

|---|

No study sessions yet.

40 Terms

What is a lease?

A lease is “a contract that conveys the right to use an underlying asset for a period of time in exchange for consideration”

Who is the lessor?

the ‘entity that provides the right to use an underlying asset in exchange for consideration’

Who is the lessee?

the ‘entity that obtains the right to use an underlying asset in exchange for consideration’.

What is a right of use asset?

A right-of-use asset ‘represents a lessee's right to use an underlying asset for the lease term

What are lease payments?

Payments made by a lessee to a lessor relating to the right to use an underlying asset during the lease term

When does a contract contain a lease? What 2 things must the contract give the customer?

if it conveys the ‘right to control the use of an identified asset for a period of time in exchange for consideration

the contract must give the customer:

the right to substantially all of the identified asset’s economic benefits

the right to direct the identified asset’s use.

Can the right to direct the use of the asset still exist if the lessor puts restrictions on its use in a contract?

Yes, These restrictions define the scope of a customer’s right of use

When does a customer NOT have the right to use an identified asset?

t if the supplier has the practical ability to provide an alternative asset and if it would be economically beneficial for them to do so.

What is the substance and legal form of a lease agreement?

Substance = Lessee has the right to use the asset for a period of time in exchange for consideration

Legal form = The asset legally belongs to the lessor

Substance does NOT equal legal form

Purchase of assets (substance = legal form)

What do we recognise initially with lessee accounting?

Lease liability - Recognise at present value (PV) of payments not yet made:

fixed payments

amounts expected to be paid under residual value guarantees

options to purchase that are reasonably certain to be exercised

termination penalties if lease term reflects expectation that they will be incurred.

2 Right of use asset - Recognise at cost, which equals:

initial value of lease liability

payments made at or before commencement (deposits/advance payments)

initial direct costs (NEVER add general costs)

estimated costs of asset removal or dismantling as per lease conditions (can include environmental clean up costs)

What is the double entry to record a right of use asset?

Dr Right-of-use asset (non-current assets) X

Cr Lease liability (PV of payments not yet made) X

Cr Cash/payables (initial direct costs and deposits/advance payments) X

-> may include a CR entry for a provision for dismantling costs

What does the lease term comprise of?

non-cancellable periods

periods covered by an option to extend the lease if reasonably certain to be exercised

periods covered by an option to terminate the lease if reasonably certain not to be exercised.

What are lease payments are discounted by using?

interest rate implicit in the lease, or if unavailable

the lessee’s incremental borrowing rate.

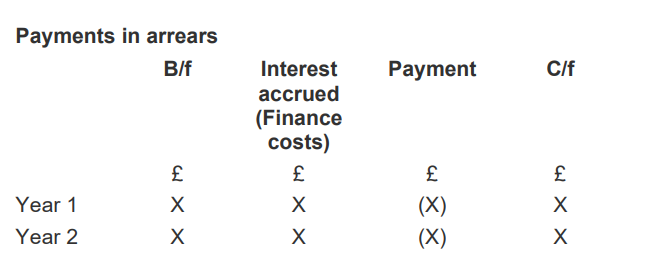

What is the lease liability table for payment in arrears?

b/f Interest accrued at X% (FC) Payment c/f

Year 1 X X (X) X

Year 2 X X (X) X

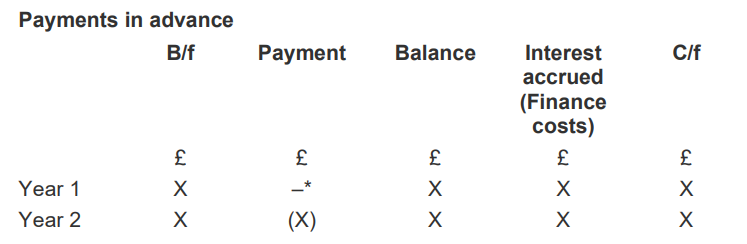

What is the lease liability table for payment in advance?

fdwdsd b/f Payment Balance Interest accrued (FC) c/f

Year 1 X - X X X

Year 2 X (X) X X X

What is the PV formula to calculate the present value of future lease payments?

= PV[0.05, 3, 10000, 5000]

= PV[Discount rate, lease term, initial annual payment, diff. between option period and initial annual paymens)

Or for payments in advance where payment has already been paid

=PV(0.05,3, 100000,-50000)

Where -50000 is the amount paid in advance

What is the double entry for the interest accrued?

DR Finance cost X

CR Lease liability X

What is the double entry for lease payments?

DR Lease liability X

CR Cash X

What is the finance charge using the ‘constant periodic rate of interest’ method?

X% × balance of liability outstanding

What is the current and non-current liability using the payment in arrears table?

b/f Interest accrued at X% (FC) Payment c/f

Year 1 X X (X) X

Year 2 X X (X) X

Year 1 c/f = Liability at end of Year 1

Year 2 c/f = Non-current liability

Difference between Year 2 c/f and Year 1 c/f = Current liability

What is the current and non-current liability using the payment in advance table?

fdwdsd b/f Payment Balance Interest accrued (FC) c/f

Year 1 X - X X X

Year 2 X (X) X X X

Year 1 c/f = Liability at end of Year 1

Year 2 balance = Non-current liability

Difference between Year 2 balance and Year 1 c/f = Current liability

How do we treat initial deposits?

DR Right of use asset X

CR Cash X

→ It doesn’t impact the lease liability

How do we treat incentives received before/on commencement of the lease?

They are are deducted to arrive at the initial right-of-use asset figure.

Note: Incentives received after commencement of the lease are not examinable

What 2 terms are right of use assets depreciated over?

over the shorter of the lease term and the useful life of the asset if ownership does not transfer to the lessee at the end of the lease term

OR

over the useful life of the asset if ownership does transfer to the lessee.

What are right of use assets subject to?

impairment reviews

What can happen if the right-of-use asset belongs to a revalued class of assets?

it may also be revalued. If revalued, it is the fair value of the right of use which is relevant (not the underlying asset’s fair value).

What is the definition for economic life?

the period over which an asset is expected to be economically useable by one or more users, or the number of production or similar units expected to be obtained from an asset by one or more users

What is the useful life?

the period over which an asset is expected to be available for use by an entity’

What should you assume about ownership?

you should assume that ownership of the asset does not transfer to the lessee, nor do they have the option to purchase the asset at the end of the lease term (unless the question states this).

When is a simplified treatment allowed? What is recognised?

If the lease is short-term (12 months or less at the inception date),

or

of a low value

the lessee can choose to recognise the lease payments in the SPL on a straight line basis.

No lease liability or right-of-use asset would therefore be recognised.

What are some examples of low-value underlying assets?

tablet and personal computers, small items of office furniture and telephones.’

What are the 2 criteria for choosing the simplified treatment?

The election to use the exemption:

must be made by asset class for short-term leases

can be made on a lease-by-lease basis for low-value assets.

What 7 things should be disclosed, regarding leases?

depreciation charge for right-of-use assets

finance cost on lease liabilities

expense relating to short-term leases

expense relating to leases of low-value

total cash outflow for leases

additions to right-of-use assets

carrying amount of right-of-use assets by class of underlying asset (if not given on the face of SFP).

What does an entity do in a sale and leaseback transaction? What is this a common way of doing?

an entity sells one of its own assets and immediately leases the asset back.

This is a common way of raising finance whilst retaining the use of the related asset.

The buyer/lessor is normally a bank

What is an example of when a transfer is not a sale?

if the lessee has a substantive right to repurchase the asset.

What is the accounting treatment if the transfer is not a sale?

Continue to recognise asset.

Recognise a financial liability equal to proceeds received.

What is the accounting treatment if the transfer is a sale?

Derecognise the asset.

Recognise a right-of-use asset as the proportion of the previous carrying amount that relates to the rights retained.

Recognise a lease liability.

A profit or loss on disposal will arise.

What are the double entries for a sale and leaseback?

Dr Cash (Proceeds) X

Cr Property, plant and equipment (carrying amount) X

Dr Right-of-use asset (Carrying amount × Lease liability/FV) X

Cr Lease liability (PV of lease payments) X

Dr/Cr Loss/Profit on disposal (β) X

Proceeds will ALWAYS equal fair value

ROU asset formula is aka “proportion of rights retained”

What 2 leases are there with UK GAAP?

A finance lease

– is a lease that transfers substantially all the risks and rewards of ownership to the party using the asset.

An operating lease

– is any lease other than a finance lease.

How do you account for the 2 types of lease in UK GAAP?

To account for a finance lease:

record the acquisition of the asset, creating a fixed asset and equal finance lease liability:

– Dr Fixed asset – Cr Finance lease liability

– The amount recorded should be the lower of the fair (cash) value of the asset and the present value of minimum lease payments.

charge the annual depreciation on the fixed asset in the same way as under IFRS standards.

subsequently, account for the liability in the same way as the liability for a rightof-use asset.

To account for an operating lease:

recognise the lease payments in P&L on a straight-line basis