CIT 300 chapter 2 notes / identifying competitive advantages

learning outcomes:

explain why competitive advantages are temporary

what are the 4 key areas of a SWOT analysis

describe porter’s five forces model and explain each force

compare porter’s 3 generic strategies

demonstrate how a company can add value using porter’s chain value analysis

identifying competitive advantages

business strategy: a leadership plan that achieves a specific set of goals/objectives such as increasing sales, decreasing costs, entering new markets, or developing new products or services

stakeholder: a person or group that has an interest or concern in an organization. stakeholders drive business strategies, and depending on the stakeholder’s perspective, the business strategy can change

competitive advantage: a feature of a product or service on which customers place a greater value than they do on similar offerings from competitors

example: raising canes and kfc. in certain places, canes may have a competitive advantage over kfc because of their cane’s sauce being close in price value to regular kfc sauces.

first-mover advantage: occurs when a company can significantly increase its market share by being first with a new competitive advantage

example: when apple introduced itunes with the ipod before other companies included software with their mp3 players

competitive intelligence: the process of gathering information in a competitive environment in order to increase a businesses chance at succeeding

different stakeholders found in businesses

partners/suppliers

reliable contracts

ethical materials handling

responsible production

shareholders/investors

maximize profits

grow market share

high return on investment

community

professional associations

ethical recycling

increase employment

employees

fair compensation

job security

ethical conduct/treatment

customers

exceptional costumer service

high-quality products

ethical dealing

government

adhere to laws and regulations

increase employment

ethical tax reporting

business tools for analyzing business strategies

SWOT analysis: evaluates project position

evaluates an organization’s Strengths, Weaknesses, Opportunities, and Threats to identify things that work for or against business strategies

potential internal strengths: strengths associated with the competitive advantage

potential internal weaknesses: areas that require improvement

potential external strengths: trends that the organization can benefit from

potential external weaknesses: outside risks detrimental to an organization

—

the five forces model: evaluates industry attractiveness

analyzes the competitive forces within the environment in which a company operates to access the potential for profitability in an industry

threat of substitute products/services:

power of customers to buy alternatives

becomes high when there are many alternatives, and low when there are few

buyer power:

power of customers to drive down prices

switching costs: costs that make customers reluctant to switch to different products/services

loyalty programs: rewards customers based on their spending

threat of new entrants:

power of competitors to enter a new market

high when there are few entry barriers to enter a new market and low when there’s many

entry barrier: a feature of a product or service that customers have come to expect and that new competitors must offer in order to survive in the market

supplier power:

power of suppliers to increase the price of materials

supplier can increase power by:

charging higher prices

limiting services or quantity

shifting costs

and this power can be decreased by:

using MIS to find alternative products

supply chain: consists of all parties involved in getting raw materials or a product

rivalry among existing competitors:

high when competitive is fierce in a market and low when there’s less competition

product differentiation: occurs when a company develops unique differences in its product/services in order to influence demand

—

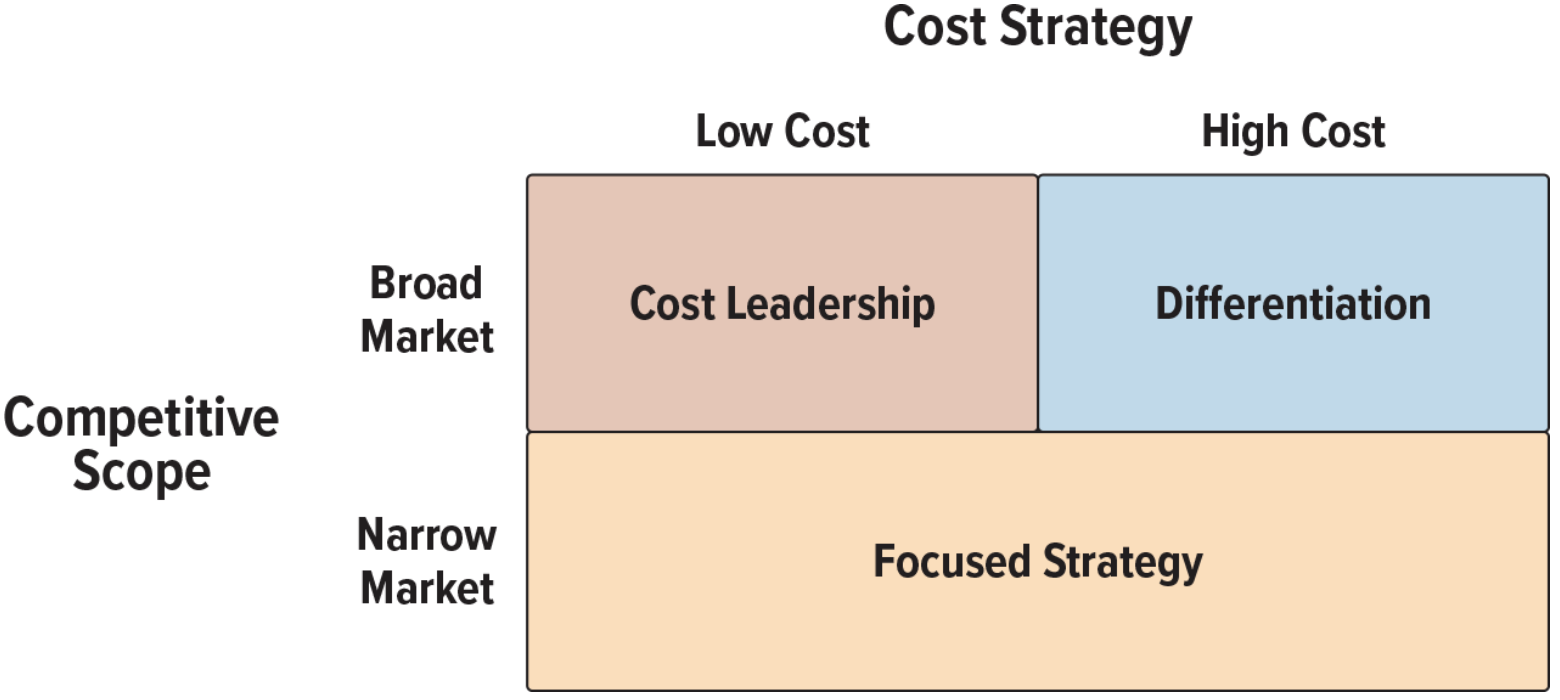

portner’s three generic business strategies: chooses business focus

generic business strategies that are neither organization nor industry specific and can be applied to any business, product, or service

broad market, low cost: loads of different products at low costs

example: walmart

broad market, high costs: loads of different products at high costs

example: erewhon

narrow market, low costs: a specific product at low costs

example: payless shoe stores, cheap shoes

narrow market, high costs: a specific product at high costs

example: jimmy choo, expensive shoes

—

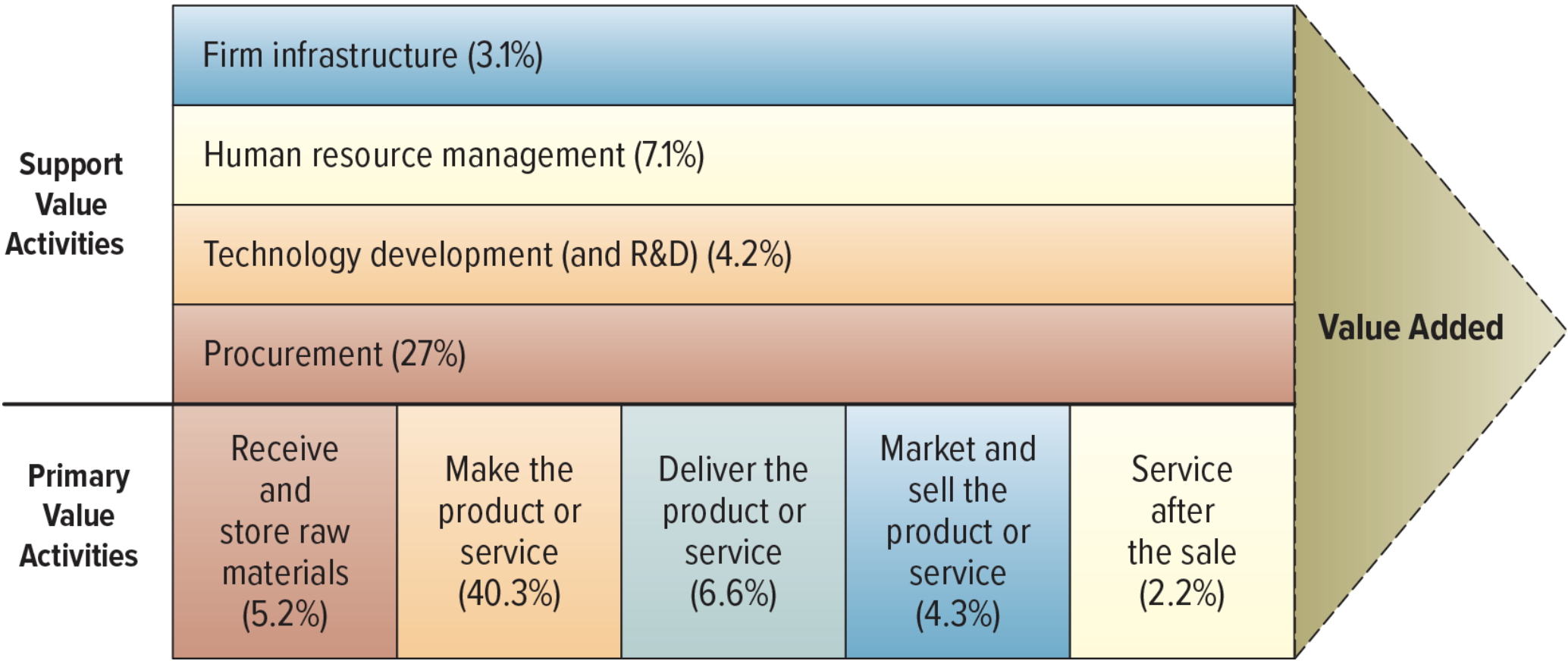

value chain analysis: executes business strategy

views a firm as a series of business processes that each add value to a product or service

business process: a set of activities that accomplish a certain task

primary value activities: acquire materials, and manufacture, deliver, market, sell and provide after-sales services

inbound logs

operations

marketing and sales

service

support value activities: help with firm infrastructure, HR development, tech. development, and procurement

firm infastructure

HR

tech dev.:

procurement

digital value chain: digitizes work across primary and supporting activities

case study questions:

porter’s five forces evaluate how “attractive” a market could be to a business, i.e, how profitable that market could be. this “attractiveness” is calculated using “five forces,” which are: the threat of alternative products, the threat of new entrants, the threat of existing competition in the market, and buyer and supplier power

so, if you’re planning on opening a coffee shop in a small town, you could think about the alternative to your place that people could go to get coffee for cheaper, how many new coffee shops may enter the market where you live, if you already have coffee shops in your town, and you could think about how you could get buyer and supplier power on your side, possibly by making a rewards program or by up charging on your coffee

it would be difficult to operate in more than one of porter’s generic strategies because each business strategy operates in a specific market with specific prices

learning outcomes are on page 30

review questions on page 31

Knowt

Knowt