Chapter 6: Merchandising Operations and the Multistep Income Statement

Objective 6.1: Distinguish between service and merchandising activities.

Operating Cycles

Operating activities are done by companies and businesses to generate revenues.

Service companies provides a service to their customers (ex: gym memberships, cleaning services)

The operating cycle for service companies goes as follows:

Selling a service

Collecting payment/cash

Using the cash to pay for operating expenses

Merchandising companies buy products from manufacturers to resell to their customers.

The operating cycle for merchandising companies goes as follows**:**

Buy inventory

Reselling inventory

Collecting cash

Using the cash to pay for operating expenses

Manufacturing companies make their own products to sell.

The products made by manufacturers and sold by merchandisers is inventory (goods held for sale).

The day you buy inventory, it is an asset. Once sold, it becomes an expense.

Objective 6.2: Explain the differences between periodic and perpetual inventory systems.

Inventory Systems

Merchandisers have three accounts they focus on: Inventory, Sales Revenue, and Cost of Goods Sold.

Inventory shows the costs of goods that is being held for sale.

Sales Revenue is the total selling price of all goods sold.

Cost of Goods Sold is the total cost of all goods sold.

Gross profit represents profit earned before taking into account other expenses such as salaries, wages, depreciation, etc.

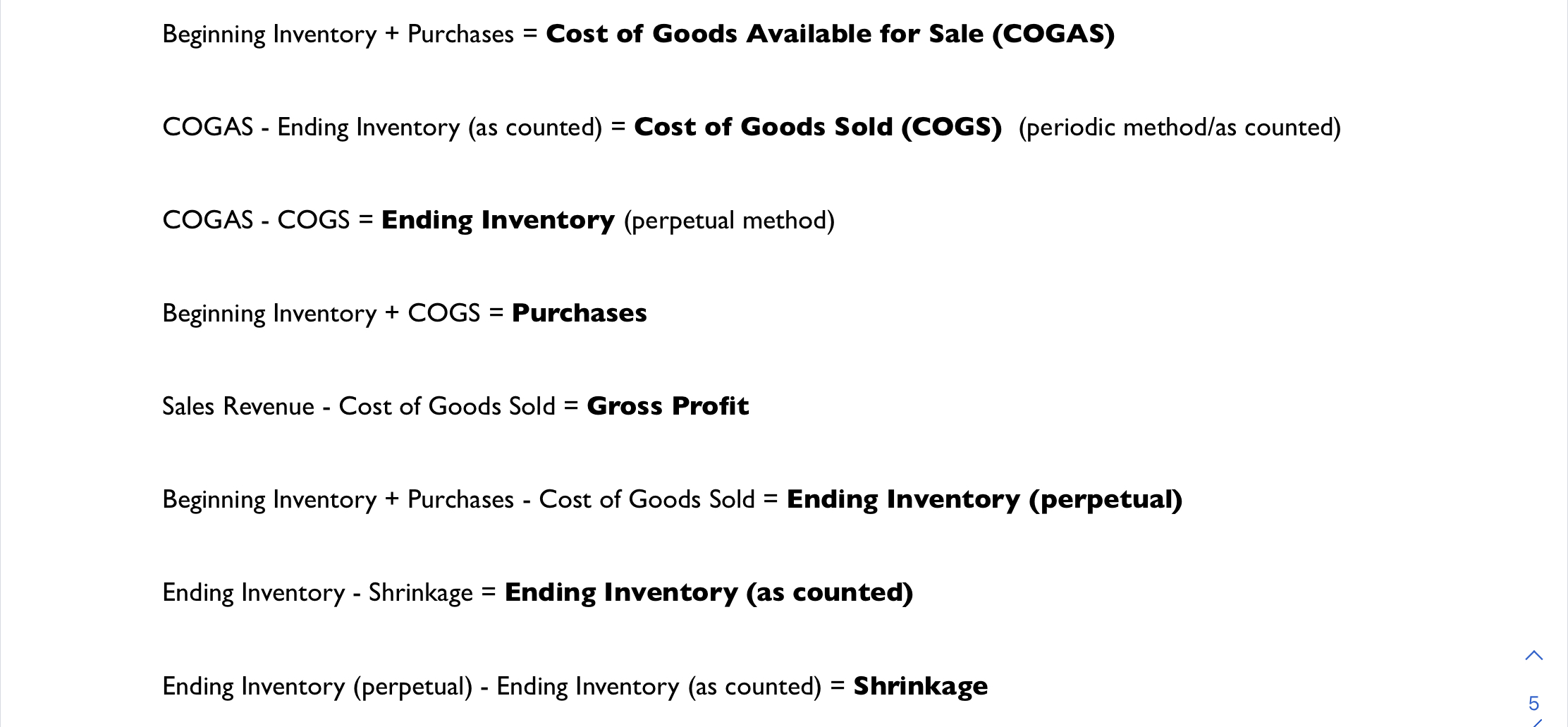

Equation to calculate gross profit:

Sales Revenue - Cost of Goods Sold = Gross Profit

Beginning inventory is the stock of inventory we have at the start of an accounting period.

Purchases are what you buy throughout the year.

Goods Available for Sale is everything you can potentially sell.

Equation to calculate goods available for sale:

Beginning Inventory + Purchases = Goods Available for Sale

If the goods available for sale are sold, it becomes Cost of Goods Sold on the Income Statement.

Equation to calculate cost of goods sold:

Beginning Inventory + Purchases - Ending Inventory = Cost of Goods Sold

If the goods available for sale are not sold, they stay on the balance sheet as ending inventory.

Ending inventory is the stock of inventory you still have at the end of the accounting period.

Equation to calculate ending inventory:

Beginning Inventory + Purchases - Cost of Goods Sold = Ending Inventory

Periodic Inventory System

A periodic inventory system updates the inventory records for merchandise purchases, sales, and returns only at the end of the accounting period.

We use the periodic system for small companies (self-owned, mom and pop shops).

To know how much inventory is on hand, there must be a physical count of inventory at the end of the period.

We use the Cost of Goods Sold equation for the periodic system (BI + P - EI = CGS). Ending Inventory is known because of the physical count done, we are finding cost of goods sold.

Advantage: Simple to maintain (dealing with “small” inventory)

Disadvantage: Cannot calculate theft, so count may not be accurate.

Perpetual Inventory System

When using a perpetual inventory system, inventory is updated every time it is bought, sold, or returned.

Used with bigger businesses (Walmart, Target) because of large inventory.

These stores use bar codes and scanners to update inventory. Scanning a product shows inventory has been removed and lets the business know to buy more.

The perpetual methods uses the equation: Cost of Goods Available for Sale - Cost of Goods Sold = Ending Inventory.

Cost of Goods Sold is known because of the continuous inventory updating, so we know what we have sold.

A physical count is needed at least once a year.

Inventory Control

A perpetual system has better inventory control because it is continuously updating its inventory count.

The perpetual system can also estimate shrinkage, which is the loss of inventory from theft, fraud, and error.

Equation to calculate shrinkage:

Ending Inventory (perpetual method) - Ending Inventory (physical count) = Shrinkage

ALL EQUATIONS:

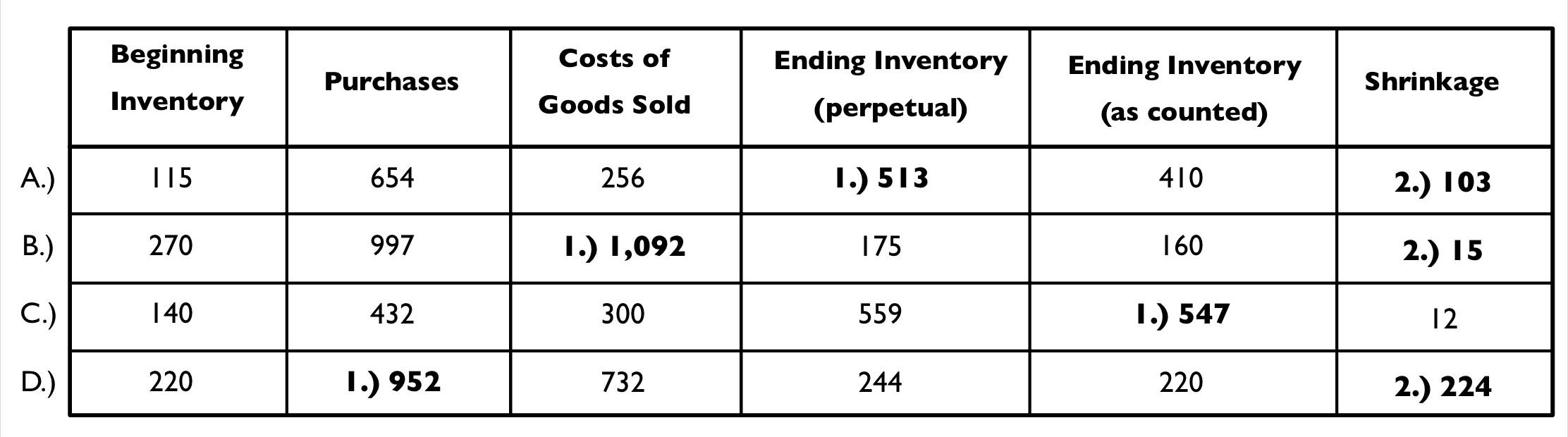

EXAMPLE:

Step 1: Find the equation(s) that needs to be used.

Step 2: Fill in the equation with numbers needed.

Step 3: Solve.

A1.) Solve for Ending Inventory (perpetual)

Equation: Beginning Inventory + Purchases - Cost of Goods Sold

Fill: 115 + 654 - 256 = Ending Inventory (perpetual)

Answer: 513

A2.) Solve for Shrinkage

Equation: Ending Inventory (perpetual) - Ending Inventory (as counted)

Fill: 513 - 410 = Shrinkage

Answer: 103

B1.) Solve for Cost of Goods Sold

Equation: Beginning Inventory + Purchases - Ending Inventory (as counted)

Fill: 270 + 997 - 175 = Cost of Goods Sold

Answer: 1,092

B2.) Solve for Shrinkage

Equation: Ending Inventory (perpetual) - Ending Inventory (as counted)

Fill: 175 - 160 = Shrinkage

Answer 15

C.) Solve for Ending Inventory (as counted)

Equation: Ending Inventory (perpetual) - Shrinkage

Fill: 559 - 12 = Ending Inventory (as counted)

Answer: 547

D1.) Solve for Purchases

Equation: Beginning Inventory + COGS

Fill: 220 + 732 = Purchases

Answer: 952

D2.) Solve for Shrinkage

Equation: Ending Inventory (perpetual) - Ending Inventory (as counted)

Fill: 244 - 220 = Shrinkage

Answer: 224

Objective 6.3: Analyze purchases transactions under a perpetual inventory system.

Transportation Costs

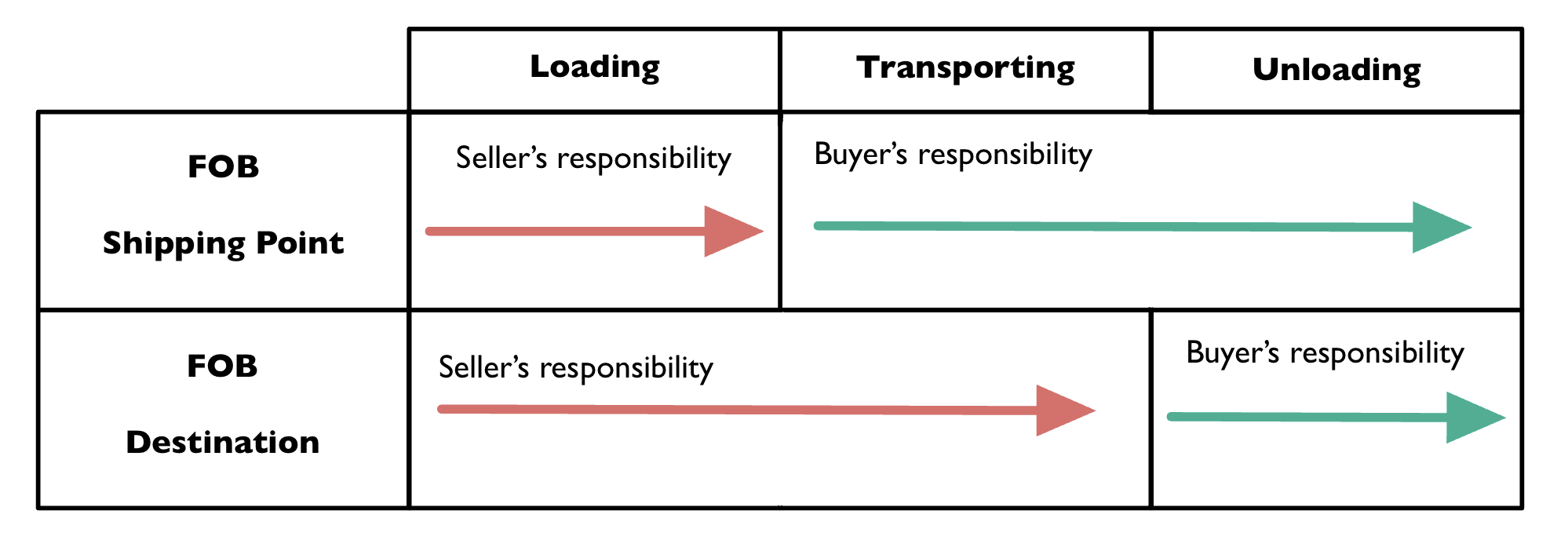

The transfer of control between the merchandiser and the customer can occur at two points.

The sale for FOB shipping point is recorded when the seller loads the goods onto the truck. Goods in transit belong to the customer at the point of shipping.

“Delivery” occurs when goods are loaded onto the truck.

The sale for FOB destination is recorded when the goods arrive to the customer. They are ready to be unloaded. Before this arrival, the goods belong to the seller until they reach their destination.

“Delivery” occurs when goods are ready to be unloaded by the buyer.

Purchase Returns and Allowances

Purchases Returns and Allowances is a contra account to purchases.

When products are received and are damaged or a customer is not satisfied with the purchase, they can either:

Return the item for a full refund or

Keep them and ask for a cost reduction, aka an allowance (Purchase R & A).

When these returns and allowances happen, either a cash refund or reducing a liability owed to the supplier will be recorded.

Purchase Returns and Allowances has a normal debit balance

Purchase Discounts

Purchases discounts are an incentive for prompt payment.

Example: 2/30, n/60

The 2 represents the discount percentage offered.

The 30 is the number of days this offer is available, aka the discount period.

The “n” is for “net” purchase (after returns and allowances).

The 60 is the maximum credit period and indicates when the final payment is due.

Inventory is recorded at the value after the discount is accounted for.

Objective 6.4: Analyze sales transactions under a perpetual inventory system.

Recording Inventory Sales

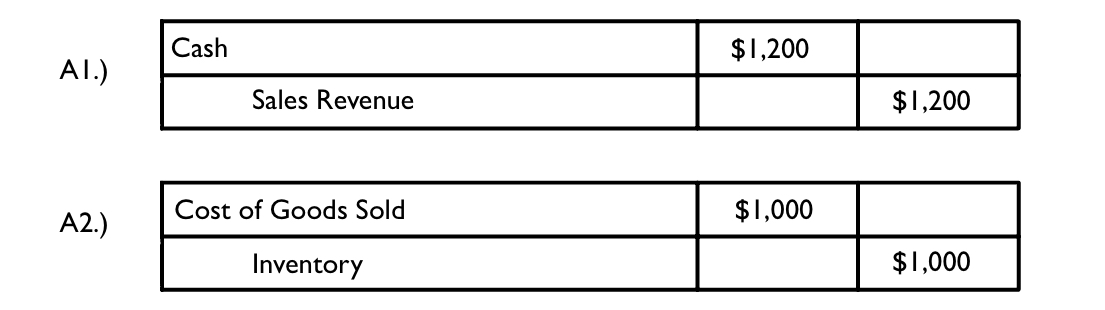

Every merchandise sale will have two journal entries and are recorded in a perpetual inventory system.

The first entry is to record the sale at the selling price:

Debit Cash

Credit Sales Revenue

The second entry is to record cost:

Debit Cost of Goods Sold

Credit Inventory

Because Cost of Goods Sold is an expense, it will always be debited.

Example (part A):

A company sells 4 bikes at the price of $300 and receives a total of $1,200 cash (300 x 4). The original cost of the bikes is $250 in the company’s records, which totals $1,000 cash (250 x 4)

Sales Returns and Allowances

When goods sold to a customer arrive damaged or do not satisfy the customer, the customer can either:

Return the goods for a full refund OR

Keep the product and ask for a reduction in the selling price for the item, aka an allowance (Sale R & A).

Sales Returns and Allowances (Sales R & A) is a contra account and reduces the amount the seller would have received from the customer.

Contra accounts oppose the accounts they are stuck to, so Sales has a normal credit balances and Sales Returns and Allowances has a normal debit balance.

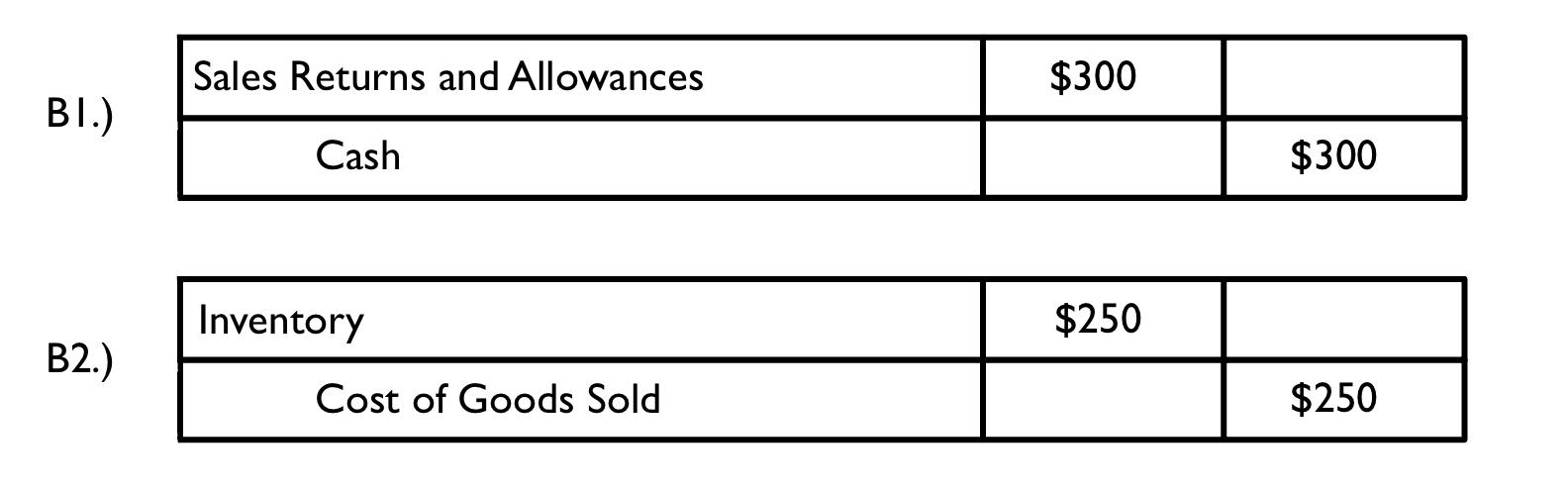

There are two journal entries:

One updates sales records (shows what customer got charged)

Debit Sales Returns and Allowances

Credit Cash

And the other updates inventory records (shows what the company paid for it)

Debit Inventory

Credit Cost of Goods Sold

Example (part B):

One bike is later returned to the store and the customer is given a full refund of $1,200. The bike is then put back into inventory at the original cost (given in part A, $250).

Sales Discount

When giving customers a discount, instead of lumping the discount into a sales revenue account, we use a contra-account called Sales Discount.

Sales Discount is attached to Sales Revenue.

Sales has a normal credit balance, so Sales Discounts has a normal debit balance**.**

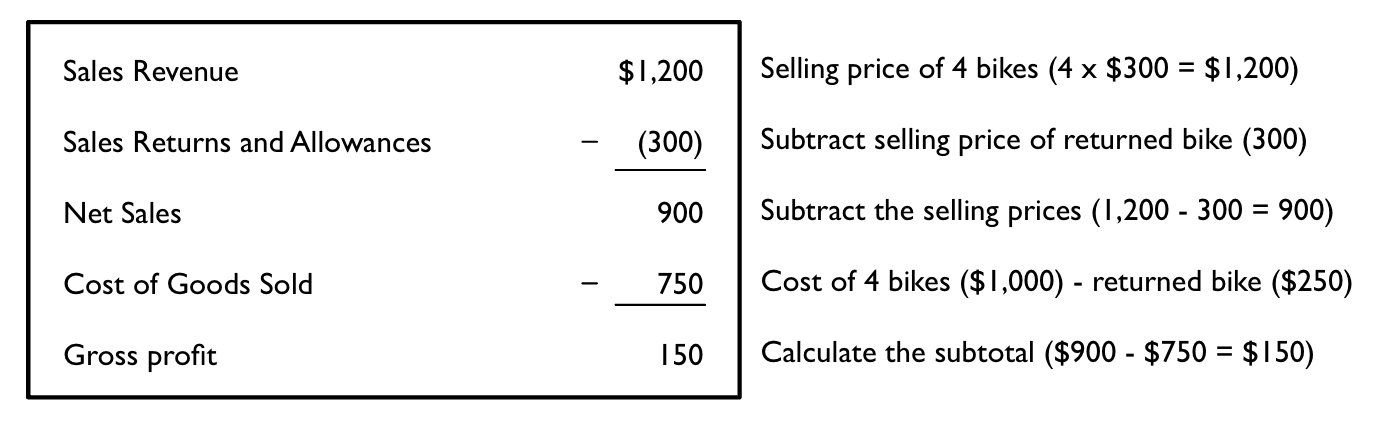

Reporting Sales-Related Transactions

The first step of the multistep income statement is to calculate gross profit.

Equation to calculate profit:

Net Sales - Cost of Goods Sold = Gross Profit

Equation to calculate net sales:

Sales Revenue - Sales Returns & Allowances - Sales Discounts = Net Sales

Example (part C): Report the effects of sales transaction.

Objective 6.5: Analyze sales of bundled items under a perpetual inventory system.

Sales of Bundled Items

A bundle is packaging items together and selling them for one price to create a “deal” for the customer.

Bundles can be of products or products AND services together.

The journal entries are different because if it’s just a product bundle, the product is given and revenue can be recorded.

If it is a product and service bundle, the service must be provided before recording revenue.

For these recordings, the Five Step Revenue Model can be followed:

Identify the contract

Identify the seller’s performance obligations

Determine the transaction price

Allocate the transaction price to the performance obligation

Recognize revenue when each performance obligation is satisfied.

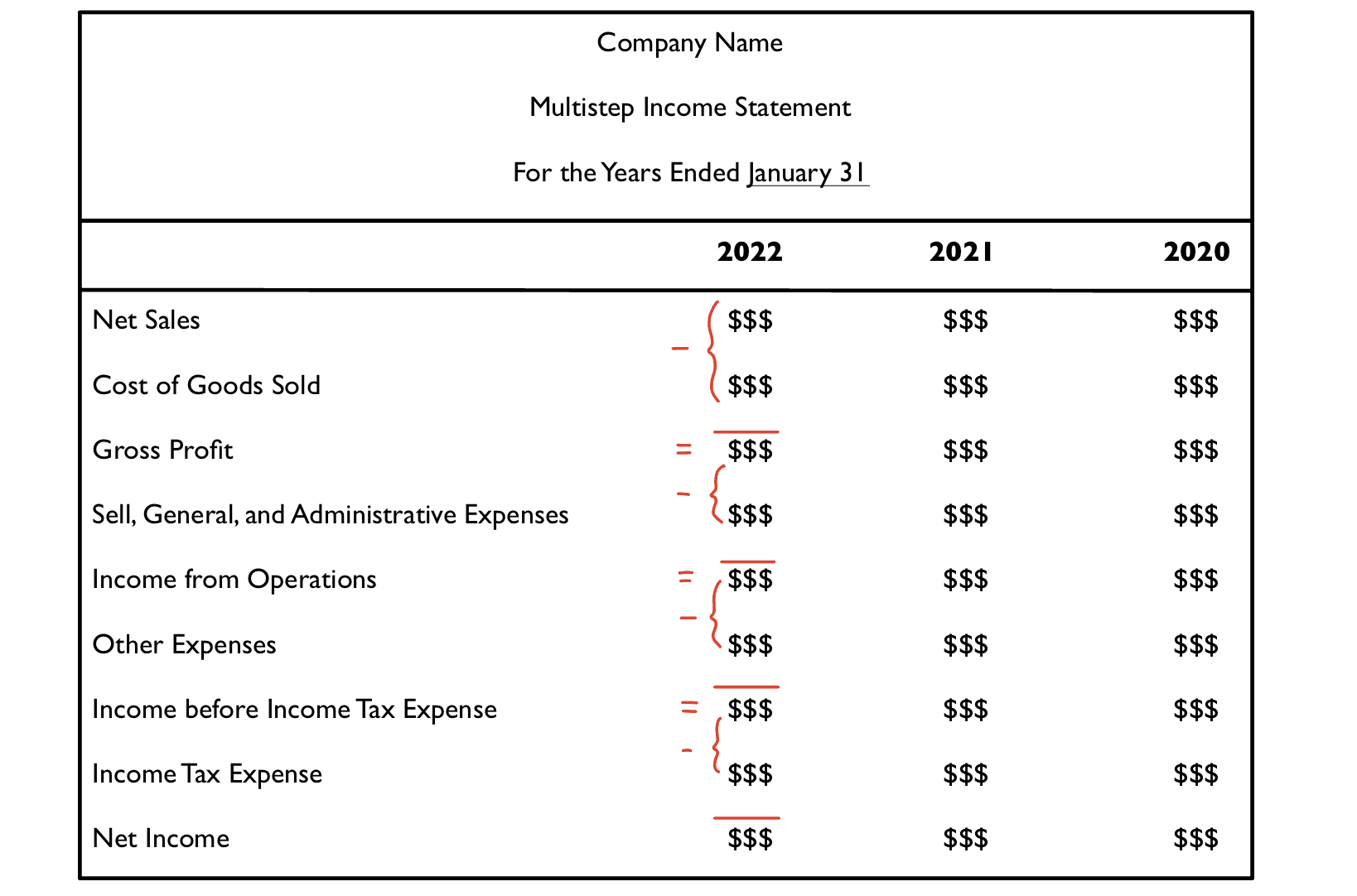

Objective 6.6: Prepare and analyze a merchandiser’s multistep income statement.

Multistep Income Statement

The Multistep Income Statement reports alternative measures of income by calculating subtotals for core and peripheral business activities.

The most important thing on a multistep income statement is the calculation of gross profit (gross margin), which is Net Sales - Cost of Goods Sold (example above).

Selling, General, and Administrative Expenses groups expenses like salaries, wages, utilities, advertising, rent, and transportation.

A multistep income statement will contain more than one year for comparative purposes.

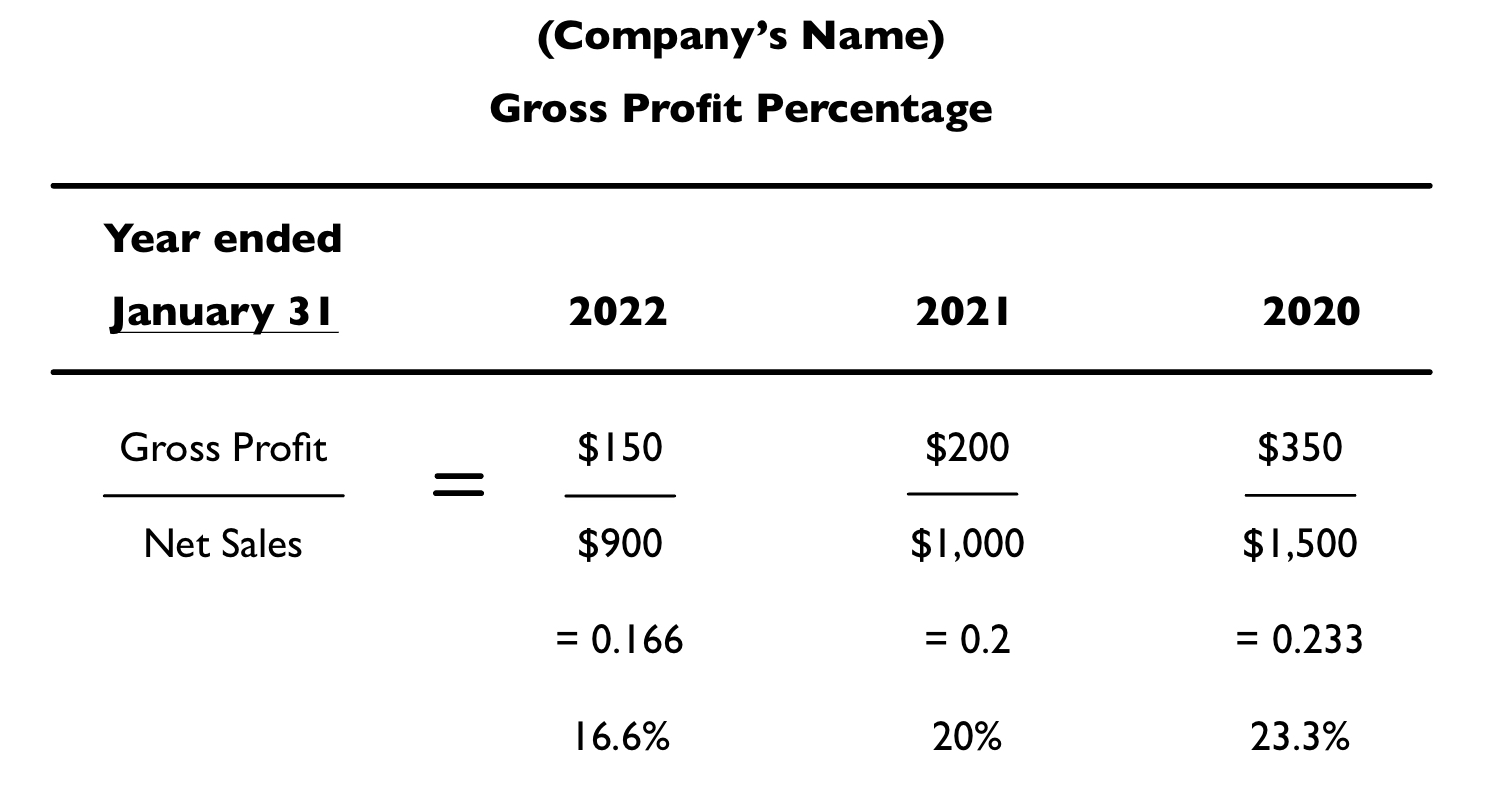

Gross Profit Analysis

Gross profit analysis helps compare the multistep incomes statements.

Equation to calculate gross profit percentage %:

Gross Profit/Net Sales x 100

The ratio calculated from this equation can be used to:

Analyze the company’s operations over the years.

Compare companies

See if a company is getting enough income to cover its operating expenses.

We want a higher percentage.

Example (part D)

Extra Material

There are two methods to Purchase and Sales Discounts

Gross method

Net Method

A company must establish which method they use.

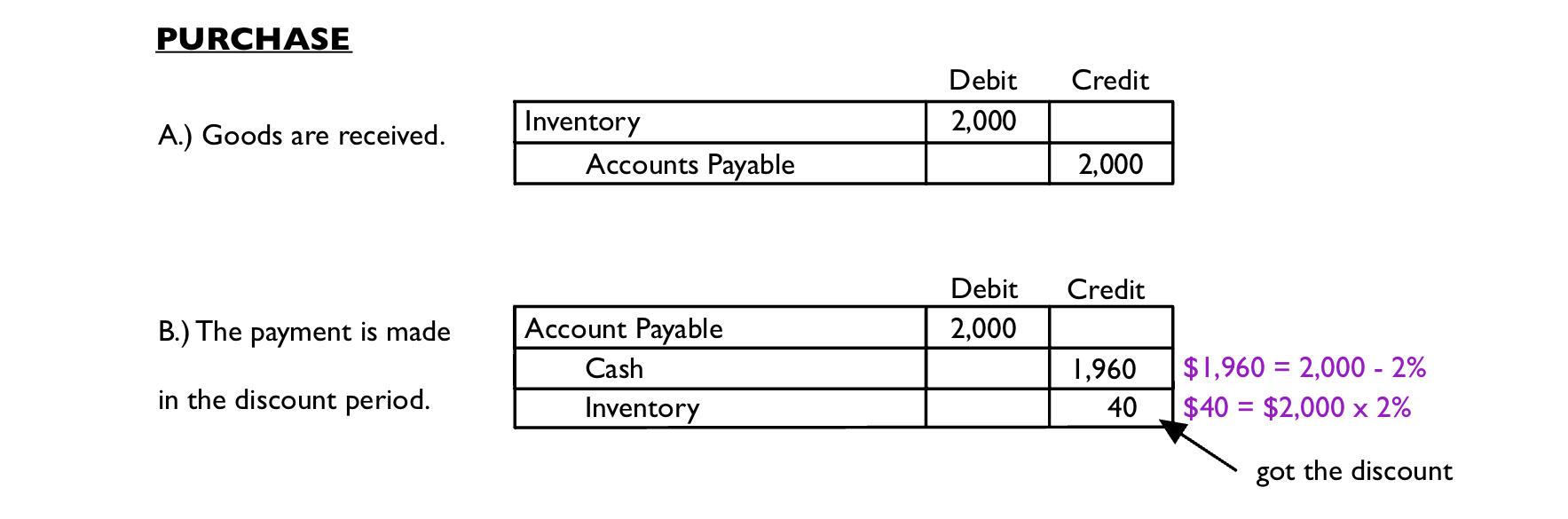

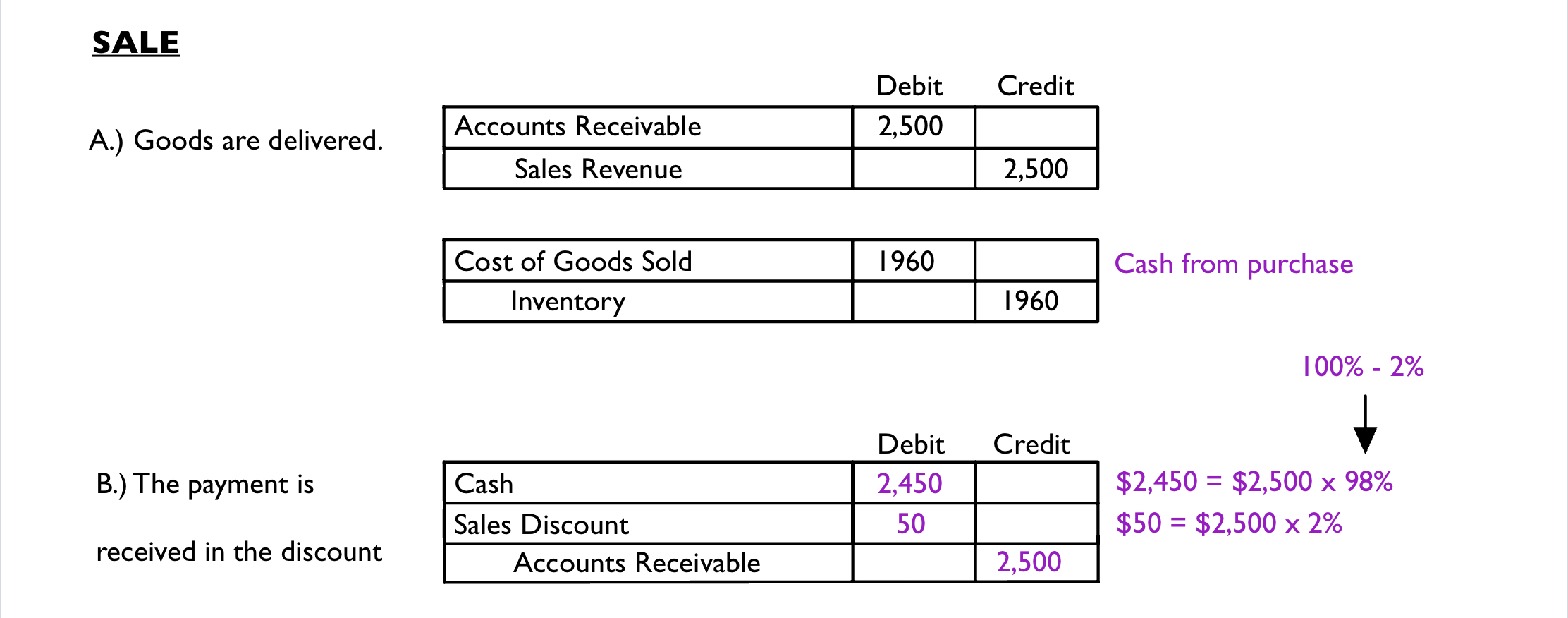

Gross Method

Gross Method = perpetual method

Can be called the “wait and see” method, we wait to see if the discount is taken before recording it.

Once the discount is used, we can book it.

Recorded later when cash is paid or received.

Example: A company buys merchandise for $2,000 with terms 2/30, n/60, offered by the supplier. The company then sells the merchandise to another business (the customer) at the price of $2,500, with terms 2/30, n/60. offered to the customer. The company pays within the discount period and the customer pays the company in the discount period.

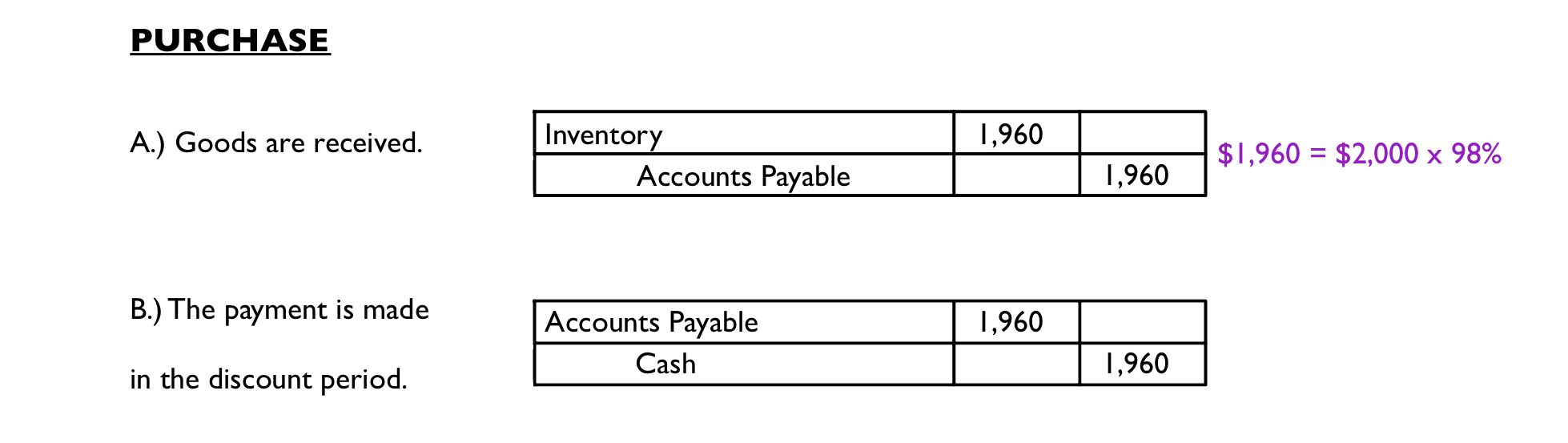

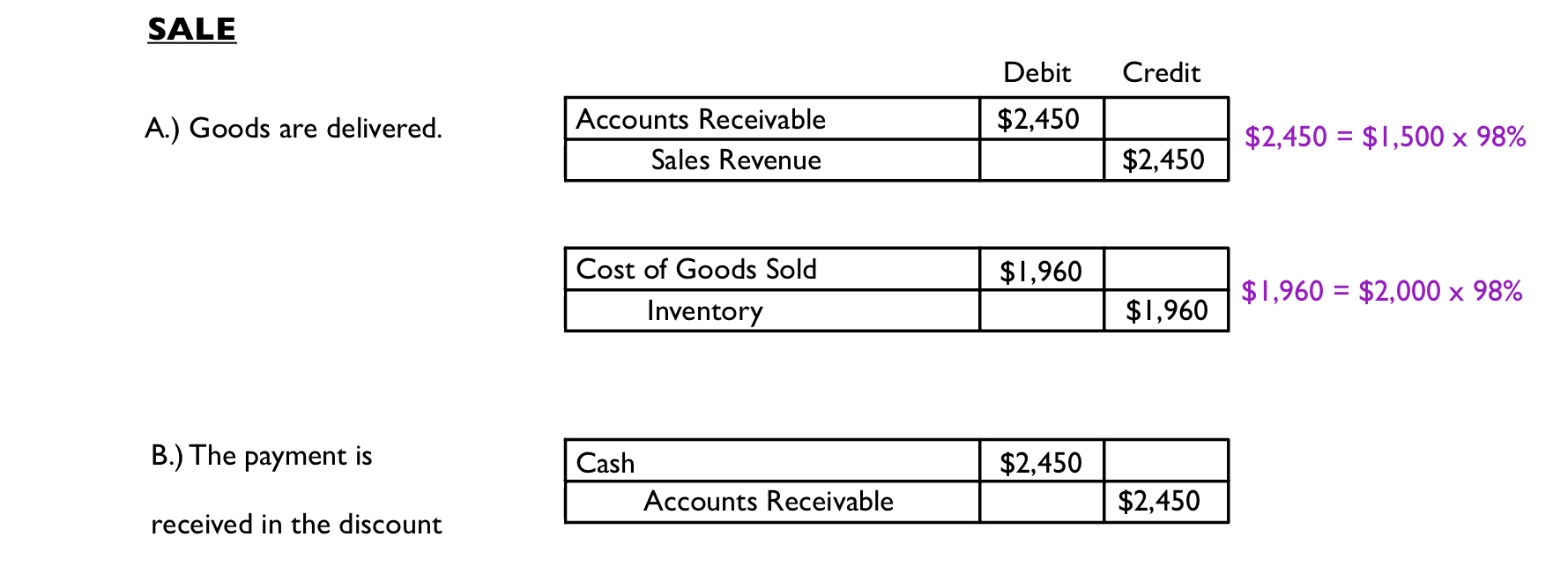

Net Method

Net Method = periodic method

Can be called the “assumption” method.

We assume the discount is taken and record it when its first offered (at the time of the initial purchase or sale).

If the discount is not taken, we must update the record.

Example: A company buys merchandise for $2,000 with terms 2/30, n/60, offered by the supplier. The company then sells the merchandise to another business (the customer) at the price of $2,500, with terms 2/30, n/60. offered to the customer. The company pays within the discount period and the customer pays the company in the discount period.

Knowt

Knowt