International Trade and Finance

Module 41: Capital Flows and the Balance of Payments

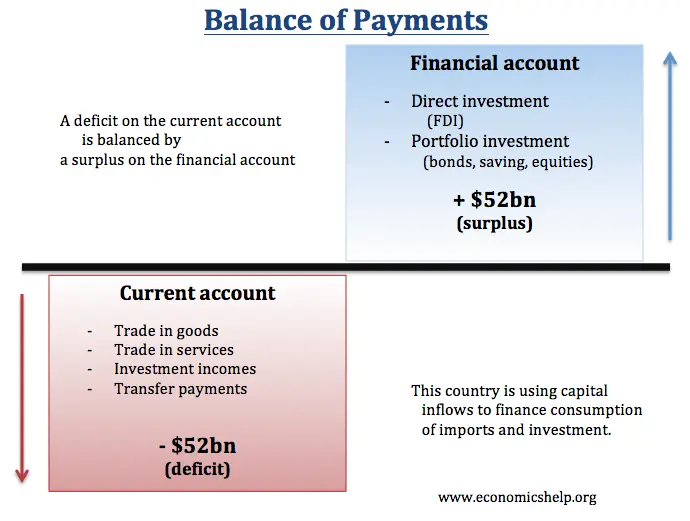

Balance of payments accounts is the summary of a country’s transactions with other countries

Amount of money gained + amount of money lost = 0

The current account is made up of goods and services, factor income, and transfers

The financial account is made up of assets/financial capital inflow and liabilities/outflow

Difference between a country’s sales to foreigners and foreign purchases

Real estate, stocks, and bonds

Capital flow

Payments to and from foreigners make up factor income

International transfers are funds sent from one country’s residents to another

Bonds lend money to the government to get it back later

The balance of payments on goods and services is the difference between the value and exports and imports during a given period

The trade balance is the difference between a country’s exports and imports

Only includes goods and not services

Capital is goods used to produce other goods

In foreign direct investment, companies build factories or acquire assets abroad

The equilibrium interest rate is the intersection of supply curve for loanable funds

Financial capital flows into countries with higher interest rates and out of those with lower interest rates

Two-way capital flows are common between economies

Module 42:

The foreign exchange market is the market where currencies are traded

Exchange rates are the prices at which currencies trade

When a currency’s value increases in terms of others, it appreciates

Exports fall and imports rise

When a currency’s value decreases in terms of others, it depreciates

Exports rise and imports fall

The equilibrium exchange rate is where currency quantity demanded is equal to currency quantity supplied

When demand for one currency changes, there is a corresponding change in the supply of the other currency

Real exchange rates are exchange rates adjusted for international differences in aggregate price levels

Other kind is nominal exchange rates

Accounts for differences in inflation rates

The aggregate price level is the general price of all goods and services over time

Purchasing power parity is the nominal exchange rate where something would cost the same price in each country

Ex: 1,000 pesos = $100

Increase in interest rates cause real exchange rates to decrease