WEEK 6

WATCH YOUTUBE VIDEO LINK

Property Investment Overview

Learning Objectives:

Understand characteristics of commercial and residential property investment.

Determine investment returns, past performance determinants, and market volatility.

Leverage effects on risk and return.

Grasp taxation issues related to property.

Assess pros and cons of indirect investment in property.

Investing in Property

Rise of the ‘Property-Owning Middle Class’: Growth of individuals owning property as an investment.

UK Property Market: Governance of both residential and commercial property.

Gearing Property Investments: Use of leverage to increase potential returns.

Returns on Investment: Consider both long-term and short-term perspectives.

Advantages of Property Ownership

Security: Owning property provides stability.

Capital Appreciation: Increase in property value over time.

Income Generation: Rental income from properties.

Buy to Let: Opportunity to purchase rental properties for income.

Collateral for Loans: Property can be used as security for borrowing.

Downsizing and Retirement: Selling property to fund retirement.

Disadvantages of Property Ownership

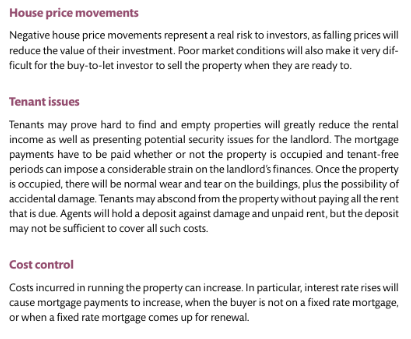

Lack of Liquidity: Difficulty in converting property to cash quickly.

Indivisibility: Can't easily split property investments.

High Initial Investment: Significant funds needed for diversification.

Time and Costs: Involvement of maintenance, management, and legal issues.

Legal Problems with Tenancy: Potential disputes with renters.

Uncertainty of Occupancy: Fluctuating cash flow due to vacancy risks.

Residential Property Investment

Income and Tax Implications: Understanding rental income and taxes.

Stamp Duty: Tax on property purchases.

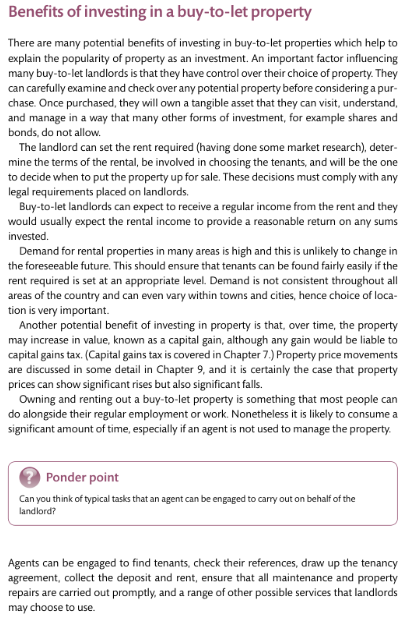

Buy to Let: Explore advantages (e.g., rental income) and disadvantages (e.g., market risks).

Choosing Property and Risks: Importance of selection and awareness of market declines.

Tenure: Different forms of property ownership (freehold vs leasehold).

Commercial Property

Types: Retail, office, and industrial spaces.

Tax Position on Income: Understanding income tax implications.

Capital Gains Treatment: How gains are taxed upon selling property.

Other Costs: Stamp duty and maintenance costs.

Indirect Investment in Property

Main Investment Vehicles:

Property shares.

Property unit trusts and OEICs (Open-Ended Investment Companies).

REITs (Real Estate Investment Trusts).

Property funds.

Insurance company property funds.

Limited liability partnerships and offshore investments.

Advantages and Disadvantages of Pooled Property Investments

Expertise: Access to professional property assessment.

Risk Distribution: Risks spread across various investments.

Liquidity: Greater liquidity than direct property investments.

Control: Lack of control over specific properties.

Illiquidity: Despite better liquidity, some illiquidity remains.

Property Appraisal

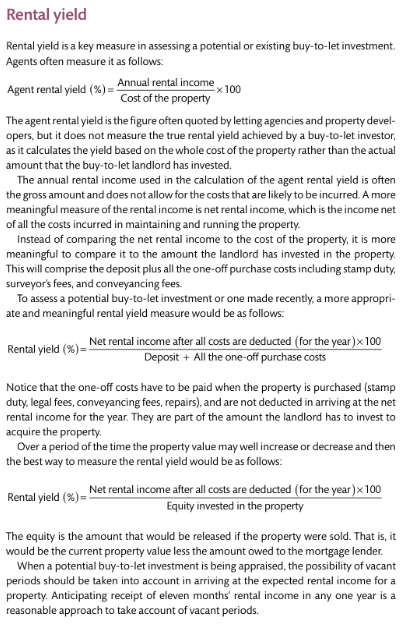

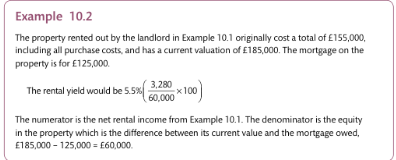

Types of Returns: Understand both rental yield and capital growth.

Rental Yield Calculation: Key metrics include gross rent and expenses.

Rental Yield Scenario

Example Setup: House divided into 2 flats, expected rental £480/month each.

Void Periods: Anticipating a 10% vacancy rate.

Purchase Price: £180,000 plus additional costs.

Agent Fees: 15% of gross rent.

Further Expenses: 5% of gross rent.

Gross Rent Calculation:

ext{Gross Rent} = 480 imes 12 imes 2 imes 90 ext{ extperthousand} = 10,368Adjusted for Expenses:

10,368 imes 80 ext{ extperthousand} = 8,294Rental Yield Calculation:

ext{Rental Yield} = rac{8,294}{180,000 + 1,800 + 1,200} = rac{8,294}{183,000} ext{ yields } 4.5 ext{ extperthousand}

New Buy to Let Rules 2015

Changes Post Summer Budget: Including tax relief adjustments and stamp duty increases.

Impact on Higher Rate Taxpayers: Diminished tax relief leading to increased tax obligations.

Summation of Insights

Government Initiatives: Promoting home-ownership through tax incentives.

Ownership Benefits: Include security, income generation, and asset appreciation.

Recognizing Disadvantages: Illiquidity, investment risk, and maintenance costs.

Commercial Property Attractiveness: Opportunities for larger investors in structured formats.

Indirect Investment: Accessing property markets through corporate shares and trusts for diversified exposure.