AP Microeconomics Ultimate Guide

My version of an AP Microecon study guide!

Unit 1 - Basic Economic Concepts

1.1 - Scarcity

Economics is the study of how an individual or an organization manages and allocates their resources effieciently. The need to allocate and organize resources comes from the concept of scarcity.

The economic problem states that our needs are unlimited and the resources available are scarce.

All resources are limited!

Scarcity : unlimited wants, limited resources (ex: land). Where society does not have enough resources to produce the goods and services which everybody needs. As a consumer, we must make choice as to how to allocate resources properly.

Microeconomics vs Macroeconomics

Microeconomics: Narrows down to individuals and firms, doesn’t focus on the big picture.

Macroeconomics: Focuses on the ecnomy as a whole, very big picture.

Factors of Production

These are resources that are scarce, can be broken down into four categories:

Land: natural resources and raw material. Ex: water, oil.

Labor: physical labor, skills, and effort. Ex: factory workers

Capital: tools used to produce a good. Ex: conveyor belts, hammers, tractors, etc.

Entrepreneurship: the ability of an individual to run a business Ex: Sal Khan from Khan Academy

Opportunity Costs and Trade-offs

Trade-offs: The alternative choice which must be given up in order to make a decision. The goods and services which you do not choose are the trade-offs.

Opportunity costs: The next best alternative if your first choice is not available.

Positive vs Normative Economics

The study of Economics can be broken down into 2 ways:

Positive Economics: this approach to economics is based on facts and figures.

Normative Economics: this approach to economics is based on assumptions.

1.2 - Resource Allocation and Economic Systems

3 big economic questions:

What goods and services will be produced? The economy has to decide what goods and services the society needs in order to properly allocate resources.

How will goods and services be produced? This deals with how businesses will go about producing these goods and services.

For whom will the goods and services be produced? This question decides who will be able to consume these goods and services, to where these resources where will be allocated.

Types of Economic Systems

Centrally-Planned (Command) Economic System:

Here, the government makes all the economic decisions and answers the three questions on its own. They set the prices for goods and services, as well as set wage rates. They do not respond to consumer wants, and innovation is discouraged.

Market Economic System:

Economic changes are guided by the changes in price which occur as individuals and sellers interact in the market. There is a lot of competition and a variety of goods and services. However, there will be a wealth disparity in the market.

Mixed Economic System:

A system which has characteristics of both command and market system. There are private property rights which are protected, however, the government is able to intervene.

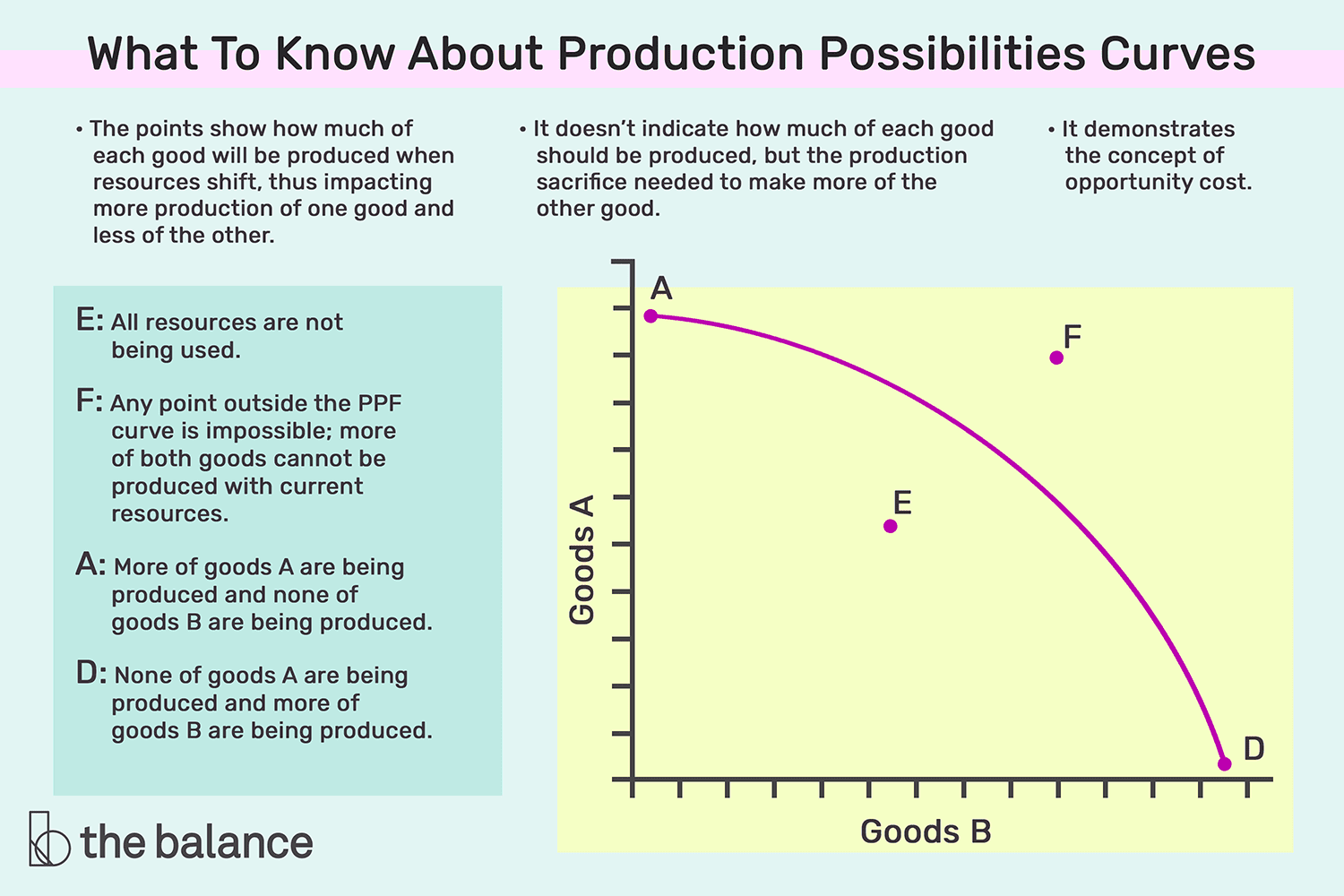

1.3 - Production Possibilities Curve

Represents the best possible combinations of goods, given a fixed amount of resources.

Illustrates the trade-offs that faces an economy, compares only two goods

If the PPC is linear, it has a constant opportunity cost, if it is curved, it has increasing opportunity costs

Economic growth : a rise in output and an increase in standard of living (can be caused by developments in technology, or an increase in resources)

Productive efficiency : lowest cost possible on the PPC

Allocative efficiency : the economy allocates resources so consumers are well off as possible, producing what is demanded

Constant opportunity cost

Occurs when oppurtunity cost stays the same as the production of a good increases.

Increasing opportunity cost

When one good is produced more, you give up more of another good.

Determinants of PPC

The curve can shift upwards or downwards respectively due to certain factors:

Changes in the amount of resources in the economy:

This could be due to changes in the labor force because of population changes, acquirement of new territories (ex: land for farming, mining, etc.), or destruction of territories due to weather conditions, etc.

Changes in technology and productivity:

This could be due to government schemes to help farmers for instance or could be due to the usage of inefficient production techniques, etc

Trade:

This is dependent on new resources being discovered or improved production techniques.

1.4 - Comparative Advantage and Trade

Absolute Advantage: When a firm as the ability to produce a higher amount of goods or services in a given time, compared to the others.

Comparative Advantage: The ability of a firm to produce a good or service at the lowest oppurtunity cost

Terms of Trade: people split up the work, and provide each other with a good in return for another. It is also the rate at which one good can be exchanged for another (if the price of a good obtained from trade is less than the opportunity cost of producing it, trade is beneficial)

Capital goods: goods that make consumer goods (ex: machinery)

Consumer goods : goods that are consumed (ex: food)

1.5 - Cost-Benefit Analysis

Implicit costs: opportunity costs in terms of making a choice, can include money

Explicit costs: traditional out of pocket costs (ex: rent)

1.6 - Marginal Analysis and Consumer Choice

Utility: the measure of personal satisfaction (util is a unit of utility)

Marginal utility: the change in total utility by consumer one additional unit of that good/service

Principle of diminishing marginal utility : additional units of a good/service add less total utility than the previous units do

Marginal utility per dollar : MU good ÷ P good (marginal utility of one unit of the good / price of one unit of the good)

Optimal consumption rule : to maximize utility, marginal utility per dollar spent on each good = service in consumption bundle, MU 1 ÷ P 1 = MU 2 ÷ P 2

Unit 2 - Supply and Demand

All the basics of Supply and Demand which are the foundation of the majority of concepts moving forward.

2.1 - Demand

Demand: the quantity which a consumer/buyer are willing and able to buy at different prices

Movement on the graph: downward sloping

Demand slopes down on the graph due to:

Income effect

Substitution effect

law of diminishing marginal utility

Law of Demand: As price ↑, demand ↓, and as price ↓, demand ↑

Determinants of demand:

Taste and preferences, related goods, income, buyers, expectations

Substitutes : good/service that can be used in place of another, when price of one increases, consumers will buy more of the other (ex: coffee and tea)

Substitution effect: as the price of a good increases, consumers substitute the good with another that is cheaper

Complements : goods/services that are consumed together (ex: hamburgers and buns)

Income effect: as income increases, people will buy more of normal goods, and less of inferior goods

Normal good : increase in demand when consumer’s income increases (ex: oreos)

Inferior good : increase in demand when consumer’s income decreases (ex: off brand oreos)

Diminishing marginal utility: As more units of a product are consumed, the satisfaction/utility it provides tends to decline

ex: The more glasses of water you drink, the statisfaction you get from drinking each glass starts to decline because you are forcing yourself to drink each glass

2.2 - Supply

Supply: different quantities of goods/services which sellers are willing and able to produce at a given price

Law of supply: as price ↑, quantity supplied also ↑, this is a direct relation.

The market supply shows the quantity a supplier is willing and able to offer at various prices at a given time

Reasons for the Law of Supply

Rising prices give greater opportunities to suppliers to earn a profit

With every additional unit, suppliers face an increase in the marginal cost of production

Charging higher prices provides them with the easiest way to cover the cost

The vice versa is also true; lower prices wouldn’t provide the incentive to motivate the supplier and thus reduces the quantity of product

The supply curve shifts upward, and the movement along the supply curve indicates a change in price.

Shifters of supply :

Resource costs and availability

The cost of production (land, labor, capital) has an inverse impact on the supply

When the cost of these increases, the supplier decides to produce less of the products since they are unable to afford the production cost

Other goods and services

Suppliers who produce more than one product (profit-maximizing firms) have an easier time switching to the production of another product if issues do arise in prices

ex: A farmer has land where he is able to produce corn and earn a profit

If his land is capable to produce wheat as well, in case the price of wheat increases to that of corn, he would switch to wheat production to earn better

The supply curve in this situation for wheat would shift outwards(more supply) and vice versa for corn(reduced supply)

Technology

Newer technology causes the cost of production to decline and helps improve the efficiency of the supplier

This allows the supplier to produce more, shifting the supply curve outwards(toward right)

ex: machines on the production line help reduce unit costs due to which more products are affordable by the supplier

Taxes and Subsidies

Taxes are added up to the unit cost of production, thus making it more expensive

Due to this, heavily taxed products are produced in less quantity by suppliers (supply curve shifts left)

Subsidies are the opposite of taxes and help reduce price per unit

This allows suppliers to produce more of the product(supply curve shifts right)

Expectation

If suppliers expect prices to increase in the future, they would hold back supply for the current time with the future goal of earning more profit later (and vice versa)

Number of sellers

As the number of sellers increases in the market, the supply automatically increases

This allows consumers more choices at a lower price due to an increase in competition

2.3 - Price Elasticity of Demand

Equation : %∆Qd / %∆P

0 = perfectly elastic, <1 = inelastic, =1 unit elastic, >1 = elastic

Midpoint formula : Qd2-Qd1 / (Q2d+Qd1) / 2 , replace with Qd with price for price

Inelastic demand : TR correlates direct with price

Elastic demand = TR correlates inversely with price

Elasticity: how much the Q is affected by P.

Elastic demand means that the goods are affected by a change in price.

Inelastic demand means that goods are not affected by a change in price.

Characteristics of Elastic Demand:

Flat, quantity is sensitive to price change, substitutes, luxury items, large portion of income, not needed immediately. Is equal to >1.

Characteristics of Inelastic Demand:

Steep, few substitutes, required now, small portion of income, is equal to <1

Shapes of elasticity/inelasticity

Perfectly elastic: infinity

Relatively elastic: >1

Unit elastic: 1

Relatively inelastic: <1

Perfectly inelastic: 0

2.4 - Price Elasticity of Supply

PES: measures how sensitive are sellers to price changes on goods

Equation : %∆Qs / %∆P

0 = perfectly elastic, <1 = inelastic, =1 unit elastic, >1 = elastic

Inelastic : unable to respond to price change

Elastic : short run

Extremely elastic : long run

Characteristics of Inelastic Supply:

Difficult production, high costs, hard to change to alternative, high barriers to entry, <1

Characteristics of Elastic Supply:

Easy production, low cost, easy to switch to, low barriers to entry, >1

2.5 - Other Elasticities

Cross price elasticity of demand : %∆Qd of Good A / %∆P of good B

Negative = compliments (inferior good), positive = substitutes (normal good)

Income elasticity of demand : %∆Qd / %∆income

1 = income elastic, <1 = income inelastic, negative = inferior, positive = normal

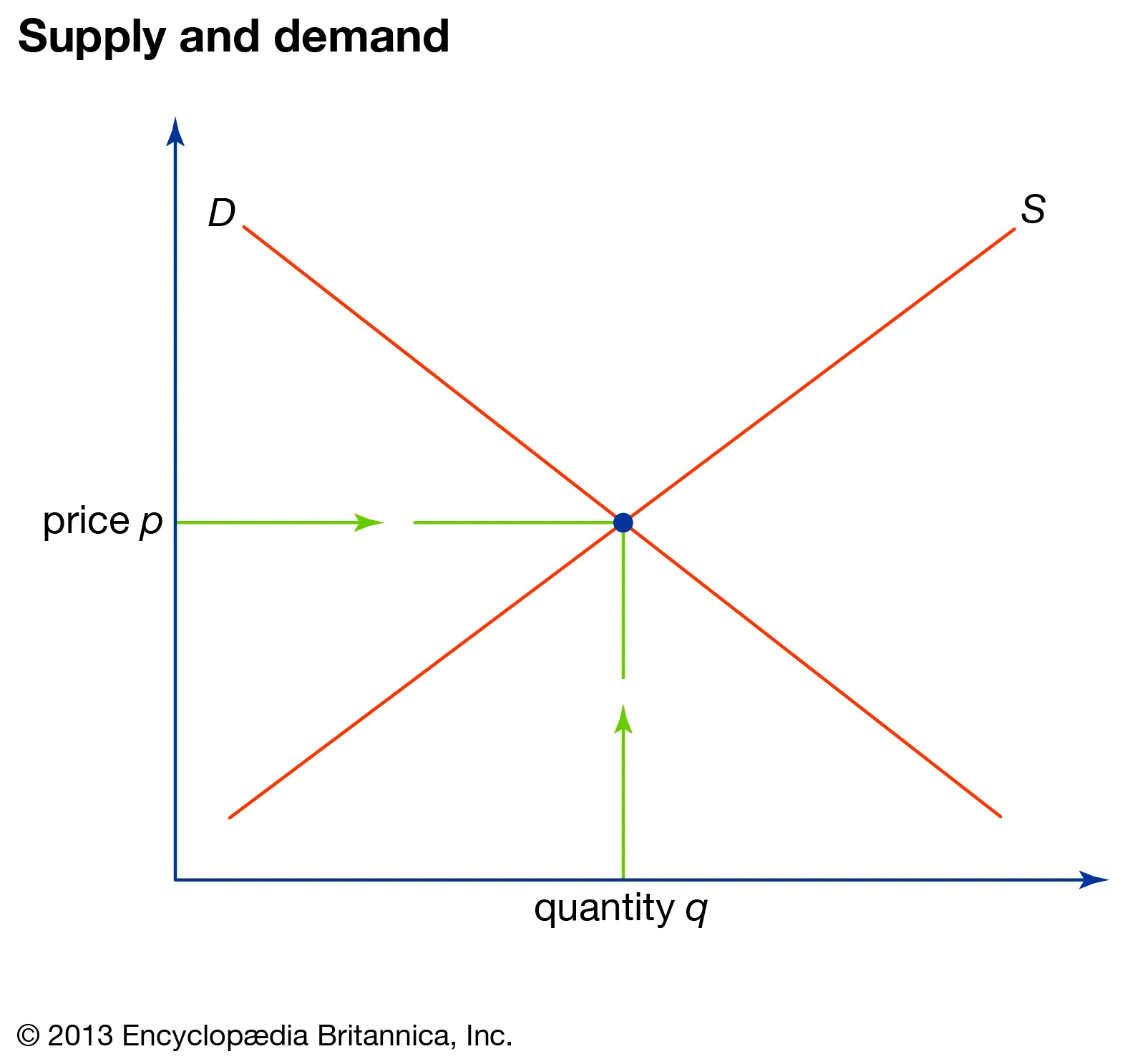

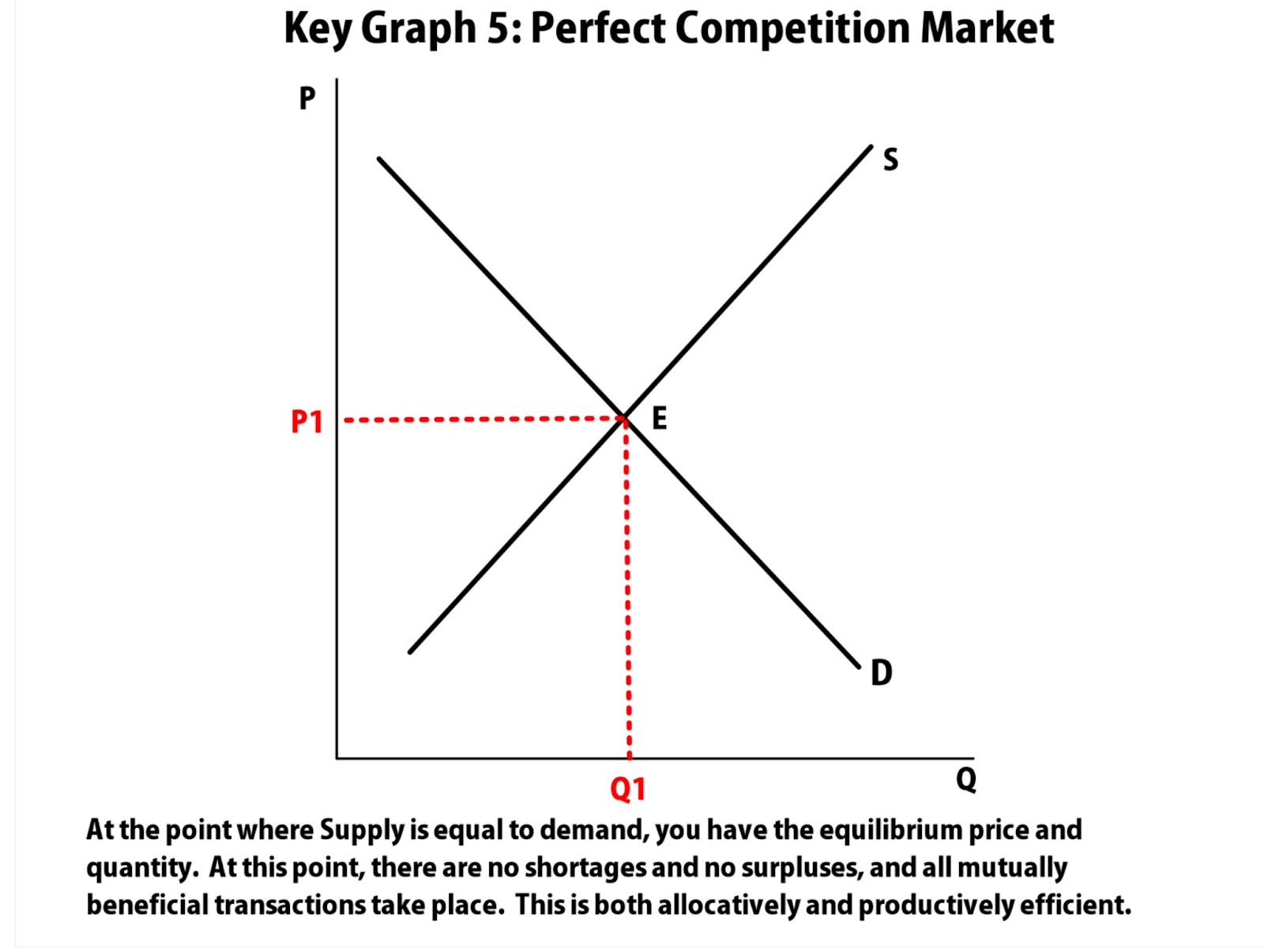

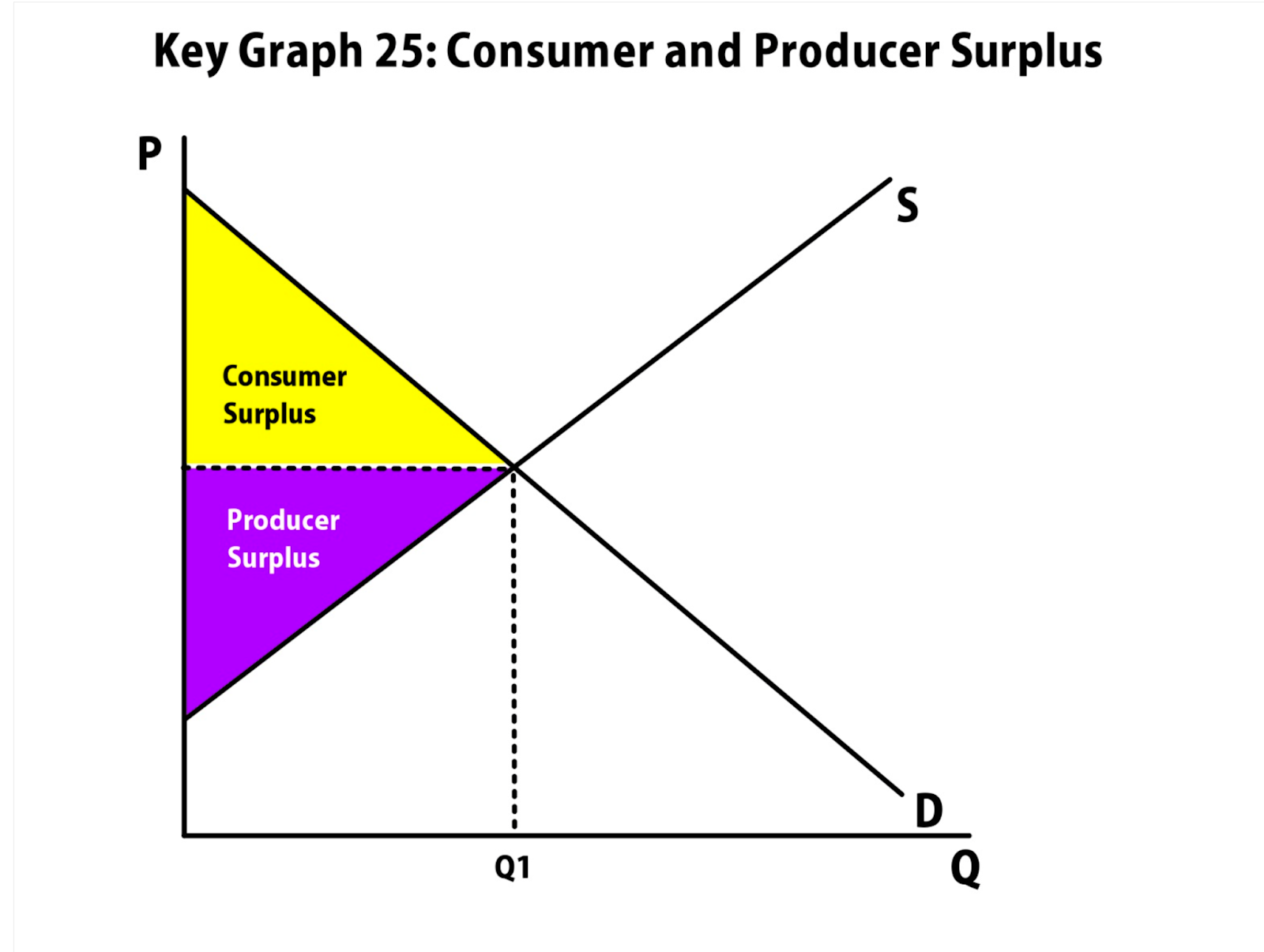

2.6 - Market Equilibrium, Consumer and Producer Surplus

Equilibrium : occurs when no one is better off doing something else

Equilibrium: Price = Quantity

Price below the equilibrium is shortage

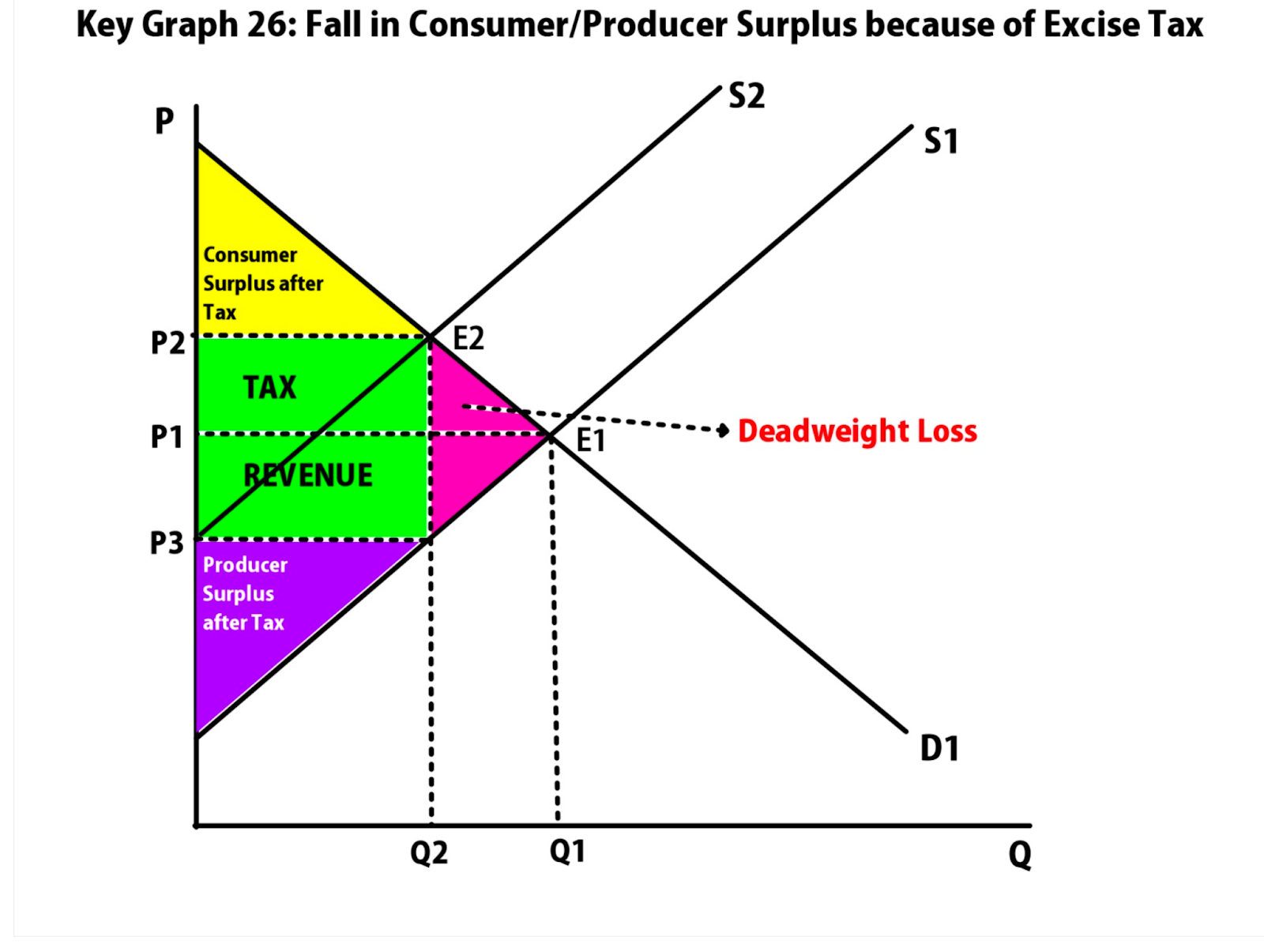

Consumer surplus : price consumers are willing to pay - actual price

Producer surplus : actual price -price the producer is willing to sell for

Demand increase : price and quantity increase

Demand decrease : price and quantity decrease

Supply increase : price decreases, quantity increases

Supply decrease : price increases, quantity decreases

Double shift : either price or quantity will be unknown. This rule states that when there is a simultaneous shift in both demand and supply, either price or quantity would stay indeterminate

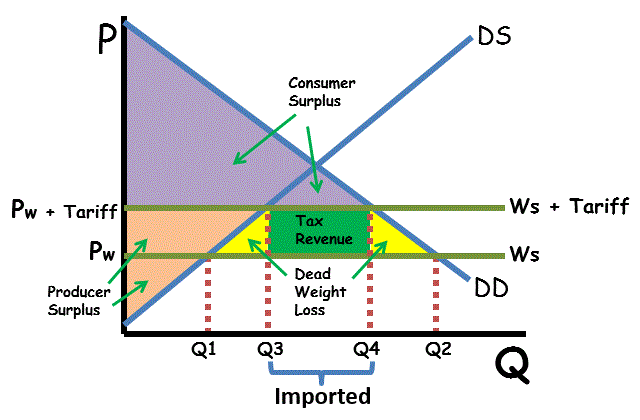

Deadweight loss (DWL) : transactions that should occur, but don’t because of government intervention (calculate the area: triangle formula, ½ (base x height)

2.7 - Market Disequilibrium and Changes in Equilibrium

Market Disequilibrium:

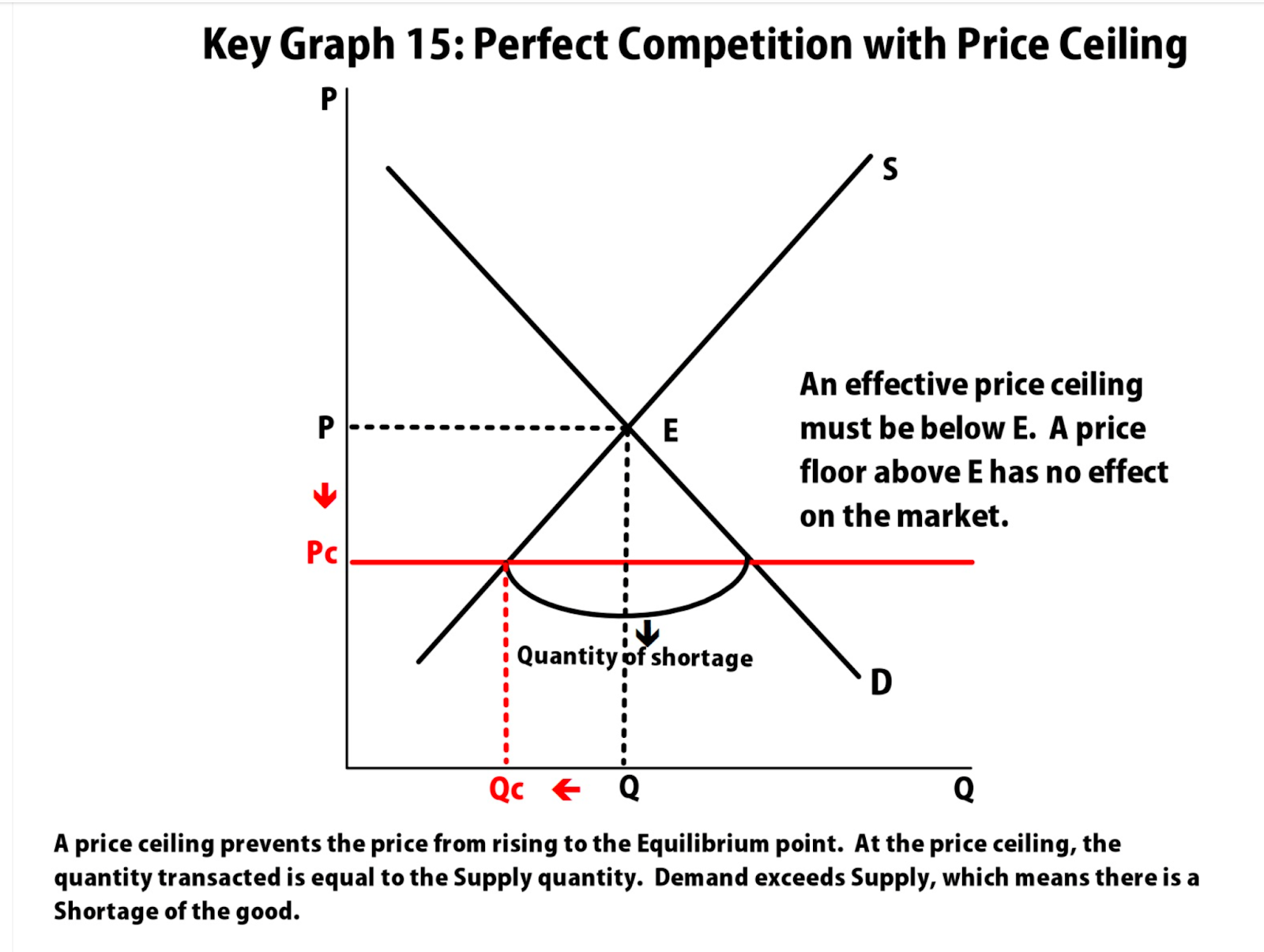

Shortage : Qs < Qd, price is lower than equilibrium

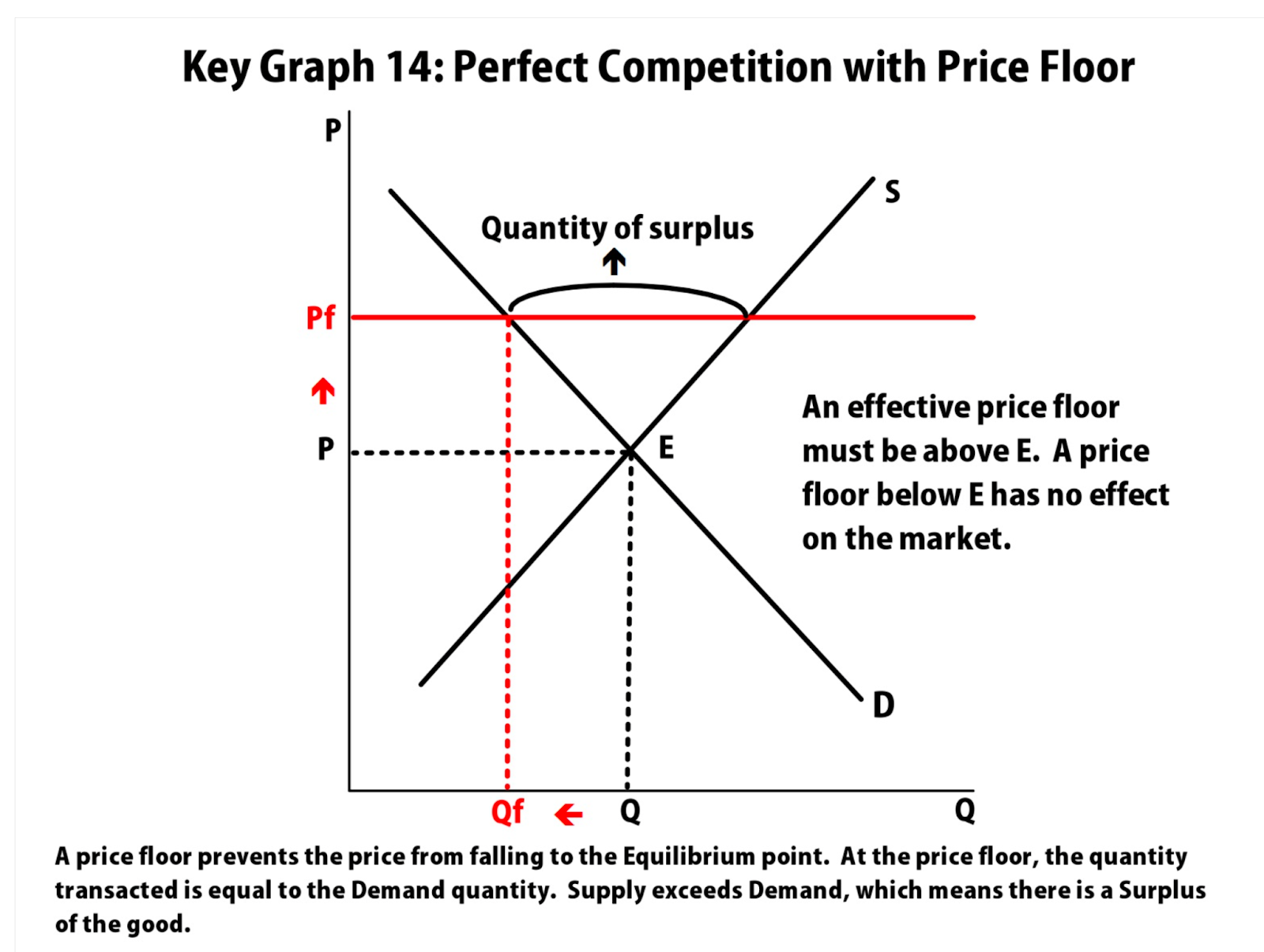

Surplus : Qs > Qd, price is above equilibrium

2.8 - Government Intervention in Markets

Price floor : minimum price a supplier can charge, price is set above equilibrium (causes shortage)

Price ceiling : maximum price a supplier can charge, price is set below equilibrium (causes surplus)

Quota: limit of a quantity that can be bought or sold (known as quantity control)

License: gives an owner the right to supply a good/service

Demand price: the price at which consumers will demand that quantity

Supply price: the price at which producers will supply that quantity

2.9 - International Trade and Public Policy

Quota rent: difference between demand price and supply price

Tariffs: tax placed on a good that is imported or exported

Import quota: restriction on the quantity of a good that can be imported

Unit 3 - Production, Cost, and the Perfect Competition Model

3.1 - The Production Function

Production function : relation between the quantity of inputs a firm uses and the quantity of output it produces.

Also related to how firms produce goods using the factors of production (land, labor, capital, and entrepreneurship)

Key Vocab:

Fixed input : an input whose quantity doesn’t change

Variable input : an input whose quantity can change

Long run : time period in which all inputs can be variable

Short run : time period in which at least 1 input is fixed

Marginal product : change in overall output when input changes

Marginal product of labor (MPL) : ∆Q / ∆L

Diminishing marginal returns : as input increases, the output of each input will be less than the previous input

Output : quantity produced

Rental rate : price of capital

Capital : goods that are used to produce goods/services

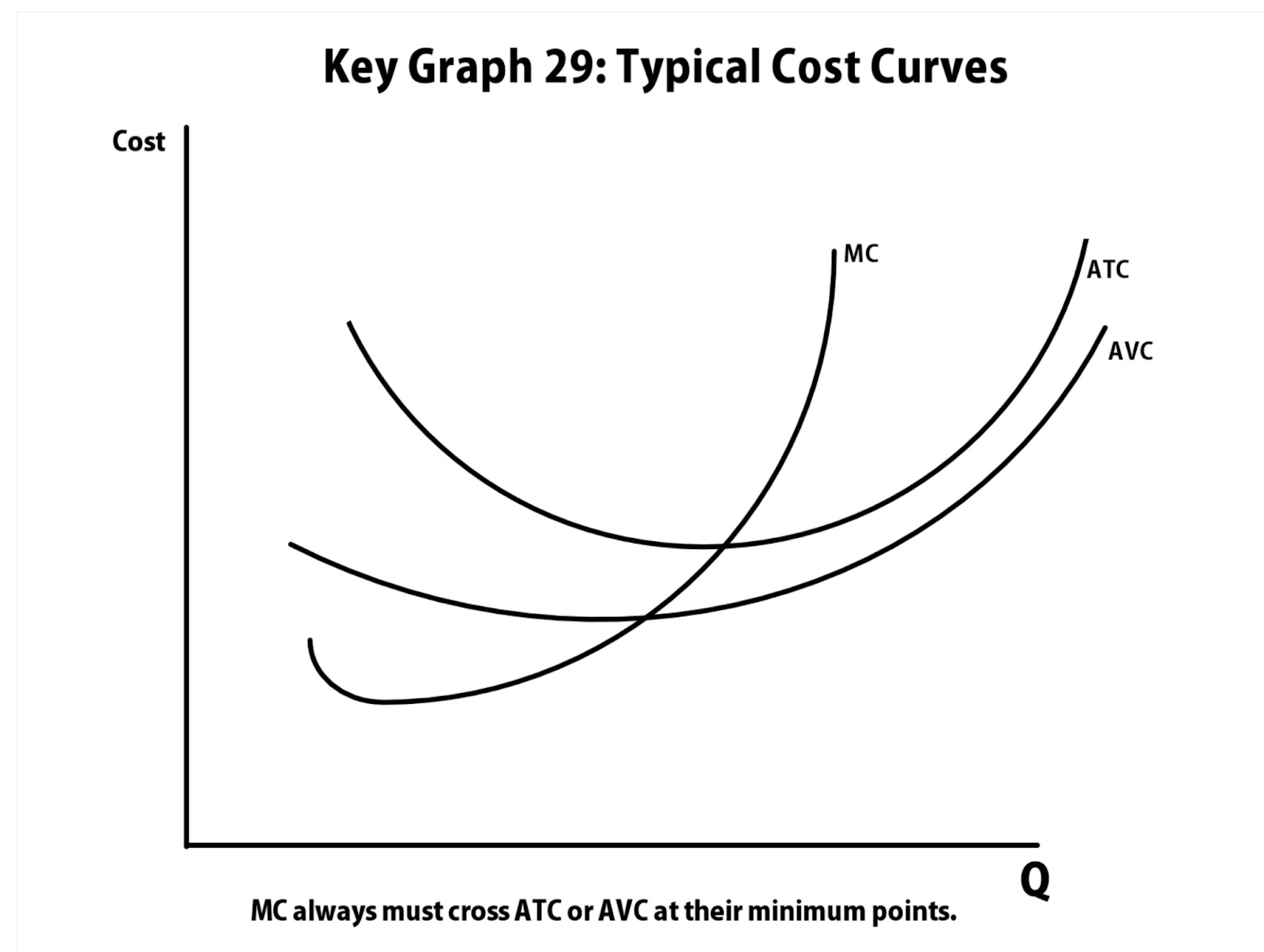

3.2 - Short-Run Production Costs

The short run is the period in which at least one of our inputs are fixed.

The long run looks into costs which aim to minimize our costs.

This can be measured by:

Fixed cost : cost that doesn’t change with amount of output produced (ex: oven)

Variable cost : cost that changes with amount of output produced

Total cost : fixed cost + variable cost

Marginal cost : cost difference of one additional unit of output (∆TC / ∆Q)

Average fixed cost (AFC) : FC / Q

Average variable cost (AVC) : VC / Q

Average total cost (ATC) : TC / Q

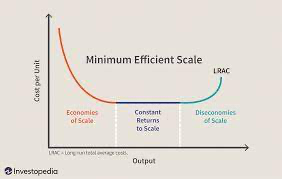

3.3 - Long-Run Production Costs

In the long run, all inputs are variable

Long run average total cost (LRATC) : same as short run ATC, but bigger

Economies of scale : LRATC declines as output increases

Diseconomies of scale : LRATC increases as output increases

Constant returns to scale : output increase directly in proportion to an increase in all inputs (ex: input doubles, output also doubles)

3.4 - Types of Profit

Profit is the excess revenue that a business gets to keep.

Economic profit : revenue - (explicit cost + implicit cost)

Accounting profit : revenue - explicit cost

Implicit cost : not an actual cost, a cost that you could’ve been earning (ex: if you own a restaurant, the implicit cost would be the salary you would have earned as being a chef working in a different restaurant)

Marginal Revenue: additional revenue gained by producing one more unit

3.5 - Profit Maximization

The profit maximising point for a firm is where it aims to increase revenue due to costs possibly being high as well.

MR = MC

If you cannot have MR=MC, MR>MC

The firms aim to produce where MR = MC due to the fact that all profits are earned without overshooting and gathering additional costs.

These calculations help a firm understand how much it must produce in order to maximize their profits.

3.6 - Firms’ Short-Run Decision to Produce and Long-Run Decisions to Enter or Exit a Market

Firms need to be able to know when to enter the market, as well as when to end production (entry and exit)

Short Run:

Shutdown rule : as long as P > AVC, continue to produce

If AVC > P : shutdown

Firms can make profit or losses

Long Run :

Exit rule : if P < ATC, exit the market

Firms make normal profit ($0), unless monopoly or oligopoly

Shut down rule: a firm should not produce unless it can cover its variable costs. If it is not able to do so, firms are better off producing nothing. However, this only tends to happen in perfect competition)

Perfect competition occurs when P<AVC at MR = MC)

As a result, this leads to long term adjustments in the long run where equalities in the market make a normal profit

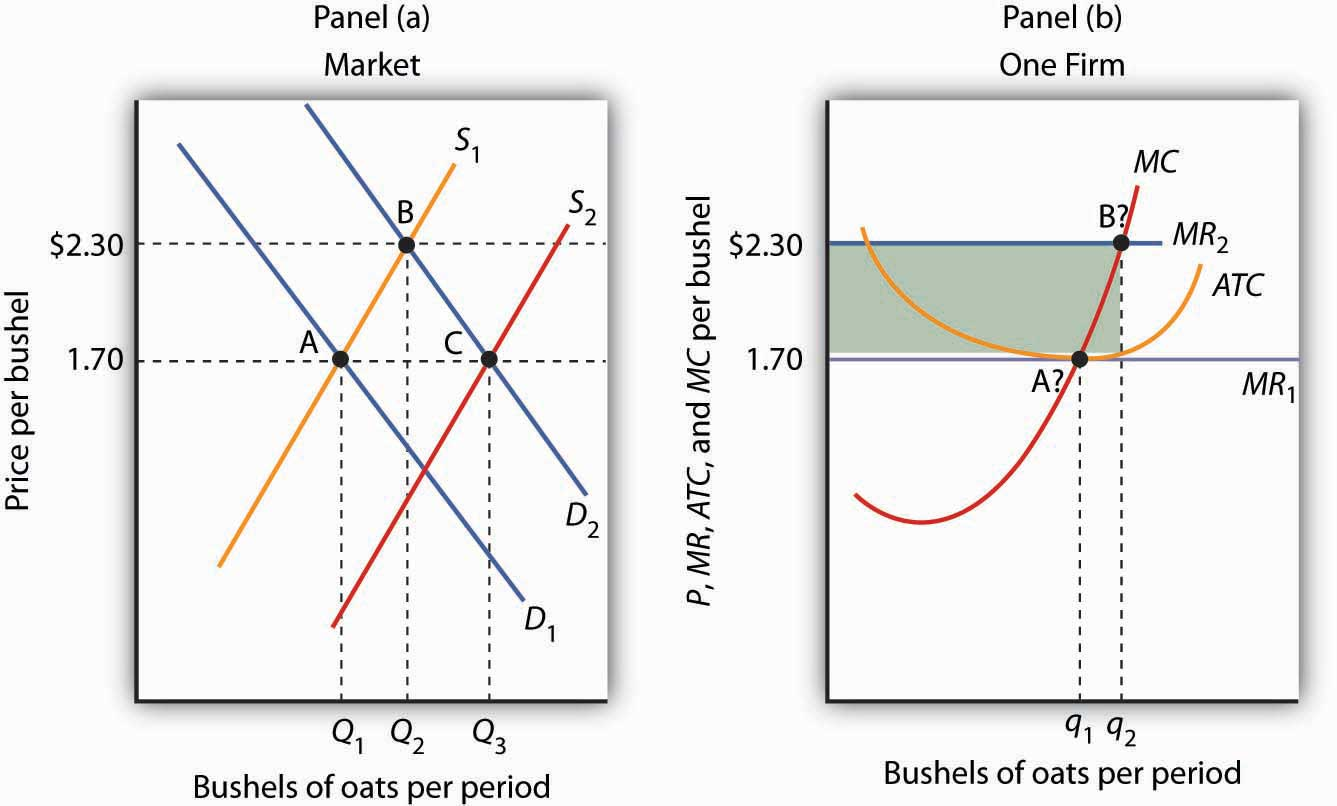

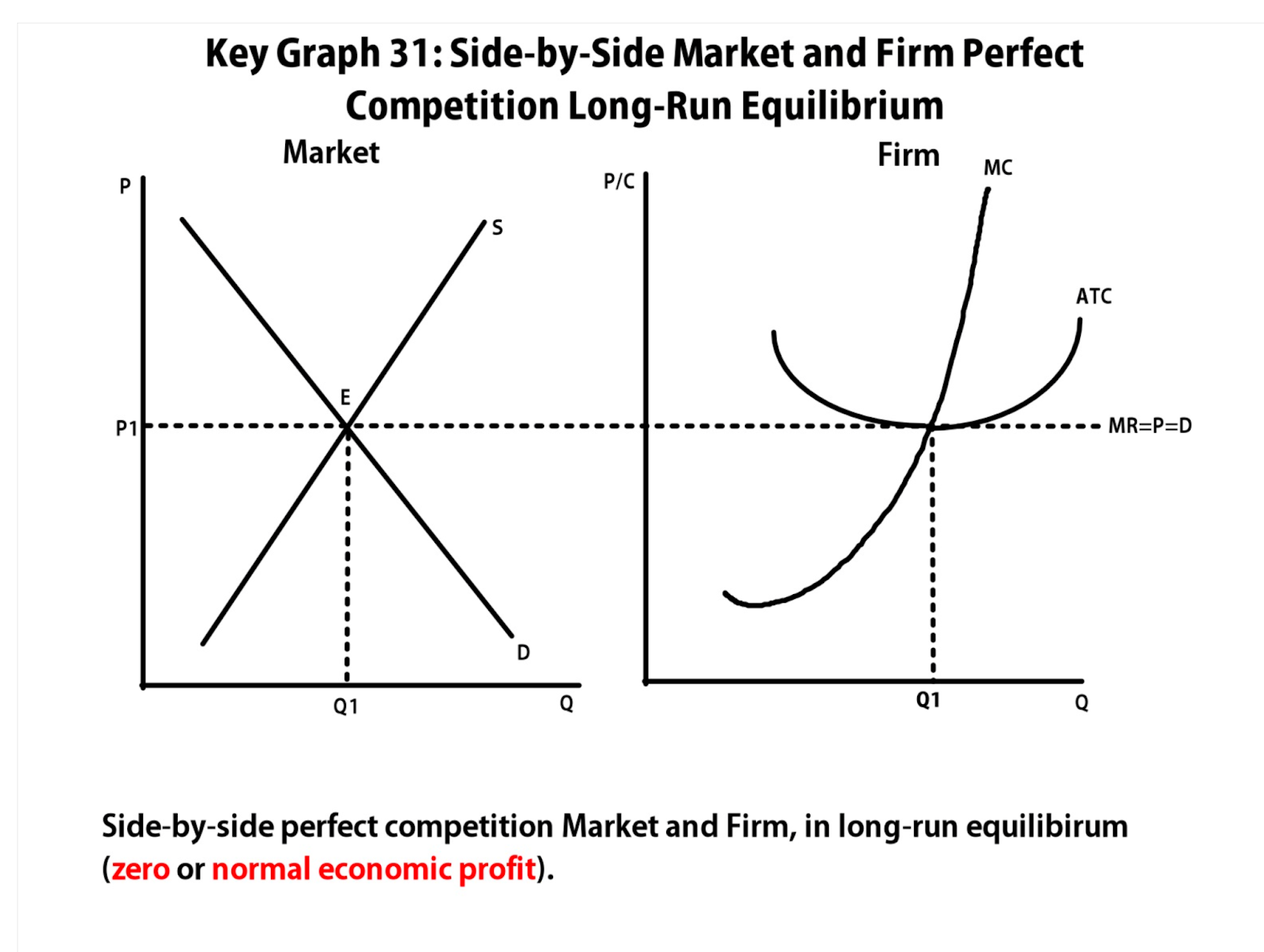

3.7 Perfect Competition

In perfect competition, many identical firms are competing at a constant market price. This market has low barriers, meaning any firm is able to enter and exit the market in the long run.

Firms in this market are price takers, who are firms which cannot charge a higher price than the equilibrium price. This means that they have no market power.

Long run will have normal profit

Short run can have either profit or loss

Unit 4 - Imperfect Competition

4.1 - Introduction to Imperfectly Competitive Markets

Firms are able to make an increased profit in the long run if there is less competition since firms are considered to be price makers. There are stricter barriers to entry in imperfect competition (Governmental, economies of scale, geography, etc.)

Common barriers to entry: control of scarce resources, legal barriers, high startup costs

Perfect Competition | Monopolistic Competition | Monopoly | Oligopoly | |

|---|---|---|---|---|

# of firms | Many | Many | 1 | Few |

Type of product | Standard | Differentiated | Unique | Standard or different |

Price control | None | Little | Yes | Some |

Barriers to entry | None | None (few) | High | High |

4.2 - Monopolies

Monopoly: market structure where there is only one firm producing a product

Only producer of a good, has no close substitutes

On the graph, there is a downward sloping demand curve

Quantity is produced : at MR = MC

Price is : MR=MC, up to demand

Supply curve : where MC > AVC

Allocatively efficient due to them producing at MR=MC

Productively inefficient because they don’t produce at the minimum of the ATC

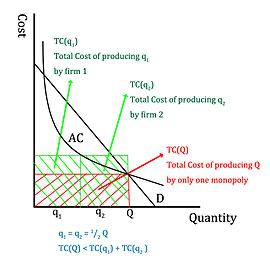

Natural monopoly: has large fixed costs, and long economies of scale, has downward sloping ATC curve

Natural monopoly production point : MR=MC

Government will correct by forcing them to set price : at D=ATC

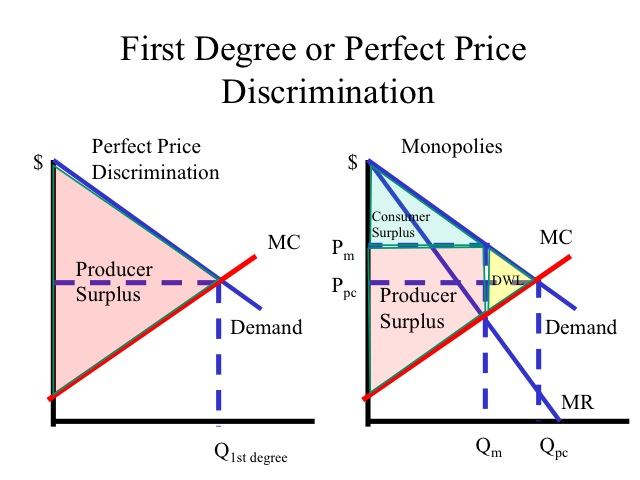

4.3 - Price Discrimination

Price discrimination occurs in specific industries as consumers pay a different price for the same good.

To be able to price discriminate, you need market power

Imperfect price discrimination : charging consumers different prices based on the buyer’s willingness to pay

Perfect price discrimination : charges all consumers the maximum they are willing to pay, no deadweight loss, produce at P=MC

Example : resellers, coupons, bulk buying (costco), etc.

In price discrimination, there is no deadweight loss and no consumer surplus as well, only producer surplus.

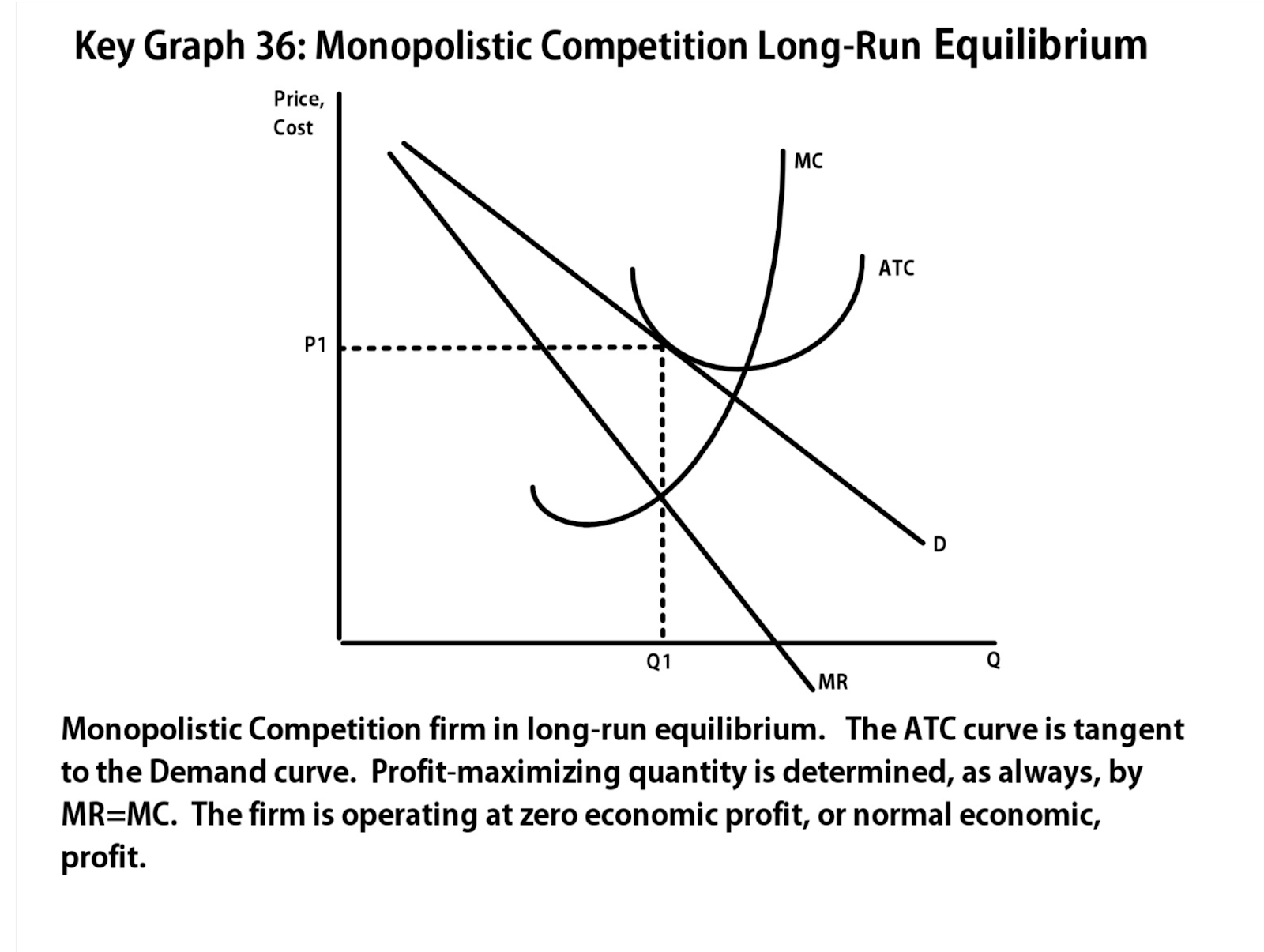

4.4 - Monopolistic Competition

Monopolistic competition: is another term for imperfect competition, and occurs when many companies offer competing products which are similar but not perfect substitutes.

Characteristics:

Combines features of both a monopoly and perfect competition

Many sellers and differentiated products

Will use advertising to make demand more inelastic + differentiate product

Makes profit in short run, normal profit in long run

Allocatively inefficient (P does not equal MC)

Productively inefficient (does not produce at minimum of ATC until long run)

Downwards sloping demand curve

Produce at MR = MC, price is MR = MC up to demand

Long Run

Normal profit in long run

Short run profits will attract new firms to join, which decreases the demand until the demand Curve is tangent to ATC, causing normal profits in long run

In long run, they produce in region where economies of scales exist, because they produce in declining portion of ATC

4.5 - Oligopoly and Game theory

Oligopoly Characteristics

Small number of firms, standard or differentiated product

Interdependent : all the actions that a firm takes will affect the other firms in the oligopoly

Cartels : a group that agrees to control the price and output of a product (often form in oligopoly)

Collusion : firms working together to maximize profit

Game Theory

Payoff matrix : represents the payoff to each player to show combinations of given strategies

Dominant strategy : the strategy that has a better payoff regardless of what strategy the opponent chooses

Nash equilibrium : point where both players can’t do better than the other

Unit 5 - Factor Markets

5.1 - Introduction to Factor Markets

Factor markets: is a resource for companies to buy what they need to produce their goods and services

Derived demand : the demand from a resource is derived by product demand (ex: an increase in the demand of movie tickets increases the demand for movie theater workers)

Marginal revenue product (MRP) : the additional revenue that is generated by an additional resource/worker

Marginal factor cost (MFC) : the additional cost of an additional resource/worker

Least cost rule : marginal product of labor/price of labor = marginal product of capital/price of capital (MPL / PL = MPK / PK)

Buy more of the one with a higher sum, and less of the one with a smaller sum (to explain, as you increase, diminishing marginal returns kicks in)

5.2 - Changes in Factor Demand and Factor Supply

Determinants of Labor Demands (DL) | Determinants of Labor Supply (SL) |

|---|---|

R.O.D | P.I.N |

1. Productivity of the Resource | 1. Personal values |

2. Price of Other resources | 2. Intervention by Government |

3. Product demand | 3. Number of Qualified workers |

These factors determine the supply and demand of these quantities

5.3 - Profit-Maximising Behaviour in Perfectly Competitive Factor Markets

Market curve : standard supply and demand curve

Equilibrium wage in the market : establishes the wage that firms will pay workers

MRP=MFC

Firms will not hire if MFC>MRP, as they will be at a loss

5.3 - Monopsonistic Markets

Many sellers, one buyer

Monopsonies pay a lower wage and hire less than perfect competition

This market is an example of Imperfect competition

MRP=MFC

MFC > supply

Unit 6 - Market Failure and the Role of Government

6.1 Socially Efficient and Inefficient Market Outcomes

Socially efficienct is when resources are allocated effectively

MSB=MSC

Allocatively Efficient Points

Perfectly competitive market : S=D, MB=MC

Perfectly competitive firm : P=MC

Perfectly competitive labor market : W=MRP (total economic surplus : MSC=MSB)

Causes of Market Failure

Market power (imperfectly competitive markets)

Asymmetric information (lack of info provided by buyers and sellers)

Positive and negative externalities

Insufficient production of public goods

Government policies used to get rid of DWL

Taxes

Subsidies

Reguations

Public prodivions

Market failure : exists when firms produce where MPB=MPC, S=D

The government tries to get them to produce where MSC =MSB

6.2: Externalities

Externality : when external cost/benefit is placed on members of society who did not pay for them

MSB does not equal MSC

Negative externality : when someone uses a product, it decreases the benefit of others (ex: smoking), MSC > MPC (correct with per unit tax)

Positive externality : when one uses a product, others benefit (ex: education) MSC < MPC (correct with subsidy)

6.3: Public and Private Goods

Rivalrous good : if someone consumers a product, others cannot (ex: food, shoes)

Nonrivalrous : national defense, fireworks, etc

Somewhere in middle : schools, roads, etc

Excludable good : non payers can be prevented from enjoying the benefits (ex: food, school, etc)

Nonexcludable : national defense, air, etc

Public goods : underproduced due to freeloader problem (ex: national defense, law enforcement, etc)

Freeloader problem : people can enjoy the benefit of a good/service without paying

Government will provide subsidies to producers

Private goods : goods produced by private markets, can be excludable

6.4: The Effects of Government Intervention in Different Market Structures

Causes of inefficient markets

Market power

Externalities

Nonrival and nonexcludable goods (public goods)

Forms of government intervention

Taxes

Subsidies

Price floors/ceilings

Regulation

Per unit subsidy : gives benefits per unit

Perfect competition : MC, ATC, AVC decreases, price doesn’t change (price taker)

Monopolistic competition : MC, ATC, price decreases (price maker where MR=MC)

Lump sum subsidy : gives benefit no matter how many units

Taxes will always shift supply curve to the left in long run, profits decrease

Per unit tax : increase MC, ATC, and AVC

Perfect competition : MC, ATC, AVC increases, price doesn’t change (price taker)

Monopolistic competition : MC, ATC, price increases (price maker where MR=MC)

Lump sum tax : only increase ATC

won’t change output level

Non price regulation : works like taxes, they ensure competition/environmental protection/health and safety

Antitrust policy : promote competition and prevents monopolies

Antitrust laws

Lawsuits

Price controls

Subsidies

Price ceiling : sets minimum price

Perfect competition : causes shortage

Monopolistic competition : becomes MR curve, price and output decreases

Price floor : sets maximum price

Perfect competition : leads to surplus

Monopsony : wages go up and workers go up

6.5: Inequality

Income distribution : measures % of income that goes to individuals in different percentiles/brackets

In a system with perfect equality, everyone would receive equal shares of income

Income : wages, rent, interest, profit

Lorenz curve : measures the distribution of income equality (you want to be as close of possible to the perfect equality line as possible)

Gini coefficient : A/(A+B)

Closer to 0, more equality

Closer to 1, more inequality

Causes of income inequality

Supply + demand in labor market

Human capital

Discrimination

Inheritance

Bargaining power

Policies to address inequality

Taxes + transfers

Minimum wage laws

Anti-poverty program

Income protection program

Scholarships

Taxes :

Proportional : everyone pays the same percentage of their income (no impact on income distribution)

Progressive : taxes are higher % on people earning a higher income (reduces income inequality)

Regressive : taxes are lower % on people earning a higher income (increases income inequality)

Knowt

Knowt