Unit 2 - Supply and Demand Guide

All the basics of Supply and Demand which are the foundation of the majority of concepts moving forward.

[[2.1 - Demand[[

Demand: the quantity which a consumer/buyer are willing and able to buy at different prices

- Movement on the graph: downward sloping

- Demand slopes down on the graph due to:

- Income effect

- Substitution effect

- law of diminishing marginal utility

Law of Demand: As price increases, demand decreases, and as price decreases, demand increases

Determinants of demand:

- Taste and preferences, related goods, income, buyers, expectation of failure

Substitutes : good/service that can be used in place of another, when price of one increases, consumers will buy more of the other (ex. coffee and tea)

- Substitution effect: as the price of a good increases, consumers substitute the good with another that is cheaper

Complements : goods/services that are consumed together (ex. hamburgers and buns)

Income effect: as income increases, people will buy more of normal goods, and less of inferior goods

Normal good : increase in demand when consumer’s income increases (ex. oreos)

Inferior good : increase in demand when consumer’s income decreases (ex. off brand oreos)

Diminishing marginal utility: As more units of a product are consumed, the satisfaction/utility it provides tends to decline

- Apple users would purchase at maximum, a limited phones-they wouldn’t purchase a new iPhone every month since that extra phone would offer them no utility or not as much

[[2.2 - Supply[[

- Supply: different quantities of goods/services which sellers are willing and able to produce at a given price

- Law of supply: as price increases, quantity supplied also increases, this is a direct relation.

- The market supply shows the quantity a supplier is willing and able to offer at various prices at a given time

@@Reasons for the Law of Supply@@

Rising prices give greater opportunities to suppliers to earn a profit

With every additional unit, suppliers face an increase in the marginal cost of production

- Charging higher prices provides them with the easiest way to cover the cost

- The vice versa is also true; lower prices wouldn’t provide the incentive to motivate the supplier and thus reduces the quantity of product

- The supply curve shifts upward, and the movement along the supply curve indicates a change in price.

- Charging higher prices provides them with the easiest way to cover the cost

Shifters of supply :

- Resource costs and availability

- The cost of production (land, labor, capital) has an inverse impact on the supply

- When the cost of these increases, the supplier decides to produce less of the products since he is unable to afford the production cost

- Other goods and services

- Suppliers who produce more than one product (profit-maximizing firms) have an easier time switching to the production of another product if issues do arise in prices

- E.g. A farmer has land where he is able to produce corn and earn a profit

- If his land is capable to produce wheat as well, in case the price of wheat increases to that of corn, he would switch to wheat production to earn better

- The supply curve in this situation for wheat would shift outwards(more supply) and vice versa for corn(reduced supply)

- Technology

- Newer technology causes the cost of production to decline and helps improve the efficiency of the supplier

- This allows the supplier to produce more, shifting the supply curve outwards(toward right)

- E.g. machines on the production line help reduce unit costs due to which more products are affordable by the supplier

- Taxes and Subsidies

- Taxes are added up to the unit cost of production, thus making it more expensive

- Due to this, heavily taxed products are produced in less quantity by suppliers(supply curve shifts towards left)

- Subsidies are the opposite of taxes and help reduce price per unit

- This allows suppliers to produce more of the product(supply curve shifts towards the right)

- Expectation

- If suppliers expect prices to increase in the future, they would hold back supply for the current time with the future goal of earning more profit later (and vice versa)

- Number of sellers

- As the number of sellers increases in the market, the supply automatically increases

- This allows consumers more choices at a lower price due to an increase in competition

[[2.3 - Price Elasticity of Demand[[

Equation : %∆Qd/%∆P

- 0 = perfectly elastic,

Midpoint formula : Qd2-Qd1/(Q2d+Qd1)/2 , replace with Qd with price for price

Inelastic demand : TR correlates direct with price

Elastic demand = TR correlates inversely with price

@@Elasticity@@: how much the Q is affected by P.

- Elastic demand means that the goods are subject to be affected by a change in price.

- Inelastic demand means that goods are not subject to be affected by a change in price.

@@Characteristics of Elastic Demand@@:

- Flat, quantity is sensitive to price change, substitutes, luxury items, large portion of income, not needed immediately. Is equal to >1.

@@Characteristics of Inelastic Demand:@@

- Steep, few substitutes, required now, small portion of income, is equal to <1

@@Shapes of elasticity/inelasticity@@

- Perfectly elastic: infinity

- Relatively elastic: >1

- Unit elastic: 1

- Relatively inelastic: <1

- Perfectly inelastic: 0

[[2.4 - Price Elasticity of Supply[[

@@PES@@: measures how sensitive are sellers to price changes on goods

- Equation : %∆Qs/%∆P

- 0 = perfectly elastic,

- Inelastic : unable to respond to price change

- Elastic : short run

- Extremely elastic : long run

@@Characteristics of inelastic Supply:@@

- Difficult production, high costs, hard to change to alternative, high barriers to entry, <1

@@Characteristics of Elastic Supply:@@

- Easy production, low cost, easy to switch to, low barriers to entry, >1

[[2.5 - Other Elasticities[[

- @@Cross price elasticity of demand :@@ %∆Qd of Good A/%∆P of good B

- Negative = compliments (inferior good), positive = substitutes (normal good)

- Income elasticity of demand : %∆Qd/%∆income

1 = income elastic, <1 = income inelastic, negative = inferior, positive = normal

[[2.6 - Market Equilibrium, Consumer and Producer Surplus[[

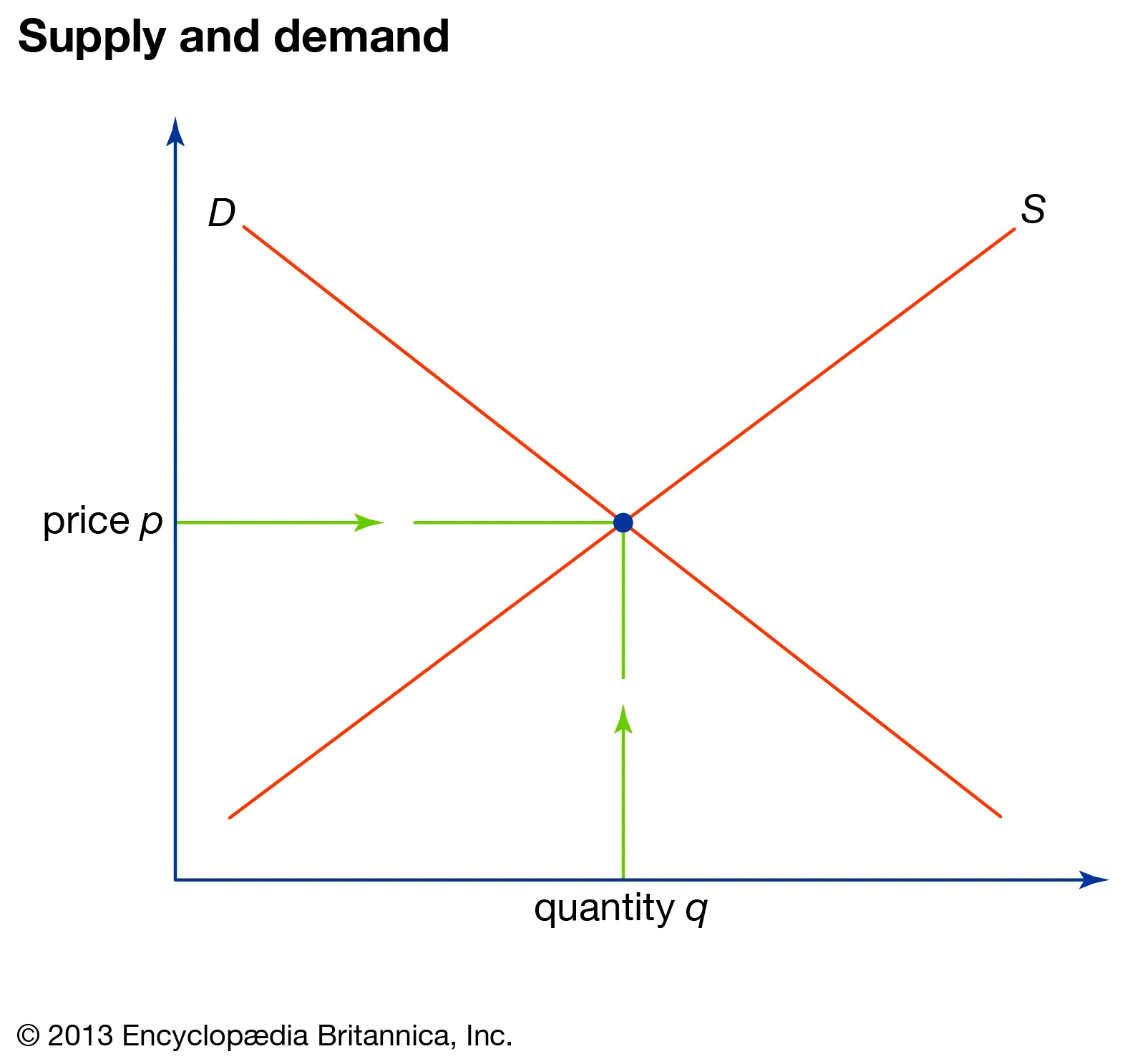

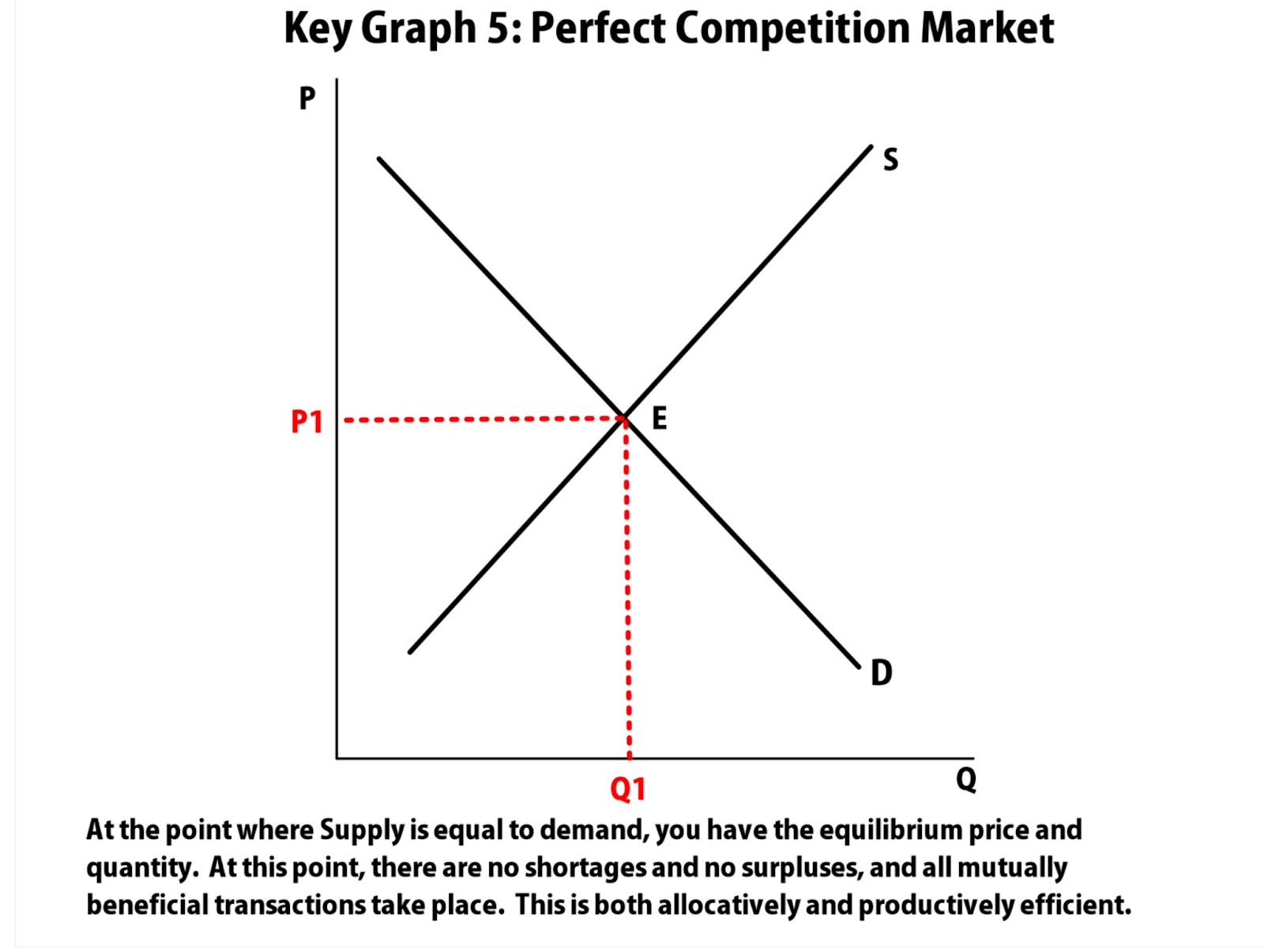

@@Equilibrium@@ : occurs when no one is better off doing something else

- Equilibrium = Qs=Qd

- Price below the equilibrium is shortage

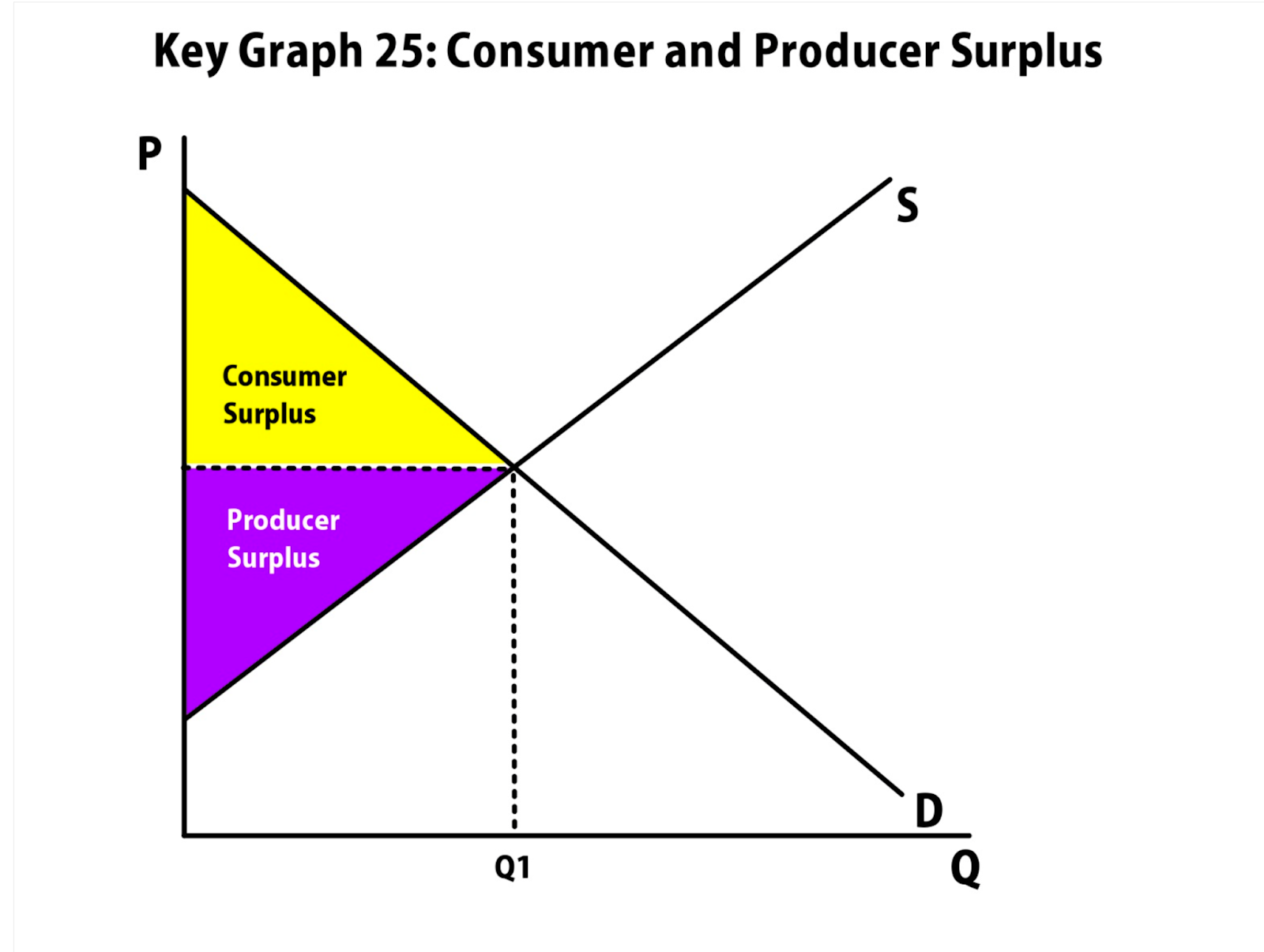

Consumer surplus : price consumers are willing to pay - actual price

Producer surplus : actual price -price the producer is willing to sell for

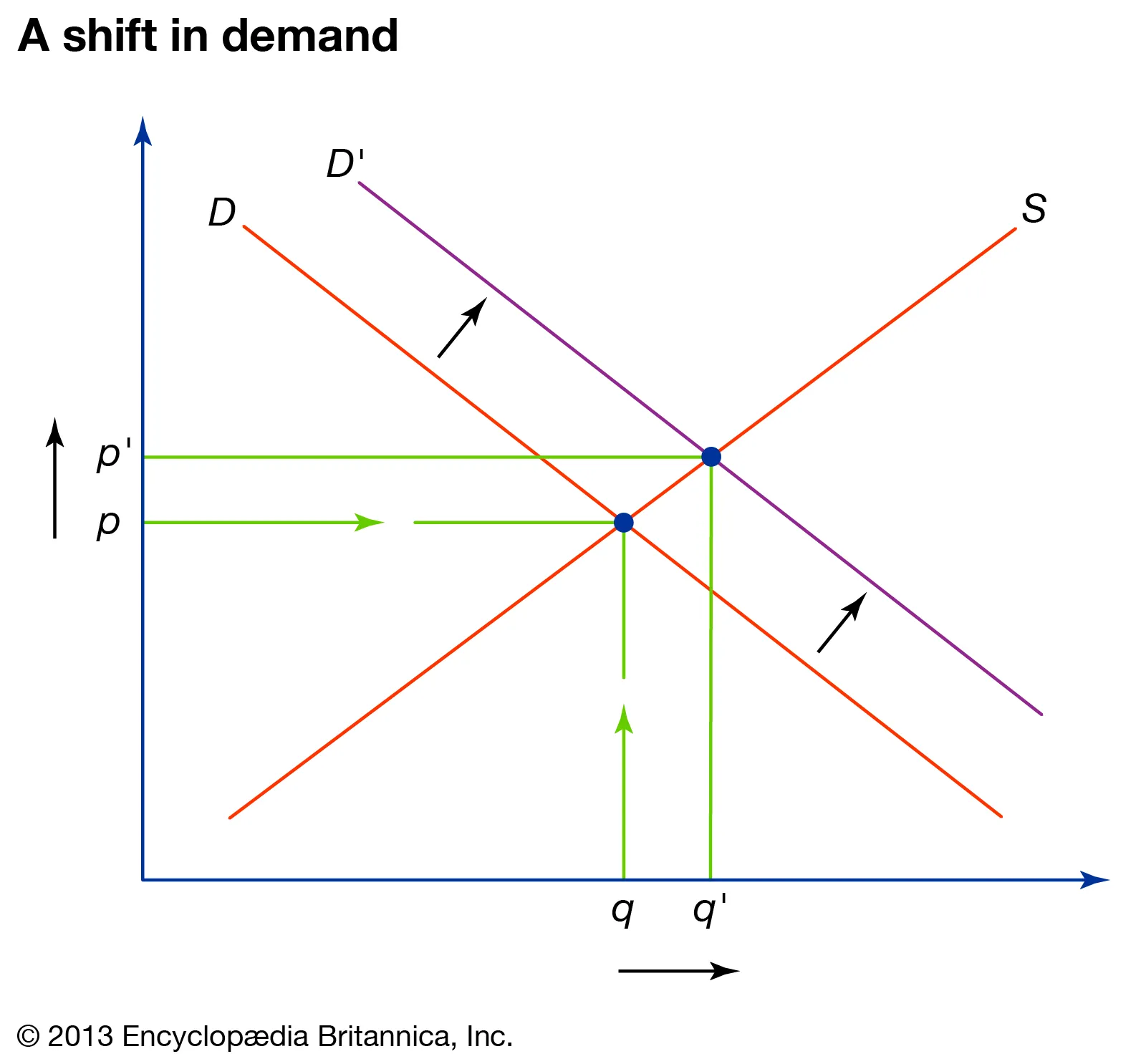

Demand increase : price and quantity increase

Demand decrease : price and quantity decrease

Supply increase : price decreases, quantity increases

Supply decrease : price increases, quantity decreases

@@Double shift@@ : either price or quantity will be unknown. This rule states that when there is a simultaneous shift in both demand and supply, either price or quantity would stay indeterminate

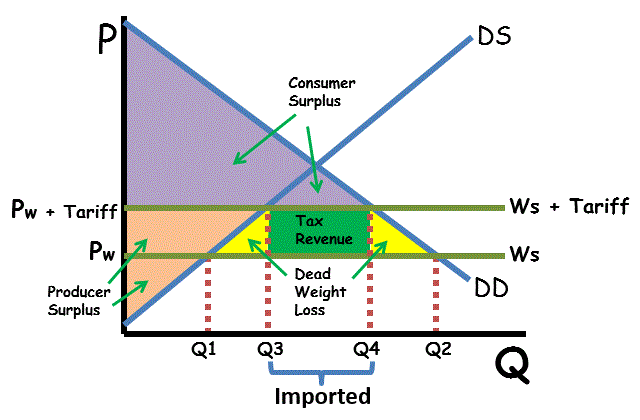

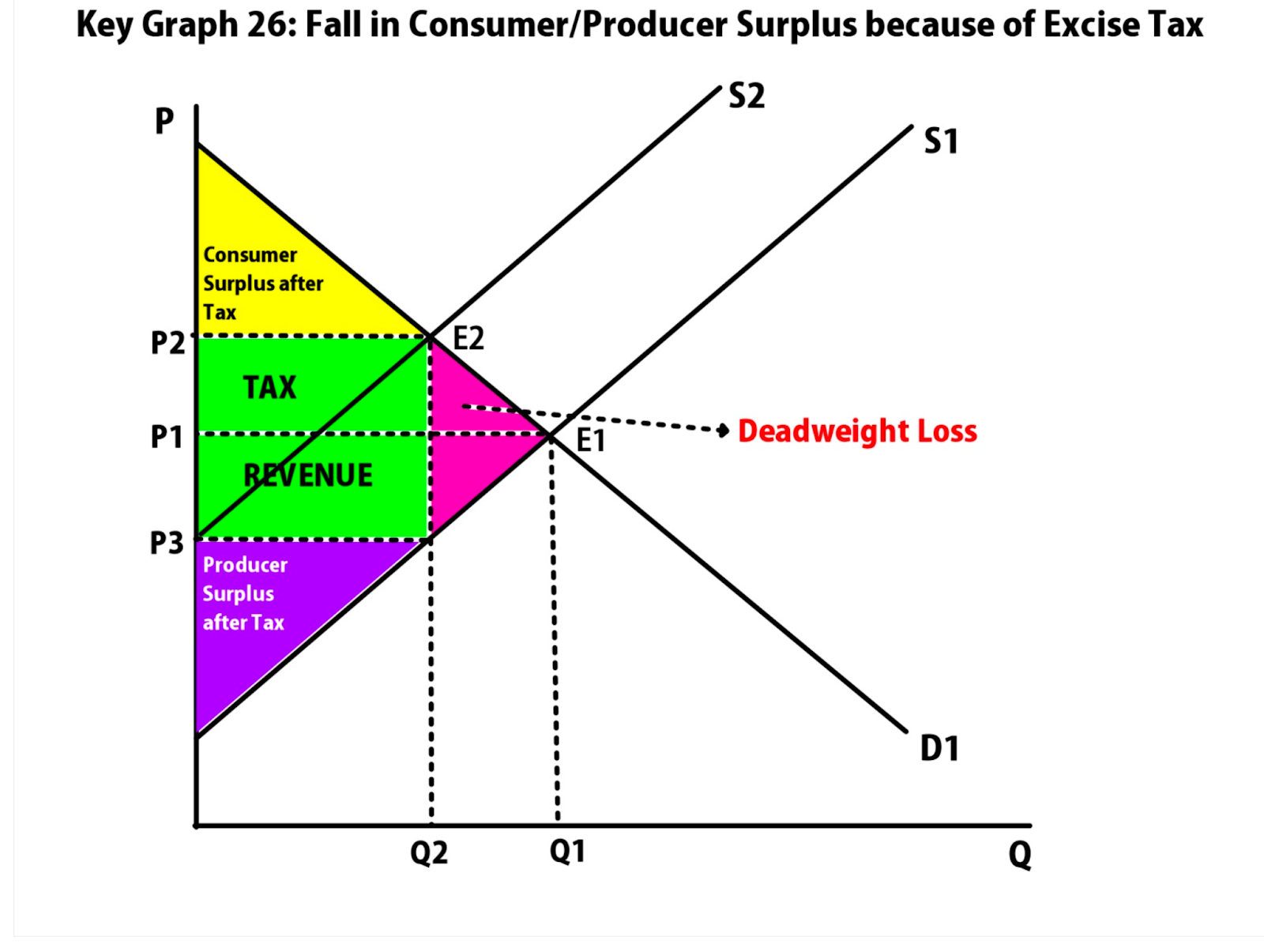

@@Deadweight loss (DWL)@@ : transactions that should occur, but don’t because of government intervention (calculate the area = triangle formula, ½(base x height)

[[2.7 - Market Disequilibrium and Changes in Equilibrium[[

[[2.8 - Government Intervention in Markets[[

@@Market Disequilibrium:@@

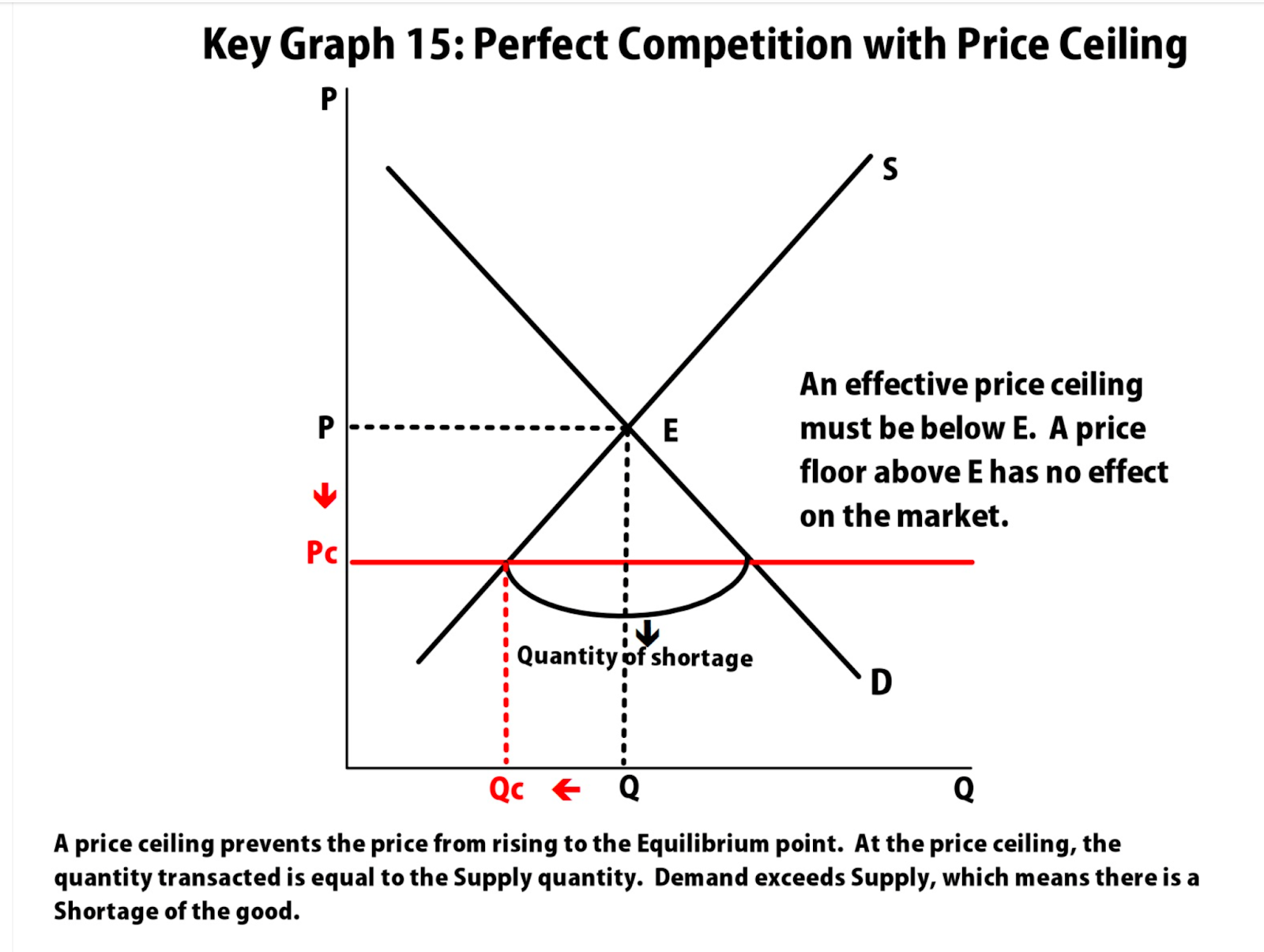

- Shortage : Qs < Qd, price is lower than equilibrium

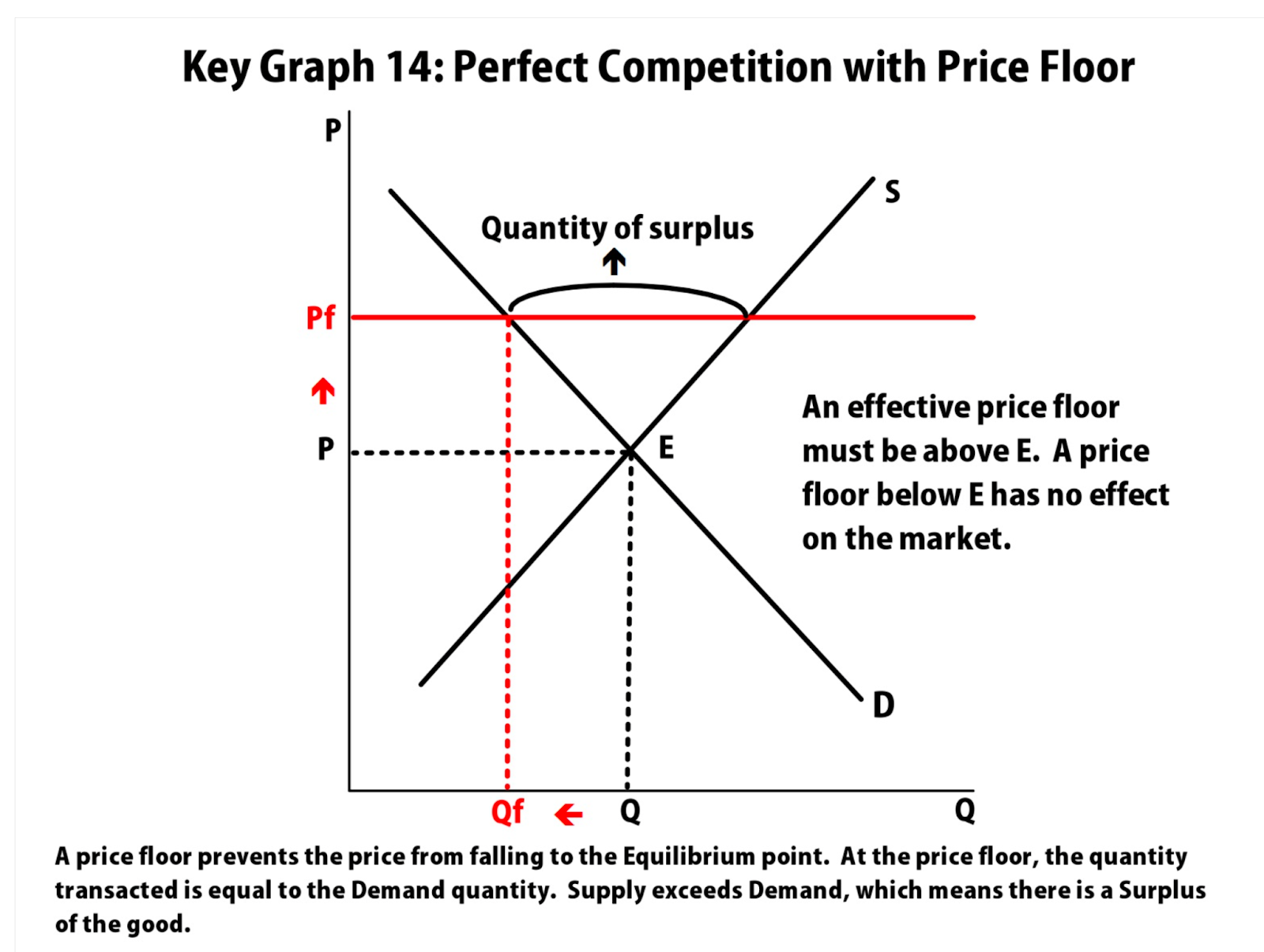

- Surplus : Qs > Qd, price is above equilibrium

Price floor : minimum price a supplier can charge, price is set above equilibrium (causes shortage)

Price ceiling : maximum price a supplier can charge, price is set below equilibrium (causes surplus)

Quota : upper limit of a quantity that can be bought or sold (known as quantity control)

License : gives an owner the right to supply a good/service

Demand price : the price at which consumers will demand that quantity

Supply price : the price at which producers will supply that quantity

[[2.9 - International Trade and Public Policy[[

Quota rent : difference between demand price and supply price

Tariffs : tax placed on a good that is imported or exported

Import quota : restriction on the quantity of a good that can be imported