Ap micro 4 and 5

Chapter 4 Notes

● Efficiently Function Markets

■ Market Failure: Inability of a market to bring about the allocation of resources that best satisfies the wants of society; typically involving under or over allocation of resources to the production of a particular good due to externalities

■ Total Surplus: the sum of consumer and producer surplus (AKA social surplus)

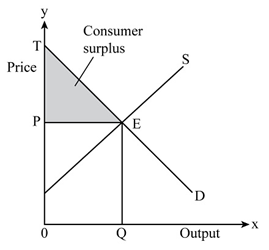

○ Consumer Surplus

■ The difference between the maximum price a consumer is (or consumers are) willing to pay for an additional unit of a product and its market price; the triangular are below the demand curve and above the market price

■

■

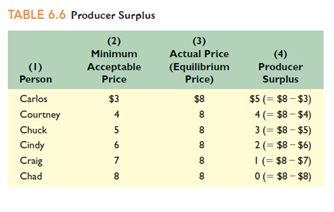

○ Producer Surplus

■ The difference between the actual price a producer receives (or producers receive) and the minimum acceptable price; the triangular area above the supply curve and below the market price

■

○ Total Surplus and Efficiency

■ Assuming that a demand curve reflects buyers’ full willingness to pay and the supply curve reflects all of the costs facing sellers, then the equilibrium price point on such a graph reflect productive and allocative efficiency

● Productive efficiency: the production of a good in the least costly way; occurs when production takes place at the output level at which per-unit production costs are minimized

● Allocative Efficiency: apportionment of resources among firms and industries to obtain the production of the products most wanted by society; the output of each product at which its marginal cost and marginal benefit are equal and at which the sum or consumer surplus and producer surplus is maximized

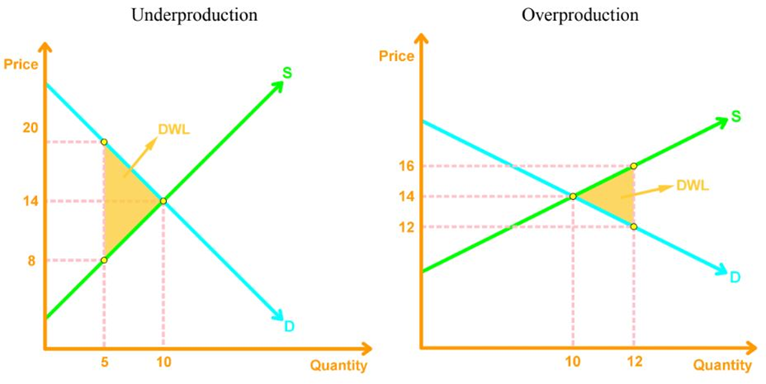

○ Efficiency Losses (Deadweight Losses)

■ Reductions in combined consumer and producer surplus caused by an underallocation or overallocation of resources to the production of a good or service. Also called deadweight loss.

■

● Positive and Negative Externalities

■ Externalities: A cost or benefit from production or consumption that accrues to someone other than the immediate buyers and sellers of the product being produced or consumed

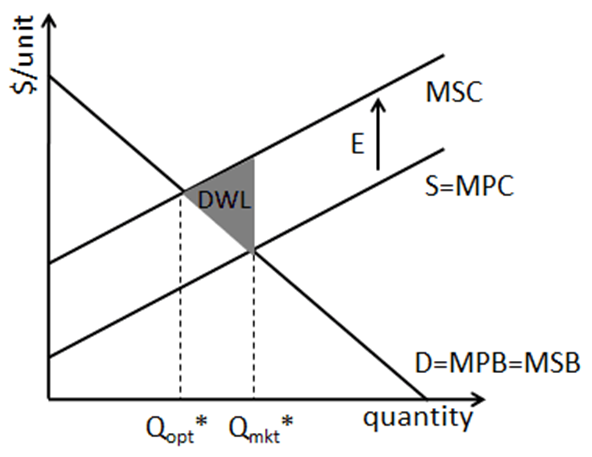

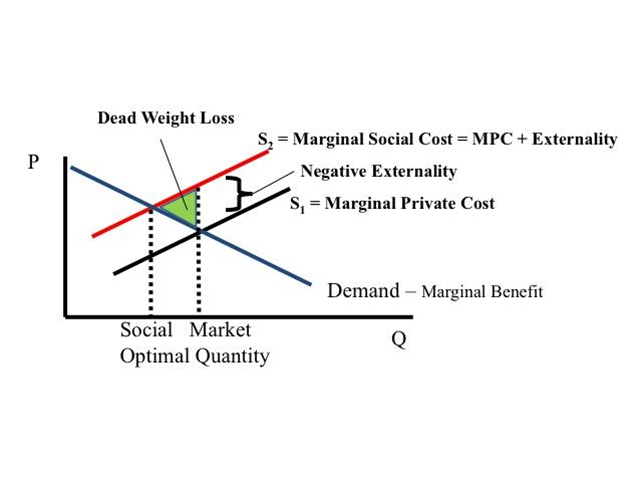

○ Negative Externalities

■ Cost imposed without compensation on third parties by the production or consumption of sellers or buyers

● Ex. Manufacturer dumps toxic chemicals into a river thus killing the fish prized by sports fishers

● Ex. Cigarette 2nd-hand smoke

■ By not accounting for negative externalities a firm’s supply curve is shifted to the right of where it would if the firm accounted for all costs including those not involved in the buying and selling of their product

■ This leads to overproduction and misallocation of resources, ultimately harming both the environment and public health.

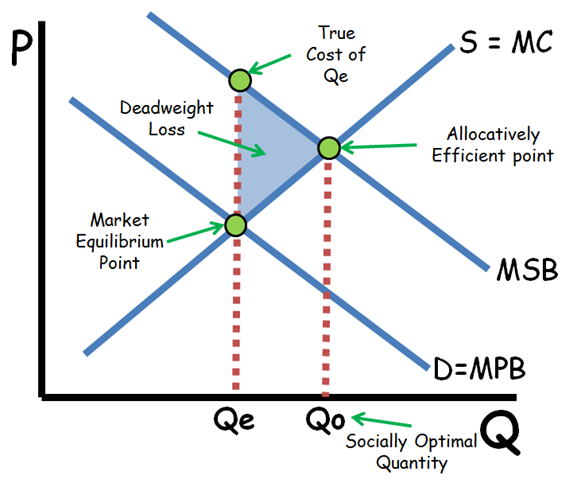

○ Positive Externalities

■ Benefit obtained without compensation by third parties from the production or consumption of sellers or buyers (free riders)

● Ex. A beekeeper benefits when a neighboring farmer plants clover

● Ex. People who live near Disney World get free firework shows

■ Positive Externalities result in market demand curves that fail to include the willingness to pay of the people who receive the positive externalities.

● (i.e. Underproduction)

● This results in a market demand curve that is shifted to the left of where they would be if they included all the benefits and totally willingness to pay

●

○ Government Intervention

■ May achieve economic efficiency when externalities affect large numbers of people

■ Govs. can counter overproduction caused by negative externalities with direct controls or Pigovian taxes.

■ Govs. can counter underproduction caused by positive externalities with subsidies or government provision

■ Direct Controls

● Government politics that directly constrain activities that generate negative externalities. Examples include maximum emissions limits for factories and laws mandating the proper disposal of toxic wastes

■ Pigovian tax

● A tax or charge levied on the production of a product that generates negative externalities.If set correctly, the tax will precisely offset the overproduction generated by negative externalities

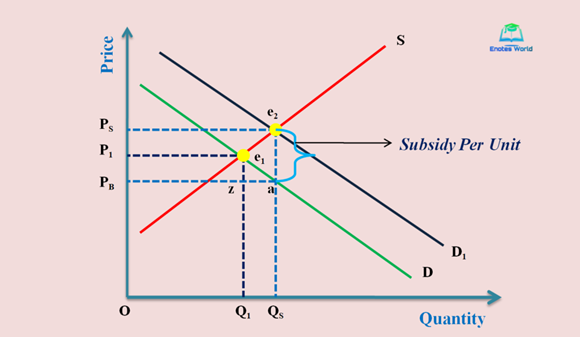

■ Subsidies to buyers

● Lowering the cost of a product/service through government funding to correct for underproduction. Allows more consumers to acquire the product or service and thus shift the demand curve to the right.

●

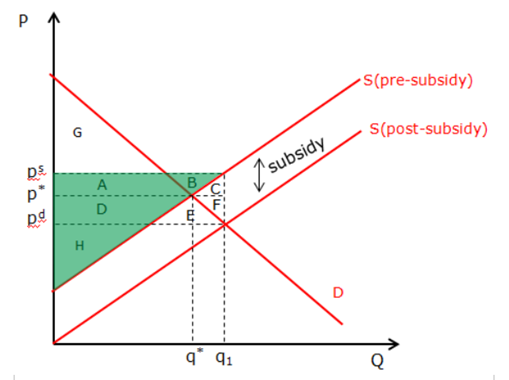

■ Subsidies to producers

● Essentially a tax in reverse. Meant to decrease the cost of production allowing for more of a product or service to be provided and thus shift the supply curve to the right.

■

■ Government provision

● When positive externalities are extremely large the government may simply provide the product for free to everyone

● Ex. the polio vaccine

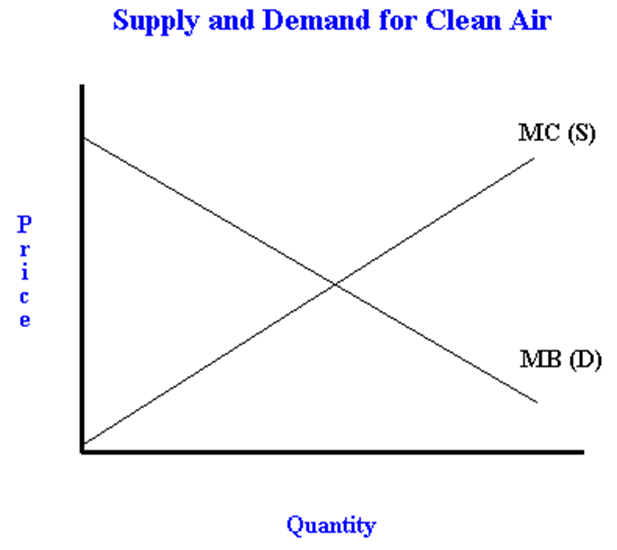

● Society’s Optimal Amount of Externality Reduction

○ Reducing externalities is not free and thus a balance between marginal benefits and marginal costs must be the goal

○ MC, MB, and Equilibrium Quantity

■ Optimal reduction of an externality: the reduction of a negative externality such as pollution to the level at which the marginal benefit and marginal cost of reduction are equal

■

○ Shifts of MB and MC Curves

■ Logically, the location of MB and MC curves are not permanent and can change for a variety of reasons

● Ex. More efficient pollution-control technology would shift the MB curve rightward

● Asymmetric Information

○ One other source of market failure is asymmetric information

■ When one party to a market transaction possesses substantially more information than the other party

○ This inequality of info makes it difficult to distinguish between trustworthy sellers/buyers from untrustworthy sellers/buyers

○ Government intervention to equalize information available may occur

○ In rare circumstance, the government may simply supply a good or service itself

○ Inadequate Buyer Information about Sellers

■ Can cause underallocation of resources

■ Ex. Suppose there were no qualifications necessary for a person to advertise themselves as a surgeon

● The market may eventually sort out the true surgeons from frauds, but in the meantime many people would forgo surgery less they die. Leading to an underallocation of surgeries being performed

○ Inadequate Seller Information about Buyers

■ Remember that “buyers” can refer to consumers buying products or firms buying resources

■ If sellers are worried about being taken advantage of by buyers that will drastically reduce the amount of market activity

■ Moral hazard problem: the possibility that individuals or institutions will behave more recklessly after they obtain insurance or similar contracts that shift the financial burden of a bad outcome onto others

● Medical malpractice insurance may increase the amount of malpractice

● Unemployment compensation may lead some workers to shirk finding a job

● Guaranteed contracts for professional athletes may reduce the quality of their performance

■ Adverse Selection Problem

● Problem arising when information known to one party to a contract or agreement is not known to the other party, causing the latter to incur major costs

○ Ex. People with the worst health are most likely to buy health insurance

○ Ex. A business owner about to hire an arsonist to burn their store down is most likely to buy fire insurance

○ Ex. Low productivity workers will apply for jobs with the best wages and hours

○ Ex. People who know they are unlikely to pay off debt will more actively seek out credit cards

● In the case of insurance, sometimes the government simply requires all individuals to acquire it, such a auto insurance, or paying into social security, even if most people will never need it.

○ Qualification

■ Sometimes the private sector is able to overcome the asymmetric information problem without government intervention

● Warranties

● Franchises

● Third party reviewers

● Credit scores

Chapter 5

· Public Goods

o Demand-side market failure: Underallocations of resources that occur when private demand curves understate consumers’ full willingness to pay for a good or service

§ In their most extreme, in the case of public goods, markets will fail to produce any of a public good

o Characteristics of Private Goods

§ Good for sale in stores or on the internet

§ Distinguished by Rivalry and Excludability

· Rivalry: When one person consumes a product it is not available for another person to consume

· Excludability: Sellers can prevent people who do not pay for a product from obtaining its benefits

o Public Good Characteristics

§ Products that typically can’t be provided for a profit and so gov. use tax revenue to provide them

§ Distinguished by Nonrivalry and Nonexludability

· Nonrivalry: One person’s consumption of a good does not preclude consumption of the good by others (Ex. National defense, street lights, GPS)

· Nonexcludability: No effective way of excluding individuals from the benefit of the good once it comes into existence

§ These characteristics create a Free-rider problem

· The inability of potential providers of an economically desirable good or service to obtain payment from those who benefit because of nonexcludability

§ Because people cannot be forced to pay for the good, private producers will essentially see zero demand

§ More examples of public goods: lighthouses, public art displays, public concerts

§ Essentially only two way to provide public goods

· Private philanthropy (not feasible for extremely expensive products like national defense)

· Government provision

o Optimal Quantity of a Public Good

§ Governments can best determine demand for a public good c through surveys or public votes

§ Goal remains: MB = MC

o Demand for Public Goods

§ Demand for public goods is somewhat unusual. It is found through public surveys of the price people would be willing to pay for each subsequent unit of a public good

· Ex. There are two people in a society. A survey finds how much each would be willing to pay for the first unit of a public good, how much they would be willing to pay for a second unit of that good, then a third, and so on. These price points for each quantity are then added together to form the demand curve for the public good

·

· Quasi-Public Good: Good or service to which excludability could apply but that has such a large positive externality that government sponsors its production to prevent an under allocation of resources

o Examples: Education, streets and highways, police and fire protection, libraries, museums, preventive medicine, sewage disposal

o The Reallocation Process

§ Governments reallocate resources from the production of private goods to public and quasi-public goods by levying taxes on households and businesses

· This pulls money away from private goods as households and businesses experience an income loss

· Government Failure

o Inefficiencies in resource allocation caused by problem in the operation of the public sector

§ Examples: principal-agent problem, the special-interest effect, the collective-action problem, rent seeking, and political corruption

o Principal-agent problem

§ At a firm, the conflict of interest that occurs when agents (workers or managers) pursue their own objectives to the detriment of the principals’ (stockholders) goals. (2) When elected officials (who are the agents of the people) pursue policies that are in their own interests rather than those that would benefit voters

o Special-interest effect

§ Any political outcome in which a small group gains substantially at the expense of s much larger number of person who each individually suffers a small loss

· Essentially costs are spread into tiny chunks among a huge number of people

o Ex. $10 million subsidy to drone makers results in a 3 cents per person cost on all Americans. Voters have little incentive to persuade their representatives to vote no

o Rent-Seeking Behavior

§ Attempts by individuals, firms, or unions to use political influence to receive payments in excess of the minimum amount they would normally be willing to accept to provide a particular good or service

· Examples: Tariffs on foreign goods, tax breaks that benefit specific corporations, government construction projects that create union jobs but cost more than the benefits they yield, occupational licensing that goes beyond what is needed to protect consumers, large subsidies to farmers.

o Limited and Bundled Choice

§ The political process forces citizens to be less selective in choose public goods and services than with private

· Voters have limited choice in candidates who hold a collection of policies they do and do not agree with

· Citizens must “buy” public goods they do not want

· Politicians must accept large spending bills that often contain spending they do not want

o Bureaucracy and Inefficiency

§ Many economists argue that without a profit-motive, government employees have little incentive to pursue peak efficiency

§ Vested interests within government bureaucracy will use political clout to block attempts to reduce the size of their agencies

o Inefficient Regulation and Intervention

§ Regulatory capture

· Occurs when a government regulatory agency ends up being controlled by the industry that it is supposed to be regulating

o Typically happens when people hired by a regulator are people who have worked or plan to work in the industry being regulated

o Corruption

§ Political corruption: Unlawful misdirection of government resources or when officials abuse their entrusted powers for personal gain

Knowt

Knowt