(8) Session 10 - Regulating Occupational Health & Safety (OHS) And Worker’s Compensation

OHS Overview

Occupational Health and Safety (OHS): Commonly referred to as "occupational health and safety," OHS aims to reduce workplace deaths and injuries.

History: OHS initiatives began over 130 years ago as efforts to minimize workplace deaths and injuries.

Internal Shared Responsibility: OHS is considered a shared responsibility between employees and employers, forming what is known as the internal responsibility system.

Relevance Post-COVID: The field of OHS is emerging as crucial, particularly in areas of people analytics, reflecting its increased importance post-Covid.

Key Pillars of OHS:

Commitment by Leadership/Management: Leaders are expected to actively support and engage in OHS practices ("Walk the talk").

Employee Participation: Employee involvement in OHS initiatives is vital for their success.

Healthy Work Environment: Compliance with OHS-related legislation is essential to create a safe work environment.

Tailored Initiatives: It's important to recognize that OHS initiatives should be customized to fit specific workplace environments; there is no "one size fits all" solution.

WHMIS - What?

Definition: WHMIS stands for Workplace Hazardous Material Information System.

Purpose: Established by the federal government as a national standard, WHMIS classifies different classes of hazardous materials such as flammable, poisonous, corrosive, and dangerously reactive materials.

Regulatory Flexibility: It allows different jurisdictions to define their own specific requirements regarding the labeling, storage, disposal, and handling of hazardous materials.

OHS - Basic Legal Principles

Sources of OHS Law

Federal: The Canada Labour Code (Part II) governs occupational health and safety at the federal level.

Provincial: In Saskatchewan, the Saskatchewan Employment Act (Part III) addresses provincial OHS concerns.

Regulations and Specific Laws: There are various regulations supplementing the main OHS-related laws, as well as numerous industry-specific laws, such as the Transportation of Dangerous Goods Act.

Basic Principles of OHS Laws

Employer Obligation: Employers must take every reasonable precaution to ensure the workplace is safe. This does not imply that workplaces must be completely risk-free.

Employee Obligation: Employees are required to comply with OHS laws and any safety directions established by their employer.

Employee Rights:

Participate: Employees have the right to participate in joint health and safety committees.

Know: Employees have the right to know about workplace hazards, including information under WHMIS and occupational exposure limits for hazardous substances.

Refuse Unsafe Work: Employees have the right to refuse unsafe work, although this right is not often exercised.

Enforcement of the Law

Complaints and Investigations: Enforcement is typically initiated through proactive government enforcement or individual complaints, which usually trigger an investigation.

Consequences for Non-Compliance: Non-compliance by employers can lead to fines, the shutting down of workplaces, and in rare cases, jail time.

Criminal Prosecution: The Criminal Code allows for the prosecution of corporations for incidents resulting in death or injury at the workplace, although this is rarely done in practice.

Worker’s Compensation (WC): Context

Overview

Regulation: Worker’s Compensation is regulated at the provincial/territorial level with different regulations across Canada.

Establishment: The system was established in Saskatchewan in 1911.

Purpose: It provides benefits to employees who are injured at work or to survivors if the employee is killed at work. The system operates on a no-fault insurance basis, protecting employers from lawsuits while ensuring employees receive reasonable compensation for lost earnings, as well as medical treatment and rehabilitation.

5 Cornerstones of WC (Meredith Principles) - apply in all jurisdictions

No-fault Compensation: Parties waive the right to sue, which eliminates disputes over responsibility for injuries.

Collective Liability: Costs are shared among employers without employee contributions.

Exclusive Jurisdiction: The Worker’s Compensation Board acts as the final decision-maker and is not bound by legal precedent, ensuring decisions are tailored to specific cases.

Security of Payment: A fund guarantees that compensation will always be available for employees, providing financial security and reassurance.

Independent Board: The board is autonomous, non-political, and financially independent of the government, which helps in maintaining its impartiality.

OHS - The Data for Saskatchewan (SK)

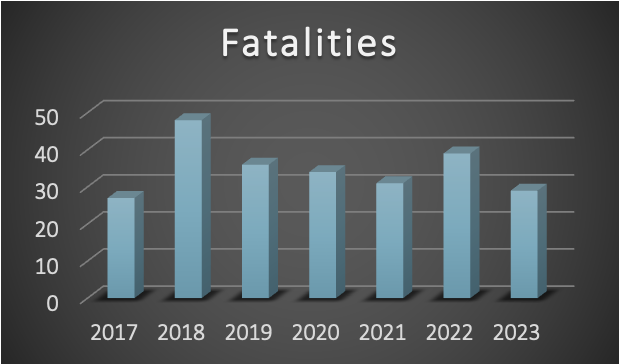

Fatalities

The graph displays a trend in workplace fatalities from 2017 to 2023. It shows a slight decline over the years, with a notable decrease in 2023 compared to 2022.

Time Loss Claims

This graph shows the number of time loss claims from 2017 to 2023. After a peak in 2020, there has been a general decline, suggesting improvements in workplace safety or claims management.

Long-term Trends

Motor Vehicle Crashes: From 2011 to 2020, motor vehicle crashes were the #1 cause of fatalities in the workplace.

Asbestos-Related Diseases: 72% of disease fatalities between 2011 and 2020 were related to asbestos.

Top Industries for Serious Injuries in 2023: The health care, transportation, and construction industries were highlighted as having the highest rates of serious injuries.

Worker's Compensation Claims in 2023

By Type of Injury:

Injuries to the hand were the most frequently reported, followed by back, leg, arm, and head injuries.

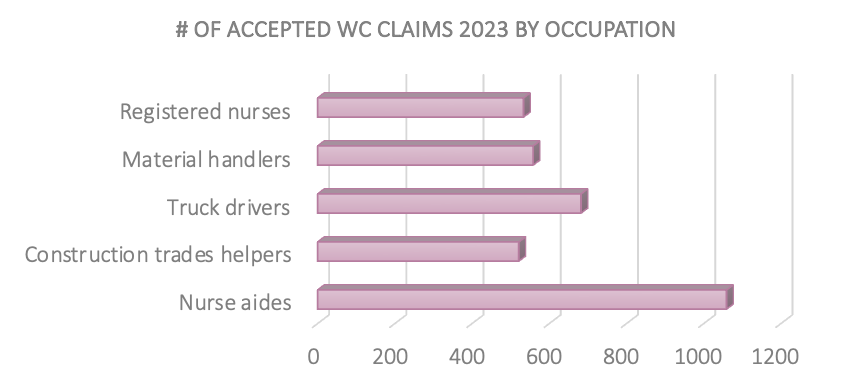

By Occupation:

Registered nurses filed the most claims, followed by material handlers, truck drivers, construction trades helpers, and nurse aides.

Workers Compensation: Key Design Features

Key Features of Worker's Compensation

Immunity from Lawsuit: Provides immunity from lawsuits for the employer/worker, but not for third parties.

Fair Compensation: Ensures fair compensation for injured workers and fair premium rates for employers.

Benefit of Doubt: In claims adjudication, the benefit of the doubt is often given to the worker.

Comprehensive Prevention and Management: Includes comprehensive injury prevention and disability management strategies.

Long-term Stability: Focuses on long-term stability, financial security, and cost-effectiveness of the compensation system.

Responsibilities of WC Boards

Non-Profit Operation: WC Boards operate on a non-profit basis.

System Administration: Responsible for the administration of the worker’s compensation system.

Contributions and Benefits: Manages the collection of contributions and the payment of benefits.

Claims Adjudication: Handles the adjudication of claims and dispute resolution.

Types of Injuries Covered

Traumatic Injuries: Such as broken bones.

Repetitive Stress Injuries: Such as tendonitis.

Occupational Diseases: Including respiratory problems caused by exposure to chemicals.

Reinjuries and Complications: Covering reinjury and difficulties with a previous work-related injury.

Legislation (SK) and Funding

System Funding and Operation

Funding: The system is funded solely by employer contributions.

Assessment Rates: Assessment rates are determined by the Worker’s Compensation Board of each jurisdiction.

Participation: Participation in the system is mandatory for most organizations, with some industries allowing voluntary participation. Certain provinces also require a minimum number of employees for mandatory coverage.

Self-insurers: Typically large Crown corporations, or federal and provincial agencies. These entities:

Do not pay assessment rates.

Have their claims administered by WC Boards, which charge a fee for the service.

Are individually liable for any accident costs as they occur.

Key Legislation

The Worker’s Compensation Act, 2013: The primary legislative framework guiding Worker’s Compensation in Saskatchewan.

The Worker’s Compensation General Regulations, 1985: Details the general operational regulations of the compensation system.

The Worker’s Compensation Miscellaneous Regulations: Covers additional, miscellaneous aspects of worker’s compensation not specifically addressed in the main act or general regulations.

Employer Assessment Rates

Calculation and Basis

Rate Calculation: Assessment rates are wage-related and calculated per $100 of assessable earnings (e.g., $1.45 per $100 of assessable earnings).

Assessable Earnings: These include salary/wages, overtime, bonuses, etc., and there is a cap on assessable earnings.

Minimum Premium: There is a minimum annual premium requirement established for employers.

Industry Specifics and Adjustments

Industry Specific: Rates vary depending on the employer’s type of operation.

Experience Rating: Employer rates can be influenced by their specific safety record and experience, which shifts responsibility from a broad industry classification to individual assessment.

Prospective: Rates may increase or decrease based on the past year's experience.

Retroactive: Assessments can be adjusted retroactively, resulting in a refund or surcharge based on actual experience.

Factors Influencing Rates

What Impacts Assessment Rates?:

Industry classification of the employer.

Application of experience rating.

Presence of safety-based program incentives.

Recent accident costs in respective industry classes.

Financial position of the Workers' Compensation Board.

Economic conditions.

Labor conditions.

Adjudication policies.

WC Benefits for Workers and Dependents

Short-Term Disability (STD)

Nature of Benefits: Can be total or partial, with benefits typically ranging from 75-90% of pre-accident earnings.

Concurrent Conditions: Conditions existing before or emerging after the accident that are not directly related to the accident (like underlying diseases) are not compensable.

Duration of Benefits: If a concurrent condition prolongs the healing of a compensable disability, STD benefits are usually extended until recovery.

Long-Term Disability (LTD)

Award System: Most jurisdictions use a dual award system for economic and non-economic losses.

Non-Economic Compensation: Includes compensation for loss of body parts or function, typically given as a one-time lump sum.

Economic Compensation: Measures loss of earning capacity, usually paid as monthly installments reflecting the difference between pre- and post-accident earning potential.

Health Care Related Benefits

Coverage: Encompasses most medical expenses that are generally covered by provincial health plans or extended health care plans, such as hospital care, physician services, drugs, and ancillary services.

Additional Support: Offers a wide range of vocational rehabilitation services, including training assistance, workstation modifications, job search assistance, and ergonomic modifications.

Survivor Benefits

Pension and Financial Support: Provides a pension and/or lump sum to a surviving spouse based on the deceased employee's earnings and the number of dependent children.

Child Allowance: Continues support for dependent children up to age 18, or older if they are full-time students.

Other Supports: Includes a lump sum for funeral costs and coverage for the transportation of the body.