AP Macro Unit 2

2.1 GDP

The Circular Flow and GDP

Macroeconomics is the study of the large economy as a whole

Why study it? - Government during the Great Depression didn’t understand how to fix a depressed economy with 25% unemployment

GDP - Gross Domestic Product

All countries have three economic goals

Promote economic growth

Limit unemployment

Keep prices stable (limit inflation)

Natural income accounting

Economists collect stats on production, income, investment and savings.

GDP is the dollar value of all final goods and services produced within a country in one year.

What does it tell us?

GDP measures how the U.S. is doing financially

How do you use it?

Compare to previous years (Is there growth?)

Compare to policy changes (Did the new policy work?)

Compare to other countries (Are we better off?)

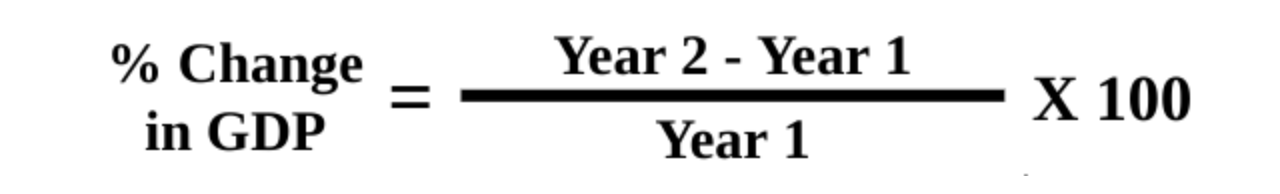

How to measure growth from year to year?

GDP does not accurately measure the standard of living

GDP Per Capita (one person)

GDP divided by the population. It identifies on average how many products each person makes.

What is NOT included in GDP?

Intermediate Goods

Goods inside the final goods (Price of finished car, not the stock radio or tires)

Non Production Transactions

Financial transactions (stocks, bonds, real estate)

Used goods (old goods, used clothes, existing homes)

Non-market and Illegal Activities

Things made at home (Unpaid work, black markets, drugs)

Ways to Calculate GDP

Expenditure Approach - add up all the spending on final goods and services produced in a given year.

Consumer spending + investment + government spending + net exports (exports minus imports) provides a complete picture of the economy's total output.

GDP (Y) = C + I + G + (X-M)

Consumer spending

Durable goods (cars)

Non-durable goods (food)

Services (dental work)

Investment spending

Investment is NEVER when individuals buy assets like stocks and bonds.

Investments is ALWAYS when businesses by capital like machines, resources and tools.

Government spending

Includes payments made by the gov. for goods and services

NOT stuff like social security

Income Approach - adds up all income earned from selling all final goods and services produced in a year.

Value-added Approach - add up the dollar value added at each stage of the production process.

Each method should generate the same number

2.2 Limitations of GDP

GDP does not account for the distribution of income among residents of a country, which can lead to an incomplete understanding of economic well-being.

It ignores non-market transactions, such as household labor and volunteer work, which can significantly contribute to societal welfare.

GDP may not reflect the sustainability of growth, as it does not consider the depletion of natural resources or environmental degradation.

Non-market transactions - many goods and services provide value but don’t count in GDP

2.3 Unemployment

Unemployment

workers that are actively looking for a job but aren’t working.

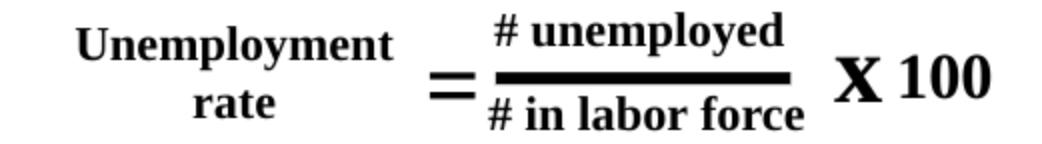

The unemployment rate

the percent of people in the labor force who want a job but are not working.

Real GDP = nominal GDP/GDP deflator x 100

3 Types of Unemployment

Frictional unemployment

Temporary employment or being between jobs

Ex: High school or college graduates looking for jobs

Individuals that were fired or are looking for a better job

Season unemployment is a specific type of frictional employment

Structural unemployment

Changes in the labor force make some skills obsolete

These workers don’t have transferable skills and these jobs will never come back, workers must learn new skills.

Ex: AI replacing jobs, milkman, VCR repair man

Technological unemployment is a type of structural employment where automation and machinery replace workers.

Cyclical Unemployment

Unemployment caused by a recession

As demand for goods and services falls, demand and labor workers are laid off

Sometimes called “demand deficient unemployment”

Ex: Steel workers laid off during recessions

Natural Rate of Unemployment

The economy is doing great if there is only frictional and structural unemployment

NRU - Frictional plus structural

Full Employment Output (Y) - Real GDP created when there is no cyclical unemployment

The US is at full employment when there is 4-6% unemployment

Difference between Natural Rate of Unemployment (NRU) and Non-Accelerating Inflation Rate of Unemployment (NAIRU)

NRU focuses on output and not having too much unemployment

NAIRU focuses on inflation and not having too little unemployment

Criticisms of Employment Rate

Discouraged workers

Underemployed workers

Race/age inequalities

2.4 Price Indices and Inflation

Inflation can disproportionately affect different groups, leading to varying impacts on purchasing power and living standards.

Inflation is rising general level of prices and it reduces the “purchasing power” of money.

Ex: It takes $2 to buy what $1 bought in 1989.

Deflation is a decrease in general prices or negative inflation rate

Deflation is bad because people will hoard money and assets

This decreases consumer spending and GDP

Disinflation - prices increasing at slower rates

How is inflation measured?

The Inflation Rate - the percent change in prices from year to year

Price Indices - index numbers assigned to each year that show how prices have changed relative to a specific base year

Consumer Price Index (CPI)

Base year is given an index of 100

To compare, each year is given an index number as well

CPI = price of market basket/price of market basket for base year x 100

Inflation rate: New#-Old#/Old# x100

Problems with CPI

Substitution bias - as prices increase for the fixed market basket, consumers by less of these products

New products - the CPI market basket may not include the newest consumer products

Product quality - CPI ignores both improvements and decline in product quality

2.5 Costs of Inflation

Effects of Unanticipated Inflation

Nominal Wage - wage measured by dollars rather than purchasing power

Real Wage - wage adjusted for inflation

2.6 Real v. Nominal GDP

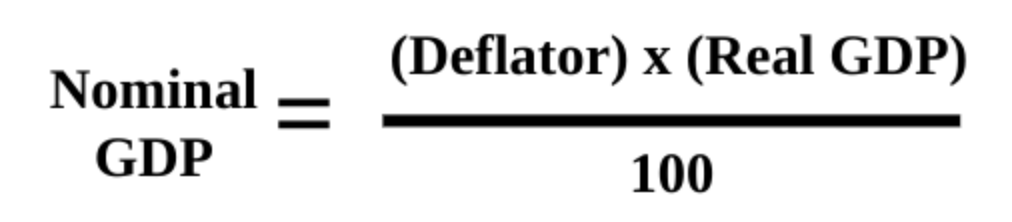

Nominal GDP - measured in current prices, doesn’t account for inflation

Real GDP- expressed in constant, unchanging, dollars. adjusts for inflation

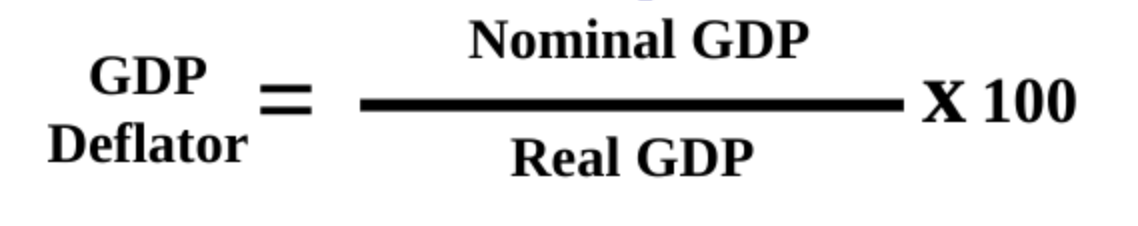

CPI VS GSP Deflator

Measures the prices of all goods produced, whereas the CPI measures prices of onlu the goods and services bought by customers

Real GDP = Nominal / GDP Deflator x 100

2.7 Business Cycles

The Business Cycle (real GDP over time) fluctuates

Real GDP per capita

Money supply

Inflation rate

Cyclical rate of unemployment

Velocity of Money

Tracks how many time a dollar is repeatedly spent in an economy

Formula:

MV=PY

(Money being tracked)(Velocity that money changes hands in a given time period)=(Price)(GDP)

Higher velocity the more active an economy