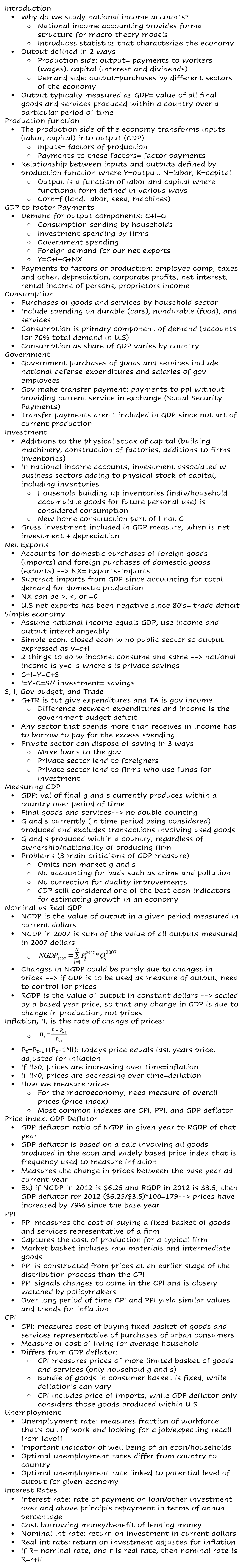

ECO3200 Chap 2 Notes

Introduction

Why do we study national income accounts?

National income accounting provides formal structure for macro theory models

Introduces statistics that characterize the economy

Output defined in 2 ways

Production side: output= payments to workers (wages), capital (interest and dividends)

Demand side: output=purchases by different sectors of the economy

Output typically measured as GDP= value of all final goods and services produced within a country over a particular period of time

Production function

The production side of the economy transforms inputs (labor, capital) into output (GDP)

Inputs= factors of production

Payments to these factors= factor payments

Relationship between inputs and outputs defined by production function where Y=output, N=labor, K=capital

Output is a function of labor and capital where functional form defined in various ways

Corn=f (land, labor, seed, machines)

GDP to factor Payments

Demand for output components: C+I+G

Consumption sending by households

Investment spending by firms

Government spending

Foreign demand for our net exports

Y=C+I+G+NX

Payments to factors of production; employee comp, taxes and other, depreciation, corporate profits, net interest, rental income of persons, proprietors income

Consumption

Purchases of goods and services by household sector

Include spending on durable (cars), nondurable (food), and services

Consumption is primary component of demand (accounts for 70% total demand in U.S)

Consumption as share of GDP varies by country

Government

Government purchases of goods and services include national defense expenditures and salaries of gov employees

Gov make transfer payment: payments to ppl without providing current service in exchange (Social Security Payments)

Transfer payments aren't included in GDP since not art of current production

Investment

Additions to the physical stock of capital (building machinery, construction of factories, additions to firms inventories)

In national income accounts, investment associated w business sectors adding to physical stock of capital, including inventories

Household building up inventories (indiv/household accumulate goods for future personal use) is considered consumption

New home construction part of I not C

Gross investment included in GDP measure, when is net investment + depreciation

Net Exports

Accounts for domestic purchases of foreign goods (imports) and foreign purchases of domestic goods (exports) --> NX= Exports-Imports

Subtract imports from GDP since accounting for total demand for domestic production

NX can be >, <, or =0

U.S net exports has been negative since 80's= trade deficit

Simple economy

Assume national income equals GDP, use income and output interchangeably

Simple econ: closed econ w no public sector so output expressed as y=c+I

2 things to do w income: consume and same --> national income is y=c+s where s is private savings

C+I=Y=C+S

I=Y-C=S// investment= savings

S, I, Gov budget, and Trade

G+TR is tot give expenditures and TA is gov income

Difference between expenditures and income is the government budget deficit

Any sector that spends more than receives in income has to borrow to pay for the excess spending

Private sector can dispose of saving in 3 ways

Make loans to the gov

Private sector lend to foreigners

Private sector lend to firms who use funds for investment

Measuring GDP

GDP: val of final g and s currently produces within a country over period of time

Final goods and services--> no double counting

G and s currently (in time period being considered) produced and excludes transactions involving used goods

G and s produced within a country, regardless of ownership/nationality of producing firm

Problems (3 main criticisms of GDP measure)

Omits non market g and s

No accounting for bads such as crime and pollution

No correction for quality improvements

GDP still considered one of the best econ indicators for estimating growth in an economy

Nominal vs Real GDP

NGDP is the value of output in a given period measured in current dollars

NGDP in 2007 is sum of the value of all outputs measured in 2007 dollars

Changes in NGDP could be purely due to changes in prices --> if GDP is to be used as measure of output, need to control for prices

RGDP is the value of output in constant dollars --> scaled by a based year price, so that any change in GDP is due to change in production, not prices

Inflation, II, is the rate of change of prices:

Pt=Pt-1+(Pt-1*II): todays price equals last years price, adjusted for inflation

If II>0, prices are increasing over time=inflation

If II<0, prices are decreasing over time=deflation

How we measure prices

For the macroeconomy, need measure of overall prices (price index)

Most common indexes are CPI, PPI, and GDP deflator

Price index: GDP Deflator

GDP deflator: ratio of NGDP in given year to RGDP of that year

GDP deflator is based on a calc involving all goods produced in the econ and widely based price index that is frequency used to measure inflation

Measures the change in prices between the base year ad current year

Ex) if NGDP in 2012 is $6.25 and RGDP in 2012 is $3.5, then GDP deflator for 2012 ($6.25/$3.5)*100=179--> prices have increased by 79% since the base year

PPI

PPI measures the cost of buying a fixed basket of goods and services representative of a firm

Captures the cost of production for a typical firm

Market basket includes raw materials and intermediate goods

PPI is constructed from prices at an earlier stage of the distribution process than the CPI

PPI signals changes to come in the CPI and is closely watched by policymakers

Over long period of time CPI and PPI yield similar values and trends for inflation

CPI

CPI: measures cost of buying fixed basket of goods and services representative of purchases of urban consumers

Measure of cost of living for average household

Differs from GDP deflator:

CPI measures prices of more limited basket of goods and services (only household g and s)

Bundle of goods in consumer basket is fixed, while deflation's can vary

CPI includes price of imports, while GDP deflator only considers those goods produced within U.S

Unemployment

Unemployment rate: measures fraction of workforce that's out of work and looking for a job/expecting recall from layoff

Important indicator of well being of an econ/households

Optimal unemployment rates differ from country to country

Optimal unemployment rate linked to potential level of output for given economy

Interest Rates

Interest rate: rate of payment on loan/other investment over and above principle repayment in terms of annual percentage

Cost borrowing money/benefit of lending money

Nominal int rate: return on investment in current dollars

Real int rate: return on investment adjusted for inflation

If R= nominal rate, and r is real rate, then nominal rate is R=r+II