ACC111

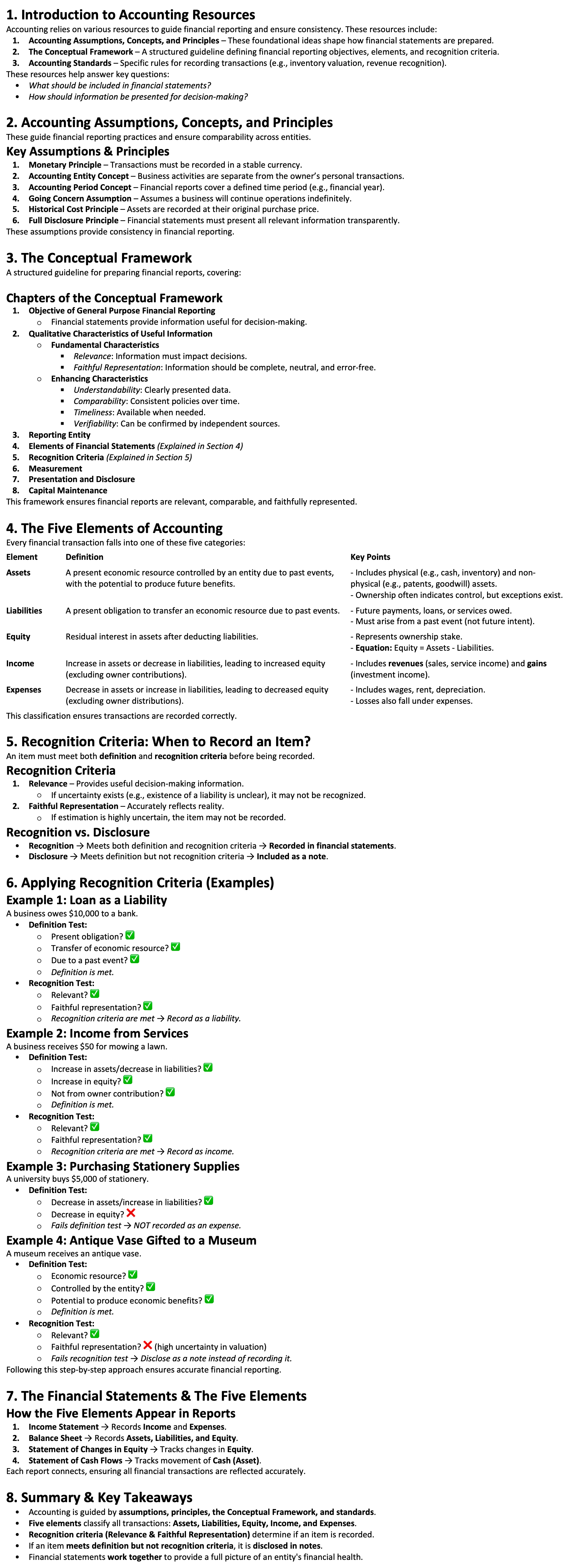

Part 3: Users of accounting information

Internal Vs. external users

Internal users: within an organisation in a position of power

Eg. Managers, senior executives, supervisors etc

need the information/data to make well informed decisions

many of their decision rely on managing the business on a day to day basis (relying on financial and management accounting data)

External users: those who are not in a privileged position to access the accounting information and have to wait for official release of financial statements

information they receive is limited/summarised and general

there is a wide range of users

Eg. Those who have stocks in the business

can be PRIMARY users or OTHER users

Primary--> those who provide resources to an entity a.k.a invest in the business (eg. Real and potential investors, lenders, creditors like employees, suppliers, customers)

Other-->

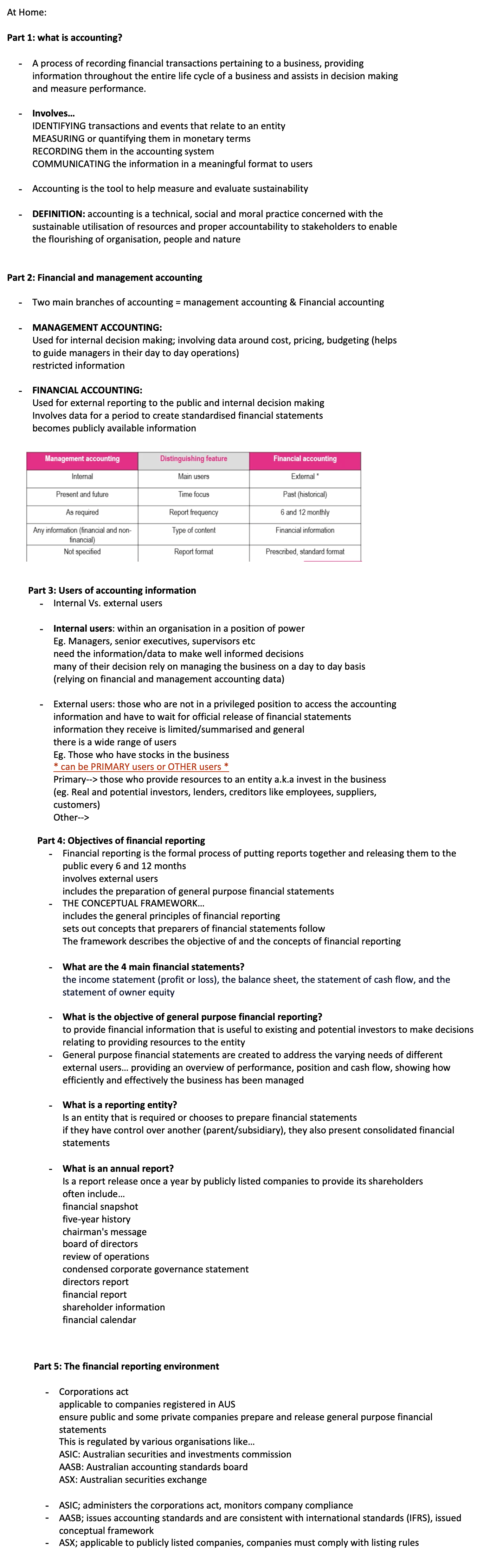

Part 4: Objectives of financial reporting

Financial reporting is the formal process of putting reports together and releasing them to the public every 6 and 12 months

involves external users

includes the preparation of general purpose financial statementsTHE CONCEPTUAL FRAMEWORK…

includes the general principles of financial reporting

sets out concepts that preparers of financial statements follow

The framework describes the objective of and the concepts of financial reporting

What are the 4 main financial statements?

the income statement (profit or loss), the balance sheet, the statement of cash flow, and the statement of owner equity

What is the objective of general purpose financial reporting?

to provide financial information that is useful to existing and potential investors to make decisions relating to providing resources to the entityGeneral purpose financial statements are created to address the varying needs of different external users… providing an overview of performance, position and cash flow, showing how efficiently and effectively the business has been managed

What is a reporting entity?

Is an entity that is required or chooses to prepare financial statements

if they have control over another (parent/subsidiary), they also present consolidated financial statements

What is an annual report?

Is a report release once a year by publicly listed companies to provide its shareholders

often include…

financial snapshot

five-year history

chairman's message

board of directors

review of operations

condensed corporate governance statement

directors report

financial report

shareholder information

financial calendar

Part 5: The financial reporting environment

Corporations act

applicable to companies registered in AUS

ensure public and some private companies prepare and release general purpose financial statements

This is regulated by various organisations like…

ASIC: Australian securities and investments commission

AASB: Australian accounting standards board

ASX: Australian securities exchange

ASIC; administers the corporations act, monitors company compliance

AASB; issues accounting standards and are consistent with international standards (IFRS), issued conceptual framework

ASX; applicable to publicly listed companies, companies must comply with listing rules

1. Introduction to Accounting Resources

Accounting relies on various resources to guide financial reporting and ensure consistency. These resources include:

Accounting Assumptions, Concepts, and Principles – These foundational ideas shape how financial statements are prepared.

The Conceptual Framework – A structured guideline defining financial reporting objectives, elements, and recognition criteria.

Accounting Standards – Specific rules for recording transactions (e.g., inventory valuation, revenue recognition).

These resources help answer key questions:

What should be included in financial statements?

How should information be presented for decision-making?

2. Accounting Assumptions, Concepts, and Principles

These guide financial reporting practices and ensure comparability across entities.

Key Assumptions & Principles

Monetary Principle – Transactions must be recorded in a stable currency.

Accounting Entity Concept – Business activities are separate from the owner’s personal transactions.

Accounting Period Concept – Financial reports cover a defined time period (e.g., financial year).

Going Concern Assumption – Assumes a business will continue operations indefinitely.

Historical Cost Principle – Assets are recorded at their original purchase price.

Full Disclosure Principle – Financial statements must present all relevant information transparently.

These assumptions provide consistency in financial reporting.

3. The Conceptual Framework

A structured guideline for preparing financial reports, covering:

Chapters of the Conceptual Framework

Objective of General Purpose Financial Reporting

Financial statements provide information useful for decision-making.

Qualitative Characteristics of Useful Information

Fundamental Characteristics

Relevance: Information must impact decisions.

Faithful Representation: Information should be complete, neutral, and error-free.

Enhancing Characteristics

Understandability: Clearly presented data.

Comparability: Consistent policies over time.

Timeliness: Available when needed.

Verifiability: Can be confirmed by independent sources.

Reporting Entity

Elements of Financial Statements (Explained in Section 4)

Recognition Criteria (Explained in Section 5)

Measurement

Presentation and Disclosure

Capital Maintenance

This framework ensures financial reports are relevant, comparable, and faithfully represented.

4. The Five Elements of Accounting

Every financial transaction falls into one of these five categories:

Element

Definition

Key Points

Assets

A present economic resource controlled by an entity due to past events, with the potential to produce future benefits.

- Includes physical (e.g., cash, inventory) and non-physical (e.g., patents, goodwill) assets.

- Ownership often indicates control, but exceptions exist.

Liabilities

A present obligation to transfer an economic resource due to past events.

- Future payments, loans, or services owed.

- Must arise from a past event (not future intent).

Equity

Residual interest in assets after deducting liabilities.

- Represents ownership stake.

- Equation: Equity = Assets - Liabilities.

Income

Increase in assets or decrease in liabilities, leading to increased equity (excluding owner contributions).

- Includes revenues (sales, service income) and gains (investment income).

Expenses

Decrease in assets or increase in liabilities, leading to decreased equity (excluding owner distributions).

- Includes wages, rent, depreciation.

- Losses also fall under expenses.

This classification ensures transactions are recorded correctly.

5. Recognition Criteria: When to Record an Item?

An item must meet both definition and recognition criteria before being recorded.

Recognition Criteria

Relevance – Provides useful decision-making information.

If uncertainty exists (e.g., existence of a liability is unclear), it may not be recognized.

Faithful Representation – Accurately reflects reality.

If estimation is highly uncertain, the item may not be recorded.

Recognition vs. Disclosure

Recognition → Meets both definition and recognition criteria → Recorded in financial statements.

Disclosure → Meets definition but not recognition criteria → Included as a note.

6. Applying Recognition Criteria (Examples)

Example 1: Loan as a Liability

A business owes $10,000 to a bank.

Definition Test:

Present obligation? ✅

Transfer of economic resource? ✅

Due to a past event? ✅

Definition is met.

Recognition Test:

Relevant? ✅

Faithful representation? ✅

Recognition criteria are met → Record as a liability.

Example 2: Income from Services

A business receives $50 for mowing a lawn.

Definition Test:

Increase in assets/decrease in liabilities? ✅

Increase in equity? ✅

Not from owner contribution? ✅

Definition is met.

Recognition Test:

Relevant? ✅

Faithful representation? ✅

Recognition criteria are met → Record as income.

Example 3: Purchasing Stationery Supplies

A university buys $5,000 of stationery.

Definition Test:

Decrease in assets/increase in liabilities? ✅

Decrease in equity? ❌

Fails definition test → NOT recorded as an expense.

Example 4: Antique Vase Gifted to a Museum

A museum receives an antique vase.

Definition Test:

Economic resource? ✅

Controlled by the entity? ✅

Potential to produce economic benefits? ✅

Definition is met.

Recognition Test:

Relevant? ✅

Faithful representation? ❌ (high uncertainty in valuation)

Fails recognition test → Disclose as a note instead of recording it.

Following this step-by-step approach ensures accurate financial reporting.

7. The Financial Statements & The Five Elements

How the Five Elements Appear in Reports

Income Statement → Records Income and Expenses.

Balance Sheet → Records Assets, Liabilities, and Equity.

Statement of Changes in Equity → Tracks changes in Equity.

Statement of Cash Flows → Tracks movement of Cash (Asset).

Each report connects, ensuring all financial transactions are reflected accurately.

8. Summary & Key Takeaways

Accounting is guided by assumptions, principles, the Conceptual Framework, and standards.

Five elements classify all transactions: Assets, Liabilities, Equity, Income, and Expenses.

Recognition criteria (Relevance & Faithful Representation) determine if an item is recorded.

If an item meets definition but not recognition criteria, it is disclosed in notes.

Financial statements work together to provide a full picture of an entity's financial health.

Sure! Here are some questions to quiz you on accounting assumptions, concepts, and principles:

What is the Monetary Principle in accounting?

It requires that transactions must be recorded in a stable currency.

What does the Accounting Entity Concept state?

Business activities must be separate from the owner’s personal transactions.

What is the purpose of the Accounting Period Concept?

It ensures that financial reports cover a defined time period (e.g., financial year).

What is the Going Concern Assumption?

It assumes that a business will continue its operations indefinitely.

In accounting, what is the Historical Cost Principle?

It states that assets are recorded at their original purchase price.

What is the Full Disclosure Principle?

Financial statements must present all relevant information transparently to users.

Feel free to answer, and I can provide feedback!

Sure! Here are some questions to quiz you on accounting assumptions, concepts, and principles:

What is the Monetary Principle in accounting?

It requires that transactions must be recorded in a stable currency.

What does the Accounting Entity Concept state?

Business activities must be separate from the owner’s personal transactions.

What is the purpose of the Accounting Period Concept?

It ensures that financial reports cover a defined time period (e.g., financial year).

What is the Going Concern Assumption?

It assumes that a business will continue its operations indefinitely.

In accounting, what is the Historical Cost Principle?

It states that assets are recorded at their original purchase price.

What is the Full Disclosure Principle?

Financial statements must present all relevant information transparently to users.

Feel free to answer, and I can provide feedback!

Sure! Here are some questions to quiz you on accounting assumptions, concepts, and principles:

What is the Monetary Principle in accounting?

It requires that transactions must be recorded in a stable currency.

What does the Accounting Entity Concept state?

Business activities must be separate from the owner’s personal transactions.

What is the purpose of the Accounting Period Concept?

It ensures that financial reports cover a defined time period (e.g., financial year).

What is the Going Concern Assumption?

It assumes that a business will continue its operations indefinitely.

In accounting, what is the Historical Cost Principle?

It states that assets are recorded at their original purchase price.

What is the Full Disclosure Principle?

Financial statements must present all relevant information transparently to users.

Feel free to answer, and I can provide feedback!