Chapter 12: Statement of Cash Flows

Objective 12.1: Identify cash flows arising from operating, investing, and financing activities.

Business Activities and Cash Flows

- The balance sheet and income statement does not explain what causes changes in cash.

- The statement of cash flows is able to show business activities that makes the company’s cash increase or decrease.

- Cash includes:

- Cash

- Cash equivalents

- Restricted cash

- Cash equivalents are ^^short term^^, liquid investments purchased within three months of maturity.

- They are convertible to amounts of cash.

- Value does not change near maturity.

- Restricted cash must legally be set aside and is not used for day to day operations.

Classifying Cash Flows

- Cash inflows and outflows correlate to operating, investing, and financing activities.

- Cash inflows will be a ^^positive number^^.

- Cash outflows will be a ^^negative number^^.

Operating Activities

- Revenues and expenses on the income statement are the result of cash flows from operating activities.

- Operating activities are day to day activities related to running a business.

- Examples of operating activities:

- Collecting money

- Receiving dividends

- Receiving interest

- The difference between inflows and outflows are the subtotal of the financial statement, which is called Net Cash Provided by (Used for) Operating Activities.

- Causes change in current assets and liabilities.

- Cash from operating activities must report the purchasing (in cash) of inventory.

Investing Activities

- The purchase and disposal of investments and long lived assets are the result of cash flows from investments.

- Examples of investing activities:

- Sale/disposal of equipment

- Sale/maturity of investments in securities

- The difference between inflows and outflows are the subtotal of the financial statement, which is called Net Cash Provided by (Used in) Investing Activities.

- Causes change in non-current assets.

Financing Activities

- The exchange of cash with stockholders and cash exchanges with lenders results in cash flows from financing activities.

- Examples of financing activities:

- Borrowing from lenders through formal debt contracts.

- Issuing stock to owners.

- The difference between inflows and outflows are the subtotal of the financial statement, which is called Net Cash Provided by (Used in) Financing Activities.

- Causes change in non-current liabilities or stockholders’ equity accounts.

Relationship to Other Financial Statements

- The statement of cash flows takes business activities during the accounting period and shows how they relate to cash.

- It does use information from the balance sheet and income statement, but converts them from the accrual basis to the cash basis.

- ^^Information needed to create the statement of cash flows^^:

- Comparative balance sheets (uses beginning and ending balances to calculate the cash flows from activities).

- A complete income statement (calculates cash flows for operating activities).

- Additional data that was affected by investing or financing activities.

- The statement of cash flows uses the basic accounting equation, but splits it up. Assets are split into cash and non-cash assets.

- ^^Breaking up the basic accounting equation^^:

- Assets = Liabilities + Stockholders’ Equity

- Cash + Non-cash Assets = Liabilities + Stockholders’ Equity

- Cash = Liabilities + Stockholders’ Equity - Non-cash Assets

- Change in Cash = Change in (Liabilities + Stockholders’ Equity - Non-cash Assets)

- Change in cash between the beginning and end of the year must be equal to the right side.

Preparing the Statement of Cash Flows

First, determine the change in each balance sheet account

==Equation to calculate the change in balance sheet accounts:==

- Ending balance - Beginning balance of the new year

Next, identify the cash flow category or categories to which each account relates.

- Some accounts have more than more activity (operating, investing, or financing).

- Retained Earnings has financing and operating activities.

- Accumulated Depreciation has operating and investing activities.

Lastly, schedules are created to summarize operating, investing, and financing cash flows.

Direct and Indirect Reporting of Operating Cash Flows

- ^^Ways to present operating activities on the financial statement:^^

- The Direct Method

- Reports the total cash inflow or outflow from each major transaction.

- Difference between the cash inflows and outflows equals Net Cash Provided (Used in) Operating Activities.

- Cash collected or paid.

- The Indirect Method

- Begins with net income from the income statement and:

- Eliminates the effects of items that don’t involve cash.

- Includes items that do have cash effects (Net income, depreciation, changes is current assets/liabilities).

- Adjusting the net income gives Net Cash Provided by (Used in) Operating Activities.

- ^^Both methods have the same result for Net cash provided^^ (used in) operating activities.

- By choosing one method over the other, there is an affect in the “Operating Activities” section of the financial statement.

- Example: Direct method.

- Step 1: When given information, locate cash inflow (collected) and outflow (paid).

- Step 2: Add inflow, subtract outflow to get “Net Cash Provided by (Used in) Operating Activities”.

- (Parenthesis indicate that you need to subtract).

| Cash collected from customers | $1,486 |

|---|---|

| Cash paid to employees and suppliers of services | ($302) |

| Cash paid to suppliers | ($653) |

| Cash paid for interest | ($34) |

| Cash paid for income tax | ($15) |

| Net cash provided by (used in) operating activities | = $482 |

- Example: Indirect method

- Step 1: When given information, locate net income, depreciation, changes in current assets, and changes in current liabilities.

- Step 2: Add to get “Net Cash Provided by (Used in) Operating Activities”.

- ^^Result will be the same as direct method^^

| Net Income | $132 |

|---|---|

| Depreciation | $89 |

| Changes in current assets and current liabilities | $43 |

| Net cash provided by (used in) operating activities | = $482 |

- Both results in $482.

Objective 12.2: Report cash flows from operating activities, using the indirect method.

Determining Operating Cash Flows Using the Indirect Method

==Equation to calculate net cash flow provided by (used in) operating activities:==

- Net Income + Depreciation + Decreases in current assets - Increases in current assets - Decreases in current liabilities + Increases in current liabilities

- Example of this process is under “Indirect Method” in previous section (steps are broken down here).

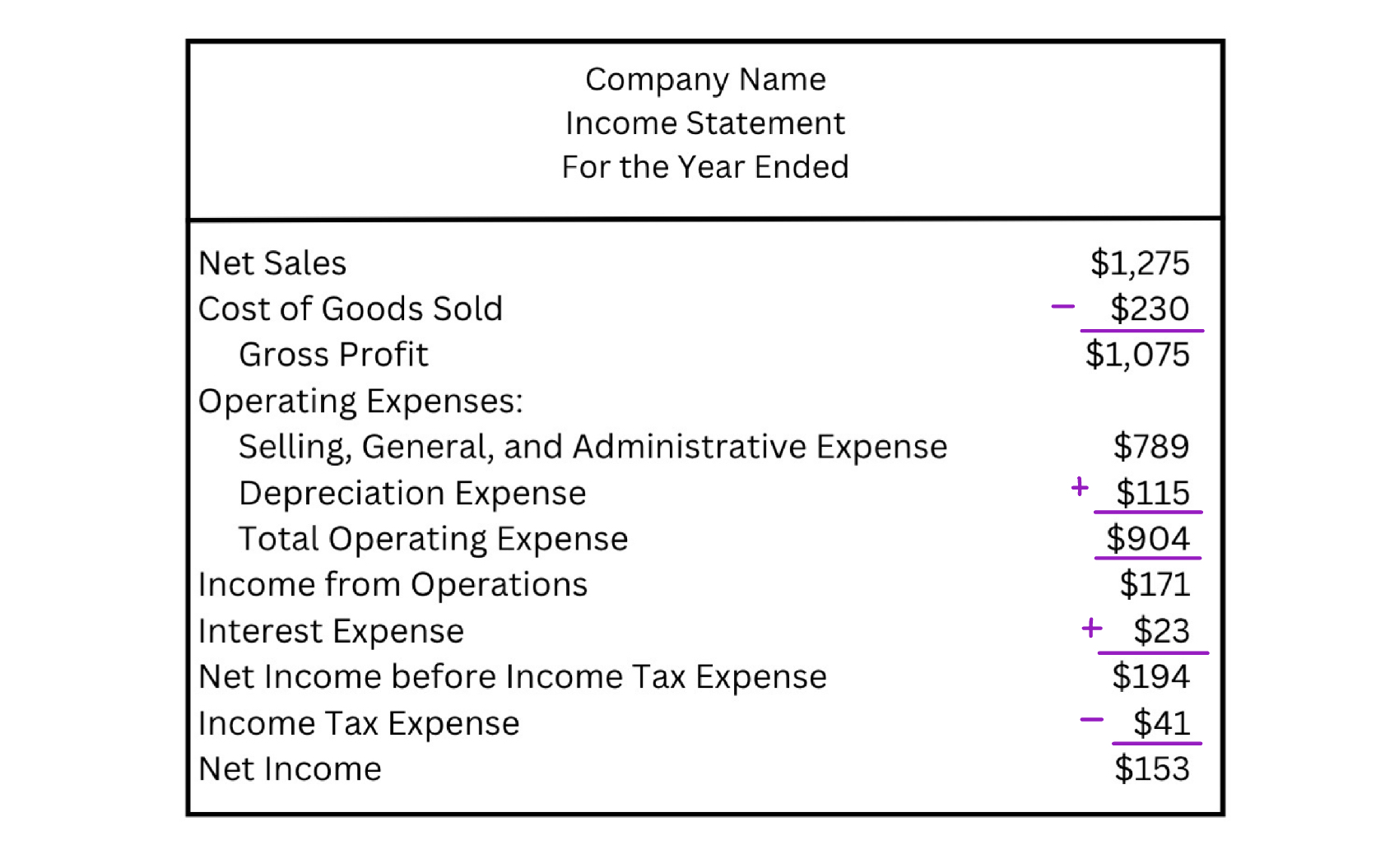

We start with the Net Income listed on the income statement (in millions):

^^Depreciation does not involve cash^^, so we eliminate the effect it has on Net Income by adding it into the statement of cash flows.

By subtracting increase in current assets, it eliminates the effect of transactions that increased Net Income but not the cash in the current period. Assets in this example include:

It also allows us to include the cash effects of other transactions that did not affect Net Income in the current period cash decrease.

Subtracting decreasing current liabilities eliminates the effects of transactions that increased Net Income but cash cash.

- In addition, it allows us to include the cash effects of other transactions that did not affect Net Income in the current period but did decrease cash.

Adding increases in current liabilities eliminates the effects of transactions that decreased Net Income but did not affect cash.

Adding increases in current liabilities allows us to include the cash effects of other transactions that did not affect Net Income in the current period but did increase cash.

Reporting Operating Cash Flows - Indirect Method

- Preparing an operating cash flow schedule:

- First calculate operating, investing, and financing changes in balance sheets.

- Cash is found at the bottom of the Statement of Cash Flows.

Net Income + Depreciation

- The format of the Statement of Cash Flows (indirect method) starts with net income and followed by depreciation.

- Net income is changed into operating cash flows.

Decrease in Accounts Receivable

- A decrease in Accounts Receivable indicates sales on account were less than the collection of cash from customers.

- An increase in Accounts Receivable indicates sales on account were more than the collection of cash from customers.

- We must add or subtract the difference to get higher cash.

- If the change in account is a…..

- Debit, then the adjustment is a credit to cash (subtracting).

- Credit, then the adjustment is a debit to cash (adding).

Increase in Prepaid Expenses

- Cash flow from operating activities reflect cash payments.

- Cash prepayments increase prepaid expenses.

- Recording expenses decreases prepaid expenses.

Increase in Accounts Payable

- Accounts Payable is increased by purchases on account.

- Accounts Payable is decreased when payments are made to suppliers.

Increase in Accrued Liabilities

- Accrued expenses increases Accrued Liabilities.

- Payment of expenses decreases Accrued Liabilities.

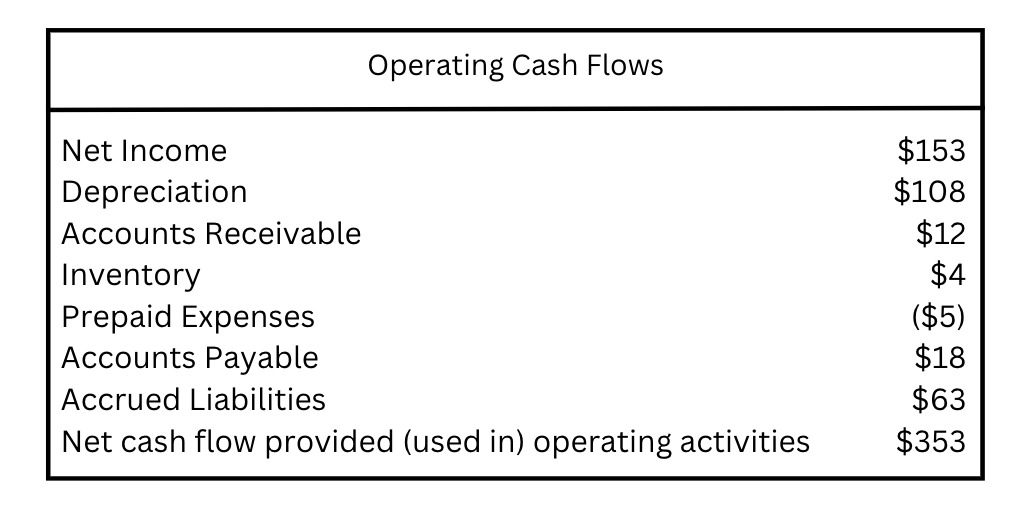

Schedule of Operating Cash Flows

Step 1: Begin with Net Income from the Income Statement (in millions)

- Net Income = $153

Step 2: Add depreciation (a non-cash expense)

- For this example, we will say depreciation is $108

Step 3: Add current assets

- Accounts Receivable = 12

- Inventory = 4

Step 4: Subtract expenses

- Prepaid Expenses = 5

Step 5: Add Liabilities

- Accounts Payable = 18

- Accrued Liabilities = 63

Step 6: Calculate net cash flows provided by (used in) operating activities

- Net cash flows provided by (used in) operating activities = $353

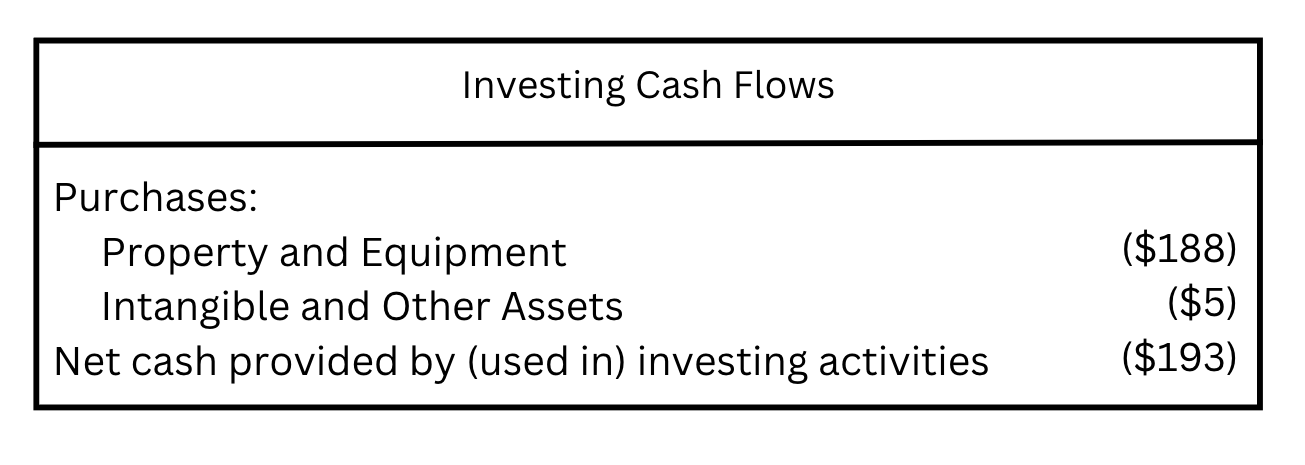

Objective 12.3: Report cash flows from investing activities.

Reporting Investing Cash Flow Calculations

- The investing activities section of this statement correlates to long lived tangible and intangible assets.

- In this section, you must identify and separately report the causes increases and decreases in accounts.

Property and Equipment

- Purchases for these assets are considered increases and outflows.

- Disposals for these assets are considered decreases and inflows.

- Add together the purchases of tangible assets to calculate net cash from investing activities.

Intangible and Other Assets

- Intangible assets are effected by disposals, impairments, and amortization.

- Cash outflow is always subtracted.

Schedule of Investing Cash Flows

Step 1: Subtract Intangible/Other Assets from Property/Equipment

The net cash provided by (used in) investing activities = ($1)

- This is the subtotal for the statement of cash flows.

Objective 12.4: Report cash flows from financing activities.

Reporting Financing Cash Flow Calculations

- This section shows changes in liabilities owned to owners, financial institutions, and stockholders’ equity accounts.

- Dividends Payable goes to owners.

- Notes Payable goes to financial institutions.

- Cash inflows and outflows are reported separately.

- Accounts in the financing activity sections:

- Notes Payable

- Bonds Payable

- Common Stock

- Retained Earnings

- Treasury Stock

- Increases and decreases are reported separately.

Retained Earnings

- Net Income increases Retained Earnings.

- Net Loss and declared dividends decreases Retained Earnings.

- Net Income was reported as an operating cash flow.

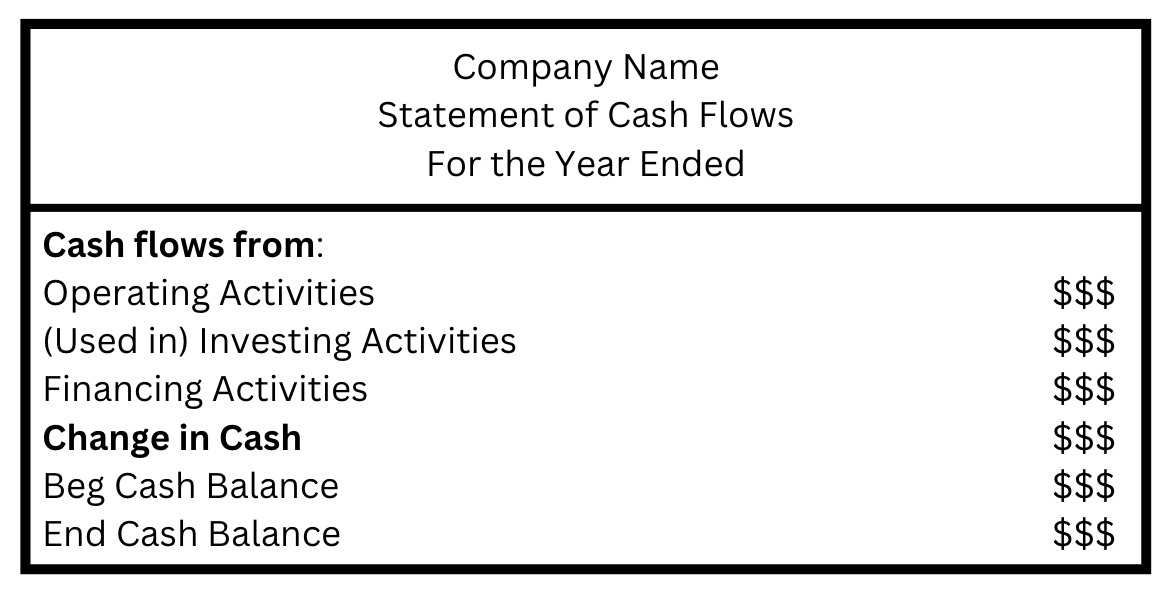

Reporting the Statement of Cash Flows

- Net increase or decrease in cash and cash equivalents with combine with operating, investing, and financing activities to get net change.

- Net change is combined with the initial cash balance to get the ending cash balance.

- The ending cash balance must be the same as the amount found on the balance sheet.

Non-cash Transactions and Other Supplemental Disclosures

- Non-cash investing and financing activities include material investing and financing transactions that ^^didn’t have an effect on cash flow^^.

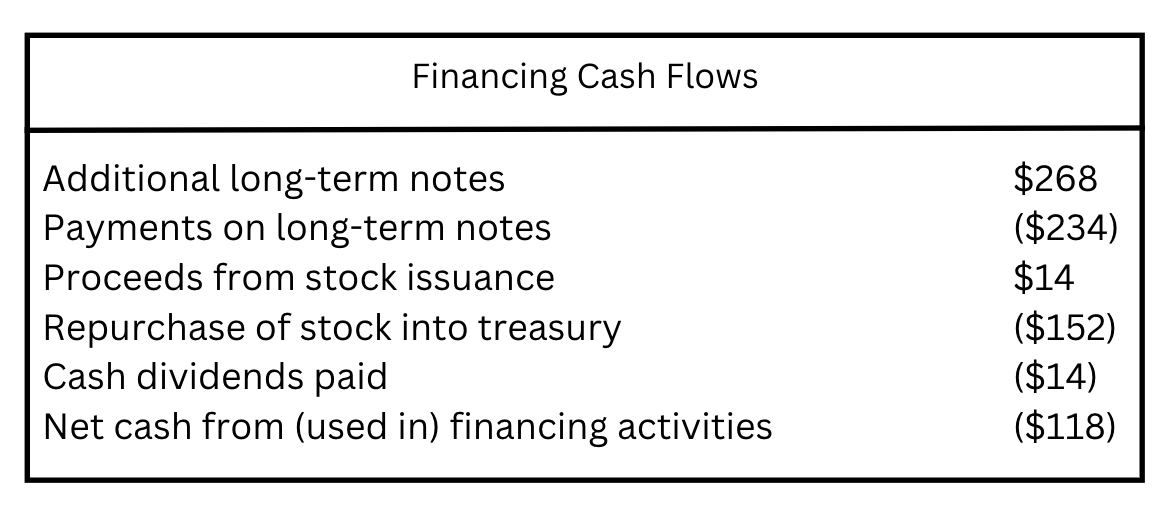

Schedule of Financing Cash Flows

Step 1: Find the value of long-term note liabilities

- Additional long-term notes = $268

Step 2: Subtract payments on notes

- Payment = ($234)

Step 3: Add proceeds from stock issuance:

- Proceeds = $13

Step 4: Subtract the repurchase of stock

- Repurchase = ($152)

Step 5: Subtract dividends paid

- Dividends = ($14)

Step 6: Calculate net cash provided by (used in) financing activities

- Net cash provided by (used in) financing activities = ($118)

Statement of Cash Flows: Put Everything Together

- Piece together each schedule:

Objective 12.5: Interpret cash flows from operating, investing, and financing activities.

Evaluating Cash Flows from Operating Activities

- Using the Statement of Cash Flows, we examine the cash flow patterns of each section.

- During the introductory phase, a company is in the process of being established.

- Negative net operating cash flow.

- Spend a lot on long term assets during this phase.

- Negative investing cash flows.

- Rely on investing activities for cash.

- The growth phase indicates the evolution of the company.

- Operating cash flows are positive as the company expands.

- Relies less on investing activities for cash.

- At the maturity phase, the company stabilizes.

- Positive operating cash flows.

- The company is not expanding anymore.

- Reduces investing activities.

- Increases financing activities.

- Finally, a company will reach the decline phase and fall out.

- Negative operating cash flows.

- Negative financing cash flows.

- Positive investing cash flows.

- Each phase helps the evaluation process.

- Operating activities indicate whether or not a company is earning enough to maintain their current assets and liabilities.

- Four causes of deviations:

- Seasonality, meaning sales are occurring more during specific points of the year.

- The corporate life cycle, aka growth in sales, which is the rapid sales of new companies. This results in negative operating cash flows.

- Change in revenues and expenses recognition:

- Record revenues before providing services.

- Delay reporting expenses.

- Both increase net income.

- There is no affect on operating activities.

- Changes in working capital management:

- Measuring to see if current assets exceed current liabilities.

- If current assets grow, operating cash flows are reduced.

Evaluating Cash Flows from Investing Activities

- Negative investing cash flows can indicate a healthy company.

- The company is buying long term assets and reselling them.

- A positive investing cash flows is not good for a company.

Evaluating Cash Flows from Financing Activities

- Having a positive or negative cash flows does not necessarily indicate whether the company is healthy or not.

- A company may borrow loans (increase cash flows) , but later pay them back later (decrease cash flows).

Objective 12.6: Report and interpret cash flows from operating activities, using the direct method.

Reporting Operating Cash Flows with the Direct Method

- The direct method is able to go into more detail about operating activities.

- You can analyze the relationship between cash inflow and outflow.

- The direct method:

- Summarizes operating transactions that result in either debit or credit to cash.

- To prepare it, adjustments to revenues and expenses on the income statement must be made.

- Example of this process is under “Direct Method” in section 12.1

Converting Sales Revenues to Cash Flows

- If Sales Revenue is negative, there is an increase in Accounts Receivable.

- If Sale Revenue is positive, there is a decrease in Accounts Receivable.

Converting Cost of Goods Sold to Cash Paid to Suppliers

- If Cost of Goods Sold causes an increase in inventory, then there is a decrease in Accounts Payable when cash payments are made to the suppliers.

- If Cost of Goods Sold decreases inventory, Accounts Payable is increased until a payment is made.

Converting Operating Expenses to a Cash Outflow

- Expenses that a company will incur are selling, general, and administrative expenses.

- If expenses cause an increase in prepaid expenses, then Accrued liabilities will decrease.

- If expenses cause a decrease in prepaid expenses, Accrued Liabilities increase.