Module 2 - Week 2

1.4 Accounting System

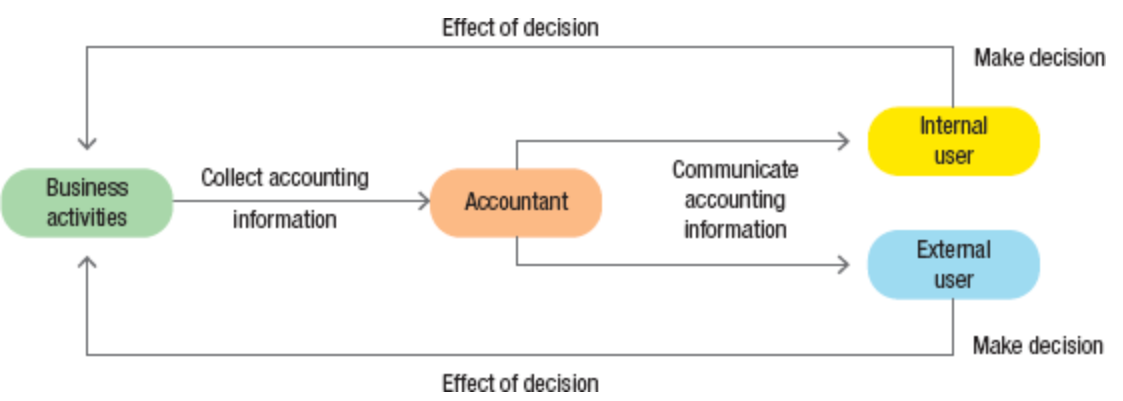

Accounting system is a means by which accounting information about a business’s activities is identified, measured, recorded and summarized so it can be communicated in an accounting report.

There are two branches of accounting:

management accounting, provides vital information about a business to internal users.

financial accounting, provides information about a business to external users.

1.4a Management Accounting

Management accounting information helps managers inside the business to plan, operate and evaluate a business’s activities.

Managers must operate the business in a changing environment.

Managers can request ‘tailor-made’ information in whatever form is useful for their decision making. e.g. dollars, units, hours worked, etc.

Accounting information also provides segments of the business, including products, tasks, plants, or individual activities, depend on what information for decision managers are making.

1.4b Financial Accounting

Financial accounting information is organized for the use of interested people outside the business.

External users analyse the business’s financial reports as one source of useful financial information about the business.

For these users to be able to interpret the reports, businesses report follows specific guidelines, known as generally accepted accounting principles (GAAP).

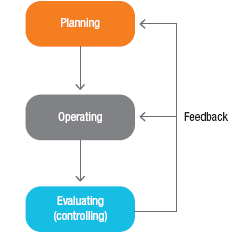

1.4c Management Activities

In small businesses, owners are often managers.

In large businesses, owners employ managers to drive the operations of the business.

Managers play a vital role in the success of a business, by setting foals, making decisions, committing the resources of the business to achieving these goals and then achieving them.

Planning

Planning establishes the business’s goals and the means of achieving these goals and is a key requirement for business sustainability.

Managers use the planning process to identify what resources and employees the business needs, and to set standards, or benchmarks, against which they can later measure the business’s progress towards its goals.

Managers will report to owners in relation to the plan. Since business environment changes so rapidly, plans must be ongoing and flexible enough to deal with change before it occurs or as it is happening.

Managers of multinational businesses must consider such factors as languages, economic systems, political systems, monetary systems, markets and legal system. Managers must also plan and encourage online communication between and among branches in different countries.

Operating

Operating refers to the set of activities in which a business engages to conduct its business according to its plan.

Managers and work teams must make day-to-day decisions about how best to achieve goals.

they can decide which product to sell, pricing, how to produce, where to advertise and whether to buy new equipment or expand facilities.

Evaluating

Evaluating is the management activity that measures the actual operations and progress of a business against standards or benchmarks.

Provides feedback for managers to use to correct deviations from those standards or benchmarks, and to plan for the business’s future operations.

Evaluating is a continuous process that attempts to prevent problems, and to detect and correct problems as quickly as possible.

The more countries in which a business operates, the more interesting the evaluating activity becomes. Managers must pay particular attention to the cultural effects of evaluation methods and feedback in order to achieve effective control.

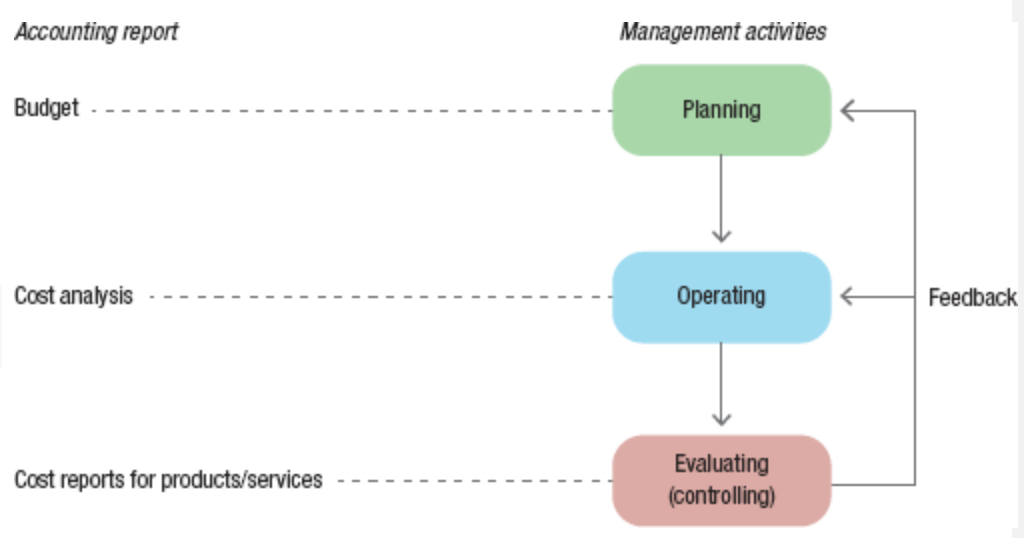

1.4d Accounting support for management activities

Internal users include individual employees, work groups or teams, departmental supervisors, divisional and regional managers, and top executives.

Accounting information help internal users plan the operations of the business, operating the business and for evaluating the operations of the business.

Basic management accounting report

Budgeting: the process of quantifying managers’ plans and showing the impact of these plans on the operating activities and financial position of the business.

Once the planned activities have occurred, managers can evaluate the results of the operating activities against the budget to make sure that the actual operations of the various parts of the business have achieved the results planned.

Cost analysis: or cost accounting, the process of determining and evaluating the costs of specific products or activities within a business.

Managers use cost analysis when making decisions about these products or activities.

Cost reports for products and services: A cost report might show that total actual costs for a given month were greater/lesser than total budgeted costs.

The detailed information will be useful for managers as they analyse why these differences occurred, then make adjustments to the operations to help reach its plan.

1.4e Accounting support for external decision making

Management accounting gives people inside a business vital information about the business and its performance.

Financial accounting involves identifying, measuring, recording, summarising and then communicating economic information about a business to external users for use in their various decisions.

External users are people outside the business who rely on accounting information to decide whether or not to engage in some activity with the business.

e.g. investors, stockbrokers, financial analysts, consultants, bankers, suppliers, labour unions, customers and local, state/territory and federal governments, including governments of countries in which the business conducts operations.

some of the accounting information that internal users need also helps external users.

Guidelines for reporting to people outside the business

Financial reports prepared using these guidelines enable comparison among firms and provide external users with reassurance that they can rely on the information to make decisions.

Generally accepted accounting principles (GAAP) are the currently accepted principles, procedures, practices and standards that businesses use for financial accounting and reporting in Australia, New Zealand and all over the world.

These principles establish minimum disclosure requirements for the eternal reports of businesses that sell shares to the public.

If not follow these rules, external users would not be able to understand the meaning of the information.

GAAP cover such issues as how to account for inventory, buildings, income taxes and capital stock; how to measure the results of a business’s operations; and how to account for the operations of businesses in specialised industries.

Accounting standards are important for protecting the interests of investors, managers and the general public by establishing acceptable accounting procedure and the content of the report.

The Australian Accounting Standards Board (AASB) sets standards for Australian companies and government bodies.

International Financial Reporting Standards (IFRS) generated by the International Accounting Standards Board (IASB) are used globally in accordance with the objectives of the governing body.

Publicly traded companies report to the Australian Securities and Investments Commission (ASIC). This agency examines corporate financial reports to ensure they conform and comply with GAAP and the Corporations Act 2001.

1.4f Basic Financial Statements

To reach a goal, a business must first achieve its 2 primary objectives: earning a satisfactory profit and remaining solvent.

Profit (net income) is the difference between the cash and credit sales (revenue) and its total costs (expenses).

Solvency is a business’s long-term ability to pay its debts as they come due.

Financial statements are accounting reports used to summarizes and communicate financial information about a business.

a business’s accounting system produces three major financial statements:

Income statement

balance sheet

cashflow statement

Additional: statement of changes in owner’s equity.

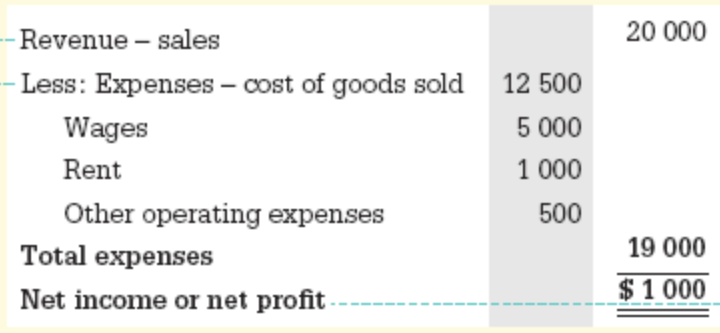

Income statement

Income statement (Profit and loss statement) summaries the results of its operating activities for a specific time period and shows the business’s profit for that period.

It shows a business’s revenues, expenses and net income (or net loss) for that time period, usually one year.

revenues are the amounts earned by charging customers for goods or services

expenses are the costs of providing the goods/services. e.g. COGS, operating expenses, taxes, wages, insurance, rent, etc.

net income is the excess of revenue over expenses, a net loss is expenses greater than revenues.

Net result is transferred to owner’s equity, providing a link between the income statement and the owner’s equity section in the balance sheet.

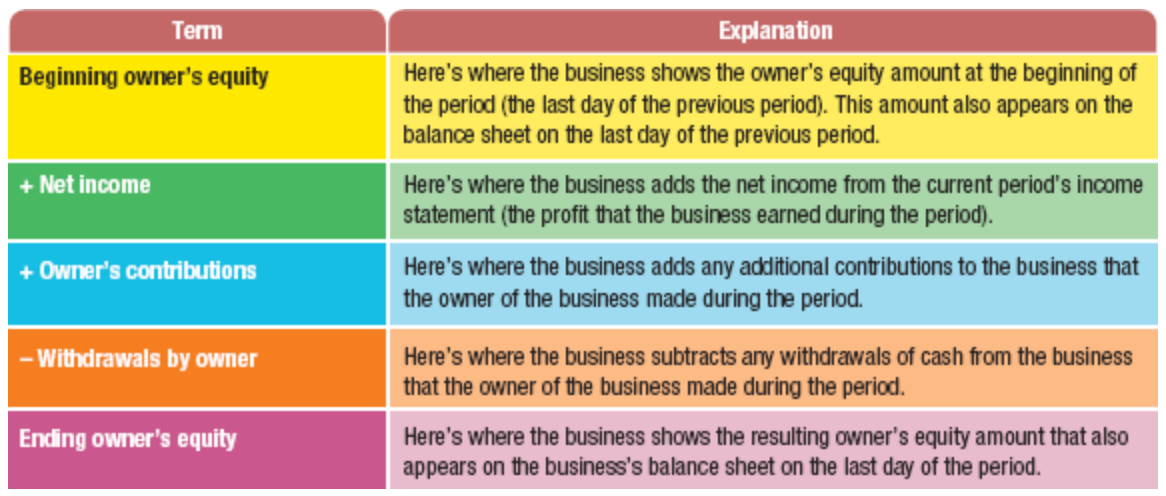

Statement of changes in owner’s equity

Statement of changes in owner’s equity explain the amount shown in the owner’s equity section of the business’s balance sheet.

Net income earned during the period increases the owner’s investment in the business’s assets.

Additional contributions of money by the owner to the business during the time period also increase the owner’s investment inthe business’s assets.

Net loss does the opposite. As does the owner’s choice to remove (or withdraw) money from the business (disinvesting).

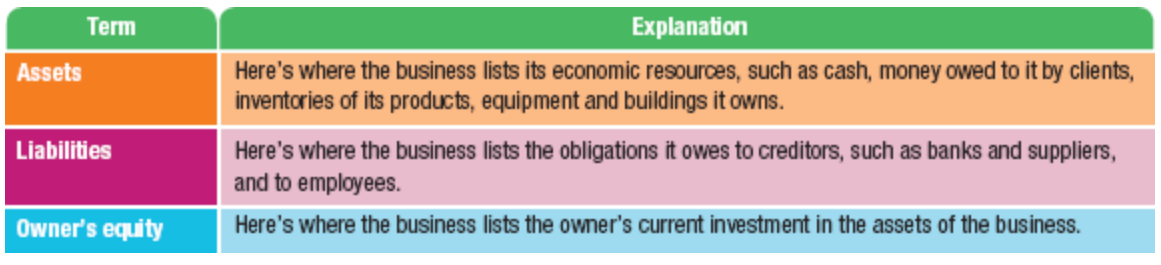

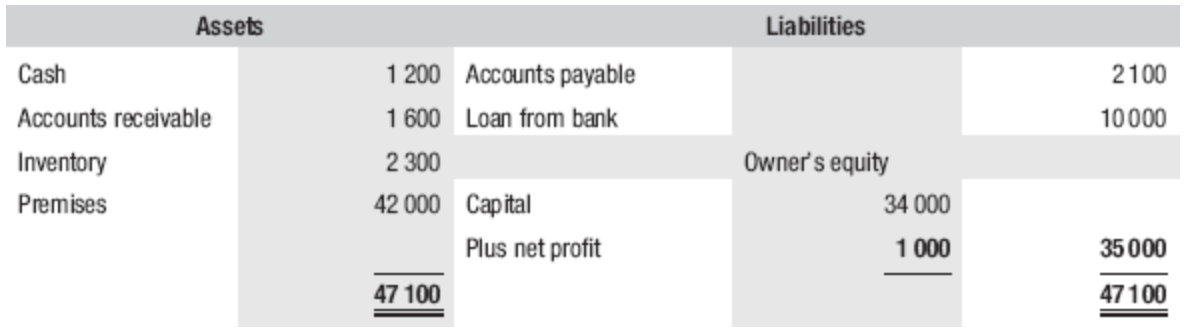

Balance sheet

Balance sheeet summaries its financial position on a given date (usually the last day of the time period covered by the income statement).

It is also called a statement of financial position.

A balance sheet lists the business’s assets, liabilities and owner’s equity as at a given date.

Assets are economic resources or items that a business owns and expect it to provide future benefits.

Liabilities are the business’s economic obligations (debts) to its creditors (bank, supplier, employees).

The owner’s equity of a business is the owner’s current investment in the assets of the business, which includes owner’s contributions to the business (capital) and earnings.

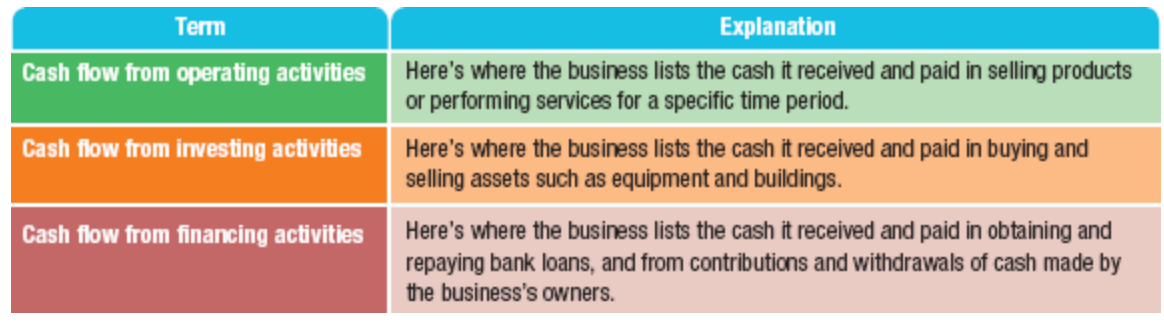

Cash flow statement

→ Annual report may have all of these statements or above combined.

1.5 Ethics in Business and Accounting

Information in the financial statements does not convey a realistic picture of the business’s result and operations. Decision based on faulty information can lead to disaster. e.g. Enron.

→ Accountants are expect to maintain high ethical standards.

Professional Organisation's Codes of Ethics

The International Federation of Accountants (IFAC) developed a code of ethics for accountants in each country to use as the basis of their own code of ethics.

IFAC expects professional accountants in each country to add their own national ethical standards to the code, or even delete some, to reflect their national differences.

The code in IFAC addresses objectivity, resolution of ethical conflicts, professional competence, confidentiality, tax practice, cross-border activities and publicity.

Also include independence, fees and commissions, activities incompatible with the practice of accountancy, clients’ money, advertising and solicitation.

For Australia: CPA Australia, Chartered Accountants Australia and New Zealand (CAANZ), Institute of Public Accountants (IPA)

They all adopts the Code of Ethics for Professional Accountants developed by Accounting Professional and Ethical Standards Board (APESB), which based on IFAC’s codes.

Ethics at the business level

Ethical environment allows our economy functions efficiently and enable users to direct or allocate resources productively.

Sustainability

Business should works toward environmental sustainable and socially responsible (ESG).

Benefits of practicing ESG:

improve reputation

reducing costs

strengthening the communities which they operate

improve profitability.

Environmental and social impacts are often business costs.

→ Good environmental management and social responsiblity tend to improve long-term profitability rather than reduce it.

Consider 2 key elements that affect most businesses:

Use of water and energy.

Generation of waste.

→ Thus a business must consider how to manage this to achieve the benefits above.

Sustainable business ensures that all processes, products and activities, while maintaining a profit, address current environmental concerns.

Sometimes use in term of ‘green business’.

Requires proactive business management and a strategic approach for business’s profitable, efficiently and productively.

1.6 Accountant in a Changing Society

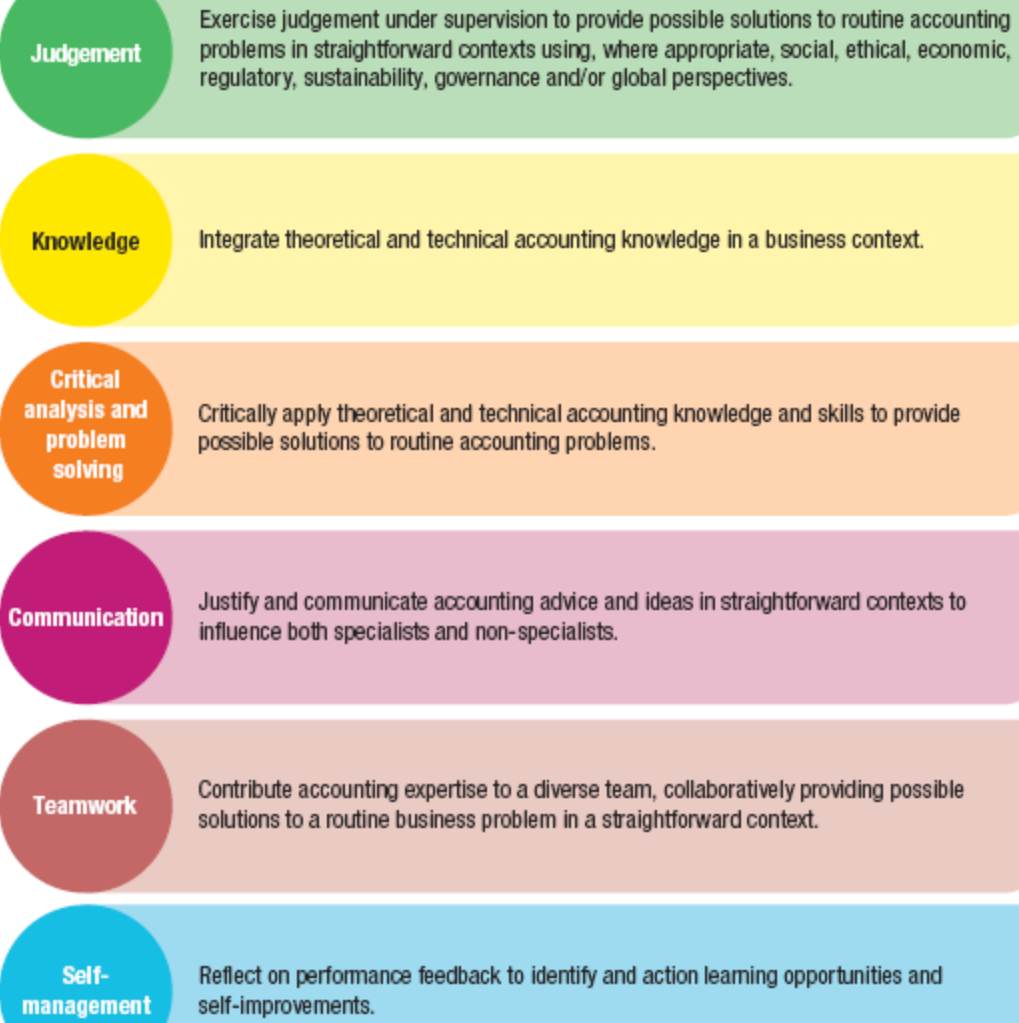

Accountants must learn the skills and standards of being a accountants. These are the skills that an accountant must have:

Judgement, Knowledge, Critical Analysis and Problem Solving

Accountants must have accounting knowledge and technical skills to construct data, to use data and make decisions, evaluate risks and solve problems.

Knowledge of related areas such as auditing and assurance, finance, economics, quantitative methods, etc.

General knowledge such as history, cultures, interpersonal, economical, political and social skills are value in making judgements.

Accountants also need to have organisational and business knowledge, know how a business work, strategies for managing change, technology, etc.

Judgement activities of an accountant, also requires critical thinking and problem solving:

inventory choice

depreciation method

capitalise or expense cost

Auditors must make judgement whether financial statements in accordance with GAAP and standards.

Managers make decisions about business operations.

Communication

Information may appear in written form, electronic, or verbal form.

Accountant must be proficient to gather information from these sources.

Be a proficient reader and listener

Possess an appropriate level of ICT proficiency.

Accountant must able to interpret, filter and deciding on the available information.

Accountant must be able to present their ideas to internal as well as external users, even if people have different interests, backgrounds and understanding of business and accounting.

Accountants must be able to justify and communicate accounting advice and ideas in routine collaborative contexts involving both accountants and non-accountants.

Teamwork

Being able to work on team projects, demonstrate leadership, having a interpersonal skill to work with other and managers and board members.

Ability to influence, lead and motivate others.

Withstand and resolve conflict.

Organise and delegate tasks.

Self-Management Skills

Able to take responsibility and be accountable for their own continuous learning in order to keep remain of current issues.

Ability to reflect on performance feedback in order to identify and carry out learning opportunities that will lead to self-improvement.

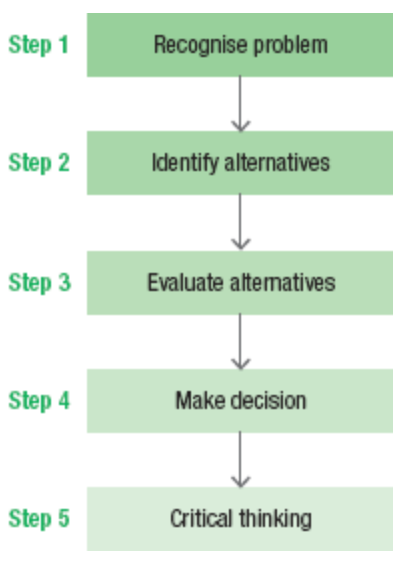

Critical Thinking (expanded)

Critical thinking is the process that evaluates ideas, determines whether any of the ideas work, what types of problems involved, whether it can be improved and which outperform the rest.

Able to use the thought processes and actions necessary for thinking critically, constantly watch and monitor your thinking.

Characteristics of the critical thinker

An critical thinker rely on their own conclusions rather than those of others, valuing the truth.

Being objectivity, or being unbiased.

Having an open mind, consider new ideas and eliminating biases, empathy of other POV.

Critical thinkers also tolerate ambiguity and willingly defer judgement until they can collect more information and consider and evaluate other solutions.

Critical thinkers must think creatively.

Have a courage of their own convictions.

→ Must apply a variety of thinking and reasoning strategies to the though process. Able to define, clearly and precisely, the problem or issue at hand.

Applying Critical Thinking to Business Decisions

Step 1:

An incorrectly defined problem will lead to an unproductive course of action at best, and could create new problems.

Decision maker needs to clearly states the problem, gather the facts surrounding the problem and identify the objectives that would be achieved if solving the problems.

Analyse information from these sources for faulty logic, unsupported assumptions and emotional appeal, and need to determine the credibility of these sources of information.

Step 2:

Generating, brainstorming numerous alternative solutions makes it more likely that at least one of them will be workable.

solution must fit within the boundaries or limits of the company.

Step 3:

Weighting the advantages and disadvantages of each solutions, such as:

taxes

costs

profits

timing

→ Evaluate advantage and disadvantage of each workable solution to fully understand each alternative.

Step 4:

When making decisions, ranking the alternatives from best to worst based on their effectiveness in achieving desired results, then rank them on desirability to the company’s value.

Accounting Information and decision-making summary